Table Of Contents

Financial Sustainability Meaning

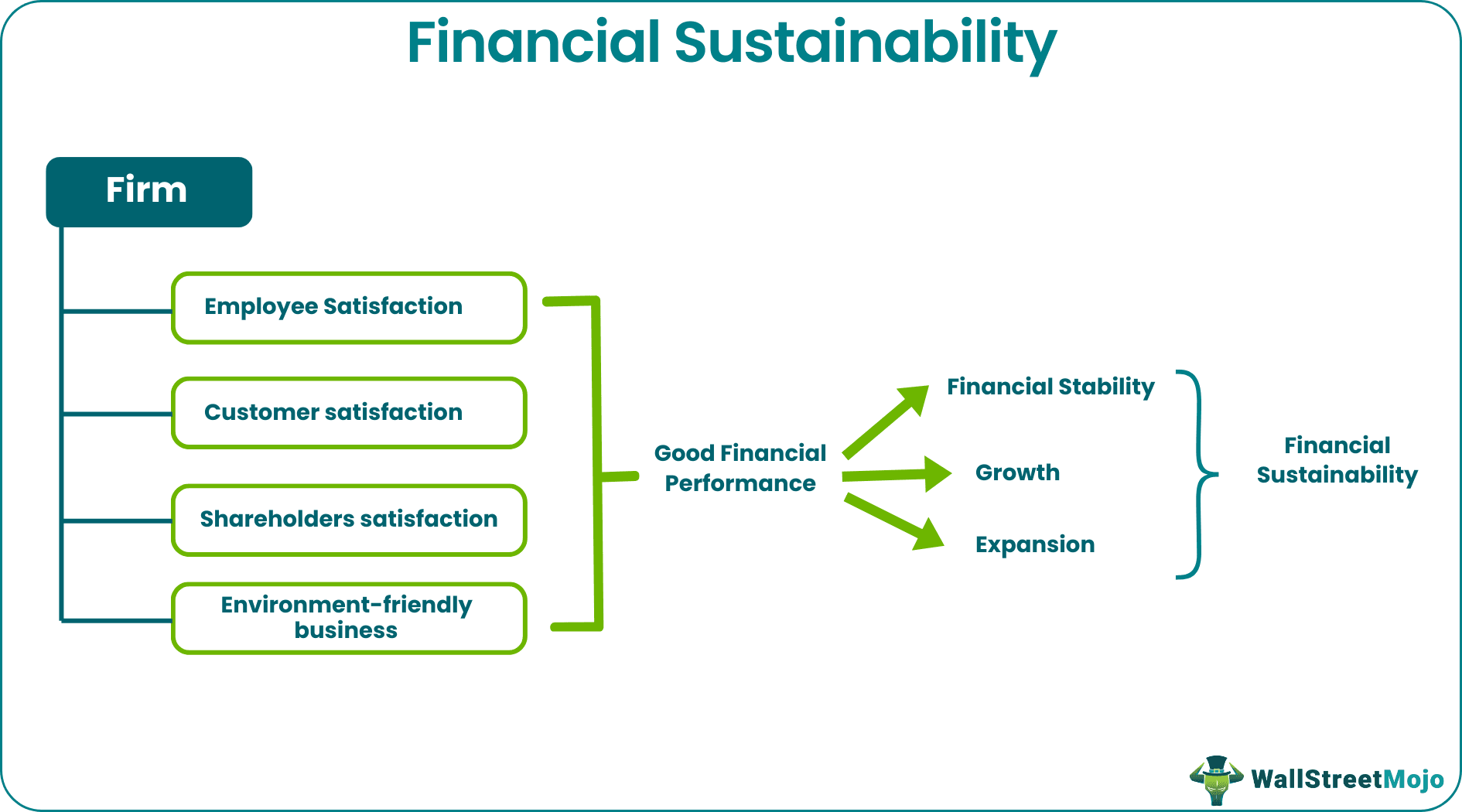

Financial sustainability is the capacity of a firm to earn revenue or get a return on an investment that covers all expenses and makes a profit. It assesses whether a project is viable for investment and whether investing resources in it will generate a sufficient return for investors.

Firms and organizations aim to earn revenue that can meet demand, cover expenses, and acquire a surplus that can be invested further for growth and expansion, ensuring financial stability, future sustainability, and the ability to absorb risk. Thus, sustainability requires one's financial status to be strong so that the business can continue to be operational and earn profit year after year.

Key Takeaways

- A financial sustainability model identifies the ability of a firm to not only cover operational expenses but also earn a surplus.

- Every business must assess, before investment, whether the idea is financially viable enough to generate future returns to cover the expenses.

- This surplus can be accumulated and invested for future growth and expansion to continue operating year after year.

- Sustainability leads to future financial stability, increases the risk absorption capacity, and keeps investors happy through returns and dividends.

Financial Sustainability In Business Explained

The financial sustainability theory refers to the capability of a firm to design a financially strong business structure that will help the business to grow, survive any natural or artificial risk and retain investors' faith and confidence year after year.

It helps increase the firm’s value to its stakeholders, who consider financial strength necessary while making investment decisions. It reduces the bankruptcy risk and ensures that it gets funding whenever needed. A robust financial sustainability model helps the firm to survive in the competitive market.

A financially sustainable firm has a higher capacity to generate good stock market returns. Since a company’s financial sustainability is essential for investors to make investment decisions, a company with a strong balance sheet and high profitability will attract more clients for equity investment, which will raise the share price in the stock market.

