Table Of Contents

What Is Forecasting Cash Flow?

Cash flow forecasting is forecasting or anticipating the cash inflow and outflow for the future period by the management of the business to make sure that the business will have sufficient funds to carry out the activities regularly. If there is any shortfall, they have to plan for alternate funding sources for the business.

Usually, such a forecast is prepared for 12 months and is constantly monitored based on business situations and changed accordingly. For example, a small firm will have its forecast for a week, whereas an established firm with strong cash flow may prepare it once a month.

Key Takeaways

- Forecasting cash flow refers to the process of projecting the cash outflows and inflows for a certain period. Carrying out this process enables organizations to get a clear idea of their future cash position.

- There are two types of forecasting cash flow techniques — the indirect method and the direct method.

- There are various forecasting cash flow advantages. A noteworthy one is that it can help in making informed decisions concerning fund management.

- There can be a significant difference between the long-term cash flow forecasts and the actual results. Thus, the projections can misguide companies.

How Does Forecasting Cash Flow Work?

Forecasting cash flow is an estimate of a company’s income and expenses for a particular time frame. This forecasting is vital for a company as it would give the management a clear idea of how much cash flow they would have at their disposal. Thereby, they can plan for expansion or arrange for more funds to execute their plans.

The forecast must include the total projected costs, projected sales, and an estimate of payment schedules. These details would give the management a clear idea of the cash flow and would allow them to plan their activities accordingly.

Cash flow forecasting is one of the business planning exercises. It is much needed to understand the cash flow position, make decisions about liquidity position and financial performance, and monitor the same. It checks for the management to conduct the business with sufficient funds and plan their expenses. Although forecasts are estimates, and deviation from it will always be there, it only acts as a guide in foreseeing the future cash flow position and liquidity.

Cash flow forecasting is an essential part of the financial modeling process. If you wish to develop a practical understanding of how it is carried out to complete a 3-statement model, opting for this Financial Modeling 2-Day Bootcamp can significantly help.

Goals

The purpose of forecasting the cash flow is to understand the business's liquidity position. This will help to know what could be the possibly available cash balance in the future period. It helps to keep track of the cash inflow and outflow. It also helps estimate the cash needed for running the business and the sources available to fund the same. It is a proactive approach to managing the funds.

This exercise helps identify probable shortfall in the cash balance much earlier and acts like a cautioning system. It helps plan the cash outflow like payments to suppliers, employees' salaries, etc. It also helps in buying credit days from the suppliers if they anticipate the shortfall in the cash balance.

It helps the management focus on the customer receivables, long-pending dues, and outstanding can be followed up for cash inflow. Indirectly this forecasting helps in making the monitoring system better.

Forecasting of cash flow is part of financial budgeting and planning, and it also helps in seeking funds externally from banks or financial institutions.

Methods

According to the action plan of organizations and their management styles, they can choose from the two methods. Let us understand the ebbs and flows of both the methods through the discussion below.

The two major methods are -

- Direct Method: It is used for short-term forecasting purposes. It is based on the anticipated future period's anticipated direct cash inflow and outflow. It helps to know the cash flow position at various points of time in the future. The input for this method of forecasting is cash receipts and payments.

- Indirect Method: It is used for long-term forecasting and business planning, and it is linked to the strategies and goals of the business. It is derived based on the Income statement/ balance sheet and working capital movements during the projection period.

Examples

When an organization plans for forecasting a cash flow statement, they consider sales, income, and other expenditures. Let us understand the concept better with the help of a couple of examples.

Example #1

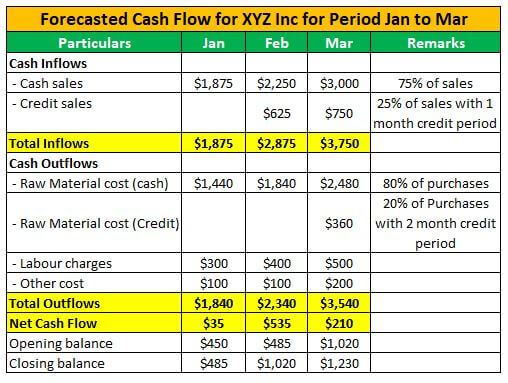

XYZ Inc., a fabric manufacturer, forecasts its cash flow for three months based on the following inputs. First, the opening balance of the cash position is $450.

