Financial Literacy for Students: The First Step to a Successful Career

Table of Contents

Introduction

Literacy matters to everyone, and when it comes to finance, not everyone has the education to manage money efficiently and ensure financial well-being. If you are clueless about how to save money or do not know how to safeguard yourself from financial fraud or scams, you will probably end up parting with a significant part of your income.

Just imagine you earn $200 by doing freelance work or tutoring, and you spend all of the money on unnecessary items. This amount could have covered your important future expenses. To avoid this, having the necessary money management skills is essential, and you can only develop those skills by becoming financially literate.

So, in this article, let us understand the importance of financial literacy for students. Moreover, let us understand what measures a student may consider taking to build a strong financial foundation.

Why Financial Literacy Matters for Students

According to a report by the OECD, more than two-thirds of students use financial products, including investments, but the levels of literacy rate remain very low. On average, 66% of students use mobile payment modes, and more than eight out of 10 students have made online purchases. However, the strange part is that many of the students still do not have the skills and knowledge required to make apt financial decisions. In fact, when given assignments like writing an essay on financial topics, students often struggle to meet the expectations of their teachers or professors. If you are one of them, you may consider taking the help of a college essay writer to solve your problem.

Without a doubt, financial literacy for students is vital as having knowledge of key financial concepts develops a better understanding of money. Precisely, it helps you as a student to prepare yourself for future expenses and manage whatever money you are getting prudently. Moreover, through the process of acquiring financial literacy skills, you can understand the significance of budgeting, investing, and saving to a large extent. By understanding these basic concepts of personal finance, you can build financial prudence, which further helps in ensuring a secure future from a financial standpoint.

Building a Strong Financial Foundation

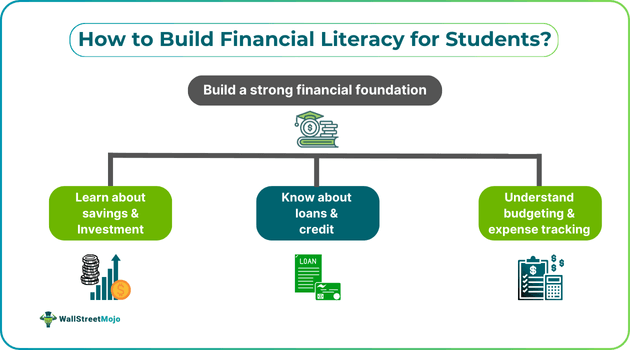

The foremost step in achieving financial literacy or building knowledge of personal finance for students involves developing a strong financial foundation. It is only when students learn the basic concepts and principles that they can apply the same practicality.

A few of the common personal finance tips for students include proper budgeting, expense tracking, and learning about credit, loans, mortgages, savings and investments. Let us look at each of these pointers in brief:

#1 - Budgeting and Expense Tracking

The base of financial education for students is budgeting and expense tracking. Once you receive a salary or even pocket money, it is necessary to decide where most of it should be spent. A budget is a pre-planned sheet that outlines the necessary expenses and what percentage of the income should be spent. In case, the expenses exceed the budget, it can cause stress. Hence, keeping the expenses in check is vital. That said, when income exceeds one’s budgeted expenses, it is favorable and can boost savings.

Along with budgeting, knowing how to track expenses is a crucial part of financial literacy for students. This is because monitoring expenses allows you to know where every dollar is going. Also, you realize which expenses are necessary at your end and which costs you can avoid. This tip for budgeting for students can help set limits and reduce unwanted spending.

#2 - Understanding Credit and Loans

In most cases, the need for credits or loans arises when income falls short of expenses. You may think your expenses are unavoidable. However, in a broader sense, not all expenses are necessary. It basically depends on us to decide which expenses are avoidable and unavoidable. For instance, a person may want to buy a second house or go on a vacation, and to meet the associated financial requirements, they would need to get financial assistance from a lending institution.

Now, it totally depends on them whether they want to take a loan to buy the house or pay the expenses of the vacation. If they deem such expenses to be unnecessary at a given point in time, they can avoid taking a loan.

Note that if you do not understand loans and credit and keep taking financial assistance without understanding your repayment capacity, you may end up defaulting. This, in turn, can significantly impact your credit score and affect your chances of getting credit in the future.

Besides learning about the concept of credit profile and credit score, students should learn about the different types of loans and their features. For instance, when opting for a mortgage, it is important to note that property stays as collateral. Knowing about these key aspects is vital to developing or improving financial literacy for students.

#3 - Savings and Investments

When you receive income, of course, it is tempting to spend first and save later. But what are the chances that your expenses will ever end? Indeed, expenses can be endless if you do not set limits. So, having a portion (or percentage) of income allotted towards savings and investing the rest can be vital for your financial security in the future. The more you invest, the closer you get to your long-term goals. Applying the principles of budgeting for students can help them decide how much to spend for their wants, what amount to allocate towards savings, and how much to invest. There are various investment options to choose from, like stocks, mutual funds, and bonds. You can invest in any of them based on factors like your financial goals, risk appetite, available funds, etc.

Financial Literacy: A Career Advantage

If the preparation to become financially competent starts in school or college, students can have the potential to build an illustrious career. After all, various jobs across different industries and sectors require different financial skills, like financial analysis, budgeting and accounting.

When someone starts building financial knowledge early, negotiating salary and making deals at work can become easier. Besides that, they will find themselves to be in a better position to manage all the benefits and income judiciously once they enter the professional world.