Table Of Contents

Foreign Exchange Market Meaning

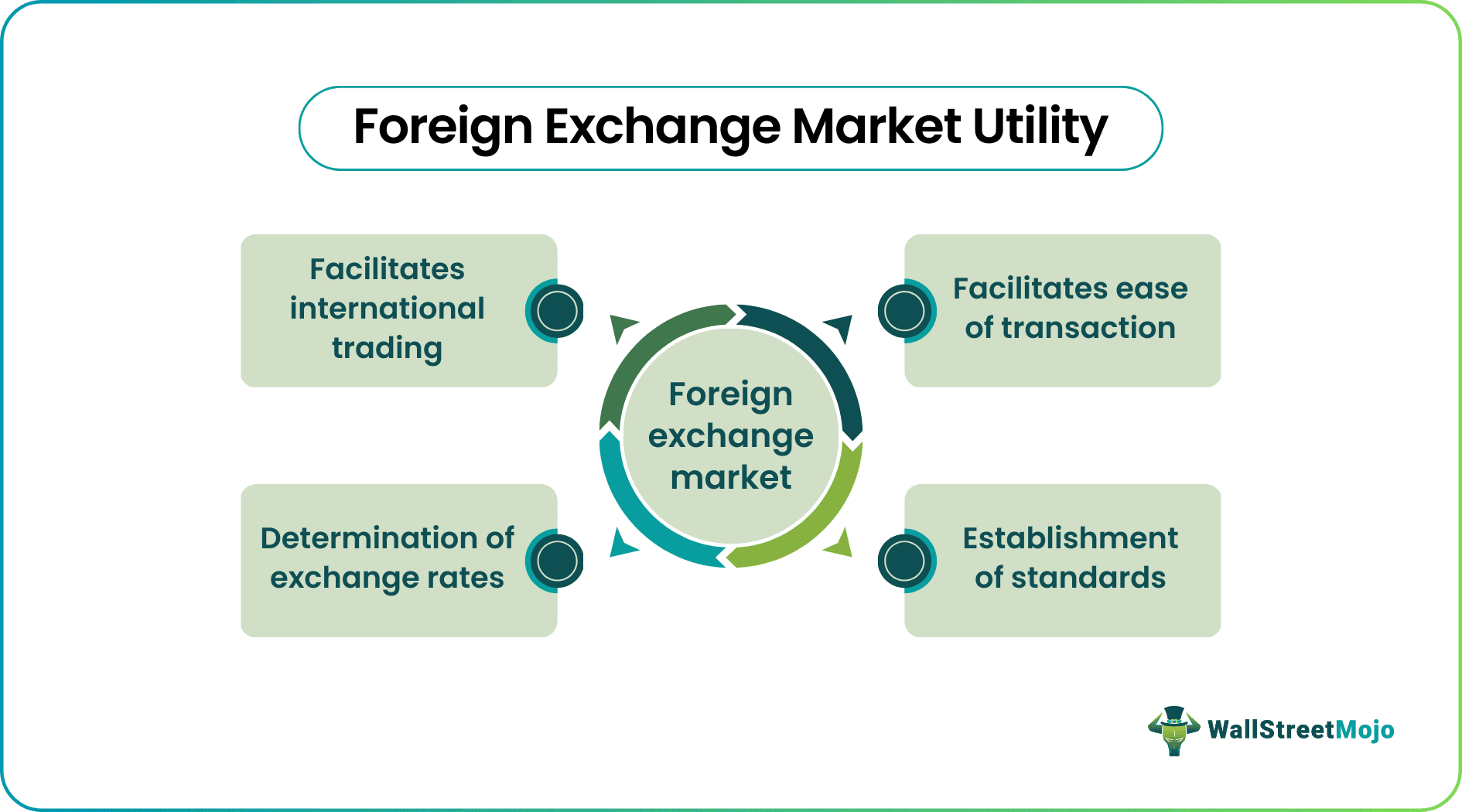

The foreign exchange market is the world's largest financial market that decides the exchange rate of currencies. Also known as the forex or currency market, it is where different types of currencies are traded. It is an over-the-counter (OTC) market with no central marketplace to facilitate easy trading and establish standards.

It comprises many markets, and they trade between individual currencies to provide international liquidity. Large commercial banks in financial centers deal in foreign-currency-denominated deposits with one another in the foreign exchange market. The value of the base currency is determined by comparing it to the other currency through its purchase and sales.

Key Takeaways

- The foreign exchange market or Forex market is the platform where different currencies are traded. It is an over-the-counter (OTC) market with no central marketplace to facilitate trading, transaction ease, and standardization during exchange of currencies.

- Different countries' currencies are traded in pairs in exchange for each other. As a result, the value of one of the currencies will differ from the other.

- Different types of Forex markets, such as the spot market, swap market, forward market, options market, futures market, and participants, make up the foreign exchange market structure.

Foreign Exchange Market Explained

The Foreign Exchange Market is the world's largest and most liquid currency exchange market. It is open to any entity or country regarding the total cash value transacted. Since there is no central currency, it is an OTC exchange market. Foreign exchange, or foreign currency exchange, is an important aspect for any company and people functioning in an international context. It facilitates the exchange of foreign currency into domestic currency and vice versa.

Countries must convert foreign currency into domestic currency for utilization in the home country. A nation should deal with all foreign entities on a one-to-one basis, meaning that all imports from a foreign country needs payment in its currency, and all exports needs payment in the other currency. However, it is not practically possible because it requires keeping track of many currency rates and the accompanying payment issues. As a result, most countries select a common currency for trading among themselves.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

How Foreign Exchange Market works?

