Table Of Contents

Forced Sale Value (FSV) Meaning

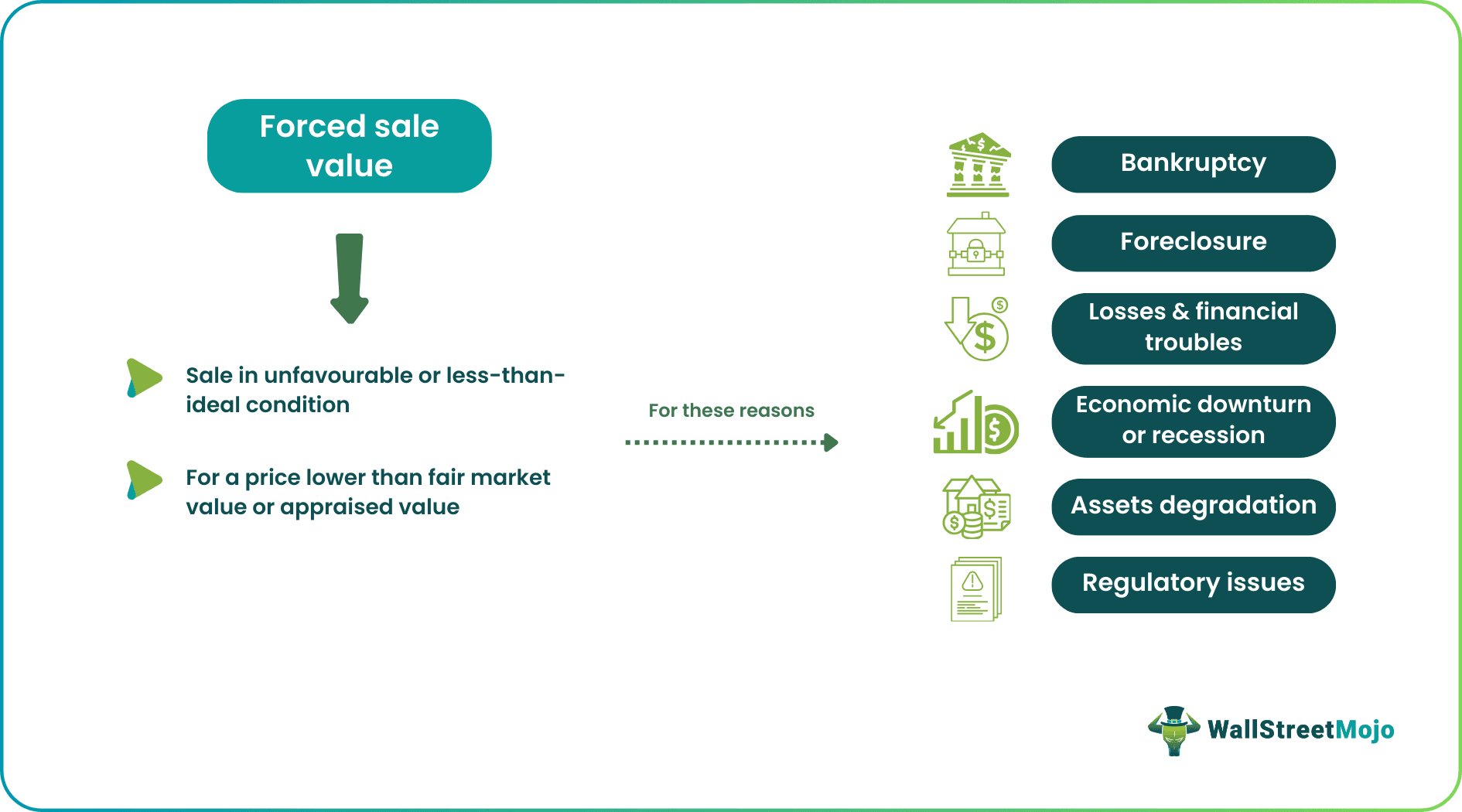

Forced Sale Value (FSV), also called Distressed Sale Value in specific situations, refers to the estimated price of an asset when it is sold within a short period (or immediately) under unfavorable business conditions. The purpose is to evaluate and arrive at a price that enables quick realization upon sale, streamlines insurance receipt in cases where a claim has been raised, or helps companies facing losses secure quick cash. It also helps entities make lending decisions and facilitates recovery in bankruptcy cases.

The FSV is generally lower than the fair market value (FMV). Companies are usually forced to sell within a limited period; they face intense pressure to liquidate the asset to ensure planned yet speedy problem resolution. The FSV technique or metric is also used by investors, creditors, and lenders as a benchmark while evaluating capital investment requests by firms facing financial distress.

Key Takeaways

- Forced Sale Value (FSV) or distressed sale value is the projected asset price for selling it immediately under pressure.

- The goal of such endeavors is to determine the value of an asset for insurance, loan recovery, or other purposes of an urgent and unavoidable nature. The appraised value and the corresponding selling costs are key determinants of the FSV.

- Valuation experts appraise assets and derive a figure based on asset type, market state, urgency, selling costs, and potential profit. Qualified appraisers consider these factors for accurate valuation.

- FSV benefits individuals and businesses by offering liquidity, preventing bankruptcy, ensuring tax efficiency, and enabling quick sales.

Forced Sale Value Explained

The forced sale value definition states that when an entity (individual or company) is forced to sell an asset quickly under pressure due to financial distress or urgency, the asset value thus computed is typically below the fair market value. If one compares forced sale value vs market value, the FSV is often lower than market value due to the urgency of the sale.

