Table Of Contents

What Is Financial Sector?

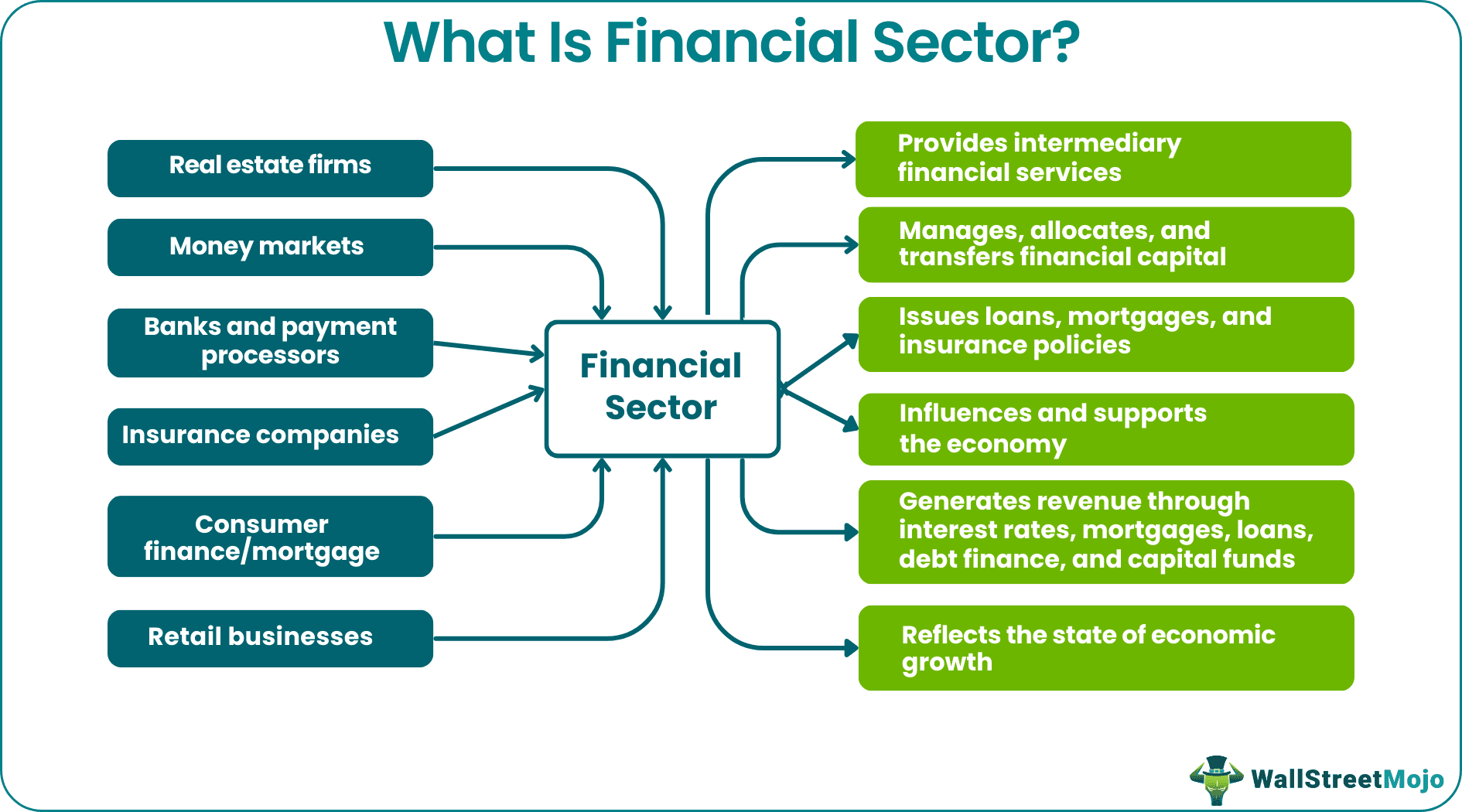

The financial sector refers to businesses, firms, banks, and institutions providing financial services and supporting the economy. It encompasses several industries, including banking and investment, consumer finance, mortgage, money markets, real estate, insurance, retail, etc.

