Table Of Contents

What Is Form 1099?

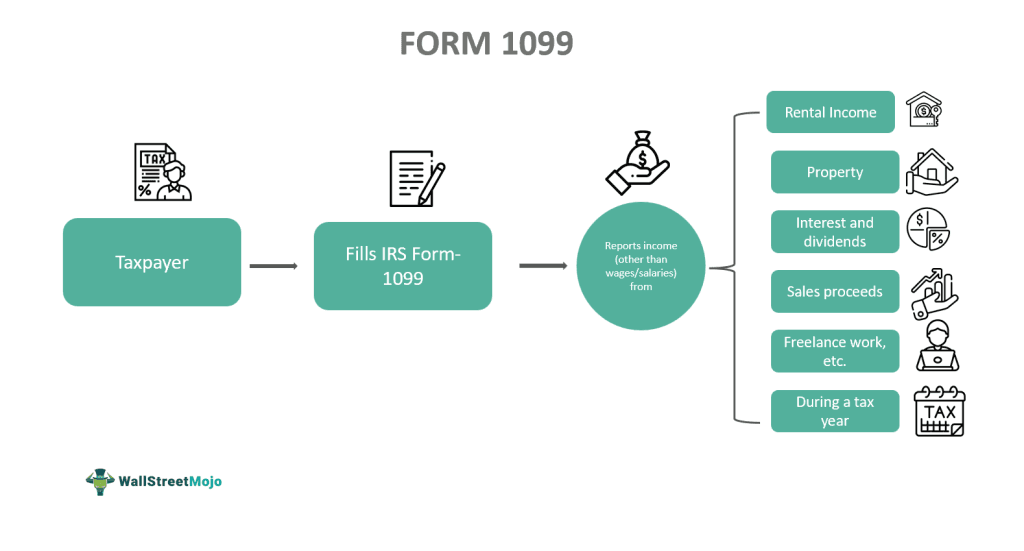

Form 1099 refers to the income tax form used by taxpayers to report their annual income to the Internal Revenue Service (IRS) received from any source, whether as a freelancer or anything besides their salary. It has to be done so as to help the IRS compare the incomes of taxpayers as recorded in their Form 1040. Thus, the IRS gets appropriate data to calculate, impose, and collect taxes from taxpayers.

Most taxpayers still need to fill out this tax form 1099. Still, only those firms and financial institutions have to issue it to their autonomous contractors and freelancers hired by them within 1st week of February. Individuals are exempt from filing it except when they have hired any contractor or freelancer for their work.

Key Takeaways

- On Form 1099, the Internal Revenue Service (IRS) requires taxpayers to declare all yearly income, including any earned outside their wage or as a freelancer or contractor.

- It must be completed to assist the IRS in comparing taxpayers’ reported incomes on forms 1040. IRS obtains the necessary information to determine, levy, and raise revenue through taxpayers.

- It has six main types - 1099-MISC form, 1099-INT form, 1099-DIV form, 1099-C form & 1099-R form. Only employers having freelancers or independent contractors have to submit the form to the IRS.

- It reports only miscellaneous income, but Form 1040 reports salaried income.

Form 1099 Explained

Form 1099 gets issued by firms and businesses to their freelancers and hired contractors, summarizing their annual earnings other than salary. It includes the details of freelance work compensation, bank interest earned, and investment dividends. These have to be provided to the tax-filing workers within the first week of February by the firms, businesses, or individuals. It can be provided to the tax filers via email, electronically, or hardcopy.

More importantly, one does not have to submit it to the IRS but has to keep it for tax records to be used during an audit of accounts. One copy is sent to the IRS and one to the service or goods providers. Therefore, if the tax filers do not mention these incomes on their Form 1040, their income tax return could be flagged, calling for audit.

Types

Firms and small businesses may issue many types of this form to individuals and contractors. However, there are mainly six types of 1099 forms, as discussed below:

1. 1099-MISC form

Form 1099-misc aids one in reporting all miscellaneous income obtained by freelancers or independent contractors from their employers. Firms paying more than $600 a year to anyone not employed by them have to issue this form.