It occurs due to external pressure, especially in emergencies or for purposes like loan recovery, tax saving, legal matter resolution, etc. Such a sale is generally triggered by economic turmoil, recessions, financial challenges, bankruptcy, taxation issues, statutory orders or penalties, etc. The reasons for such a sale among individuals (not companies) could be changes in financial conditions due to personal matters or relationships.

Companies or individuals facing financial problems or in need of cash to resolve imminent issues initiate the valuation process for timely liquidity. It is an asset valuation method in finance, where sellers select a buyer offering the highest value within a short decision-making window. The FSV computation (and consequent sale) is also useful in situations where lenders, banks, or financial institutions need to sell collateral to recover bad debts or non-performing assets from defaulting borrowers. For this, such entities publish an urgent sale notification. Investors looking for investment options at low costs find transactions governed by FSV beneficial.

Unfavorable market conditions can trigger FSV transactions in cases where a seller is in need of quick sales proceeds realization. In some cases, sellers do not have sufficient time or resources to market the asset well, resulting in the seller or the sale process becoming buyer-driven entirely. In certain cases, an asset’s selling costs, such as auction charges, legal fees, maintenance, insurance, etc., may be high. If this happens, the FSV is usually lower than the asset’s FMV or appraised value. FSV applies to cases where an asset is obsolete or has depreciated considerably. Hence, sellers cannot command the market rate due to such asset degradation.

At times, assets are sold by government order. In such cases, the FSV is computed, and the sale is initiated and concluded. Government departments or agencies undertake such activities to recover taxes, penalize defaulters, etc., as part of the compliance function. Sellers typically suffer heavy financial losses in such situations. Therefore, FSV represents an asset's worth when compelled by rapid sale, benefiting buyers and banks while affecting sellers adversely. The financial sector is rife with such transactions as entities attempt to avert or address financial difficulties for various reasons from time to time.

How To Calculate?

No specific formula or method is preferred or employed to determine the FSV. Companies usually hire experts and qualified appraisers for asset valuation; they generally select a formula that best suits the situation. Appraisers consider several relevant factors for FSV computation, such as:

- The asset type,

- Current market conditions,

- The urgency of the sale,

- Selling expenses (expenses related to the selling process), and

- A comparative analysis of the profits an entity can earn from selling now versus later.

Apart from these determinants, the estimated price of an asset if it were auctioned is considered. The timeframe for this activity ranges from sixty to ninety days. The entire exercise depends on a few interested buyers at the time of sale. Professional appraisers generally apply the formula given below to calculate an asset’s forced sale value.

FSV = Appraised value - Selling costs

where:

- Appraised value = estimated value of the asset during normal times of the markets

- Selling costs = expenses concerning selling the asset, like auction commissions and marketing fees

Another method applicable is the formula of liquidation as shown below:

Liquidation value = Current liabilities - Value of assets

Companies initiate liquidation only when they wish to eliminate and nullify the assets and liabilities from their books entirely and shut down the business.

Examples

Let us study a few examples to understand this topic.

Example #1

Let's assume TechNova is a struggling electronics company in Malaysia. To combat its financial troubles and reduce operating expenses, it decided to sell office space. The goal was to sell it within three weeks. For this, it computed its forced sale value in Malaysia. The appraisers appointed for the FSV computation arrived at the valuation for the office space in question. TechNova made every possible attempt to get the highest price for its office space. However, the company needed funds urgently. Hence, it was forced to sell it for less than its worth, i.e., the appraised value. Due to this, it suffered monetary losses.

Example #2

A January 2023 article explains the complex problem of condo ownership in Austin, Texas. It covers shared spaces, ownership rules, and state laws. The Texas Condominium Act (1963) outlines the condo purchase and ownership regulations in Texas. In 1993, an amendment was passed, allowing condo complexes to be sold if 80% of its owners agree.

Due to this law, some owners are forced to vacate their homes and receive compensation based on their ownership proportion. One of the key reasons for the enforcement of this rule is the dilapidated condition of condo complexes after years of use.

Despite making financial sense, this law often causes unexpected problems for the people it affects. While condo owners receive compensation, the chances of earning more through a regular sale instead of a government-mandated sale cannot be ignored.

Benefits

The FSV method offers many advantages to businesses grappling with financial problems. They have been discussed below:

- Swift liquidity: It helps entities (individuals and companies) liquidate their assets within a specific period and secure funds to meet their financial needs.

- Bankruptcy resolution: When a business or an individual encashes assets during a period of financial strain, it helps them avoid bankruptcy.

- Creditor protection: FSV gives creditors the legal right to recover their dues from defaulting borrowers. They can safeguard their assets and avoid legal hassles in case of disputes. They can liquidate collateral and recover the loan extended to a borrower.

- Tax efficiency: It decreases an entity’s tax liability. By lowering the asset value, owners or sellers pay lower taxes to the government than they would if the appraised or fair market value were considered.

- Quick sale: Since the asset has to be sold urgently to meet pressing financial obligations, the transaction for sale is executed quickly.

- Attractive prices: Buyers stand to gain in such situations since FSV does not offer sellers adequate time to find appropriate buyers. Hence, the asset prices are typically low, making the asset affordable and attractive to buyers.

- Investor opportunity: Investors can diversify their portfolio by investing in affordable assets bought through FSV.

- Lender advantage: Lenders, banks, and financial institutions benefit the most from FSV because they can use the proceeds from the sale of collaterals to reduce non-performing assets in their books.