This sector is often equated to the financial markets, which is not true. It reflects the state of the economy, and a substantial part of it influences it. It generates revenue through interest rates, mortgages, loans, debt finance, capital funds, thus spurring economic growth.

Key Takeaways

- The financial sector consists of businesses, corporations, banks, and other financial institutions providing financial services and sustaining an economy.

- It reflects the state of the economy and has a significant impact on it through interest rates, mortgages and loans, debt financing, and capital funds.

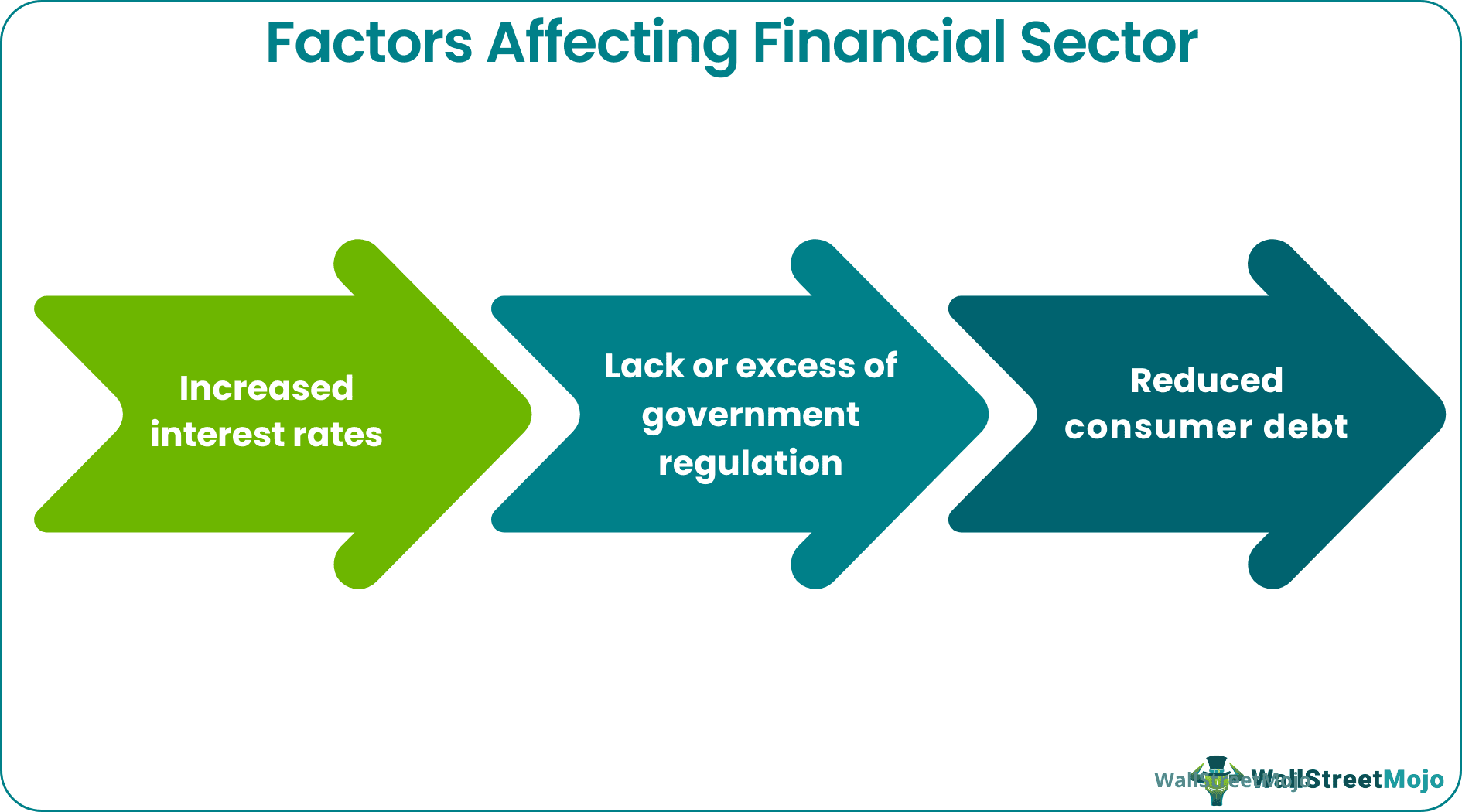

- Increased interest rates, a lack of or excessive government regulation, and reduced consumer debt can considerably affect the sector. In times of recession or financial crisis, the government provides immediate assistance to the sector.

