Table Of Contents

What Is Form ADV?

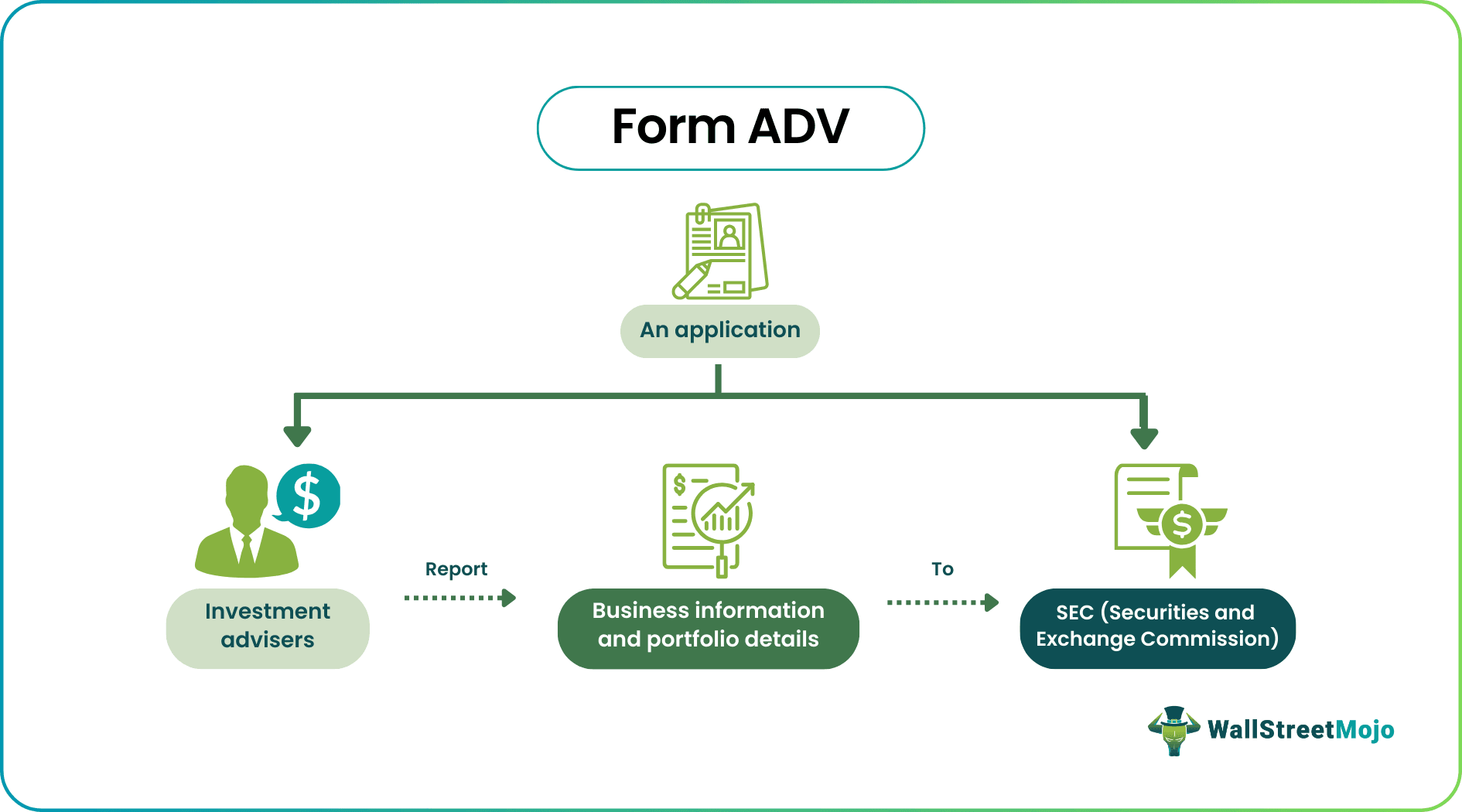

Form ADV is a document or uniform code made by the SEC (Securities Exchange Commission) for investment advisers. The main purpose of this form is to register their business practices, client information, and other details to the public through the SEC portal. It is a uniform code

SEC Form ADV contains three main parts, and advisers must file all of them. It acts as a mandatory form registered at both state and federal levels. In addition, individuals can access and file them easily on the SEC website. Besides, even exempt reporting advisers must file it. However, if the form filing is inappropriate, the SEC might reject them.

Key Takeaways

- Form ADV is a uniform code followed by investment advisory firms and exempt reporting advisers under the Investment Act of 1940 to the SEC.

- They must report all details about their business, client information, compensation, and firm practices under Part 1 (1A and 1B), Part 2 (2A and 2B), Part 3, and disclosures.

- Before filing, registration with the SEC (Securities and Exchange Commission) and state securities authorities is a must.

- However, wrong or inappropriate information about the advisers can return the application to them.

Form ADV Explained

Form ADV, or Uniform Application For Investment Adviser Registration And Report By Exempt Reporting Advisers, is a mandatory form issued by Securities Exchange Commission (SEC) for investment advisers. Here, advisers can register their business practices and client information to the public via SEC's portal. In total, five main and sub-parts describe each component of this form. However, certain requirements are needed by the SEC while filing the Form.

The SEC form ADV has three parts, out of which the first two have further classification. Part 1 details the investment adviser's business, practices, employees, clients, and others. In contrast, Part 2 of Form ADV requires the adviser to prepare narrative brochures in plain English.

