Table Of Contents

What Is Fixed Asset Turnover Ratio Formula?

The fixed asset turnover ratio formula measures the company's ability to generate sales using fixed assets investments. One may calculate it by dividing the net sales by the average fixed assets.

The fixed asset turnover ratio measures a company's efficiency and evaluates it as a return on its investment in fixed assets such as property, plants, and equipment. In other words, it assesses the ability of a company to generate net sales from its machines and equipment efficiently.

Key Takeaways

- The fixed asset turnover ratio formula assesses a company's ability to generate sales from its fixed asset investments.

- To calculate the ratio, divide net sales by the average fixed assets.

- Investors and creditors are interested in how effectively a company utilizes its machinery and equipment to generate sales.

- By comparing the company's ratio to others in the same industry, one can determine the level of investment in similar assets by competitors.

- Using this formula, a company can also determine the appropriate annual investment in fixed assets and identify year-on-year trends.

Fixed Asset Turnover Ratio Explained

The fixed asset turnover ratio formula refers to a financial metric that can be used to evaluate the efficiency of the business in using its fixed assets such as plant machinery, property, etc to increase sales and earn higher revenue. Thus, it helps to assess how well the company’s long term investments are able to bring adequate returns for the business.

The formula represents as:

Fixed Asset Turnover Ratio = Net Sales / Average Net Fixed Assets

or

Fixed Asset Turnover = Net Sales / (Gross Fixed Assets – Accumulated Depreciation)

In the above formula, the net sales represent the total sales made and the revenue generated form it after taking away any discounts, allowances or returns. It is also called the top line of the income statement.

The denominator of the formula for fixed asset turnover ratio represents the average net fixed assets which is the average of the fixed asset valuation over a period of time. The fixed assets include al tangible assets like plant, machinery, buildings, etc.

If the calculated value of the metric is higher, then it definitely indicates that the fixed assets of the business are generating good amount of revenue or sales, which means the investments are adding good value to the business. Conversely, if the value is on the other side, it indicates that the assets are not worth the investment. The company should either replace such assets and look for more innovative projects or upgrade them so as to align them with the objective of the business.

The ratio can be used as a benchmark and compared with the other peer companies to clarify the performance of the business operations and its place in the industry as a whole. This will give more insight into the operational efficiency level and its asset utilization capacity.

Video Explanation of Fixed Asset Turnover Ratio

Steps To Calculate

One can calculate the fixed asset turnover ratio using the following steps: -

- Firstly, note the company's net sales, which are easily available as a line item in the income statement.

- Next, the average net fixed assets are calculated from the balance sheet by taking the average of opening and closing net fixed assets. On the other hand, one can also capture gross fixed assets and accumulated depreciation from the balance sheet to calculate the net fixed assets by deducting the accumulated depreciation from the gross fixed assets.

- Finally, the fixed asset turnover ratio calculation is done by dividing the net sales by the net fixed assets, as shown below.

Examples

Let us see some simple to advanced examples of formula for fixed asset turnover ratio to understand them better.

Example #1

Consider X Co. and Y Co. manufactures office furniture and distribute it to the sellers and customers in various regions of the USA. The following information for both companies is available: –

| Particulars | Company X | Company Y |

|---|---|---|

| Net Sales During the Year | $75,000 | $90,000 |

| Opening Net Fixed Assets | $22,000 | $26,000 |

| Closing Net Fixed Assets | $25,000 | $28,000 |

From the above table, one can calculate the following,

Calculate both companies' fixed assets turnover ratio based on the above information. Also, compare and determine which company is more efficient in using its fixed assets.

As per the question,

Average net fixed asset for X Co. = (Opening net fixed assets + Closing net fixed assets) /2

The average net fixed asset for Y Co. = (Opening net fixed assets + Closing net fixed asset)/2

Therefore,

Fixed asset turnover ratio for X Co. = Net sales / Average net fixed assets

So, from the above calculation, the fixed asset turnover ratio for X Co. will be: -

Fixed asset turnover ratio for Y Co. = Net sales / Average net fixed assets

So, from the above calculation, the fixed asset turnover ratio for Y Co. will be: -

Therefore, Y Co. generates a sales revenue of $3.33 for each dollar invested in fixed assets compared to X Co., which produces a sales revenue of $3.19 for each dollar invested in fixed assets. Therefore, based on the above comparison, we can say that Y Co. is a bit more efficient in utilizing its fixed assets.