- The sector's two main pillars are banking and insurance, which provide loans, mortgages, and insurance policies.

Understanding Financial Sector

The financial sector plays a significantly important role in the economy by providing intermediary financial services, managing, allocating, and transferring financial capital. As a result, the government offers instant support to the sector in a recession or financial crisis. In addition, it works as a bridge between savers and borrowers. In other words, it takes funds from savers (via bank deposits and investments) and lends them to borrowers (individuals, households, businesses, or governments).

The sector covers various industries which ultimately contribute to the business and the economy of a country. It represents people's income, revenue, and expenditure of firms and retail businesses. The stock market or stock exchanges worldwide can be thought of as a mirror that reflects the sector's growth or decline in part.

Banking and insurance are the two major cornerstones of the sector. Banks are not only important in people's lives, but they are also an important aspect of any country's economy. As a result, every government implements financial sector reforms to regulate, stabilize, and build the economy. Likewise, the insurance industry protects people's health, lives, and businesses. In a nutshell, the sector issues loans, mortgages, and insurance policies.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Factors Affecting Financial Sector

A multitude of positive and negative factors can have a substantial impact on the sector, including:

- Increased interest rates

- Lack or excess of government regulation

- Reduced consumer debt

Example

Let us look at the following financial sector examples to understand the concept better:

Example #1

Amid a rift with the United States, China recently revealed its determination to open up its financial sector. The country also plans to introduce reforms for international banks and insurance firms to attract more foreign investment. In addition, improving rules for cross-border financial institution trades is expected to boost imports and exports.

Example #2

Big Tech firms — Alphabet, Apple, Meta, Amazon, and Microsoft – are preparing to continue their efforts to penetrate the financial sector of India. However, the Reserve Bank of India (RBI) expressed concerns over its threats to traditional banks and technology companies in the nation. As per RBI, issues like antitrust laws, TBTF, cybersecurity, and data privacy can create problems for regulators. Nevertheless, the RBI acknowledges that it will be an important step toward improving efficiency and financial services access.

Roles

The financial sector benefits an economy and its stakeholders in a variety of ways, such as:

- It uses the funds accumulated by the people and businesses for the people and businesses and eventually contributes to a healthy economy.

- Every product manufactured, every service rendered, every good sold mark some profit for the concerning industry, thus stabilizing the economy.

- The sector thrives on loans, interests, mortgages, debt finance, insurance premiums, and credit lines, essential for businesses, houses, education, healthcare, etc.

- Financial sector jobs and stability are directly proportional to the income of citizens and businesses.

- When people invest in mutual funds or buy shares of a company, they support a business. As the business grows, the investor earns, and the sector grows.

- If all industries perform well in a country, generate revenues, make profits, it creates employment opportunities. Thus, it improves the stock market, foreign market, and the economy.

- The sector generates funds for businesses and the economy to function efficiently.

- Economists and business experts link the sector to a nation's economy. Therefore, the government always supports the sector by implementing new laws and reforms.

- If any crisis comes to financial sector companies, such as private or government banks, insurance companies, real estate firms, it can heavily impact the sector and economy.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The financial sector contributes significantly to the economy by providing financial services and managing, allocating, and moving financial resources. It serves as a link between lenders and savers. The sector encompasses various industries that contribute to a country's business and economy. Loans, interest, mortgages, debt finance, insurance premiums, and credit lines are all important for businesses, housing, education, and healthcare, among other things.

Rising interest rates, a lack of or excessive government regulation, and lower consumer debt levels can all significantly impact the industry. In times of recession or financial crisis, the government steps in to help the industry.

The financial sector consists of banking and investment, consumer finance, mortgages, money markets, pension funds, real estate, insurance, and retail.