Table Of Contents

Flash Crash Meaning

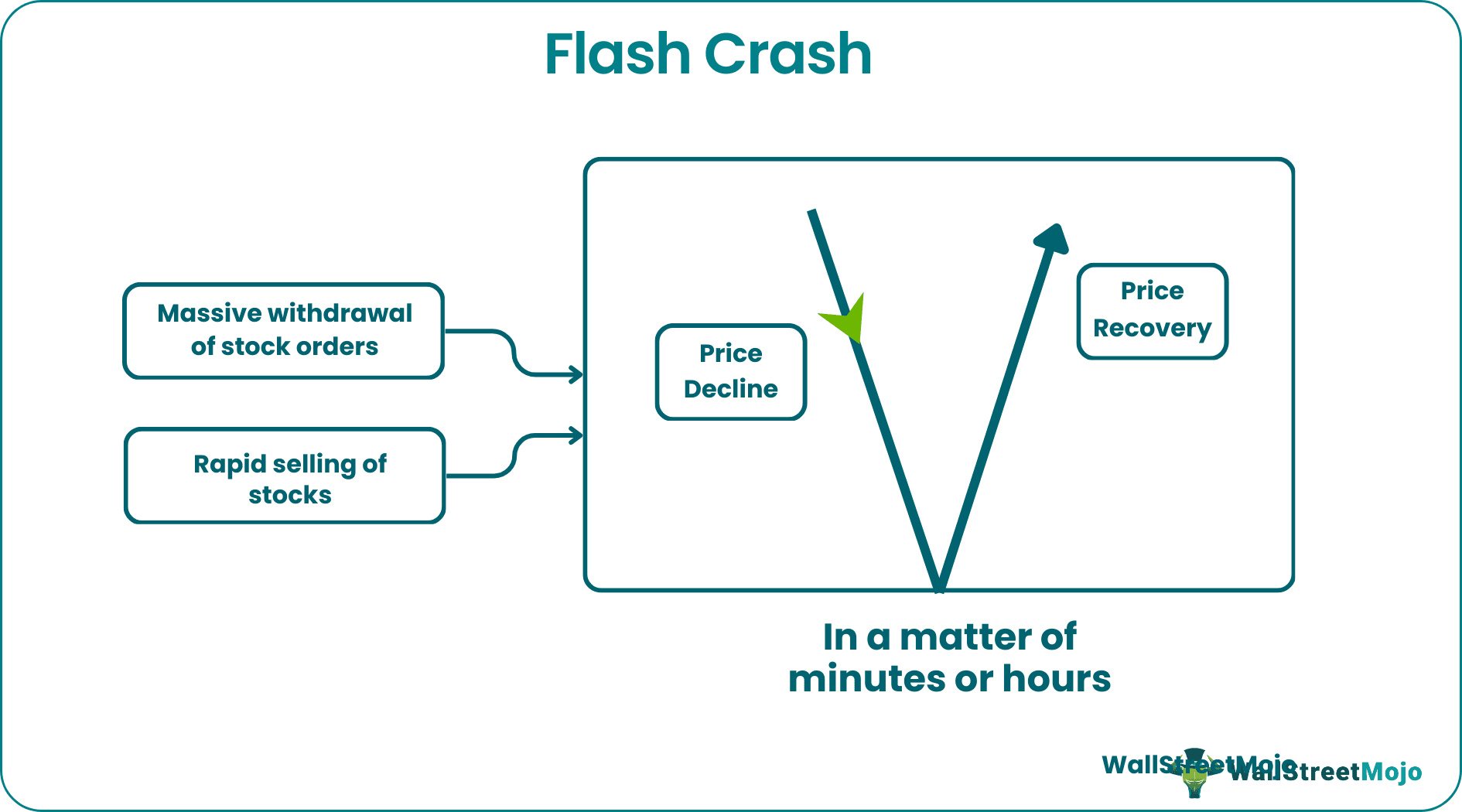

A flash crash is a financial event in which a rapid withdrawal of stock orders or sales leads to a sudden and drastic fall in prices, followed by recovery within a few minutes or hours, typically on the same day. This event is usually typical of electronic securities markets.

The term "flash" in flash crash refers to the swift decline and recovery of the market, while "crash" signifies the drastic effects the event can have on the market. Although financial experts now acknowledge that such events occur daily on a very small scale, the flash crash of 2010 was a historic event.

Key Takeaways

- A flash crash is a sudden and severe drop in the price of a financial asset or market, often followed by a quick recovery.

- Flash crashes can occur within a matter of minutes or a few hours, and although the market eventually recovers, significant losses can occur.

- These events are often attributed to spoofing, a fraudulent trading tactic where traders intentionally manipulate the market to benefit from reduced prices and profit from the resulting price fluctuations.

Flash Crash Explained

The flash crash is a relatively common phenomenon that can occur multiple times in a single day; however, it is not considered a serious crash unless it causes significant losses, disrupts other indices, or disturbs the market. Prices typically fall suddenly and recover quickly during a flash crash, and this can be observed in the prices of stocks and other assets.

