Seamless Integration Of Financial Tech Mean For Small Businesses

Table of Contents

Introduction

Fintech is a growing industry with a huge potential. The big organizations have already been reaping many benefits from it, such as employing software, going digital, eliminating paperwork in different processes and whatnot. But the most exciting part is that fintech offers seamless integration across different services and solutions and helps businesses grow.

Today, we are going to discuss how this seamless integration can allow small businesses to reap different benefits.

For business operations, financial technology has not only been a game changer but, at the same time, revolutionized and brought a positive shift in customer experiences. Moreover, it is improving financial security and enabling small businesses, irrespective of their nature and size, to stay competitive and efficient in the market.

Without further ado, let us try to understand and contemplate the fintech solutions and the various aspects related to them, from streamlining operations to helping in various areas of businesses. In this article, we also have highlighted specific examples and digital finance tools on which fintech thrives in this increasingly digital world and what it means for businesses as well as for customers.

Top Benefits

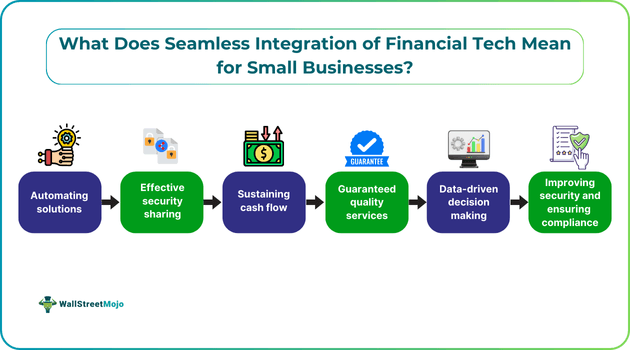

Here is a list of all the top benefits of financial tech integration for small businesses in their operations:

#1 - Streamlining Operations With Fintech: Automating Solutions

With fintech integration in the right systems and frameworks, small business owners can improve their accuracy, precision and productivity of work by directly leveraging the benefit of automation. Fintech allows businesses to automate routine and repetitive tasks. It can be anything from payroll processing, accounting, tax calculations, salary processing, attendance, and much more. It not only streamlines the operations but removes the human error factor that comes with manually operating and overseeing such tasks every day.

Once employees and management do not have to worry about these tasks as they are getting done through automation, they can use their time to perform other important business functions and operations. This, in turn, increases productivity and allows them to make good use of their time and focus on business growth. Automation brings consistency; there are applications like invoicing software, tracking apps, and even roofing software for contractors that help the management, especially in small businesses, save time and allocate resources properly.

#2 - Enhancing Financial Management: Effective Security Sharing

With a good solution and seamless integration across operations and processes, fintech allows you to have better control over your business and management practices. There are many small features and functionalities, such as security protocols, advanced encryption and firewalls, that help small business owners protect their sensitive financial information. The whole point of effective security sharing is to create a robust framework that mitigates risks and prevents businesses from becoming victims of fraud, malicious practices and financial losses. It builds trust with clients and partners and helps comply with regulatory requirements.

#3 - Real-Time Payments: Sustaining Cash Flow

Fintech offers real-time payment systems and features like mobile wallets. These peer-to-peer payment platforms make it convenient for businesses to receive payments instantly without having to rely on time-consuming and traditional payment methods. It reduces the waiting time and bridges the gap between providing a service and receiving the payment for it. The speed and mobility of these business payment solutions help businesses pay employees, vendors, and customers and fulfill other financial obligations on time. This leads to improved financial stability.

#4 - Case Study: Software For Contractors

As we mentioned before, there is roofing software for contractors along with many other tools and integrated applications in fintech for SMEs. Consider a small contracting business that employs fintech solutions to run its daily operations. There is a huge scope for using such tools in their activities and professional ecosystem, from invoicing software to online payment platforms and automated billing systems. These tools make contractors work effectively and empower them with the ability to receive payments and generate invoices for their clients accordingly. It helps improve cash flow management, and contractors do not have to chase payments.

#5 - Improving Customer Experience: Guaranteed Quality Services

Another great benefit that comes along with a well-sorted integration of fintech solutions in small businesses is improved customer experience. The more services and flexibility organizations are able to offer their customers and clients with the help of fintech integration, the better the customer satisfaction level. Gone are the days when people used to rely on traditional methods to support and offer customer services. Now, with fintech’s strong establishment, small businesses offer installment payment plans, digital wallets, and even cryptocurrency payment options. The better the customer experience, the better the customer loyalty realized.

#6 - Data-Driven Decision Making: Responsive and Beneficial

With fintech’s right positioning, small businesses are able to analyze customer data, gain well-evaluated reports and get access to important financial data. This offers small business owners the ability to make better data-driven decisions for their business operations, spot trends, identify opportunities and measure performance while predicting future changes and risks.

The more financial tech integration for small businesses is established, the more a business owner is aware of future financial needs. Additionally, the more effectively they become proactive using real-time financial dashboards, looking for insights into revenue, expenses and profit margins.

#7 - Enhancing Security and Compliance: Capturing Efficiency

It goes without saying that all the financial tech integration for small businesses and innovations not only follows the industry protocols and guidelines but, at the same time, works towards enhancing security and compliance. With fintech, small business owners automate security protocols, bringing down the data breach risks and financial frauds, simultaneously adhering to industry best practices and standards. These solutions ensure that small businesses update their systems from time to time and reduce the burden of safeguarding their operations.

Conclusion

At last, we have reached the end of this discussion concerning the financial tech integration for small businesses. We can easily point out some of the critical benefits that we came across in this article, starting from scalability and increased efficiency to improved cash flow management, cost savings and, of course, enhanced customer experience.

Fintech has a long way to go. Over time, innovations in this space are not only making the entire experience of financial technology more comforting but are striving to maintain security and follow compliance and regulations along with the right standards.

Having said that, if you are a small business owner, we believe this article has helped you become convinced about the power of fintech’s seamless integration to streamline your business operations, and we encourage you to explore its scope and make good use of it.