One compares a country's currency with its common currency for international transactions. Trades would take place in this currency, which is the economically dominant currency. As a result, a country must trade in U.S. dollars or other major currencies such as the Euro, Pound, or Japanese yen. A balance of payment account helps to keep track of a country's external trade. This account is credited with foreign currency receipts while debited with foreign currency payments. Other factors being constant, a country with a deficit balance of payments will have a weak national currency, and vice versa. Therefore, the demand for foreign currency increases when the country's balance of payment account is in deficit. As a result, their value relative to the home currency rises.

One trades the currencies of different countries in pairs in exchange for each other. As a result, one of the currencies will have a different value than the other. This decides how much currency a country can purchase from another country and vice versa based on supply and demand. The currency market's primary job is to establish this price relationship worldwide. This improves liquidity in all other financial markets, critical for overall stability.

Types of Forex Market

The foreign exchange market features different modes of trading, and they are embodied as follows:

#1 - Spot Market

Transactions demand quick payments at the prevailing exchange rates. It requires immediate currency delivery or exchange on the spot- often within 48 hours. Spot transactions are those in which currency exchange occurs two days following the contract date. The spot rate is the effective exchange rate for a spot transaction, and the spot market is the market for such transactions. When an increase or decrease in the commodity's price occurs between the actual agreements and traded time, traders face uncertainty. Spot market traders are less prone to such uncertainties in the market.

#2 - Forward Market

The forward market involves transactions in which exchange takes place at a specified date in the future for a specific price. In other words, the forward currency market entails making a contract today to purchase or sell foreign currency in the future. Forward rates are similar to spot rates, except the delivery takes place much later. However, there may be differences between the spot and forward rates. The difference is the forwarding margin or swap points. In addition, traders can customize the period of delivery at their will. This exchange helps exporters and importers avoid the challenges of rate fluctuations by using relevant forward exchange contracts.

#3 - Future Market

A futures contract is another version of a forward contract traded publicly on a futures exchange. It includes the price and the time in the future to buy or sell an asset, just like a forward contract. Unlike a forward contract, a futures contract has a fixed contract size and maturity date. Futures can only be exchanged on an organized exchange and they undergo competitive trading. A forward contract does not require margins, unlike all players in the futures market. Furthermore, traders must pay an initial margin into a collateral account to create a future position.

#4 - Swap Market

Swaps allow the exchange of two streams of cash flows in two different currencies. Swaps, or double transactions, are operations in which a purchase or sale of the same currency for forwarding delivery follows a simultaneous sale or purchase of spot currency. The spot currency is swapped against the forward currency. Commercial banks that engage in forwarding exchange activity may use a swap operation to alter their fund position.

#5 - Options Market

Options are derivative instruments that allow a foreign exchange market operator to buy or sell a foreign currency at a predetermined rate (strike price) on or before a specific date (maturity date). A call option allows traders to buy the underlying asset, whereas a put option allows them to sell it. Exercising the option means purchasing or selling the underlying asset through the option. In the options market, exercising the option is not an obligation for traders.

Foreign Exchange Market Graph

To demonstrate the working of a foreign exchange market, let us take an example of two currencies: U.S. dollars and the Chinese Yuan. When the market traders exchange dollars for the Chinese Yuan, the demand for Yuan goes up, and the supply of dollars also goes up. The supply of dollars increases as there has to be an equal number of value-denominated dollars to buy Yuan from the market. The demand and supply factors work simultaneously. When people give more and more dollars to buy Yuan, the value of dollars depreciates. The Yuan's value appreciates as there is an existing demand for that currency. When a country's currency appreciates, its imports become cheaper. When the currency depreciates, imports become expensive. The country now has to pay domestic currency value equal to the other currency to pay for their goods.

The graph shows that the point where the price of Yuan and the supply of dollars meet is the point of equilibrium (of price and quantity). It is otherwise known as the foreign exchange rate.

Participants in Forex Market

The foreign exchange market structure constitutes various participants, and a few of them are:

#1 - International Companies

International business enhances the flow of cash across markets. For example, suppose a U.S.-based company sells tools in the United Kingdom. The trade will involve the conversion of pounds into dollars for repatriation. This makes them participants in the foreign exchange market.

#2 - Traders

Individuals who trade their own money for profit are called traders. Retail traders account for a sizable and rapidly expanding sector of the market. These retail dealers serve customers seeking to buy or sell foreign currency for educational, travel, or tourism purposes.

#3 - Central Banks

From the foreign exchange market history days, these institutions have been participants in the forex market. They control the money supply in their country, interest rates, and inflation to stabilize their economy (examples: the U.S. Central Bank - U.S. Federal Reserve (Fed) and European Central Bank (ECB)). Interventions from them reduce the fluctuation of the domestic currency and ensure the exchange rate is following the requirements of their economy. For example, if the euro shows signs of depreciation, the central bank may decide to sell a certain amount of its foreign currency holdings. The increased supply of foreign currency will reduce the demand and help pause the declining trend of the euro.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

It is a market that offers a platform to trade currencies of different countries.

Foreign exchange market history tells us that the Foreign exchange market functions based on the demand and supply principles of a commodity. Like any commodity, the demand for a particular currency pushes its value up; this is called appreciation of the value of a currency. The supply and demand of one currency against another determines the values at which exchanges will trade them against one another. For example, if $1 equals 80 Euros, it essentially means that 80 Euros have to be spent on purchasing $1 worth of goods.

There are various forex markets with distinctive foreign exchange market features the spot market, swap market, forward market, options market, and futures market.

The foreign exchange market functions with the primary goal of providing international liquidity and stabilizing exchange rates.