Table Of Contents

What Is Form 8-K?

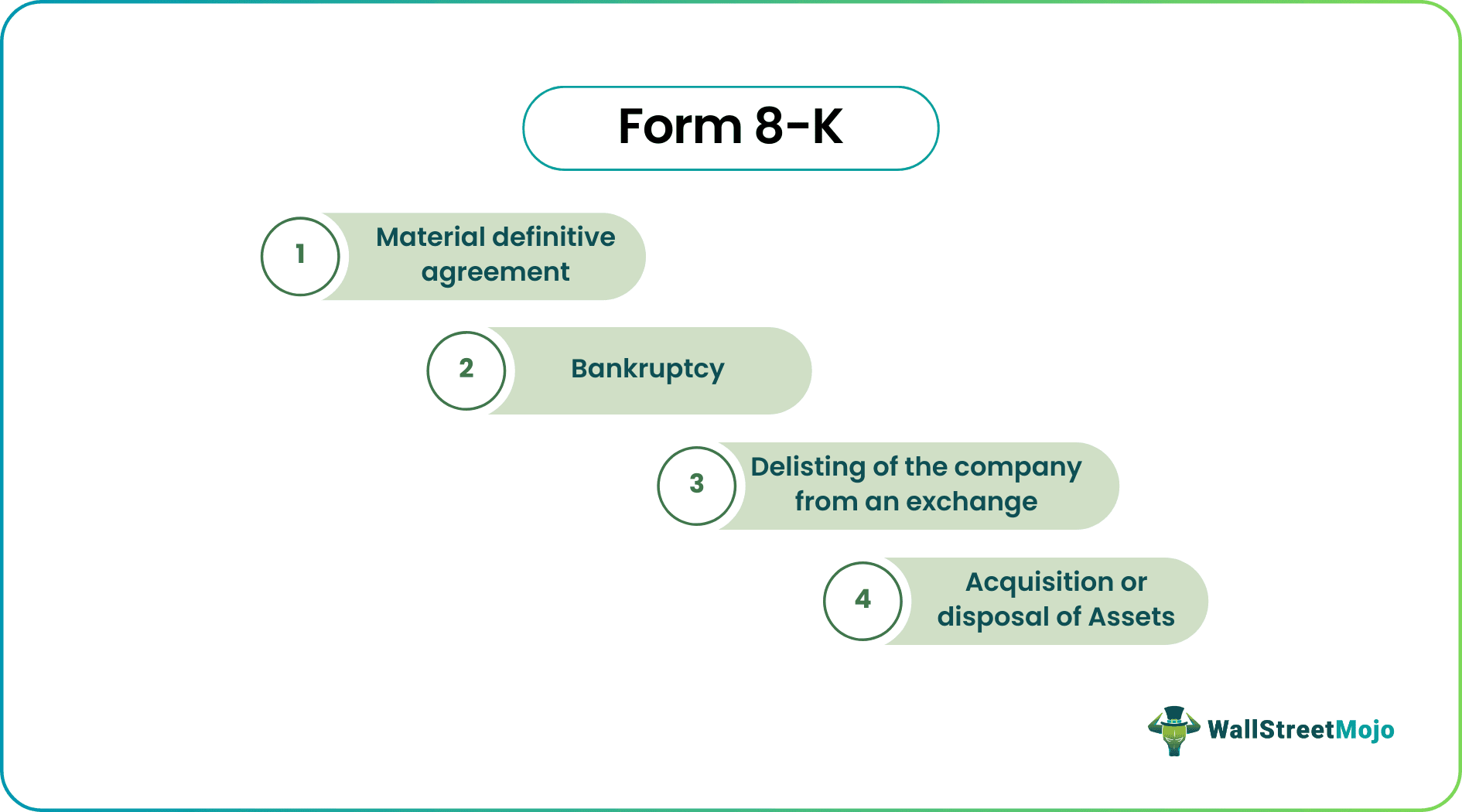

Form 8-K is a filing that the publicly traded companies must make with the Securities and Exchange Commission (SEC) to announce any unscheduled material events (delisting, policy changes, bankruptcy, mergers, acquisitions, etc.) that the shareholders should know. It is done in addition to the filing of annual reports and quarterly reports of the company on Form 10-K and Form 10-Q, respectively.