The origin of Form ADV dates back to the late 20th century in the United States. After the Stock Market crash in 1929, the federal government saw the need for a regulatory system. Therefore, the Investment Act in 1940 was passed. This Act included various sections relating to the investor's protection. Among all, Form ADV was also a major decision. Later, on January 12, 1994, an open meeting was held to discuss the amendments in Form ADV. As a result, in 2000, the new changes were adopted by the public.

According to the SEC, those investment advisers managing more than $25 million in funds (assets under management) must file Form ADV. However, based on AUM, the reporting also differs. For example, individuals with more than $110 AUM must file Form ADV to the SEC. However, an AUM of less than $110 has to register at the state level.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Contents

Let us look at the components or parts of the Form ADV to comprehend the document better:

1. Form ADV Part 1

The first part of the Form ADV includes details about the investment advisor's business. In contrast, it contains other details like state licenses, number of employees, compensation made to them, client's AUM, and others. It is organized to fill in the blanks and checkboxes. So, they can fill it with whatever applies to the applicant. Later, the SEC will review, check, and proceed with the remaining details. However, there is further classification in Form ADV Part 1, namely Part 1A and 1B. Let us look at them:

- Part 1A

This section contains Schedule A, Schedule B, C, D, and R. Schedule A contains the names of executive directors and direct owners. In contrast, Schedule B contains the names of indirect owners with 25% or more interest/ownership in the business. Schedules C, D, and R contain additional details for the above schedules and rely on advisers. However, investment advisers must also fill out the DRP (Disclosure Reporting Pages) to disclose certain details about the business.

- Part 1B

Here, advisers must fill in certain details about the state securities authorities. However, those already registered with SEC can skip Part 1B. Also, the same applies to those filing it electronically.

2. Form ADV Part 2

Part 2 of Form ADV contains information about the investment advisory firm in a narrative brochure format. In addition, it must be in plain English for better understanding. However, exempt advisers cannot fill this section. Here, too, there are two sub-sections, namely Part 2A and 2B. The former part concentrates on creating a brochure containing all details about the firm. In contrast, Part 2B asks the applicants to create a brochure supplement with the supervised person's details.

3. Part 3 Or Form CVS

The last part of SEC Form ADV contains summarized data and information about retail investors. Also, it must describe their relationship with them.

Instructions

Let us look at the instructions to be followed while filing the Form ADV:

- An individual must first register either with the SEC or the state securities authority.

- Exempt reporting advisers do not require to be registered with the SEC. They get an exemption because their private funds are less than $150 million. However, it is necessary with one or more state authorities.

- Investment advisory firms and exempt advisers can fill the firm in electronic and hardship (paper) format. So, if a person is applying electronically, they must use the IARD (Investment Adviser Registration Depository) system.

- They must visit the IARD website and request for Entitlement Package. Once FINRA (Financial Investment Regulation Authority) receives the request, access is granted along with a password. Also, applicants get a unique CRD (Central Registration Depository) number for further filing purposes.

- Applicants must timely fill and submit the Form ADV. If online filing is not possible, they can use the temporary or continuing hardship exemption. Here, they get a temporary extension for filing the Form.

- Paper filing is also available for advisers. It is only applicable if a person cannot file electronically or states do not allow online filing. However, paper filing is also possible if they are registered with SEC or state securities authority and have a continuing hardship exemption.

- Depending on the applicant, different individuals are assigned to sign Form ADV. For example, sole proprietors for a sole proprietorship, general partners for a partnership firm, principal officers for a corporation, and others.

- Advisers can easily switch from state to SEC registration by filing with the latter within 90 days of annual updating amendment filing.

- Likewise, for the vice versa case, withdrawal from SEC registration (Form ADV W) within 180 days.

- Non-residents who are a partner must also register with the SEC, even if they do not reside in the United States. It must be filed within 30 days in paper format.

Examples

Let us look at the examples of Form ADV for a better understanding:

Example #1

Suppose Radcliff has operated an investment advisory firm for the past five years. During this period, he has created a client base of 300+ investors. Also, they serve all over New York, Austin, and Seattle. Therefore, Radcliff must register their firm for Form ADV with the SEC. It requires them to provide details and information about their business and clients. In addition, they must prepare a brochure that will summarize their business and supervised persons. As a result, after filing all three sections of the Form, it will be available on the IARD website. And anyone who wishes to access it can easily do it.

However, clients can easily access the narrative brochure if they need information about the advisory firm.

Example #2

On January 13, 2023, the Securities and Exchange Commission (SEC) proposed an amendment in Form ADV (Part 1A). As per the new changes, an addition will be made to Item 7 of Part 1. From now on, RIAs (Registered Investment Advisors) must conduct services under federal securities law to stop cybercrime.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

According to the SEC, Form ADV refers to the Uniform Application For Investment Adviser Registration And Report By Exempt Reporting Advisers. However, the word ADV is an acronym for the word Adviser.

Registered Investment Advisers must update the Form within 90 days after the fiscal year ends. They must file the annual updating amendment with all updates in Parts 1, 2, and 3, along with a narrative brochure. In contrast, exempt reporting advisers must also update within 90 days. However, Part 3 must get amended within 30 days if a person is already registered with the SEC.

Although both are necessary documents for filing with the SEC, they have a slight difference between them. The former is a uniform code for registering and reporting investment advisory details with the SEC. However, Form ADV-W is a form or notice filled out when an adviser wants to withdraw its investment advisor form with the SEC.

Yes, there are fees involved while filing this Form ADV. It includes fees for the IARD system along with registration and other fees. A person must pay for the initial application, initial reporting, and annual updating amendment.