Table Of Contents

What is Foreign Exchange?

Foreign exchange, or forex, is trading one currency for values equivalent to another currency. The trading occurs between currency pairs. The foreign exchange rate fluctuates often and the supply and demand factors in the market determines it. The platform where this exchange occurs is the foreign exchange market.

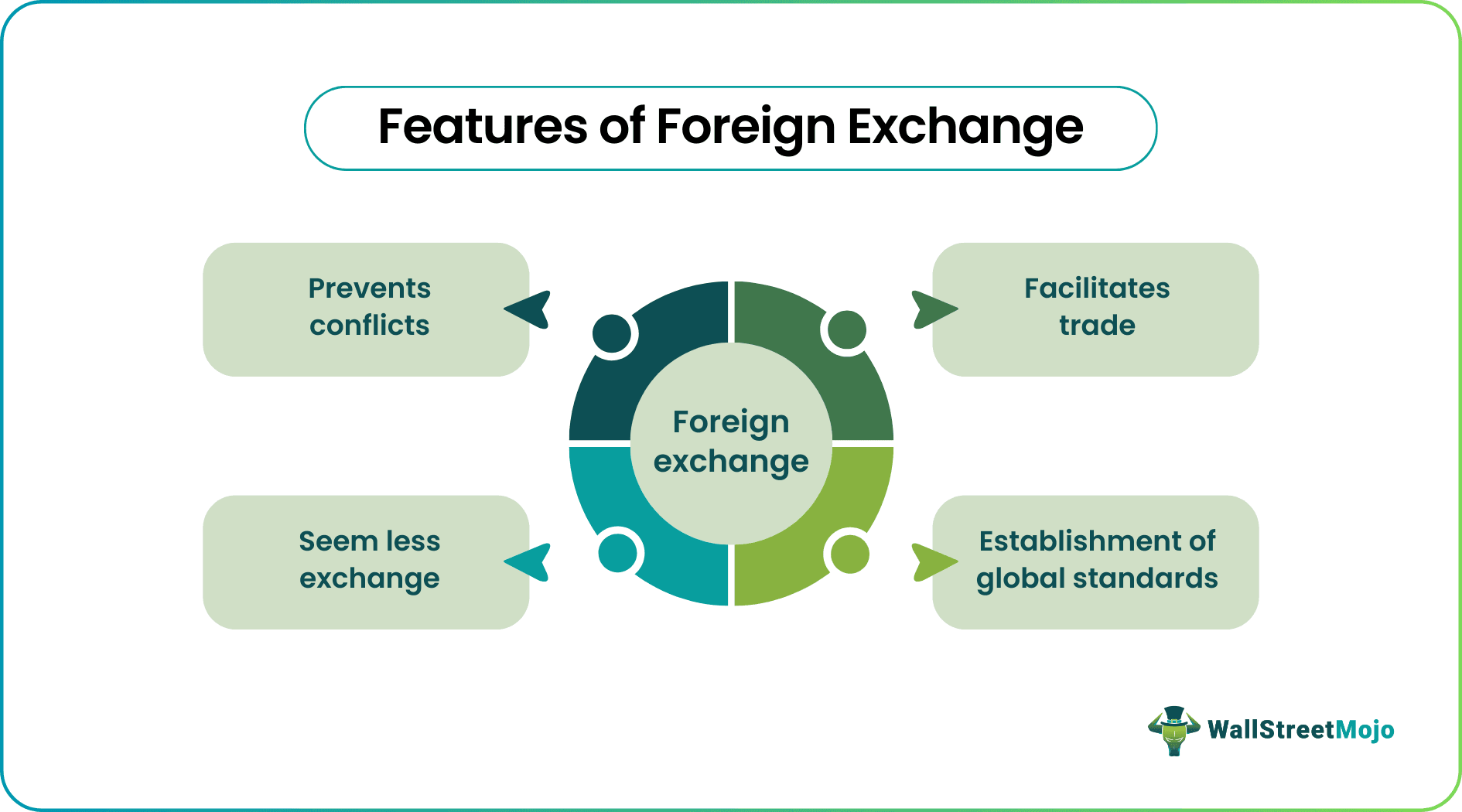

It facilitates international trade between countries through the seamless exchange of money. The market has established its own set of standards. Fixing an exchange rate method prevents confusion by providing a globally recognized standard. It eliminates conflicts between nations as the overall flow of the currency determines the foreign exchange rates.

