Features / Offerings | Financial Modeling & Valuation Course | 2-Day Boot Camp on Financial Modeling (Live) | Financial Modeling Immersive Program (2-Months) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| ✅ | ✅ | ✅ | ||||||

| ✅ | ✅ | ✅ | ||||||

| ✅ | ✅ | ✅ | ||||||

| ✅ | ✅ | ✅ | ||||||

| ✅ | ✅ | ✅ | ||||||

| ✅ | ✅ | ✅ | ||||||

| ✅ | ✅ | ✅ | ||||||

| ❌ | ✅ | ✅ | ||||||

| ❌ | ✅ | ✅ | ||||||

| ❌ | ✅ | ✅ | ||||||

| ❌ | ✅ | ✅ | ||||||

| ❌ | ❌ | ✅ | ||||||

| ❌ | ❌ | ✅ | ||||||

| ❌ | ❌ | ✅ | ||||||

Financial Modeling 2-Day Bootcamp : 100% Practical, Career-Boosting Skills

Create a Full Dynamic Financial Model in 2 Days (6 hours) | Any Graduate Or Professional is eligible| Build & Forecast IS, BS, CF from Scratch | Expert: Dheeraj Vaidya, CFA, FRM, taught 100k learners | Complimentary Financial Modeling & Valuation & Basic Accounting Course| APRIL BOOT CAMP: FULLY BOOKED | NEXT DATES: May 3 &4, 2025(8:30 am-11:30 am EST)-FILLING FASTHIGHLIGHTS OF FINANCIAL MODELING BOOT CAMP

Key Features & Highlights

May 3 & 4,2025 (Filling FAST)

May 3 & 4,2025 (Filling FAST) : (APRIL BOOT CAMP: FULL)COMPLEMENTARY – 1 Year Access

COMPLEMENTARY – 1 Year Access : Financial Modeling And Valuation & Basic Accounting CourseMaster 3-Statement Financial Model

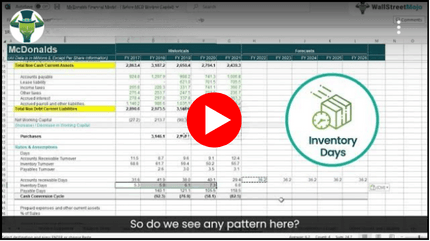

Master 3-Statement Financial Model : Create IS, BS & CF integration from scratch for a firmExcel-Based Schedule Building

Excel-Based Schedule Building : Create depreciation, working capital & debt schedulesAdvanced Ratio Analysis

Advanced Ratio Analysis : Analyze key financial ratios used by top investment banksCertfication

Certfication : Boost your career with a prestigious financial modeling certificationHURRY UP!

Unlock Premium Course Benefits Worth $1,000+!

2-Days Financial Modeling Live Boot Camp (Value: $495)

2-Days Financial Modeling Live Boot Camp (Value: $495) :25+ Hours of Financial Modeling & Valuation Course (Value: $495)

25+ Hours of Financial Modeling & Valuation Course (Value: $495) :2+ Hours Of Financial Modeling 101 (Value: $73)

2+ Hours Of Financial Modeling 101 (Value: $73) :2+ Hours Of Basic Accounting Course (Value: $95)

2+ Hours Of Basic Accounting Course (Value: $95) :Depreciation Forecasting Mastery (Benefits Included)

Depreciation Forecasting Mastery (Benefits Included) :Working Capital Forecasting (Benefits Included)

Working Capital Forecasting (Benefits Included) :Shareholders’ Equity Forecasting (Benefits Included)

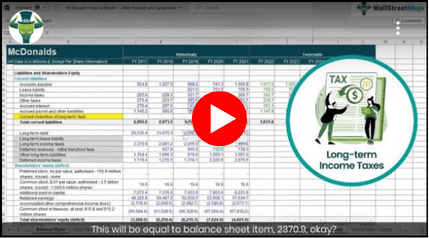

Shareholders’ Equity Forecasting (Benefits Included) :Debt Forecasting & Repayment Planning (Benefits Included)

Debt Forecasting & Repayment Planning (Benefits Included) :Excel Templates & Session Recordings (Benefits Included)

Excel Templates & Session Recordings (Benefits Included) :Exclusive Career Benefits & Certificates (Benefits Included)

Exclusive Career Benefits & Certificates (Benefits Included) :COURSE COMPARISON

Features & Benefits With Our Top Financial Modeling Programs

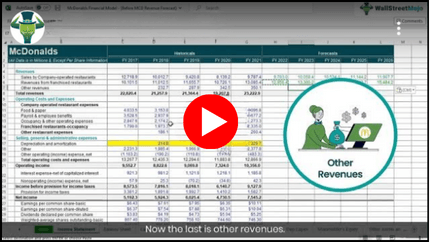

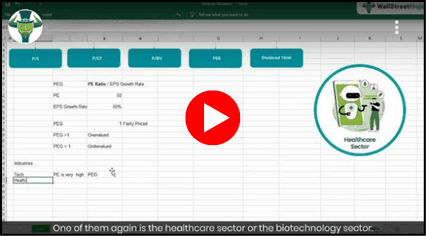

BOOT CAMP & SELF-STUDY COURSE PREVIEW

Sample Videos

PURSUE YOUR DREAM CAREER

Top Companies That Hire Professionals With Financial Modeling Skills

BOOT CAMP INSTRUCTOR

Learn Directly From The Industry Expert!