Form 8-K ensures that the stakeholders are aware of the current status and the events and activities that companies have undertaken to achieve their objectives from tome to time throughout the year. This is the document that investors and the public participants may refer to for making important investment decisions.

Form 8-K Explained

Form 8-K is an essential report that a publicly-traded company files with the Securities and Exchange Commission (SEC) in case of any unscheduled material event. This form is extremely common in publicly traded companies, and the companies can file any numbers throughout the quarter.

Also known as current report, these forms are filled in by the entities to record the events conducted or activities carried out throughout the fiscal year, which are likely to affect investors or other stakeholders in the long run. This form is a mandatory document that must be filled to bring to notice the current events and activities of the businesses.

Investors refer to the details filled in this form to track the current status of the businesses and then decide if they would invest in their assets. In addition, the public also gets access to these files so that they know how their companies are performing and what are the future prospects.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Purpose

It is to inform the investors about any of the unscheduled material events occurring in the company so that the investors can make their decision, keeping in mind those facts. Generally, the events that qualify as the “material events” include filing the form 8-K for bankruptcy, changes taking place for the significant personnel of the company, i.e., its executive board, and the case when there is any failure from the side of the company to comply with the various listing requirements of the company as with this the company gets delisted from a trading exchange in which it was listed. It acts as an immediate notification system for investors and analysts. It is filed within four business days from when such an event happens and even earlier in a few cases.

When to Use?

There are certain form 8-K requirements related to disclosures that one must know of. Some of the highlights of the required disclosure items are as follows:

- Company’s delisting from an exchange

- In case of the fundamental business policy changes

- Changes happened to the rights of shareholders.

- Situation of Bankruptcy or Receivership

- Disposal or Acquisition of Assets

- Material Impairments

- Unregistered Equity Securities sale

- Any amendments in the Articles of Incorporation

- Changes in Control of Registrants

- Apart from the above, there are various other events that investors might want to read about.

Uses and Importance

This form is designed in such a way that it acts as an immediate notification system for the investors as well as for the analysts. It is used to inform existing and potential investors about the unscheduled material events in the company. The importance of Form 8-K is as follows:

- This report is in addition to the report filed by the publicly traded companies in form 10-K and Form 10-Q. Here the form 8-K plays a vital role as it is filed within a few days of happening of the event instead of waiting for some time to file the same quarterly reporting Form 10-Q or annually reporting Form 10-K.

- It helps the investors and analysts make informed decisions as their decision is based on the events in the company in which they are investing their money or the company they are analyzing for some purpose.

Reading Form 8-K

Generally, two significant parts of this filing include the name and description of the event. The information depends on the fact that the company fills out the form. For a better understanding, consider the following some of the critical situations:

- Material Definitive Agreement: In this case, the company must file Form 8-K to inform the investors about any material agreements that are not made during ordinary business or when there are any material amendments against those agreements.

- Delisting of the Company From an Exchange: In case of delisting, the company is required to file 8-K to notify the investors about the same and provide specific regarding the reason for such non-compliance with listing requirements of an exchange.

- Bankruptcy: In this case, the company is required to file an 8-K to provide an outline regarding how the company will reorganize itself under Chapter 11, as such reorganization allows it to continue its operations under the supervision of Chapter 7. Such information is vital for the investors as it has pertinent information regarding shares of the company and its plan of dealing with the situation.

- Acquisition or Disposal of Assets: In this case, the company must inform the terms and conditions of such transactions.

Difference Between Form 8-K and 10-K

The Form 8-K is the report that the publicly traded companies file with the SEC whenever there are any unscheduled material events to inform its investors about the same, and companies have to make most of the disclosures within four business days from the date of triggering of the event and even earlier in a few cases. In contrast, form 10-K is the annual report filed by publicly traded companies with the Securities and Exchange Commission (SEC) every year that contains in-depth information about the company and its financial performance during that year and the same contains details that are more than the details provided in the annual report of the company.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.