Key Takeaways

- Foreign exchange is the process of exchange of one currency for another. The foreign exchange rate fluctuates often as the supply and demand factors influence it largely.

- Besides supply and demand, interest rates, central bank policy, economic growth, inflation, geopolitical status etc. also influences the currency demand.

- In a free exchange, all currencies are exchanged in pairs. They are expressed as the base currency and quote currency. The exchange rate sets the amount of quote currency needed to purchase one unit of the base currency.

Foreign Exchange Explained

Foreign exchange is the activity of conversion of currencies by means of an exchange rate. The foreign exchange market is vast and open throughout the day. Trading takes place over the counter (OTC), and banks and financial institutions jointly oversee the market. There is always an exchange of goods and services across borders, which helps facilitate international trade between countries. Transactions in the foreign exchange market provide a mechanism for transferring purchasing power from one currency to another. Like any other market, the currency prices depend on the supply and demand of sellers and purchasers. However, there are other forces that influence these rates. Interest rates, central bank policies, economic growth rate, inflation, and the country's geopolitical situation can all influence currency demand.

Transactions with foreigners takes place through national currencies. However, external transactions takes place by means of a common currency. Such a currency should be an economically dominant one. Examples include U.S. dollars, Euros, British pounds, and Japanese yen. The balance of payment account keeps track of the country's external trade. Receipts are credited to it, and payments are debited from it. Depending upon whether the foreign currency receipts are more or less than the payments, the account balance becomes negative or positive. Assuming other things are constant, it is clear that if a country has a balance of payment deficit, it has a weak national currency. Deficit balance of payment results in increased demand for foreign currencies. Therefore, countries keep foreign exchange reserves to accommodate changes in these rates and save the value of their currencies if they depreciate.

Example

The following example is provided to give readers a basic understanding:

Let us take the example of David. David is visiting a new country in Europe. He is there as a tourist. He cannot spend his dollars in a foreign country as an American. It is the case for every foreign national. If the individual visits a foreign country, they have to make transactions in its currency. Here, the currencies involved are the Euro and the U.S. dollar. Suppose the exchange rate prevailing is 1.2 dollars for 1 euro. David has to spend 12 dollars to purchase an item worth 10 Euros. Suppose the dollar value against the Euro increases, and it is 2 dollars to get one Euro. David has to spend 20 dollars to purchase 10 Euros worth of items. Here, the dollar's value is less than the Euro, which means the dollar's value depreciates in comparison.

Trading in Foreign Exchange

There are several ways in which trade occurs in the forex markets. The categories of markets involve:

- The spot market: The exchange rates here are in real-time and settled within two days.

- Forward market: The parties involved here agree to settle the amount in the future on a specified date.

- Futures market: The foreign exchange currency trade at a future date and at a predetermined amount. They undergo public trading, unlike the forward market.

Currency denomination is a code of three letters, such as USD for American dollars, AUD for Australian dollars, and EUR for Euros. All foreign exchanges trades takes place through currencies in pairs. One is the base currency, and the other is the quote currency. The exchange rate determines how much quote currency is takes to buy 1 unit of the base currency. If there is an increase in the exchange rate, the base currency's value concerning the quote currency has risen. Similarly, if there is a decrease in the exchange rate, the base currency value has fallen compared to the quote currency.

For traders, foreign exchange markets work like any other market, and currency trading for profit like any other asset. Therefore, they are subject to market risks like them. These traders speculate on the price fluctuations between the currency values of the two countries and bid profit by selling the more valuable currency.

Foreign Exchange Reserves

Foreign Exchange reserves, often known as Forex reserves, are assets that a central bank or other monetary entity holds to check the balance of payments, influence the exchange rate of its currency, and preserve financial market stability. They include foreign currencies, gold reserves, and treasury bills.

Frequently Asked Questions (FAQs)

Exchanges happen when one country's currency is traded for another country's currency for a determined value. This value is otherwise known as the exchange rate.

The foreign exchange rate is when one currency is exchanged for another. These rates are determined by the supply and demand factors prevailing at the moment.

Foreign currency exchange gain/loss occurs when there is a difference in the exchange rates on the booking date and the date of payment denominated in a noon functional currency. The foreign currency exchange gain or loss related to a Section 988 transaction is considered ordinary income under IRC 988(a)(1)(A).

Foreign exchange rates have an impact on the value of the currency. If the value is appreciated, that country's goods become more expensive than before to other countries. This reflects on the GDP of the country, the unemployment level, and the general price level in an economy.