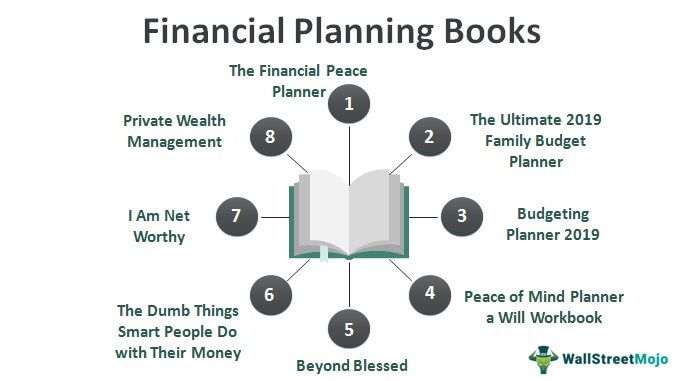

Top 8 Financial Planning Books [2024]

Financial planning books will help you know how to plan a personal budget, how to save, how to invest, and how to prepare for insurance, estate, retirement, tax, and all other activities included with the money. Below is the list of such financial planning books that you must read in 2024:

- The Million-Dollar Financial Advisor ( Get this book )

- The Financial Peace Planner ( Get this book )

- Private Wealth Management ( Get this book )

- I Am Net Worthy ( Get this book )

- The Dumb Things Smart People Do with Their Money ( Get this book )

- Peace Of Mind Planner ( Get this book )

- Beyond Blessed ( Get this book )

- 2021 Budgeting Planner Keep Calm and Budget on ( Get this book )

Let us discuss each Financial Planning book in detail and its key takeaways and reviews.

#1 - The Million-Dollar Financial Advisor

Powerful Lessons and Proven Strategies from Top Producers

Author: David J Mullen Jr

Book Review

The best financial advisers are well qualified and skillful to succeed irrespective of market conditions. The book was written based on interviews with the top fifteen advisors, each doing millions of dollars in business. They have explained the successful universal principles in thirteen distinct lessons in a step-by-step procedure for immediate implementation.

Key Takeaways

- Longtime approach.

- Marketing.

- Mindset.

#2 - The Financial Peace Planner

A Step-by-Step Guide to Restoring Your Family's Financial Health

Author: Dave Ramsey

Book Review

The author clearly explains how to come out of a debt situation when you’re deeply struck by it with his own experience. When the author went bankrupt, he had utterly rebuilt his financial life. This is the essential book when you’re in debt. This book will be life-changing for debt-ridden people.

Key Takeaways

- How to clear a debt.

- Assess the urgency of the situation

- Creating a realistic budget.

- Understanding the flow of money.

#3 - Private Wealth Management

The Complete Reference for the Personal Financial Planner, Ninth Edition

Author: G. Victor Hallman, Jerry S. Rosenbloom

Book Review

This book is the latest edition that allows you to operate in today’s markets, from setting financial objectives and executing the planning process to investing in equities and fixed-income securities to retirement income planning to methods for lifetime wealth transfers, insurance, real estate, Alternative Investments, and many more about wealth.

Key Takeaways

- A variety of economic benefits and investment products.

- New developments in estate and marital deduction planning.

- Education planning.

- Retirement Plans.

- Management.

#4 - I Am Net Worthy

The Financial Master Plan For Millennials

Author: Chris Smith

Book Review:

This book provides a practical, step-by-step approach to tackling Personal Finances for today’s young adults, i.e., from student loans to savings accounts and cars to credit scores. The author and the financial expert Chris Smith, along with 9 different co-authors, wrote the book by collecting different perspectives of people with a common goal of financial independence. The book also guides you to stop spending on unwanted things and put your money to work for a healthy financial future.

Key Takeaways

- The basics of money from Investing in savings.

- Long term investing.

- Personal Finance.

#5 - The Dumb Things Smart People Do with Their Money

Thirteen Ways to Right Your Financial Wrongs

Author: Jill Schlesinger

Book Review:

The author clearly explains the thirteen mistakes you make with your money without knowing it. This book will help you avoid such errors and blind spots. It also mainly concentrated on paying down debt, maximizing retirement contributions, beefing up an emergency fund, college financing, insurance, and real estate. The author clearly explained the mistakes we make in finance and how to overcome them.

Key Takeaways

- Retirement planning.

- Avoiding bad habits.

- Follow the right financial advice.

#6 - Peace Of Mind Planner

Guide to the End of life, Everything You Need to Know When I'm Gone End of Life Planner for Affairs and Last Wishes

Author: Kathryn Bartlett

Book Review:

This book is helpful to us when we are alive and suitable for the people we love when we are no more. One can write all the details of the properties, wishes, funeral and burial arrangements, instructions to the caretakers, financial information, dependents, insurance, medical, and legal key contact.

Key Takeaways

- Financial planning after the decease.

- Last words to friends and family.

- Belonging and Wishes.

#7 - Beyond Blessed

God’s Perfect Plan to Overcome All Financial Stress

Author: Robert Morris and Dave Ramsey

Book Review:

Everyone wants to eliminate all their financial stress and enjoy what God has intended. But this is more challenging than we think; the authors have clearly explained in this book how to overcome such financial stress and be relieved. This book shares the Biblical principles, personal stories, and practical insights to help you overcome debt and reach your financial goals, experience the joy God intends for you, and bless others.

Key Takeaways

- Biblical Principles.

- Managing Finances.

#8 - 2021 Budgeting Planner Keep Calm and Budget on

Yearly and Monthly Money Management Budget & Expenses Planner Journal Notebook.

Author: Sara Lept

Book Review:

This budget planner will help you greatly to get your finances in order. This book will help you achieve your goals and track your savings and expenses. Maintaining and following this book makes it easy to track your finances.

Key Takeaways

- Finance Tracker

- Annual summary

- Budget worksheet.

AMAZON ASSOCIATE DISCLOSURE

WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com.