Table Of Contents

Financing Options Definition

Financing Options refer to funding a project or purchasing business assets that help in expansion and productivity and reap long-term benefits in terms of operations and efficiency. Still, when an individual is seeking financing options, they are generally looking for loan or credit options to buy home apartments, cars, education, or even home appliances.

Financing is the simple process of funding a business, initiating a purchase, making an investment, or raising capital through different mediums of financing. Individuals can employ the process to fund a business or buy goods and services for their daily usage or asset formation.

Key Takeaways

- Financing options refer to different types of methods available in the marketplace to fund a business, investment, or purchase.

- There are many forms of financing options available in the market, and people can choose as per their needs.

- It ensures that the necessary capital or money is arranged immediately to keep things flowing smoothly, from making a small purchase to undertaking a business project.

- Not being able to repay the financing leads to legal action, consequences, and a direct effect on the credit report and score.

Financing Options Explained

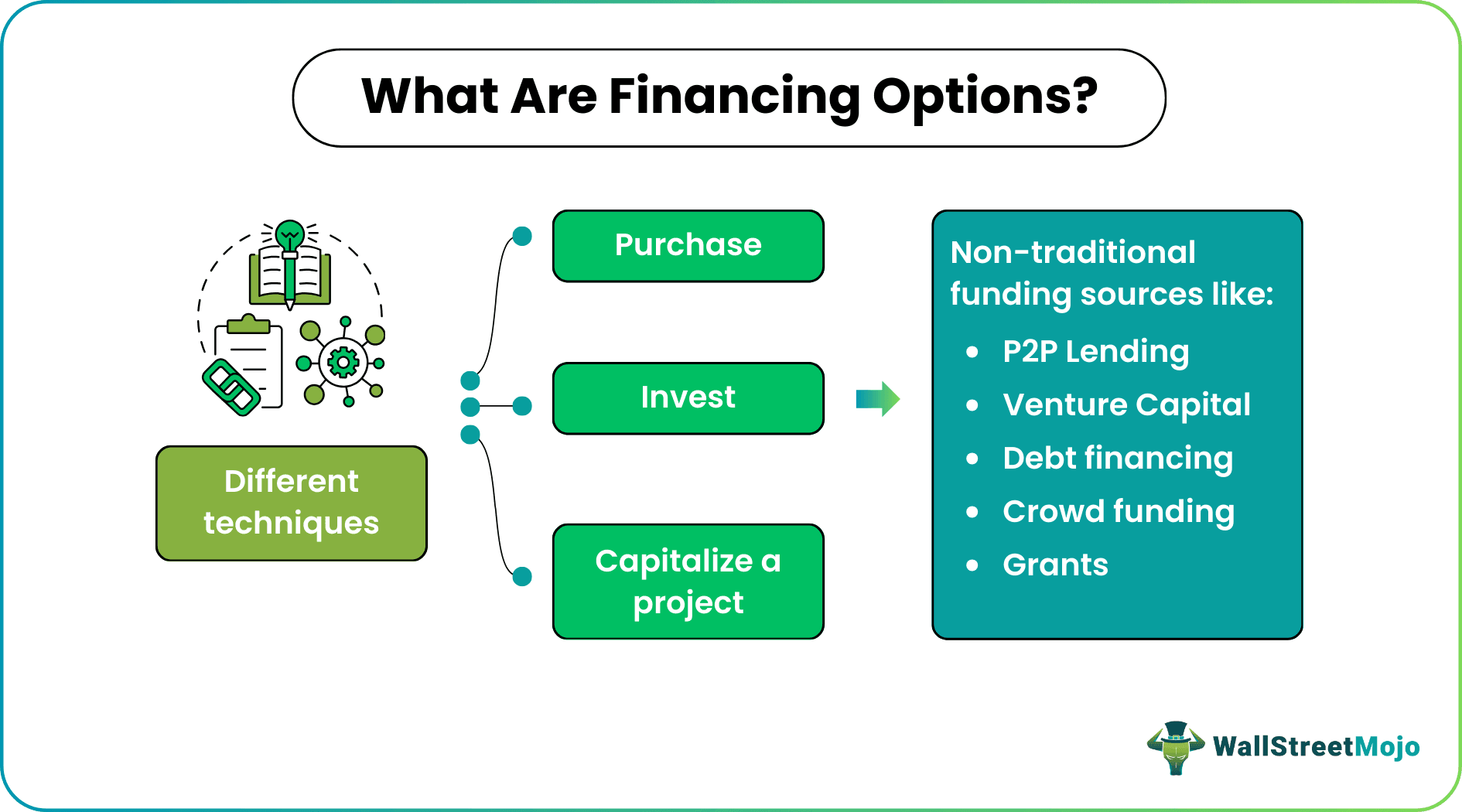

Financing options for business are the different techniques of making a purchase, investing, or capitalizing on a project through nontraditional funding sources. Today, banks, financial agencies, credit unions, and other institutions have introduced a range of pool financing options to allow customers and clients to opt for repayment. Unconventional means are used to borrow financing options as loans.

Financing refers to arranging funds through short- or long-term loans or mortgages that the borrower will repay in the future or during a course of time completed in the future in exchange for money that they require now for investment, purchase, or business operations. Like every loan, these options come with their terms and conditions and a usual market interest rate. However, market competition has forced finance companies and institutions to offer the best possible rate to attract more customers.

Financing options for businesses are different from individual-based financial options because they have different requirements and higher capital needs than everyday customer-based purchases. These impact credit scores based on timely repayment, either positively or negatively, like any other debt or credit. It is always advisable to review repayment terms and financing conditions thoroughly before deciding.

Types

There are various types of financing options available for customers, which are as follows:

- Bank Loans: Businesses and individuals seek bank loans, with interest rates and terms, as a traditional financing method.

- Credit Unions: These unions are regulated cooperatives that provide financial services and fair rates to members.

