Table Of Contents

For further credit (FFC) Meaning

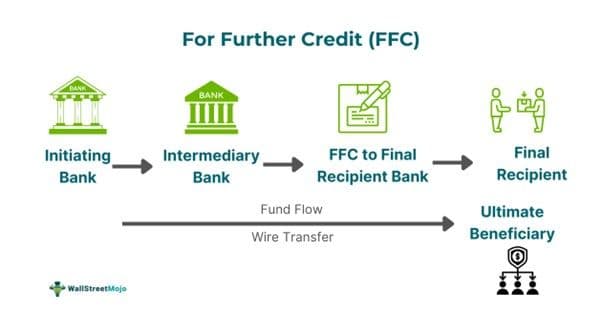

For Further Credit (FFC) refers to an instruction indicating that the funds sent to an intermediary or main account should be further credited to a specific final recipient's account. It is a banking term commonly used in wire transfers, especially in international transactions.

You are free to use this image on your website, templates, etc.. Please provide us with an attribution link.

FFC is used when a recipient receives payments through a central or intermediary account, which then allocates the funds to the designated final account. FFC transfers help ensure that payments reach the correct recipient, even if the payment must pass through multiple financial institutions or accounts. Corporations, businesses, and financial institutions frequently use this for complex financial transactions, particularly in brokerage, investment accounts, and international banking.

For Further Credit Meaning

Key Takeaways

- For Further Credit (FFC) is a term commonly used in banking and international wire transfers. It refers to routing funds to the ultimate beneficiary's account through an intermediary bank.

- It helps sellers manage their cash flow efficiently and ensures payments are received on schedule.

- FFC is used in corporate settings and aids transparency for AML (Anti-Money Laundering) purposes, international wire transfers, investment transactions, trust and escrow services, cryptocurrency transactions, and layered transactions.

- While the FFC facilitates fund transfers to the intended beneficiary, it complicates the transfer process and requires careful attention to detail.

For Further Credit Explained

For Further Credit (FFC) is a banking term used to indicate that funds transferred to an intermediary account must be forwarded to the final beneficiary's account. This typically occurs in situations where the recipient bank acts as an intermediary, passing the funds along to the actual account holder specified in the transfer instructions.

FFC is commonly used in international wire transfers, trust and escrow services, and investment transactions. It's particularly important in transactions that involve multiple institutions or accounts before reaching the ultimate recipient. This process ensures that funds are properly routed through intermediary banks or accounts to the correct beneficiary.

While FFC is not typically associated with cryptocurrency transactions, it plays a critical role in facilitating complex, layered transactions, ensuring the correct allocation of funds while maintaining compliance with anti-money laundering (AML) regulations. It supports the secure flow of payments in global trade, enabling smooth cash flow management and timely settlement of goods and services.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Usage and Application

- International Wire Transfers: Commonly used in cases where funds must pass through intermediary banks before reaching the final recipient.

- Investment Transactions: Used when transferring funds to brokerage accounts, ensuring proper allocation to the investor's account.

- Trust and Escrow Services: Funds are temporarily held in escrow before being transferred to the designated beneficiary, often requiring an intermediary.

- Cryptocurrency Transactions: Not typically used in cryptocurrency wallets or exchanges, as these usually operate differently from traditional banking, but it could apply in cases where funds are routed through intermediary institutions before reaching the final destination.

- Layered Transactions: Facilitates complex banking transactions involving multiple accounts or parties, ensuring secure routing and proper handling.

- Corporate or Institutional Transactions: Ensures that funds are correctly allocated to the end recipient in large-scale financial transactions.

- AML (Anti-Money Laundering) Compliance: Acts as a tool to track fund movements through various intermediary steps, providing transparency and helping meet AML regulations.

- Bank Transfers and Brokerage Accounts: Commonly used for secure fund transfers and management within financial institutions.

Examples

Example #1

Imagine an investor is sending money to their brokerage firm for a specific investment. The funds are first transferred to the brokerage firm's main account held with an intermediary bank. Following the instruction 'For Further Credit to ' ensures that the funds are then properly credited to the investor's brokerage account after passing through the intermediary bank.

Example #2

Another example is the FFC provision added by Fidelity. The financial service entity added FFC instructions for both domestic and international wire transfers, ensuring that funds sent to its main accounts are properly allocated to the individual accounts of its clients. This approach not only streamlines the process but also enhances accuracy in fund allocation by providing clear directives to intermediary banks. Additionally, it helps maintain compliance with financial regulations and ensures proper tracking of transfers.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Advantages and Disadvantages

Advantages

- Proves useful in transferring funds to the correct intended beneficiary or secondary account.

- Beneficial for conducting complex financial transactions and structures.

- Essential for AML purposes, providing transparency in the funds transfer route.

Disadvantages

- Can make the transfer process more complicated, requiring detailed and careful attention.

- This may result in misrouted funds due to incorrect details or miscommunication.

- Time-consuming, expensive, and tedious, especially regarding credit line usage, overall cost, and working capital.