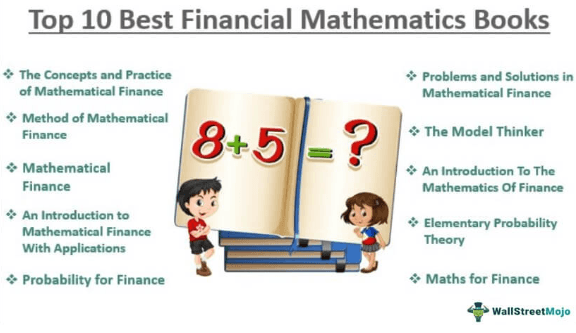

List of Top 10 Financial Mathematics Books [2025]

Mathematical finance, also known as quantitative finance, is applied mathematics where analysts solve real-life cases and problems by creating models, taking observed market prices as input. Below is the list of the top 10 books on mathematical finance.

- The Concepts and Practice of Mathematical Finance ( Get this book )

- Method of Mathematical Finance ( Get this book )

- Mathematical Finance: A Very Short Introduction ( Get this book )

- An Introduction to Mathematical Finance With Applications ( Get this book )

- Probability for Finance ( Get this book )

- Problems and Solutions in Mathematical Finance ( Get this book )

- The Model Thinker ( Get this book )

- An Introduction To The Mathematics Of Finance ( Get this book )

- Elementary Probability Theory ( Get this book )

- Maths for Finance ( Get this book )

Let us discuss each mathematical finance book in detail, along with its key takeaways and reviews.

#1 - The Concepts and Practice of Mathematical Finance

Author: Mark S. Joshi

Financial Mathematics Book Review:

An excellent book by an Indian writer, Joshi produces an introductory study material on the pricing of financial instruments like derivatives and underlying securities. He also explains the methods to implement financial models along with their usage.

Key Takeaways For This Best Financial Mathematics Book:

- The book covers important concepts of Black Scholes, stochastic volatility, jump-diffusion, variance, and many more.

- Practical examples back the theoretical concepts.

- Challenges your mind and motivates you to learn quantitative finance.

#2 - Method of Mathematical Finance

Author: Loannis Karatzas

Financial Mathematics Book Review:

The book is an extraordinarily brilliant work of Loannis about mathematical finance. But unfortunately, he mainly targets the mathematically sound crowd that knows probability and stochastic concepts but needs to become more familiar with their application in finance.

Key Takeaways For This Top Financial Mathematics Book:

- The book includes theorems and proofs of modern mathematical methods.

- It includes two financial revolutions of the late 20th century.

- Learn to create portfolios with the largest mean return (subjective of risk)

#3 - Mathematical Finance

A Very Short Introduction

Author: Mark H.A. Davis

Financial Mathematics Book Review:

The book is a comprehensive overview of applied mathematics in the finance industry. The finance industry has evolved as the most important branch of modern economics. Thus, it creates limitless opportunities for quantitative analysts.

Key Takeaways For This Best Financial Mathematics Book:

- Introduction and usage of arbitrage theory in pricing financial contracts.

- Explore the development of mathematics in finance.

- People with little knowledge of statistics and calculus can benefit from this book.

#4 - An Introduction to Mathematical Finance With Applications

Understating and Building Financial Intuition

Author: Arlie O. Petters

Financial Mathematics Book Review:

The book is an all-in-one complete learning set that offers theoretical methods, proper derivation, and many examples and problems to get a practical understanding. The book is an introductory source that targets undergraduate students of finance. Develop a foundation in applied mathematics applicable to finance.

Key Takeaways For This Top Financial Mathematics Book:

- Learn fundamental financial concepts and tools to build real models.

- The book mainly focuses on the financial derivatives market.

- The book is distributed systematically between theory and its applications.

#5 - Probability for Finance

Author: Ekkehard Kopp

Financial Mathematics Book Review:

This comprehensive guide offers rigorous and unfussy content to students and professionals. Kopp mainly focuses on the concepts of Probability necessary for understanding the financial markets.

Key Takeaways For This Best Financial Mathematics Book:

- Book offers essential material to study modern finance.

- It is with examples and exercises for self-evaluation.

- Free from jargon text provides a simplified learning course.

#6 - Problems and Solutions in Mathematical Finance

Author: Eric Chin

Financial Mathematics Book Review:

The book covers applying advanced mathematical techniques. For example, Eric says the existence of quantitative finance is based on concepts and theories of applied mathematics like probability, statistics, stochastic processes, etc.

Key Takeaways For This Top Financial Mathematics Book:

- The book is a set of four volumes covering various areas of mathematical finance.

- Learn stochastic calculus in vol1, Equity Derivative in vol2, interest rates, inflation in vol3, and commodity in vol4.

- A complete reference for quantitative practitioners and students.

- Explore real problems and cases in the finance industry and their solutions.

#7 - The Model Thinker

What You Need to Know to Make Data Work for You

Author: Scott E. Page

Financial Mathematics Book Review:

Data is the basic requirement for the growth and existence of every industry. For example, data plays a key role in the stock market, e-commerce industry, or census figures. Now, the data analyst has to extract the required and meaningful out of the raw data and produce verifiable results. The book shows you how to do this.

Key Takeaways For This Best Mathematical Finance Book:

- Enhance your analytical reach with quantitative finance.

- Learn mathematical, statistical, and computational models.

- Learn to analyze data and make accurate predictions.

#8 - An Introduction To The Mathematics Of Finance

Author: Stephen Garret

Financial Mathematics Book Review:

Book follows a deterministic approach (i.e., development of future states of the system excluding randomness) and produces a complete introductory guide about mathematical finance. The book especially focuses on interest rates and their calculations.

Key Takeaways For This Best Financial Mathematics Book:

- Learn theories of compound interest, also known as deterministic financial mathematics

- The book follows topics covered in CTI exams of the Institute and Faculty of Actuaries.

- Comprehensive text loaded with examples and exercises.

#9 - Elementary Probability Theory

With Stochastic Processes and an Introduction to Mathematical Finance

Author: Koi Lai Chung

Financial Mathematics Book Review:

The book discusses the theories of probabilities. Chung says probabilities have always been one of the most important topics of mathematics. However, the topic has evolved into a discipline that directly interacts with data analysis and quantitative mathematics.

Key Takeaways For This Top Financial Mathematics Book:

- The book targets Mathematics students. Learn probability and its application in the finance industry.

- The latest edition includes two additional chapters on applied mathematics.

#10 - Maths for Finance

An Introduction to Financial Engineering

Author: Marek Capinski and Tomas Zastawniak

Financial Mathematics Book Review:

The book offers fundamental and introductory knowledge about calculus and probability. In addition, it covers three important areas of finance and its mathematical applications: option pricing, Markowitz portfolio optimization, and the Capital Asset Pricing Model.

Key Takeaways For This Top Financial Mathematics Book:

- An excellent reference for acquiring introductory mathematical knowledge.

- Learn stochastic interest rate models.

- Book offers various financial concepts along with practical examples.

AMAZON ASSOCIATE DISCLOSURE

WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com