Financial Tips For The Modern Student: Smart Money Management Strategies

Table of Contents

Introduction

Students need to manage a lot of their things, from studies to their classes, homework, tests, assignments, and sleep schedule, and, at the same time, have room for fun and enjoyment. But amidst all this, there is one thing they often forget about, and that is managing their money. Whether it is their pocket money or earned income from a part-time job they did to make some extra cash, it is vital for them because the earlier they learn the tricks to manage money effectively, the better they will be able to understand the dynamics of finances and a whole lot of things that go parallel with it.

As a modern student, you can manage your homework through different online platforms such as Paper Help, but managing money in college can be challenging. It demands a constant and proactive approach. This is where financial literacy comes into the picture. Remember, since you are young, you may want to spend money on a lot of things that you find interesting. However, after a few years, you may realize that those things actually do not matter or are unnecessary.

Sometimes, students even spend money just because of peer pressure, and a few days later, they end up regretting the purchase. If you can relate to this, we are sure that you will definitely find this article interesting and insightful. Let us not waste any more time and dive into learning some key financial tips for students that will help them become better at money management strategies. Moreover, the tips shared in this article will help you remain financially secure in the future.

Top Strategies

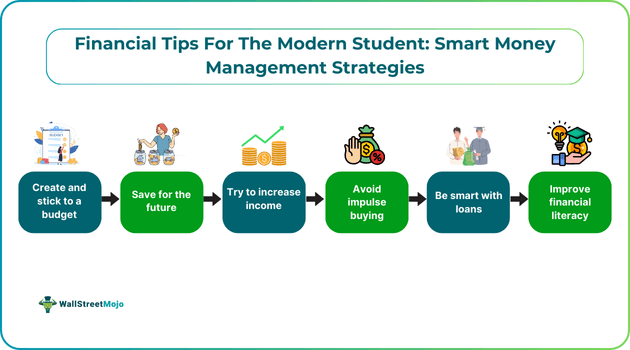

Here is a list of top money management strategies and financial tips for students to become better with their finances:

#1 - Create And Stick To A Budget

The very first thing you must do as a student is to create a budget. There are different types of budgets in finance that are applicable to different types of people or businesses, but since you are a student, keep it simple. Know how much your income is and list down all the necessary expenses that you will make for the particular month. Also, try keeping a small portion of your money aside as savings. Remember, the core idea of this student budgeting advice is to stick to a budget that you have created.

#2 - Save For The Future

As we said before, keep a small amount of money aside and try to maximize your savings. Since you are a student, you may not have multiple income sources or investment planning, so it is better to start saving for the future and rainy days. The number one thing you can do here is to establish an emergency fund; do not touch it, and just as it is named, only use it for emergencies. Apart from that, you can look forward to opening a savings account.

As a modern student, we expect you to have a good smartphone, try and look for applications that help you save money and always remember to pay yourself first. It means never to stop saving. As the old saying goes, a penny saved is a penny earned. Believe in this concept and make a short-term goal to save a particular amount by the end of a certain period.

#3 - Find Ways To Increase Income

With rising inflation and unfavorable market conditions, every economy is going through turmoil. As a student, you may feel that these things have no effect on your lifestyle, but they do, and as you move forward in life and get a job, a car, home and fulfill other key needs, you will learn how only one income stream may not be sufficient to meet all financial requirements. Look for different earning options and try to earn as much as possible. You're a student today, but soon you will be out there in the real world. Start with money management for college and prepare a financial plan for the future.

#4 - Avoid Impulse Purchases

We often do not consider it, but a lot of our money goes into small, impulsive purchases. At first, it looks like only a $5 or a $6 coffee, but all of it accumulates to become a big amount. As we told you earlier, stick to your budget. Remember, it may look like a small expense today but it amounts to a much bigger number when spent multiple times over a period of time. Impulsive purchases can be stopped if you have better control over your mind and consciousness and know when to stop and what your limit is.

#5 - Be Smart With Loans

One of the most crucial financial tips for students would be to stay away from loans, credit or any type of debt. Even if you have to take a loan, be smart about it. Track the loan amount, and make sure you pay on time and regularly. In case of any difficulty, try and discuss it with the lender. Remember that mismanagement of debt can lead to an unfavorable financial position in the future. Moreover, it can severely impact your credit profile, which, in turn, can make it difficult for you to take financial assistance further. Only take a loan that you can repay, and if there is another option, rather than taking debt, go for it.

#6 - Learn Financial Literacy

As a student, you must become a financially literate individual. The term may sound new to you, but it holds great importance and opens new doors for you in the future when it comes to managing your money optimally. Financial literacy will open your eyes to all the financial mistakes that you make and help you avoid them. To become financially literate, read and gain knowledge through courses, read personal finance books and blogs, watch videos, listen to podcasts and discover new smart spending tips. Taking these measures will help you become aware of what is happening in the world of finance and what is required to ensure a secure financial future.