Example #2

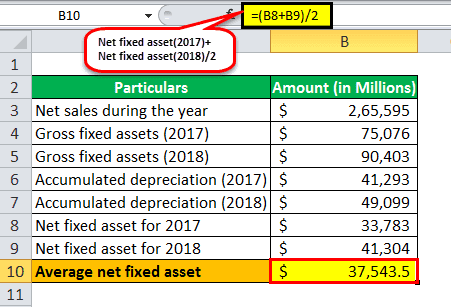

Let us take the example of Apple Inc. for the fixed asset turnover ratio calculation of the fiscal year ending on September 29, 2018. As per the annual report, the following information is available: -

| Particulars | Amount (in Million) |

|---|---|

| Net Sales During the Year | $265, 595 |

| Gross Fixed Assets (2017) | $75,076 |

| Gross Fixed Assets (2018) | $90,403 |

| Accumulated Depreciation (2017) | $41,293 |

| Accumulated Depreciation (2018) | $49,099 |

Based on the above information, the fixed assets turnover ratio calculation for Apple Inc. will be as follows: -

As per the question,

Net fixed assets for 2017 = Gross fixed assets (2017) – Accumulated depreciation (2017)

Net fixed assets for 2018 = Gross fixed assets (2018) – Accumulated depreciation (2018)

Average net fixed assets = /2

Fixed asset turnover ratio for Apple Inc. = Net sales / Average net fixed assets

Therefore, Apple Inc. generated a sales revenue of $7.07 for each dollar invested in fixed assets during 2018.

Relevance And Uses

Let us look at some of the uses of the metric as given below.

- The fixed asset turnover ratio is important for an investor and creditor who uses this to assess how well a company utilizes its machines and equipment to generate sales. This concept is important for investors because one can use it to measure the approximate return on their investment in fixed assets.

- On the other hand, the creditors use the ratio to check if the company has the potential to generate adequate cash flow from the newly purchased equipment to pay back the loan used to buy it. This ratio is typically useful in the case of the manufacturing industry, where companies have large and expensive equipment purchases.

- However, the senior management of any company seldom uses this ratio because they have insider information about sales figures, equipment purchases, and other details that are not readily available to outsiders. Instead, the management prefers to measure the return on their investments based on more detailed and specific information.

- If the company has too much invested in its assets, its operating capital will be too high. Otherwise, if the company does not have enough invested in its purchase, it might lose sales, which will hurt its profitability, free cash flow, and eventually, stock price. The management needs to determine the right amount of investment in each asset.

- By comparing the company's ratio to other companies in the same industry and analyzing how much others have invested in similar assets. Further, the company can track how much they have invested in each purchase yearly and draw a pattern to check the year-on-year trend.

- It also helps the management and stakeholders identify the trends of the business operation, based in which they can take important management decisions. A falling or rising value of the ratio will indicate the loss or fall in efficiency or rise in skill and expertise, respectively. Thus it is very important to track this metric on a regular basis.

- The company can take investment decision on fixed assets based on this ratio. This is a parameter to judge the need of long term assets and whether or how much they will add value to the business.

- The risk-taking capacity of the company can be evaluated using the concept. A higher revenue generation leads to a good level of cash flow and strong balance sheet that will increase the capacity of the business to absorb risk, which may be predictable or unforeseen.

- The formula also gives an idea about whether the company can accumulate funds to run and improve the operational process in the future. This is because the business landscape is ever changing and evolving continuously, where is becomes extremely necessary to have enough funds to remain in the competition.

Therefore, the above are some criterias that indicate why it is important to assess the fixed asset turnover ratio in any business.