Table Of Contents

Forfaiting Definition

Forfaiting is a method of obtaining medium-term funds for a business involved in international trade. The process consists of a company engaged in exporting the capital goods, selling foreign accounts receivables like promissory notes or bills of exchange, and immediately receiving the financing. The party external to the international transaction who provides the funds is called the forfaiter.

The receivables owed by the importer are sold forfaiting services at a discounted rate and without recourse in exchange for cash. These are eligible for trading in the secondary markets. The forfaiter usually is a third-party or intermediary, such as a financial institution or bank capable of taking on the associated risks of the exchange.

Key Takeaways

- Forfaiting refers to an option business exploring to obtain funding while involved in international trade.

- The forfaiters are usually financial institutions, banks, insurance underwriters, or trading companies.

- Forfaiting and factoring are not the same, although both are methods of obtaining funds while involved in a trade. Forfaiting, on average, has more benefits, but it may be more costly to receive funds.

- A few advantages include mitigating the risk involved with trading and covering 100% of the necessary funding for completing the transaction.

How Does Forfaiting Work?

Forfaiting refers to the method of trade financing where an exporter can sell their medium or long-term receivables from their international sales to a forfaiter, who can be a specialized financial institution or a department in a bank.

Many times, businesses in international trade run into the issue of delivering goods or services on time, only to be paid months later. For some companies, this way of doing business is unachievable. So, forfaiting finance is required upfront for things like:

- Paying their employees

- Purchasing necessary supplies

- Ensuring the order is complete and on time

These issues can create a dilemma for the supplier (exporter) when they need funds to continue day-to-day operations. Importers also desire to get the products and ensure the order's accuracy before making payments.

Forfaiting was created in Switzerland in the 1950s to bridge the "payment gap" between the exporter and the importer. Luckily, businesses have options nowadays to finance and receive the funds upfront through forfaiting instead of waiting and receiving the funds from the importer. Now businesses can partner with financial institutions such as banks or insurance underwriters, hiring them as a forfaiter. This process will typically involve selling foreign accounts receivables such as:

- Promissory Notes - A written letter signed by a party stating the intention to pay a specified amount on a specific date.

- Accounts Receivables - Claims on money due for sold products or services.

- Bills of Exchange is essentially an IOU for goods or services within an outlined amount of time.

- Letter of Credit - A guarantee from a bank ensuring the supplier will get paid.

Process

For receiving finance for an already heavily documentation prone industry such as international trade, forfaiting finance can be a tricky transaction if not understood properly. Let us understand the process through the discussion below.

After the forfaiter accepts the receivables, it will draw up a contract that the supplier will sign. The agreement will usually state specifics of the transactions, such as:

- The foreign accounts receivables being purchased

- The amount it will be purchased for

- The date and any other documents

The forfaiter will typically purchase the goods at a discount rate outlined in the contract. The supplier can use the funds to continue operations rather than waiting to be paid by the importer.

It will then deliver the goods or services to the buyer (importer). Since forfaiting deals are non-recourse and the responsibility is transferred to the forfaiter, it would be up to the forfaiter to collect the payments from the buyer.

Examples

Let us understand the concept of forfaiting services in detail with the help of a couple of examples.

Example #1

Several financial institutions and other providers like banks or insurance underwriters. In this example, we will be discussing what the forfaiting process would look like with Swiss Forfait (SF), a financial institution that primarily deals with this.

