Table Of Contents

What Is A Flip-Over Poison Pill?

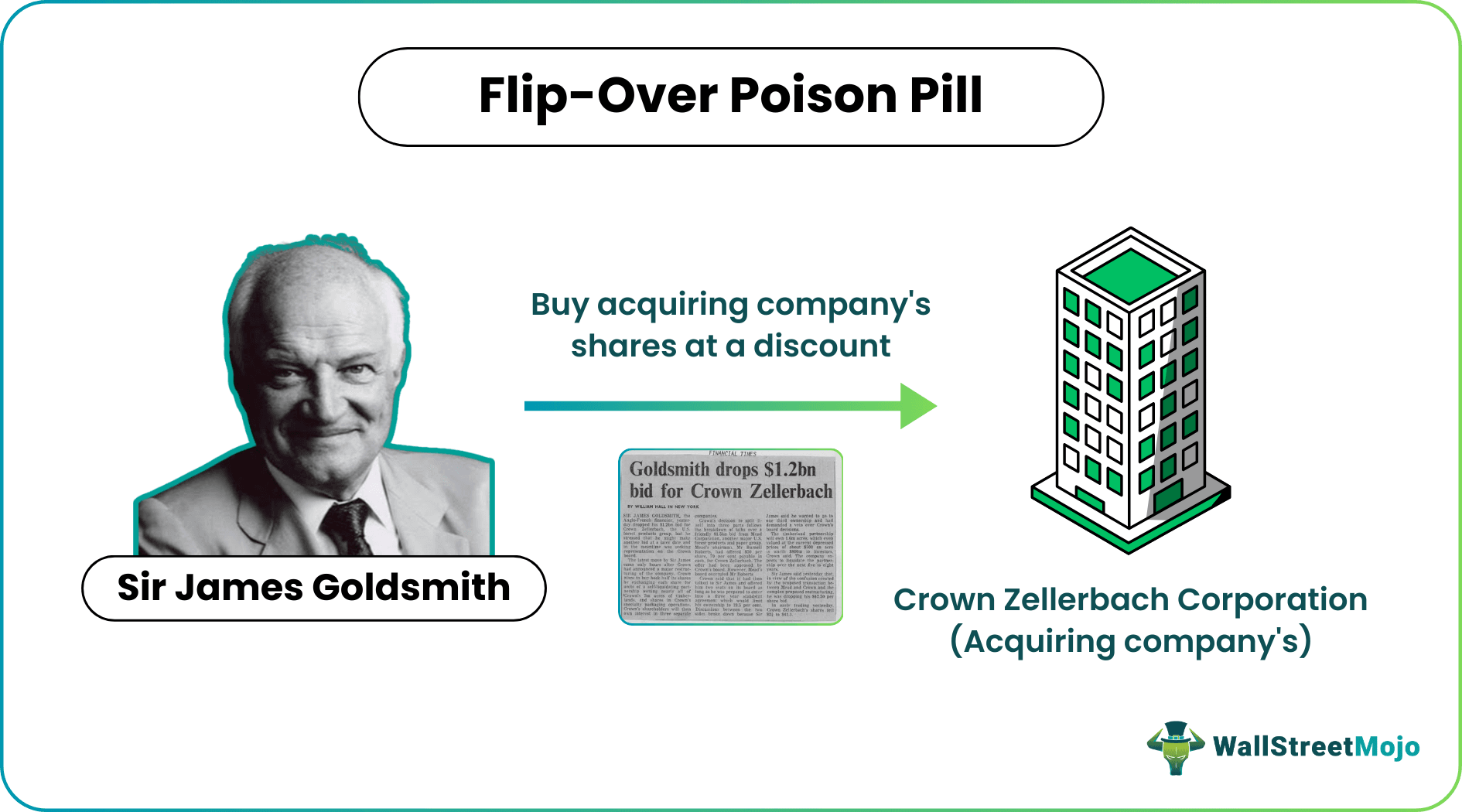

Flip-Over Poison Pill refers to the defense strategy used by the companies to prevent them from a hostile takeover. Under this, the company's shareholders under the target are allowed to buy the acquiring company's shares at a discount with the main motive of combating the unwanted attempts of the takeover.

The flip-over poison pill strategy has been designed to make the transaction unattractive to the acquirer until they end the deal or are compelled to negotiate terms with the Board of Directors. This strategy is only used by firms that have adopted the bylaw.

Table of contents

- How Does A Flip-Over Poison Pill Work?

- Strengths

- Weaknesses

- Example

- Frequently Asked Questions (FAQs)

- Recommended Articles

- The flip-over poison pill is a company's defensive measure to protect itself from a hostile takeover. Under this approach, the company's shareholders purchase shares of the acquiring company at a discount to deter the takeover attempt.

- In this strategy, each right represents the hostile bidder's conditional right to purchase common stock shares. These rights are then detached from the shares, becoming freely transferable.

- The flip-over poison pill strategy makes the transaction unattractive to the acquirer until the deal ends or they are compelled to negotiate with the Board of Directors.

How Does A Flip-Over Poison Pill Work?

