Table Of Contents

Flat Tax Definition

A flat tax is a taxation system whereby a uniform tax rate applies to all taxpayers irrespective of their income. Such a tax usually doesn't provide any deduction or exemption to the taxpayers. As both rich and poor are taxed at the same rate under this system, it draws a lot of flak for being anti-poor.

Many countries take up this system to propel their economies and streamline their taxation process. Countries like Russia, Georgia, Estonia, Ukraine, and Lithuania have been using this tax system successfully. However, critics argue that it is a form of regressive taxation where the burden falls on the people belonging to the low-income category. At the same time, it allows an undue advantage to the individuals with high income.

Key Takeaways

- Flat tax refers to the taxation of all income groups at a standard rate by the government. It is still prevalent in countries like Russia, Ukraine, and Georgia.

- Under this taxation system, the government doesn't facilitate any exemption or deduction to the taxpayers.

- Income from other sources such as interest on securities, investment returns, capital gains, dividends on bonds, etc., are often excluded from the taxable income.

- It is the inverse of progressive tax, where the high earning group is levied with a higher tax rate, and the lower-income class is either exempted or charged with low tax rates.

- Even with an increased income, the tax rate remains the same. This motivates people to work hard.

How Does Flat Tax Work?

Under this tax system, a person earning a higher income does not fall into a higher tax bracket. This acts as an incentive and encourages them to progress. However, since people with lower income are also taxed at the same rate, they are left with lesser disposable income.

This means that people earning less end up paying proportionately more than their well-off counterparts. This leads to critics arguing that this system increases the disparity between the rich and the poor.

Nevertheless, this tax system acts as a powerful stimulus for economic growth from an economic point of view. This is because it doesn't punish individuals for generating a higher income or profit. Instead, it encourages people to spend or invest their excess earnings in the economy. This paves the way for the progress of a country's economy.

Furthermore, this system simplifies the tax filing process sparing taxpayers countless hours of complying with complex tax codes. Hence, in some countries, politicians argue that governments should introduce a flat rate for taxation with certain exemptions and deductions to the lower-income group.

Features

Let us go through the distinct characteristics of the flat tax system to gain more information on it:

- Single rate of tax: A single tax rate is imposed on every individual irrespective of their income level. It is the easiest way of taxing the personal income of individuals.

- Low tax rate: The percentage charged under the flat tax system is usually lower than the progressive method. The personal tax rate in Russia is around 13%. On the other hand, the U.S., with a progressive tax system, charges 10-24%.

- Exempts income from other sources: The taxable income under this method excludes the capital gains, earnings on investments, income from interest, dividends, etc.

- Deduction/exemptions not allowed: The tax is imposed at a uniform rate, and no deduction or exemption is permitted. However, on implementation, governments do allow certain deductions or exemptions based on conditions.

- Regressive in nature: This tax shows a regressive trend where the person with low income pays proportionately higher taxes, and a person with higher income pays lower taxes. However, the tax percentage remains the same for everyone.