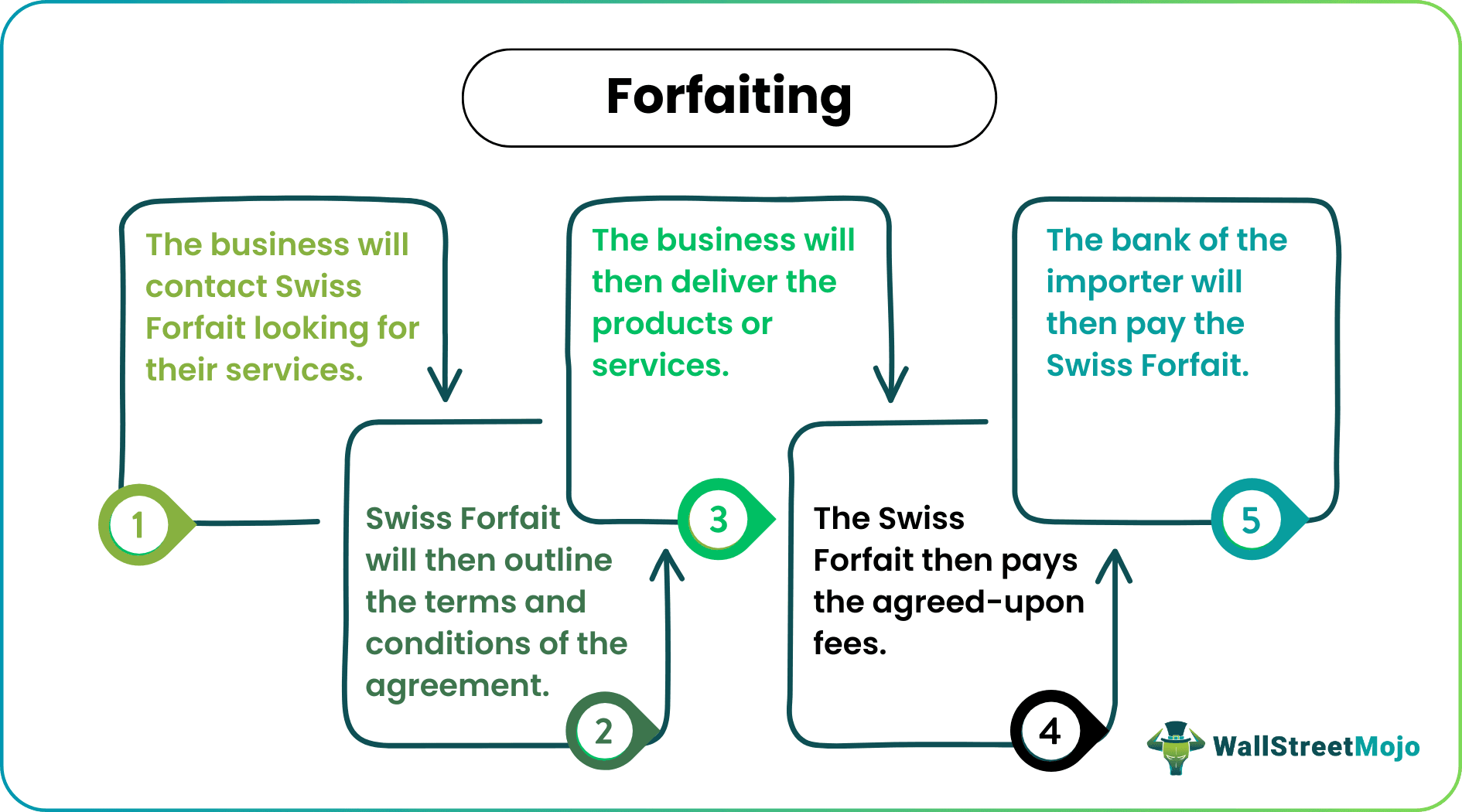

When a business is looking to export goods or services but does not want to take on the risks associated with the transaction or does not have the funds necessary to continue operations, they can contact Swiss Forfait (SF) to provide forfaiting services. The process would look like the following:

- The seller will contact Swiss Forfait (SF) looking for their services.

- SF will ask the seller for details about the exchange and request any necessary documents.

- The financial institution accepts the foreign accounts receivables from the seller.

- SF will outline the terms and conditions of the agreement, including the goods being purchased and the discount price.

- The seller and SF will enter into a contract that explicitly states the accounts receivables, purchasing price, the date, and necessary documentation.

- The seller will deliver the products or services to the buyer.

- SF will pay the seller the agreed-upon fees.

- The bank of the importer will then pay SF.

- SF will collect the payments from the buyer.

Example #2

In 2017, The United Nations endorsed the uniform rules for forfaiting set by the International Chamber of Commerce (ICC) in collaboration with International Trade and Forfaiting Association (ITFA).

These rules would go on to reduce barriers to international trade significantly and increase harmony as the same rules would be applied internationally. Therefore, different countries could follow same rules and reduce the complexity of the whole process.

Pros & Cons

Pros

- Able to finance up to 100% of the contract value

- Provides immediate funds

- Allows businesses to expand and grow operations through exporting to other nations

- The risk is mitigated by involving multiple parties

- Flexible funding option

- Forfaiting can involve fixed interest rates

Cons

- The cost can be higher than other financing options

- Must meet a certain threshold amount (currently $100,000 in the US)

- Not a suitable method for short-term transactions

- Primarily used for capital goods

- Currency problems make forfaiting unfavorable at times

- In some cases, the higher cost can be passed to the buyer

Forfaiting vs Factoring

Forfaiting

- Forfaiting is used exclusively for international trade

- It involves both exporter and importer

- Forfaiting covers the entire purchasing amount

- It pays cash for medium and long–term receivables

- Forfaiting involves financial instruments that can be sold in a secondary market

- It is usually used for capital goods

- Forfaiting is always non-recourse

Factoring

- Factoring can be used in international or domestic trade

- It only involves the exporter

- Typically, factoring covers around 80 to 90% of the purchasing amount

- It pays cash for short–term contracts

- Factoring consists of the money due or accounts receivables

- It is primarily used for consumer goods

- Factoring can be recourse or non-recourse