Flip-Over Poison Pill is a defensive strategy that enables shareholders to purchase shares at a highly discounted price in an acquiring company. If the technique is adopted and the acquisition turns out successful, the target firms' shareholders will dilute the equity of the acquiring firm. It gets triggered when a hostile bid is successful, and strategy is commonly used to combat unwanted takeover attempts.

As per this strategy, each right represents the conditional right to acquire shares of common stock of the hostile bidder at a discounted price. Once the event is triggered, the rights would detach from the shares, becoming freely transferable. However, at that point, the rights would not be significant. If the acquirer were to attempt a merger/similar transaction, the rights issue would be of importance. The rights holder can purchase the shares of the acquirer at half price. Specifically, the rights holder would be entitled to pay the exercise price and receive in return the shares of the acquirer’s common stock with twice the market value.

- A flip-over poison pill is designed to provide additional compensation to the target company's shareholders at the expense of the acquirer.

- It also has the effect of impeding the ability of a hostile bidder to acquire the target firm like a leveraged buy-out.

Flip-in Poison Pill Explained in Video

Effects

The most severe effect is that it can threaten the status of controlling shareholders or the acquirer. A flip-over will not dilute the acquirer's interest in the target company but instead interest the acquirer's shareholders in the acquirer.

The acquirer would be required to issue any additional shares to shareholders of the target company, and even a 100% owner can easily find themselves in the minority. The controlling shareholder may be unwilling to cause a threat to their status, causing the acquirer to forego the acquisition.

The flip-over poison pill is also suggested to be effective only if the acquirer insists on a merger or similar transaction post-implementation of flip-over. If the acquirer insists on maintaining a controlling stake in the target firm, no protection is offered since:

- The dilutive effect of the flip-over rights is only triggered by a second step merger or business combination or

- A bidder willing to forego such a transaction can avoid negative consequences associated with the rights.

Shareholders have rights attached to their shares, whereby all shareholders accepting the acquiring firm can pay to exercise their rights. They receive a specific value of the acquiring company’s shares at market price on the transaction date. Typically it’s double the exercise price, giving the same two-for-one deal in a flip-in but with the acquiring company’s stock instead.

Strengths

As flip-over is a poison pill strategy, below are some of the benefits which are may also be common to other similar practices:

- They are effective deterrents against hostile takeovers

- There is room for bargaining leverage, and boards can choose not to enact such a strategy if the acquiring company is offering a high enough bid or meeting the conditions of the target firm.

- Extending the above point, target firms can get around 10-20% more from acquiring firms if a flip-over or similar strategy exists.

- Boards also buy some time to find a "white knight" or strategies that benefit the target company.

Weaknesses

Similar to the strengths, certain drawbacks are also applicable:

- Shareholders may benefit from the takeover if the acquiring firm pays more for their stock. The shareholders may consider the option, as the stocks were purchased at a deep discount.

- Certain managers may use such techniques to prevent their positions in the larger interest.

- The firm's values can be questioned since the stocks may get diluted. Further, companies who desire to make some investments would start questioning the techniques creating drifts and possibly losing out on massive investment opportunities.

Example

Let us consider the following example to understand how flip-over strategy works:

One of the popular instances was in 1985 when Sir James Goldsmith (Anglo-French financier, politician, and business tycoon) attempted to acquire Crown Zellerbach Corporation (an American Paper Conglomerate based out of San Francisco, California). He faced a flip-over poison pill in which Sir Goldsmith attempted to acquire the firm. While he could not proceed with the merger transaction, he successfully obtained a controlling stake in Crown Zellerbach. As the goal of the flip-over is to shield unwanted acquisition, the strategy was proven to be a failure.

Flip-In Vs Flip-Over Poison Pill

Along with the flip-over poison pill, there is yet another term that plays an important role in mergers and acquisitions. The term is the flip-in poison pill, which is the complete opposite of the former. Let us have a look at the differences between the same in brief:

- While the flip-over poison pill gives the existing shareholders an opportunity to purchase shares of the acquiring company at a discounted rate, the flip-in strategy allows the existing shareholders to buy shares of the target company at a discounted price.

- The flip-over strategy works for shareholders only if the hostile takeover in question is successful and the bylaws of the acquiring company allow the right to purchase them. On the other hand, a flip-in strategy is always about discouraging hostile takeover attempts.

Frequently Asked Questions (FAQs)

Implementing a flip-over poison pill can lead to a company's stock price decline. In addition, the tactic may signal to investors that the company is not confident in its ability to compete and grow in the market.

A company may use multiple takeover defense mechanisms, including a flip-over poison pill, to provide a comprehensive defense against hostile takeovers.

Yes, a company may face legal challenges if the tactic is deemed unfair or infringes on shareholders' rights. Therefore, when a company implements a flip-over poison pill, it is important to ensure that the tactic does not violate any legal or regulatory requirements. In particular, the use of a flip-over poison pill may be subject to scrutiny under state and federal securities laws and fiduciary duty standards.

Recommended Articles

This article has been a guide to what is Flip-Over Poison Pill. Here, we explain it with an example, how it works, its strengths, weaknesses, vs flip-in poison pill. You may also take a look at the following articles:-