Table Of Contents

What Is A Floating Charge?

A floating charge is an interest kept as security that allows a lender to take control of assets that are subject to change over time. It aims to provide a lender with a flexible form of security over a borrower's assets, which can vary in value and composition over time.

This can benefit the borrower, allowing them to raise funds against their assets. This is without providing detailed information about each asset subject to the charge. It also allows the borrower to maintain flexibility in their business operations. For example, they can continue to use and dispose of the assets covered by the charge without obtaining the lender's consent.

Key Takeaways

- A floating charge covers a group of assets that can change in value and composition over time.

- Creating it can be less costly and time-consuming than creating multiple fixed charges over individual assets.

- If the borrower defaults, it "crystallizes," and the lender's security interest becomes specific to the assets at that time.

- It can be a flexible form of security interest for borrowers. It allows them to raise funds against a broader range of assets. However, it can be riskier for lenders than a fixed charge.

Floating Charge Explained

A floating charge is a form of security interest with benefits and drawbacks for borrowers and lenders.

The origin of floating charges tracks back to English law. However, it was first recognized as a security interest in the late 19th century. As a result, floating charges have become a common feature of secured lending in many countries. Australia, New Zealand, and some Commonwealth jurisdictions are examples.

Creating a floating charge involves the lender and borrower entering a security agreement identifying the assets subject to the charge. This will include a range of assets that may change in value and composition over time. Examples are inventory, accounts receivable, and equipment.

Once the floating charge is in place, the borrower can use and dispose of the assets covered. This is subject to any restrictions in the security agreement. However, if the borrower defaults, the floating charge "crystallizes." The lender's security interest becomes specific to the assets at that time. At this point, the lender may take control of the assets the charge covers to satisfy the outstanding debt.

Characteristics

Some key characteristics of a floating charge:

- Covers a group of assets: A floating charge covers a group of assets that can change in value and composition over time. Typically, this will include assets such as inventory, accounts receivable, and equipment.

- Allows borrower flexibility: While the floating charge is in place, the borrower is free to use and dispose of the assets covered by the charge in the ordinary course of its business operations, subject to any restrictions set out in the security agreement.

- Crystallizes on default: If the borrower defaults on the loan, the floating charge "crystallizes," and the lender's security interest becomes specific to the assets at that time. This means the lender can take control of the assets the charge covers to satisfy the outstanding debt.

- Priority over other unsecured creditors: In the event of the borrower's insolvency, the lender with a floating charge will have preference over other unsecured creditors but will be subordinate to creditors with fixed charges over specific assets.

- Requires registration: In many jurisdictions, including the United Kingdom and Australia, a floating charge must be under the government agency to be effective.

- Allows for easy refinancing: A floating charge can be a valuable tool for borrowers looking to refinance existing debt, as it can cover a group of assets that may be subject to change over time.

- Can be risky for lenders: Because a floating charge covers a group of assets rather than a specific purchase, it can be more difficult for lenders than a fixed charge, as the value of the investments may fluctuate rapidly. Therefore, lenders should carefully assess the risks of a floating charge before granting credit.

Examples

Let’s understand it through the following ways.

Example #1

Suppose a retail company, Globex Corp., takes out a loan from a bank and grants a floating charge over its inventory and accounts receivable. The floating charge allows Globex Corp. to continue to buy and sell stock and receive payments from customers usually. However, if Globex Corp. defaults on the loan, the bank can take control of the inventory and accounts receivable covered by the floating charge to satisfy the outstanding debt.

Example #2

In 2020, the Australian government introduced temporary changes to its insolvency laws to help businesses impacted by the COVID-19 pandemic. Among these changes was a temporary suspension of liability for insolvent trading, which allowed directors of companies to continue to trade even if their company was insolvent, provided certain conditions were met. However, the changes also included restrictions on floating charges, designed to prevent unsecured creditors from being disadvantaged if a company went into insolvency.

The limits required that any floating charge granted by a company in the six months before the commencement of the bankruptcy be converted to a fixed charge, which would give other creditors more visibility over the company's assets. This real-world example highlights how floating charges can affect creditors and the broader economy and how governments may seek to regulate their use in certain circumstances.

Advantages And Disadvantages

Some advantages and disadvantages of floating charges are:

