Financial Planning For Digital Nomads: Real-World Career Insights

Table of Contents

Introduction

Digital nomads are people who travel the world and work freely using the resources of the internet and technology. They generally do not carry much luggage or things with them and live life with the approach of creating a balance between leisure and work. There are more than a hundred countries around the world that offer digital nomad visas to people because they not only travel but also bring in more business and contribute to different economies globally.

This trend has become more evident post-pandemic. The rise of remote work has enabled individuals to work from anywhere around the world with professional freedom and break the office 9 to 5 norm. All you need is a laptop, proper connectivity and a stable internet connection, and you are good to go. Travel has always attracted people, and today, working from beaches, cafes, and even mountains is not a dream anymore.

That said, there are financial factors one must take into account if you wish to work from any place around the world. This article will highlight the process and mindset required for financial planning for digital nomads, helping one ensure a safe, secure, and sustainable long-term career while traveling.

Top Tips for Financial Planning

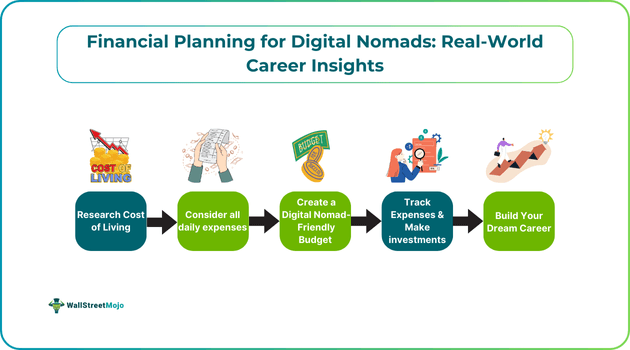

Here are the top five pro tips that you must include in your financial planning for digital nomads:

#1 - Research The Cost Of Living Before Moving To A New Country

As much as it sounds dreamy and beautiful, you must conduct in-depth research on the cost of living before you move to a new country. As someone planning to become a digital nomad, we expect that you must be earning well, and it definitely gives you the ability to choose where you live. That said, again, your income may not always be enough to cover all the expenses of certain countries. Hence, consider the following before you move to your desired location:

- Accommodation Costs: This goes without saying that you need to conduct research and know the average house rents and prices. Moreover, you must get a general idea of a rental agreement’s terms and conditions.

- Utilities: A digital nomad money management system is different compared to how tourists manage money. When individuals plan to reside at a place for a longer period, they have to bear expenses concerning different utilities to work efficiently. For example, they have to pay for water, electricity, internet, etc.

- Transportation: You'll definitely be traveling and exploring new places, so get a brief idea of the city, cab fairs, important places, and their distance from your location. To help plan your life as a digital nomad, consider using AI travel planner or organization apps that can streamline your journey, keeping you organized and on track as you balance work with new adventures.

- Food And Groceries - You can't buy and eat food for the entire period you decide to stay; you will need to cook, and for that, you will need to purchase groceries. Hence, ensure to evaluate the grocery expenses.

- Healthcare: Learn about the healthcare system of the place and develop a clear idea of the clinical and check-up procedures. Based on your understanding, figure out if purchasing a medical insurance plan is essential.

- Local Taxes: Every place has its tax regime; research it and make sure to take measures that can minimize your tax liability. If you think you are unable to understand it, try taking the help of online tools like US expat tax software that will help you with tax filing and other legal taxation queries and solutions.

#2 - Factor All Daily Expenses Into Your Financial Plan

When you move into a new place, there are dozens of expenses that most people always forget about. These elements impact a digital nomad's financial planning. Hence, a simple idea would be to record and track your daily expenses. Since you will not be working from your home, you will have to incur a wide range of expenses, for example —

- Visa And Immigration: A visa has different associated costs and fees, such as processing fees, application fees, and other additional costs. Keep them in mind.

- Cafes and Coworking Spaces: You would sometimes want to work or attend a meeting in a professional environment or a cafe. Using coworking platforms like Spacebring can help you find and manage flexible workspaces easily. It will cost you, and given that you may be doing that quite a lot, you will have to plan for such expenses beforehand.

- SIM Cards And Data Plans: Digital nomads often use multiple numbers or rely on providers like Simify so they can access the internet and stay connected in remote areas. Data plan prices can vary from one country to another, and you need to find the right one as well. So, check the charges and practice budgeting for location independence accordingly.

- Entertainment: During weekends, you will most likely visit new places and local attractions, try new food, and engage in more activities. Remember to do everything without mismanaging your finances. Estimate such expenses beforehand and stick to your financial plan to ensure a stable financial position.

#3 - Create A Digital Nomad-Friendly Budget

This is a no-brainer: Financial planning for digital nomads must have a friendly budget that is flexible enough to let you enjoy but also strict enough to keep you within a limit. When you go out in the world, there are hundreds of expenses you can't even think about. The best idea is to write everything down, create a budget, and follow it consistently.

If required, divide your budget into categories. You do not have to follow a particular template for it; do it your way. You don't have to compromise on your lifestyle, but you don't plan to go broke as well, correct? Have a proper estimate of your expenses aligned with your income and create a budget on its basis.

#4 - Expense Tracking And Investing

Again, becoming a digital nomad doesn't mean that you spend all your money on traveling and exploring. Make sure to save and invest a portion of your income. There are many online tools and financial apps that you can use as a digital nomad to start saving and investing effectively.

A useful tip related to financial planning for digital nomads is to first create an emergency fund that can help you survive a few months without work. If you already have that, you can invest in different asset classes, like real estate, equity, and debt. Making wise investments can help you set up a retirement fund that will keep your financial future secure. Reading financial news, staying informed regarding updates concerning different industries, and focusing on portfolio diversification can help you achieve your investment objectives.

#5 - Start Building Your Dream Career As A Digital Nomad

Lastly, we will only tell you to keep improving your skills, knowledge and money. If you are someone who is planning to become a digital nomad, develop your skills, leverage them, and build a strong financial and professional portfolio for yourself. In the process of financial planning for digital nomads, never take the power of social media for granted. Create and maintain a strong online presence, make connections, grow your network, join online communities, attend virtual events and online seminars, and use all these remote work finance tips to make sure you are growing both financially and professionally.