Table Of Contents

Floor Trader Definition

A floor trader (FT) refers to an exchange member who executes the trade for their own account by appearing and participating in the meeting on the trading floors located at the exchanges. It involves face-to-face interaction between professionals engaged in buying and selling securities.

Before introducing computer screens, trading floor or pit trading presenting an active environment was a common scenario. However, floor trading is still present in a few exchanges amid the electronic trading domination. For example, New York Stock Exchange (NYSE) conducts a small percentage of its trades on the floor, and NYSE floor traders still exist.

Key Takeaways

- A floor trader refers to a stock exchange member executing a trade for his own account.

- To register as an FT, they have to follow steps like: designate as a security manager to access NFA's Online Registration System (ORS), file form 8-R, submit fingerprints, proof submission from contract markets, and SEFs and payment.

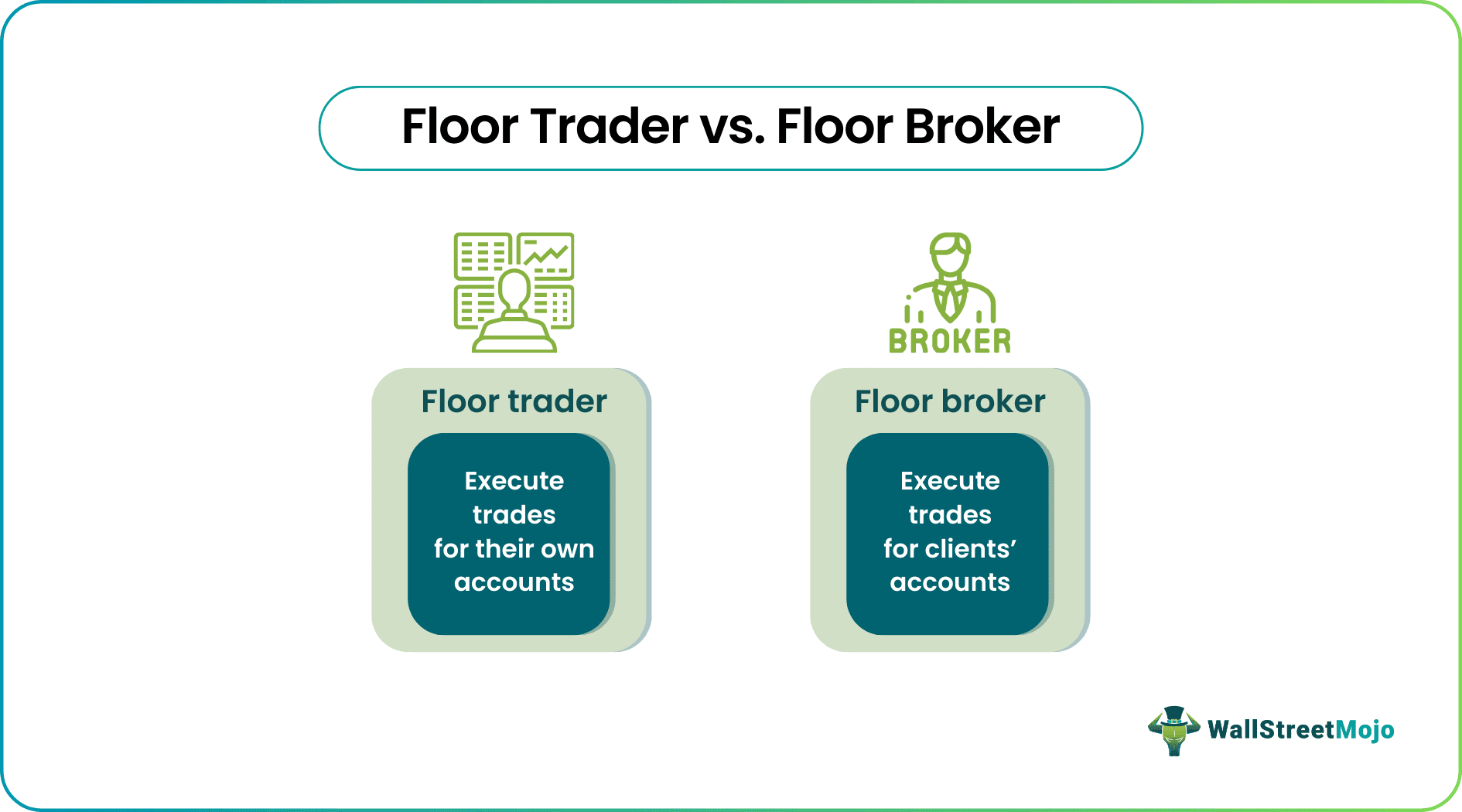

- They are often compared with floor brokers. Floor brokers execute the trade for their client's account.

Floor Trader Explained

Floor traders are the participants in the trading floors or pits. Rationality and discipline contribute to their success. Direct communication using verbal and nonverbal or hand signals similar to an auction process represents the identity of FTs. This method of communication is also known as open outcry.

FTs uses different strategies to emerge as successful trader. An example of a technique used by FTs is the ‘Floor-Trader Pivots’ deriving a pivot point above which the market is bullish and below which market is bearish. They used it as an easy mathematical technique to determine whether a price was relatively low or expensive before shouting bids and offers across the floor. Another one is order flow trading which involves watching the flow of trading orders and their subsequent impact on the price to anticipate future price movement.

There exists pure floor trade, a pure electronic trade, or a combination of the two. Electronic trading significantly reduced the relevance of face-to-face human trading floors. Even though both methods contribute to liquidity and price discovery, electronic trading is superior in providing attractive features. It enhances the liquidity and informativeness of stock markets, leading to a reduction in the cost of capital. However, there is also a notion that an electronic trading system may not provide valuable information compared to floor trading if the intensity of data involved is high..

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

How to Become a Floor Trader?

Following are the significant steps to be followed for registering as an FT according to the information from the National Futures Association's official website:

- Designate as a security manager: Enroll as a security manager to obtain secure access to NFA's Online Registration System (ORS).

- File form 8-R: Complete online Form 8-R for furnishing the application and file with NFA following the requisite instructions.

- Submit fingerprint: Form 8-R must be accompanied by the applicant's fingerprints on a fingerprint card provided by the National Futures Association.

- Proof submission: Contract markets and SEFs (Swap execution facilities) must submit proof that they have been granted trading privileges. Contract markets and SEFs may provide evidence in ORS after their applications have been filed.

- Payment: Pay a non-refundable application fee of $85. The application fee is not applicable if the trader is currently registered with the CFTC (Commodity Futures Trading Commission) or listed as a principal of a current CFTC registrant.

Floor Trader vs. Floor Broker

People who want to invest their money in financial assets can trade in the exchange market either personally or through a brokerage or member firms employing floor brokers. Furthermore, investors with time constraints or other work commitments cannot spare time to be present in the market or monitor it consistently; thus, they approach trading firms to execute their investments.

Let's look into some of the differences between an FT and a floor broker:

- Firstly, floor brokers act on behalf of their clients, whereas floor traders execute a trade for their accounts.

- Floor traders are also mentioned as registered competitive traders, individual liquidity providers, or locals, whereas floor brokers are also known as pit brokers.

- The registration as an FT is not required for an entity already registered as a floor broker to engage in floor trading.

- Firms usually hire floor brokers and provide them commission, whereas FTs make their profit, and they can also work as floor brokers.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

A trading floor or trading pit refers to the exchange floor located in the buildings of exchanges where financial assets are traded. It’s like a floor trader outlet portraying a physical location enabling the asset trading and associated activities. Electronic trading has dwindled the importance of the trading pit in this modern period.

Fundamentally, they execute the trade for their own account by appearing on the stock exchange floors. While completing a transaction, they involve in face-to-face interaction. One example of such communication is the open outcry method in which the participants on the trading floor use verbal and nonverbal signals to communicate.

According to the report published by Salary.com, The average salary of FT in the United States is $165,990 as of March 29, 2022, but the range typically falls between $125,790 and $194,090.