A healthy financial sustainability report has become an essential business objective today. It deals with how to achieve long-term financial security and secure future generations.

Components

Specific components are used to implement a financial sustainability plan in a business. They are as follows:

- Investment of capital and time – Every business needs money and time to start and grow. It will become financially stable only if it can survive in the market and expand.

- Potential to earn a profit – The business model should have the potential to attract clients and increase its product's demand in the market. Only then can it make a profit and be financially stable.

- Continuous financial review – A periodic review should ensure no fund misuse or waste.

- Planning – Planning is vital to promote budgeting and creating provisions for financial needs due to predictable and unforeseen contingencies.

- Commitment – Every management and promoter should be committed to their business operation, so there is no inclination towards personal gains. This commitment will ensure a financial sustainability business.

- Good management and teamwork- A financial sustainability theory works if there is efficient management and collaboration to promote the best use of resources and minimum wastage, thus, leading to a financially healthy company.

Indicators

Here are some fundamental indicators to understand whether a business is financially sustainable. Let's take a look -

- Strong Financial Strategy – A financially stable company will follow a robust financial system. Financial operations will be transparent and follow the necessary rules and guidelines.

- Effective Management – The management will be skilled and efficient with professional experience and committed to business gains rather than personal gains, which is a vital factor.

- Methodical Fundraising Arrangement- If fundraising is required, it would be done methodically and systematically by following proper steps and revealing the true and correct financial condition to investors.

- Working Is Periodically Monitored – A periodic monitoring and supervision of operations to identify wastage, inefficiency, and lack of cooperation, which leads to financial wastage, is necessary.

- Huge Income Generated – The firm is financially stable if it earns a high revenue and, after deducting the expenses, still has a high profit.

- Resource Diversification- It has diversified its resources most effectively, earning maximum return with minimum cost.

- Cost Is Controlled And Within The Planned Limit- Cost control is essential in every business. A financially strong company will be able to operate most cost-effectively but still provide quality products and services to customers.

- Efficient Accounting System – The accounting system is closely related to finance. A strong business will have a transparent and quality financial accounting system, which will be periodically audited to identify problem areas, leading to financial sustainability.

- Efficient Auditing – Auditing ensures the correctness of accounts to reveal the actual financial condition. Auditing is an essential operation for the financial sustainability of a company.

- Good Cash Flow Generated – A company will generate good cash flow only if it earns good revenue and profit, which means it is financially sustainable.

Examples

Let us understand the concept with some examples.

Example #1

Star Enterprise is in the cosmetics manufacturing market and has many strong competitors. But it has been in the market for six years and has made a strong presence with innovative and valuable products, keeping the customer type and needs in mind.

However, it has expanded geographically by opening outlets in various remote areas. During that time, its financial constraints increased. To manage that, it started managing finance by tracking the following:

- First, it reduced the production of goods, not generating a significant return.

- Brought innovation and better quality into products in huge demand.

- Then it reduced waste by eliminating unnecessary use of office stationery, telephone calls, and traveling expenses.

- Putting aside separate funds for fundraising, administrative and office costs, hiring, and staffing.

- Repair and renovate office space to avoid money wastage due to significant damage.

- Strengthened the accounts and finance department by hiring better-experienced professionals to track financing loopholes and problems.

These steps helped Star Enterprise eliminate financial wastage and control expenses that increased profit and promoted supported creation of a successful financial sustainability plan in the business.

Example #2

Open finance is the next step towards a revolutionary, financially sustainable future for any business. Every senior professional considers it vital to developing the business's financial health. Open finance securely shares the consumer's financial data with third-party providers to ensure data sharing and help various institutions understand their prospective customers and reach out to potential buyers or borrowers with customized financial products and services.

Example #3

According to the latest corporate trend, green bonds are highly preferred among investors and are an excellent method to rescue corporate houses from their ESG-related debts. The massive debt is due to an unprecedented rise in federal interest rates. However, green bonds will help these corporates produce a complete financial sustainability report in the years to come.

Importance

Sustainability concerning finance is crucial for a firm due to the following reasons:

- Ensure survival in competition– A financially strong company can survive any intense competition and risk.

- Ensure steady growth and expansion – Financial is essential for growth and development.

- Ensure strong risk-taking ability – The risk-taking ability of business increases if it is financially strong.

- Attractive earnings – Good earnings mean high revenue and profit, which is the source of financial stability.

- Help in further fund arrangement – A financially stable company will quickly get funding as and when required because they can pay back the creditors.

- Investors’ faith – Financial stability ensures investors' trust and confidence. As a result, they tend to invest quickly in such companies to get good returns and dividends.

Relationship Between Financial Sustainability And Operational Efficiency

Financial sustainability refers to the capacity of a business to create a financially strong foundation that will provide resources to expand and grow. Operational efficiency is the optimum use of resources to grow the business. However, here are some differences between them.

| Financial Sustainability | Operational Efficiency |

|---|---|

| Financial stability refers to the optimum use of resources to generate profits. | Operational stability refers to the optimum use of resources to reduce wastage. |

| It is vital to ensure the firm’s financial security. | It is vital to ensure financial sustainability. |

| Helps to satisfy investors with good returns and dividends. | Helps to provide quality services and products to customers. |

| Ensures businesses can get proper funding when required. | Ensures the improvement and innovation of goods and services. |

| One can measure it by analyzing the net profit, debt-to-equity ratio, price-to-earnings ratio, current ratio, etc. | One can measure it using the inventory and working capital turnover ratios. |