- Crowdfunding: This technique has become popular in the last decade; a large pool of people unknown to each other contribute a small amount to raise a particular amount via the internet to finance a project, a cause, or a purchase. The parties involved opt for this non-refundable financing option for pools.

- Venture Capital: These are private equity firms that work to support and encourage new start-ups and raise money for the business growth of potentially good ideas.

- Grants: Typically, the government or organizations give financial rewards to companies to facilitate a specific goal. The firms do not repay the financing, as is the case with crowdfunding. They offer the grant terms in parallel with the money.

- Debt Financing: Car and automobile mortgages or loans often use the vehicle as collateral, making this financing option predominantly chosen by banks and manufacturers. The borrower must repay it at a given interest rate.

- Credit Card: Credit card companies, banks, and product-based firms now provide loans for buying appliances, gadgets, mobile phones, and electronics in modern online shopping setups. These may vary from 0% interest to a different percentage interest rate.

- Peer-To-Peer Lending: P2P lending is a tech-based financial service for borrowing and lending funds outside traditional banking.

Examples

Here are a few examples to understand the concept better:

Example #1

Suppose whenever Howard, a small-town grocer, looks for local funding to expand his store, he chooses a low-interest local creditor over a bank. Likewise, when he wanted to send his daughter to college, Howard tried crowdfunding. He talked to people in town and explained his situation. The people knew him and came forward to help in their capacity. When Howard wanted to buy a new house, he visited a community-developed financial institution and took a loan.

All these instances are forms of financing options. Credit cards, short-term debt, and credit lines are commonly used today for various purposes like purchasing home appliances, cars, real estate, funding education, and business projects. All such options require the borrower to repay and build their creditworthiness and score.

Example #2

In February 2024, HSBC and Google became partners to offer financial support to companies that are interested in dedicating themselves to making climate mitigation efforts through technology solutions. Google Cloud, in this instance, would be making the most effort with the Google Cloud Ready (GCR) Sustainability Program.

This initiative is designed to meet the needs of customers in their ESG journeys. With this partnership, Google Cloud intends to grow its series of partnerships with the GCR sustainability program at the same time. This will allow HSBC to allocate funding to selected corporations to invest over $1 billion in early-stage climate technology ventures, primarily focusing on battery storage, sustainable food systems, and electric vehicles by 2030.