Dheeraj Vaidya, CFA, FRM is the Co-Founder & Course Director of WallStreetMojo.

With an extensive background as a former J.P.Morgan and CLSA Equity Analyst, Dheeraj brings expertise in financial modeling, forecasting, and valuations. Over the course of his nearly two-decade career, he has trained and mentored more than 100,000 students and professionals across various topics, including investment banking, private equity, accounting, and more.

WHAT WILL YOU LEARN?

Boot Camp Program Structure

Learn to build Financial Models from scratch in just 6 hours!

Unlock the power of company-related forecasts with our "Financial Modeling Course," focusing on the three-statement analysis.

Enroll in our Valuation Course to get discounted cash flow training and learn about trading comps. Receive a certificate after completion.

Join these basic accounting classes online to acquaint yourself with the role of revenue, expenses, assets, and liabilities in shaping the company's financial health.

Master financial modeling in 9 easy steps. Learn to build accurate financial models and enhance your financial analysis skills.

BENEFITS AND FEATURES OF BOOT CAMP

What Skills Will You Gain?

#1 - Financial Modeling: Develop a robust financial model from scratch.

#2 - Schedule Preparation: Prepare various schedules such as working capital, depreciation, debt, and more.

#3 - Statement Preparation: Complete the missing links between the three core financial statements: Income Statement, Balance Sheet, and Cash Flow Statement.

#4 - Real-World Application: Learn to model like a pro using practical case studies.

#5 - Industry-Relevant Skills: Gain skills that are in demand for investment banking, equity research, and financial analysis.

#6 - Expert Guidance: Benefit from the mentorship of a seasoned finance expert with over 20 years of experience.

#7 - Instructor-Led Boot Camp: Learn directly from the industry expert and get your queries resolved in real-time.

WHO ARE ELIGIBLE TO ATTEND THE BOOT CAMP?

Who should attend the Financial Modeling Classes?

FEATURES OFFERED

Benefits Included For You

2-Day Live Instructor led sessions of 3 hours each.

13+ hours of video lessons across 17 modules.

12+ hours of video lessons across 3 modules.

2+ hours of video lessons across 18 modules.

2+ hours of video lessons across 9 modules.

CERTIFICATION

Learn Skills, Get Certified!

Get the Financial Modeling Boot Camp certification post-completion. Plus, get course completion certificates for the self-paced courses complementary with the Boot Camp.

How & When?

How To Register For The Boot Camp?

ROLES FOR FINANCE WITH FINANCIAL MODELING SKILLS

Career Prospects

#1- Financial Analyst:

A financial analyst is a finance professional involved in creating financial models and forecasting financial statements as well. Enrolling in one of the best courses on Financial Modeling with us will help you be eligible to apply for such posts. Usually, they are hired more by well-known companies like JPMorgan Chase, WellFargo, Amazon, Deloitte, and similar others. For the job role offered, the analyst receives around $60,885 and $73,500 annually as of June 27, 2024, depending on the seniority level as well.

#2 - Equity Research Analyst:

As the name suggests, equity research analysts analyze financial information along with the different trends of the different organizations and industries and then gives an opinion in his equity research report based on the analysis conducted. In short, they give verdict to clients on their investment decisions. Some of the popular hiring companies include Goldman Sachs, Morningstar, Barclays, CRISIL, and others. As of June 27, 2024, they earn around $109,417 per year plus some additional benefits.

#3 - Investment Banker:

These investment banking analysts have a similar job role as equity analysts. However, they mostly work with investment banking firms. They prepare financial models, perform financial analyses of companies, and advise clients on buy or sell decisions. In short, they prepare pitchbook for client meetings, including M&A and LBO pitchbooks. Here, large investment banks like CitiGroup, JP Morgan Chase, HSBC, Credit Suisse, and others provide a high salary of $80,245 as of June 27, 2024 to analysts.

#4 - Private Equity Analyst:

It is just a sub-category of equity analysts that is more concerned with private firms. This is among the financial modeller jobs where analysts conduct research, forecast the performance of private firms (not listed on stock exchange), do ratio analysis, and give interpretations on private companies. They are mostly hired by Goldman Sachs, Blackstone, General Atlantic, and other private equity firms. The average salary here is $94,303 on an annual basis. Sign up for this best Financial Modeling online course with us and be eligible for such positions.

#5 - Credit Analyst:

Credit analysts facilitate credit risk management by measuring the creditworthiness of the individual or a firm. They are generally employed by banks, credit card companies, rating agencies, and investment companies. A few popular banks include CitiGroup, American Express, Barclays, HSBC, and others. In this case, the salary prospects range between $52,979 and $65,732 as of June 27, 2024 annually.

#6 - Actuarial Analyst:

An actuarial analyst is a finance professional who uses statistical models to evaluate and assess risk in many industries, including insurance, healthcare, and finance. They use this analysis further to design and price insurance policies. As of June 27, 2024, they get paid around $80,200 annually on average and are hired by mostly EY, Accenture, Mercer, and others.

PREREQUISITES TO FOR THE BOOT CAMP

What Will You Need?

There are no major pre-requisites for attending the Boot camp.

- No prior experience required

- Good, stable internet connection

- Access to Microsoft Excel and knowledge about its basic tools

TESTIMONIAL

What Learners Are Saying

FINANCIAL MODELING BOOT CAMP FAQS

Frequently Asked Questions

GOT QUESTIONS?

Still have a question? Get in Touch with our Experts