- Revenue during three months (75% of the sales in cash and 25% in credit; credit period is one month). Jan -$2500, Feb -$3000, and Mar -$4000.

- Raw material purchase (80% of the purchase is paid in cash and 20% in credit; credit period of 2 months). Jan -$1800, Feb -$2300, and Mar – $3100.

- Labor charges are paid in cash. Jan -$300, Feb -$400, and Mar – $500.

- Other costs are paid in cash. Jan -$100, Feb -$100, and Mar – $200.

Example #2

Royalty Pharma PLC, a pharmaceutical company which extensively invests in late-stage biopharmaceutical products.

They receive royalty from the companies they have acquired or helped build products. In September 2017, their forecast of cash flow including non-cash provision accounted to almost $1.30 Billion.

Importance

Let us understand the importance of forecasting the future cash flow for organizations through the discussion below.

- It helps the management look into the future of the business and helps them in decision-making about the performance of the business and to manage the funds of the business.

- It helps in understanding the difference between cash flow and profits, and it helps formulate the steps to keep both elements close.

- It helps to control the spending to manage the cash flow position stable. It helps manage the funds effectively, acts as a check, and makes the spending more accountable.

- It is important because if the business has a shortfall in the cash flow and liquidity issues, then chances are there that it may go insolvent. This exercise helps the management establish proper control over the business to take all precautionary steps.

Advantages & Disadvantages

Let us understand the advantages and disadvantages through the detailed discussion below.

Advantages

- The cash flow, Income, and expenditure of the future period also need to be forecasted. It is useful in predicting the financial position and performance, and the management will know in advance the possible actions to be taken for the improvement.

- This forecast helps to know possibly available cash balance in a future date, based on which management can plan for capital expenditures and major procurement.

- It helps track down the due receivables from clients and due payments to suppliers. Constant follow-up can be done with clients to make sure money is received on time, and also, based on the forecasted cash position, it could help in deciding to buy more credit days from the supplier.

- It is useful for scenario analysis; it helps figure out possible ways of earning and spending, planning the expenditure, etc.

- If the business is estimated to have surplus cash, it helps decide about proper investment channels or further business expansion.

Disadvantages

- It is based on assumptions and possible outcomes. It is not certain that the event may happen according to the forecasts; there can always be a deviation from the forecasts, and management should always have that contingency factored in.

- Forecasts probably give the management a sense of confidence and security, and any major deviation from the same. If the business is not prepared to face it, it can create problems in the operations.

- It is an estimate, and any unanticipated events and unplanned expenditures can bring out huge cash outflow, leading to negative cash flow and increasing liabilities.

- Cash flow is derived based on other elements like revenue, expenditure, etc.; any change in those will directly impact the forecasted cash flow.

- Long-term forecasted cash flow is far away from reality. Sometimes it can misguide the decision-makers as it is a mere estimate.

- The forecast is subject to assumptions. People involved in forecasting should make sure all the assumptions have been considered after proper analysis, and any update on the assumptions should be given effect in the cash flow (E.g.) Interest rate, tax rate, inflation rate, various governing financial laws, etc.

How To Improve?

The following tips can help in improving the forecasting process:

- Refining Data Frequency And Accuracy: One can improve the accuracy of their forecasts by using up-to-date and reliable. They can review the data and make refinements if necessary. Also, they should update the data frequently to capture emerging trends or recent changes.

- Engage In Scenario Planning: Considering that the process is inherently uncertain, individuals should consider making preparations for different scenarios. They can create multiple scenarios on the basis of varying outcomes. Moreover, they should evaluate the potential effect of every scenario on the cash flow and figure out which actions are necessary to respond effectively.

- Track And Analyze The Cash Flow Drivers: Organizations must identify key cash flow drivers and monitor them carefully. Some of the factors that they must track include customer behavior, payment terms, sales volume, and inventory management. It is important to analyze the drivers and evaluate them on a regular basis to spot deviations or patterns that might impact the cash flow.

- Manage Cash Flow Better: Ensuring effective management of cash flow can play a key role in enhancing the accuracy of forecasts. Businesses need to develop and execute strategies to optimize cash inflows and outflows.

- Review And Make Adjustments Regularly: It is important to note that making forecasts is just not enough. One needs to review the forecasts against the actual results and carry out a comparison of the deviations. Precisely, individuals must spot discrepancies and identify the underlying reasons causing the differences. This enables one to refine the forecasting methods, make adjustments to the assumptions, and enhance forecasts in the future.