Flat Tax Example

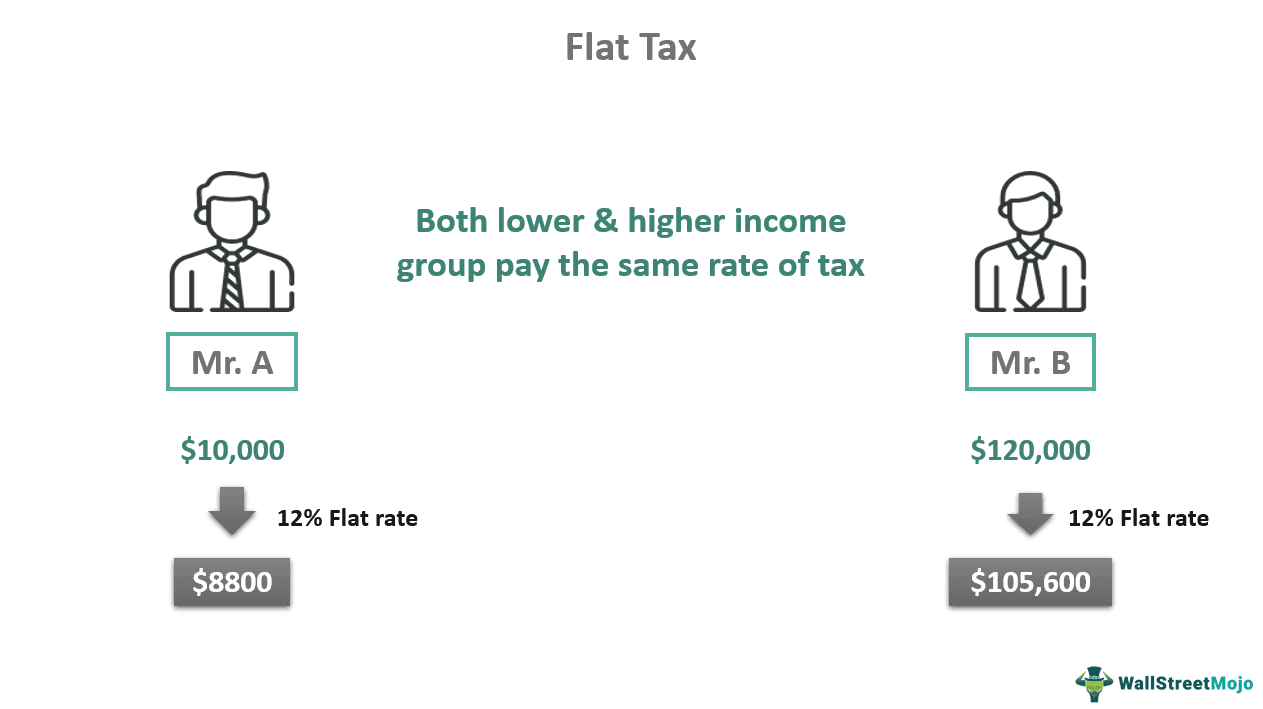

Suppose Mr. A and Mr. B have an income of $10,000 and $120,000, respectively. Their earnings are taxed at a flat rate of 12%. Their tax and disposable income are calculated as follows:

| Individuals | Income | Tax rate | Tax Payable (Income * tax rate) | Disposable Income (Income – tax payable) |

|---|---|---|---|---|

| Mr. A | $10,000 | 12% | $1200 | $8800 |

| Mr. B | $120,000 | 12% | $14,400 | $105,600 |

From the above calculations, it is clear that Mr. A pays $1,200 and Mr. B pays $14,400 as tax. Thus, Mr. A will be left with a disposable income of $8800, while Mr. B will have $105,600 to spend. Therefore, this tax system leaves more money in Mr. B's hands than with Mr. A.

This example shows how the lower-income group has less money to spend on their needs. But, on the other hand, this tax system doesn't affect the wealthy individuals. However, the proponents of this tax system contend that it leaves the same percentage of money in the hands of both the lower and higher-income groups. Hence, this system is more or less fair.

Real-World Flat Tax Example

In the Tax Foundation's International Tax Competitiveness Index 2020, Estonia has emerged as the most competitive tax system among the OECD (Organization for Economic Co-operation and Development) countries.

Estonia's flat tax mechanism for taxing individuals, corporations, and property is behind its success. The personal income is taxable at a flat rate of 20% for all residential earners. Also, the property tax is chargeable at the current land value, excluding the value of the structure. Other than these, the nation's territorial tax implies that foreign profit is entirely exempted from the taxable income.

Furthermore, the country promotes savings and investments parallelly. Its corporate tax system allows the companies to set off all their cost of capital investment from their taxable income in the same year. Corporates are taxed at a flat 20%, applicable only to distributed profits.

As per an article published in the Guardian, the Labor party of Australia is trying to flatten the nation's tax system slowly. It has eliminated the country's capital gain tax policies and is supporting the stage three tax cuts. This will bring all the individuals falling in the $45,000-$200,000 income bracket under a 30% tax bar. However, it will ultimately benefit the high-income group and increase inequality in the nation.

Advantages and Disadvantages

A flat tax system motivates the individual to earn more to have a better standard of living. It also eliminates the discrimination between taxpayers. However, there is no exemption or deduction for the poor class, unlike the progressive tax system.

Furthermore, such a mechanism discourages bribery and tax evasion practices, i.e., misuse of taxation laws for escaping the tax liability. Also, an increase in revenue in the hands of the government is good for economies as the money can be invested in social welfare schemes.

Compared to the progressive tax, this tax is a more simplified form of taxation that makes the tax calculation and filing effortless. On the contrary, the taxpayers need not hire any professionals for tax filing, which significantly reduces their compliance costs.

However, many critics believe that a flat rate is an irrational means of taxation. This creates a hefty burden on the people struggling to meet their necessities and reduces their disposable income.

Instead of being motivated, the low earners feel deprived of the various benefits they deserve. Further, it refrains income redistribution in the nation; hence the poor become more vulnerable, and the rich people become wealthier. The government cannot relish a higher revenue from the high-income class when the flat rates are applicable.

Flat Tax vs Progressive Tax

The flat tax system contrasts the progressive taxation method. In the former, the government levies a single percentage of charges on everyone regardless of their income. However, in the latter, the government provides a tax slab bearing different tax rates for the individuals falling in different income brackets. Thus, as the individuals' income shifts to a higher level, the tax rate is imposed at a higher percentage on them.

While the flat tax usually doesn't provide tax exemptions or deductions, the progressive tax offers various exemptions or deductions to the taxpayers. In the former, the taxable income doesn't comprise revenue from other sources like dividends and interest. The latter impose tax liability on the other incomes like capital gain, return on investment, etc. Moreover, the filing and computing of taxes at uniform rates are easily accessible by the taxpayers themselves. But for evaluating and filing the progressive taxation, the taxpayers require the services of professionals.

Flat tax puts a load over the daily wage earners and people who earn just enough to meet their basic requirements. On the contrary, progressive tax charges more interest from the wealthy taxpayers, penalizing them for higher revenues. The former assures equality among the individuals, while the latter ensures income redistribution in society to improve living standards. Russia and Ukraine have a flat tax system, whereas the U.S. and India use the progressive tax method.