2. 1099-INT form

Using Form 1099 tax, one has to report all the income received from their banks as interest on their savings account deposit. These incomes are taxed as ordinary income.

3. 1099-DIV form

The form summarizes all the income from the dividends and distributions received from their investment in securities. In this way, the form allows for the income to be taxed at a more favorable rate than other incomes.

4. 1099-C form

It is used to report the debt cancellation by the lenders who come under and are recognized as income by the IRS, so it must be reported by everyone who has their part of the debt forgiven by any lender.

5. 1099-R form

Form 1099-R records the income received from pension accounts like 401(k), annuities, and pensions. Suppose one gets more than ten dollars out of a given account or plan. Rolling a retirement plant into different tax-advantaged accounts needs the issuance of a 1099-R.

Who Must File?

Not everyone has to file a 1099, but only those with the following conditions:

- A person who hires an independent contractor or freelance.

- The person had paid a minimum of $10 as royalty or brokerage in place of tax-exempt interest or dividends.

- Paid a minimum of six hundred dollars for – rent, prizes and awards, other income payments, health care, and medical payments, proceeds of crop insurance, payments made to a lawyer, payments in cash received from individuals engaged in fishing or aquatic life for buying their fish and related meat, the money transferred out of a contract with a hypothetical principle to a person, business, or estate,

Besides all these, even if one has made direct sales of five thousand dollars or more of consumer goods to the buyer as reselling anywhere outside the permanently incorporated retail business establishment.

How To Fill Out?

In order to fill out the form, please follow the below instructions:

- Form 1099 has two copies – copy A & copy B.

- If one has hired an independent contractor, one has to fill the copy A. The person who receives the income is given copy B.

- To fill out this form, one must gather information like- the total sum of money paid to the contractor during the financial year, legal name, address, social security number, or tax information using the IRS Filing a Return Electronically (FIRE) system.

- But before using FIRE, one has to obtain a Transmitter Control Code (TCC).

- After getting the TCC, create an account in FIRE.

- Then, submit copy A to the IRS by January 31 or the first week of February, but first obtain the contractor’s consent.

- Then, provide copy B to the contractor by January 31.

- Copy B received by the contractor will have to be reported to the income tax return by the contractor.

- After that, submit form 1096 to the IRS by the end of February.

- Finally, check whether the resident state requires the filing of this form.

Examples

Let us consider the following instances to understand the concept better:

Example #1

Suppose Alex has a business selling printed T-shirts. For this purpose, he employs a freelancer to design the T-shirts. The freelancer charges $5 for every design that he prepares for the business. Therefore, Alex pays more than $600 to the freelancer during the financial year.

Hence, Alex had to file Form 1099 as per IRS requirements within January 31 of the current financial year and obtain the consent of the freelancer. After getting permission, Alex files copy A with the IRS and sends copy B to the contractor within the deadline of January 31.

Example #2

On November 21, 2023, the IRS announced reporting delays and specific changes in Form 1099-K. It states that in 2023, third-party reporting will only be necessary if the entity receives more than $20,000 and conducts more than 200 transactions.

It facilitates the process for taxpayers and provides an easy way to collaborate with third-party organizations. The IRS also guarantees discipline in accordance with the law with this plan. Along with this, it also plans to increase the threshold from $600 to $5000 for tax year 2024. Hence, minimizing the unnecessary 1099-K filing.

Form 1099 vs 1040

Let us discuss the difference between Form 1099 & 1040 using the table below:

| Form 1099 | Form 1040 |

|---|---|

| It reports one type of income only. | It reports numerous sources of income. |

| It helps in listing miscellaneous income. | It helps in a tax refund. |

| It is optional to file for everyone. | It is mandatory to file for everyone. |

| It is necessary to file for an income tax return. | It enables one to file a refund using Form 1099. |

| It is just supplementary. | It is the final form of income tax. |