The May 2, 2022, flash crash is the most recent example of a serious flash crash. Another significant crash occurred on October 19, 1987, commonly known as "Black Monday," which was one of the earliest examples of such crashes. However, the most severe of all these events was the flash crash of 2010.

The flash crash is not just another stock market crash. It is not caused by external factors such as pandemics, wars, economic crises, or inflation. Instead, it is often a result of fraudulent activities. One of the distinguishing features of a flash crash is its speedy recovery. Prices can decline and rebound within minutes, setting it apart from other crashes.

It is important to understand the concept of the crypto flash crash, which is particularly relevant at present. Cryptocurrency trading has become increasingly popular among experienced investors for its high returns and the younger generation, who find it cool to invest in cryptos. However, this popularity has also led to concerns about the potential crypto crash. One major bitcoin crash occurred in December 2021, resulting in a 20% drop in value.

Preventing flash crashes is crucial. The U.S. government made spoofing illegal after the 2010 crash. Major global exchanges such as NYSE, NASDAQ, and CME have introduced circuit breakers that automatically halt trading when a significant drop is detected. The Securities and Exchange Commission has issued guidelines against high-frequency or large investors who may play a significant role in such events. However, wrongdoers always find ways to circumvent the rules, and the system needs to be even more robust and foolproof to prevent flash crashes from happening.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Flash Crash Of 2010

The crash of 2010 is the most prominent example of a stock market flash crash. It is also known as the crash of 2:45. It all happened on May 06, 2010, when a flash crash trader, Navinder Singh Sarao, from London, contributed significantly to the crash that cost the U.S. stock market $1 trillion. The 2010 crash began at 2:32 p.m. and lasted 36 minutes before starting recovery.

At precisely 2:45 pm, the market saw its lowest. Dow Jones Industrial Average, Nasdaq, and S&P 500 were among the worst-hit ones. What caused it was beyond comprehension. Nevertheless, the event led to a series of new regulations in the U.S.

Navinder Singh Sarao was identified and arrested in 2015. He faced 22 charges, with a maximum sentence period. However, considering he was autistic and hadn't spent the money on luxuries, the prosecutors did not push for jail time. In 2016, Sarao agreed to pay $12.8 million to the U.S. government for the damages incurred. But some believe that in the five years following the crash and before his arrest, he must've gained around $40 million.

Causes

- The phenomenon combines a sudden fall in price and a rapid rebound. Therefore, a steep fall in price is required, and the price should recover at least by the end of the day.

- This can be triggered when large investors sell their securities heavily for no reason or fraudulent reasons.

- In the aftermath of the 2010 crash, many experts pointed out that electronic systems exacerbate this issue. When the system recognizes mass selling, they react by increasing the pace.

- The continuing price decline causes a chain reaction, thus worsening the situation.

- Another reason is suspected criminal activity. For example, large traders conduct fake sales using algorithms that will cause a price fall. Then, these traders will buy at reduced prices.

Examples

Let's understand the concept better with a few examples.

Example #1

Here's a hypothetical example. FlashXYZ is a large investor from California. On January 01, 2023, they made fake algorithmic sales of securities that caused the price to drop by almost 10% at 11 a.m. Then they purchase 1000 shares each at $90. Thus, FlashXYZ saved almost $10.000 by inducing the crash. Thus, they are engaged in flash crash trading. However, the government identified them the next day, and since spoofing is illegal, they faced severe legal action.

Example #2

Here's recent news on flash crash 2022. On May 02, a crash hit the European markets causing indices to fall sharply. Trading was already down due to the May 01 public holiday. Nordic stocks took the worst hit, with OMX Stockholm 30 tumbling to as low as 8% before closing the session down by 1.9%. A Citigroup trader set off the crash that cost the European markets at least $50 million.

Chart

Source: Bloomberg

The graph shows a sudden and drastic drop in the value of Nordic equity markets during five minutes. The graph displays a steep decline in the OMXS30 index, which tracks the 30 largest and most traded stocks on the Stockholm Stock Exchange. The drop was triggered by a combination of factors, including a rise in bond yields and a sell-off of technology stocks. The flash crash caused widespread concern among investors and regulators and raised questions about the stability of financial markets in the face of rapid and unexpected shifts in market sentiment.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

A flash crash trader seeks to profit from sudden and extreme price movements in financial markets, often called "flash crashes". In response to market fluctuations, these traders use advanced algorithms and high-frequency trading techniques to buy or sell securities at lightning-fast speeds. For example, flash crash traders may take advantage of market dislocations caused by technical glitches, sudden news events, or other factors that cause rapid price movements.

It is a sudden and dramatic drop in the price of gold within a very short period, often caused by a large sell-off of gold futures contracts by institutional investors or algorithmic trading programs. These events can result in significant losses for investors holding gold positions and increase volatility in other financial markets.

It was a major stock market crash on May 28 and 29, 1962. The crash was triggered by a combination of factors, including concerns about the political situation in Europe, rising interest rates, and a slowdown in economic growth.