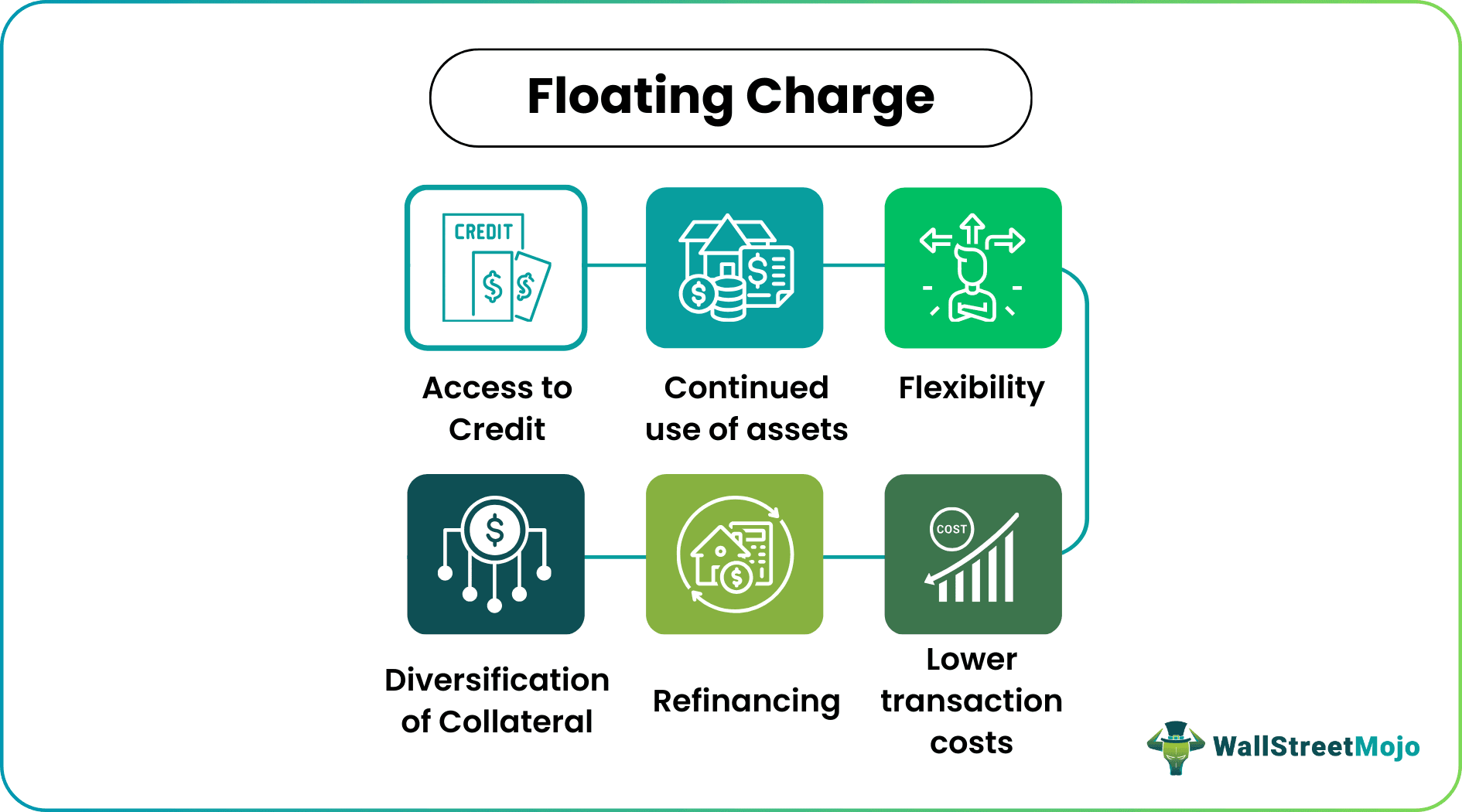

#1 - Advantages

- Flexibility: Such charges are flexible and can cover a group of assets that may change in value and composition over time, allowing borrowers to raise funds against a broader range of assets.

- Lower transaction costs: Creating it is often less costly and time-consuming than creating multiple fixed charges over individual assets, which can be a significant advantage for borrowers.

- Continued use of assets: Borrowers can use and dispose of the assets covered by the charge in ordinary business operations.

- Security for lenders: It provides lenders with some measure of protection over a group of assets, even if the value and composition of those assets may change over time.

#2 - Disadvantages

- Priority for lenders: In the event of the borrower's insolvency, the lender with such a charge will have preference over other unsecured creditors but will be subordinate to creditors with fixed costs over specific assets.

- Risk for lenders: Because it covers a group of assets rather than a specific purchase, it can be riskier for lenders than a fixed charge, as the value of the investments may fluctuate rapidly.

- Reduced visibility for other creditors: Because it covers a group of assets rather than specific assets, other creditors may have reduced visibility over the borrower's assets, which can disadvantage insolvency.

- Potential for abuse: The flexibility of it can make them vulnerable to abuse, as borrowers may use them to raise funds without providing adequate information about the assets that are subject to the charge.

Floating Charge vs Fixed Charge

While both fixed and floating charges can be helpful tools for lenders and borrowers, they have different characteristics and are suitable for different situations. Some differences between floating charge and fixed charge:

- Nature of assets: A fixed charge is a security interest over a specific investment or group of assets identified and specified in the security agreement. A floating charge is a security interest over a group of purchases subject to change over time.

- Ownership and control of assets: With a fixed charge, the lender takes ownership and control of the specific investment or assets that are subject to the head, while with a floating charge, the borrower continues to own and control the assets covered by the charge until the charge "crystallizes."

- Ability to use and dispose of assets: With a fixed charge, the borrower's ability to use and dispose of the specific investment or assets covered by the charge may be restricted, while with a floating charge, the borrower can continue to use and dispose of the assets covered by the amount in the ordinary course of business operations.

- Priority of lenders: In the event of the borrower's insolvency, a lender with a fixed charge will generally have priority over a lender with a floating head, as the specified amount will cover a specific asset or assets, while a floating charge covers a group of assets that may change over time.

- Creation of the charge: A fixed charge is usually over a specific asset or assets when we sign the security agreement. A floating payment is over a group of assets that may change over time.

- Registration: In many jurisdictions, a fixed charge must be under the registration of a government agency to be effective, while a floating head may also need to be in the form of a document, depending on the jurisdiction.