Table Of Contents

What is the Trial Balance Format?

Trial Balance has a tabular format that shows details of all ledger balances in one place. It includes transactions done during the year and the opening and closing balances of ledgers, as every entity needs to evaluate its financial position over a particular period. The trial balance shows the list of all the accounts with both debit and credit balances in one place and helps analyze the position and transactions entered into during such a period.

Generally, the trial balance format has three columns. First columns or particulars describe the ledger account as the name or head under which such ledger is created. Then there are AMOUNTS (DEBIT), i.e., the ledgers that have debit balances; generally, an entity's assets are shown under this column. The last is AMOUNT (CREDIT), i.e., those ledgers with credit balances such as share capital, reserves and surpluses, current and non-current liabilities, etc.

Table of contents

To illustrate the above text; a derived table is as follows:

| Particulars | Amount (Dr) | Amount (Cr) |

|---|---|---|

Explanation of Trial Balance

The Trial Balance can be prepared by using the following steps:

- Make ledger posting of all the journal entries.

- Re-verify whether any transaction is omitted or if all the balances are prepared correctly or not?

- After that, the final step is to arrange the closing balances of all the ledger accounts in the debit and credit array at one place called Trial Balance.

Purpose

The primary purpose of preparing the trial balance format in excel is to reconcile all the ledger balances to make the financial statements at the end of a particular period, submitted or prepared as per the legal regulations. In simple words, it can be said that the fundamental first step is to pass journal entries. After that, those journal entries passed would be posted to respective ledgers called ledger posting. After that, only the correct closing balances of all the ledgers could be seen from the Trial Balance. Sometimes, governing law mandates the preparation of Trial Balance, so for satisfying that purpose also, some entities prepare the trial balance.

Trial Balance Format

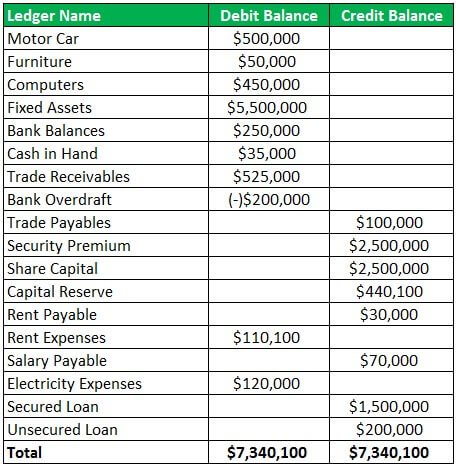

The trial balance in excel is as follows:

As per the above-drawn trial balance, all the assets have a debit balance. All the liabilities have a credit balance except the balances of Bank overdraft, which have a credit balance but are shown on the debit side. As shown above, the salary payable and rent payable are shown on the credit side. These are the liabilities of the business to be paid shortly and hence shown as a credit balance. The main thing to focus on is that the total balance of the credit and debit sides of the trial balance would always match if all the postings were made correctly.

Examples of Trial Balance Format

Example #1

Prepare the trial balance of ABC Inc. from the available balances as on date 31.03.2019, which as follows:

| Particulars | Amount |

|---|---|

| Business Loans & Advances | $500,000 |

| Reserve & Surplus | $2,250,000 |

| Profit & Loss Balance | $112,000 |

| Goodwill | $1,000,000 |

| Trade Receivables | $62,500 |

| Telephone Charges | $50,000 |

| Tangible Assets | $1,250,000 |

| Investments | $500,000 |

Now, the trial balance of ABC Inc. as of 31.03.2019 is as follows:

The main thing to notice here is the total debit and credit side of the trial balance is equal.

Example #2

Prepare the trial balance of an NBFC having the following ledger balances as of date 31.03.2019, which are as follows:

| Particulars | Amount |

|---|---|

| Loans | $50,000,000 |

| Salary Paid | $1,250,000 |

| Profit & Loss Balance | $2,512,000 |

| Provision for Bad Debts | $4,000,000 |

| Installments Receivables | $47,262,500 |

Now, the trial balance of NBFC as of 31.03.2019 is as follows:

Conclusion

Trial balance is an essential tool for any business concern to reconcile whether the books of accounts are correctly maintained or not. The ledger balances, i.e., all expenses, incomes, receipts, payments, assets, liabilities, share premiums, etc. are to be reported in the trial balance. The debit balance of the profit and loss account is to be shown on the credit side of the trial balance by mentioning a negative sign in the amount column.

While preparing the ledgers and trial balances, one must be very alert to check whether each ledger is correctly prepared. Otherwise, the final result can say the financial statements prepared do not show us the accurate picture or results of the business operations.

Finally, a person who has a good knowledge of accounting and has relevant experience in such a field should be assigned the responsibility to prepare the trial balances of the entity for the selected period, followed by the preparation of financial statements.