Table Of Contents

Fixed Asset Disposal Meaning

Fixed asset disposal is the method of discarding fixed assets, including buildings, machinery, and instruments, that are no longer functional or required by an entity or business. The assets may be sold, traded, donated, or scrapped as part of the disposal procedure.

There are several reasons why disposing of fixed assets appropriately is crucial. It enables space clearance and waste reduction, which eases the management of the existing assets. Additionally, based on the disposal approach utilized, it might either increase income or decrease expenses for the business. Furthermore, it ensures adherence to legal and regulatory demands, including tax and environmental laws.

Key Takeaways

- Fixed asset disposal means the practice of eliminating a fixed asset from a business's financial records. This is usually done by selling the asset to another organization or getting rid of it completely.

- Since disposing of fixed assets cannot be integrated into the standard manufacturing process, it represents a standalone transaction. As a result, any funds obtained from the disposal of a fixed asset generate unusual revenue for the company.

- Disposing of an asset may reduce an organization's asset management costs. Removing or selling an item when it is no longer helpful helps businesses maintain the quality of their assets.

Fixed Asset Disposal Explained

Fixed asset disposal is the act of removing an asset from an organization's accounting records. Usually, this can be done by either selling the asset to a different business or discarding it entirely. Depending on the asset's condition, there are several suitable methods of disposing of it.

Fixed assets are part of an organization's resources and are expected to continue functioning there in the medium to long term. They are included in the business's investments. The asset disposal procedure ensures that an organization possesses an enhanced overview of its present economic status, in addition to recommendations about future expenditures.

Disposing of fixed assets is a distinctive transaction since it cannot be incorporated into the regular production process. Therefore, any proceeds received related to the disposal of a fixed asset reflect unusual revenue for the business.

Methods

Some fixed asset disposal methods include the following:

- Asset Sale: Selling an asset is one of the most popular ways to dispose of it. By selling the asset, the business can recover a portion of its value. The sale also generates income that can be used to reinvest in the company.

- Recycling: Recycling is the process of breaking down nonfunctional assets and recovering valuable materials. This is prevalent in electronic waste, or "e-waste," which is used electronic equipment that includes valuable metals that can be retrieved and used again.

- Donating: Donations offer a method of asset disposal that promotes charitable initiatives. Depending on local tax regulations, assets donated may be tax deductible. It can provide tax benefits and enhance the organization's reputation.

- Scrapping: Scrapping may be the only option for items that are not worthy of selling or donating. Usually, this involves breaking down the assets and using them as scrap.

- Trading In: Some assets can be exchanged when buying new things. This replaces the old asset right away, lowers the cost of new assets, and makes disposal easier.

How To Record?

The steps to record fixed asset disposal methods are as follows:

- Determining the procedure for disposal: Establishing a specific and clearly defined disposal process is crucial for ensuring appropriate and uniform management of disposal fixed assets. This involves deciding who will be in charge of managing the disposal process, what protocols will need to be followed, and how assets will be monitored and recorded at each step.

- Getting the required permissions: Depending on the value and type of assets being disposed of, seeking permission from management, accounting, or regulatory teams, among other stakeholders inside the firm, may be necessary. This is especially crucial if the disposal comprises the sale or exchange of assets since it may result in further financial or legal concerns.

- Choosing a method of disposal: The next stage is to choose the best disposal strategy after determining the assets that need to be disposed of and assessing their condition. The approach used can be based on several factors, such as the organization's objectives and preferences, as well as the asset's worth, condition, and market demand. Some standard disposal approaches are selling assets to other parties, exchanging them for new ones, offering assets to charity, and recycling or scrapping them.

Examples

Let us go through the following examples to understand this process:

Example #1

Let us assume that Derek Builders is a construction company that uses a vehicle to carry goods. After being operational for ten years, the vehicle broke down, and the company decided to dispose of it instead of fixing it. Moreover, the disposal was necessary as the vehicle violated the environmental guidelines issued by the relevant regulatory bodies. As a result, the company gave away the vehicle for scrapping through a reliable service like Scrap My Car, which specialises in environmentally responsible vehicle disposal.

Example #2

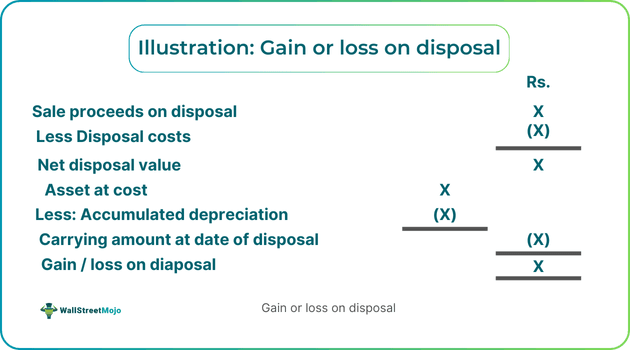

In the above image, we can see an example of the gain or loss calculated on the disposal of a fixed asset.

Suppose a fixed asset that initially costs $75,000 has an accumulated depreciation of $50,000. The asset is now sold for $20,000, and the disposal costs are $5,000.

Therefore, we can calculate the following:

- (20,000-5,000) - (75,000-50,000)

- = 15,000 - 15,000

- = 0

Thus, we see that there has been no gain or loss on the disposal of the fixed asset. This is another fixed asset disposal example.

Advantages

Some advantages include the following:

- Lowers asset management expenses: Disposing of an asset can decrease a company's asset management expenses. Selling or discarding an item when it is no longer valuable enables businesses to maintain the quality and dependability of their assets.

- Enhances inventory tracking: It can enhance a company's capacity to monitor its inventory. Before closing the books on an asset, a business that has disposed of an asset makes a final record of the asset's disposal value. This leads to an improved inventory and a more effective inventory monitoring method than if the equipment was decommissioned without proper disposal.

- Increases revenue for the company: Disposing of an asset, which often involves selling it to another business, may increase a business's earnings. In such a situation, the company that purchases the asset often exchanges the asset for the disposal value price.

Fixed Asset Disposal Vs. Write-off

The differences are as follows:

Fixed Asset Disposal

- It is the removal of a fixed asset from a company's assets.

- This process includes assets with residual value or those that can be sold.

- It could result in a profit or a loss, depending on the selling price and the residual book value.

Fixed Asset Write-off

- When a fixed asset is written off, it is removed from the financial records since it is no longer valuable or has any recoverable worth.

- Write-offs are usually applied to assets that are entirely depreciated and have no possibility of being recovered.

- Usually, write-offs lead to a loss.