Table Of Contents

What are Financial Instruments?

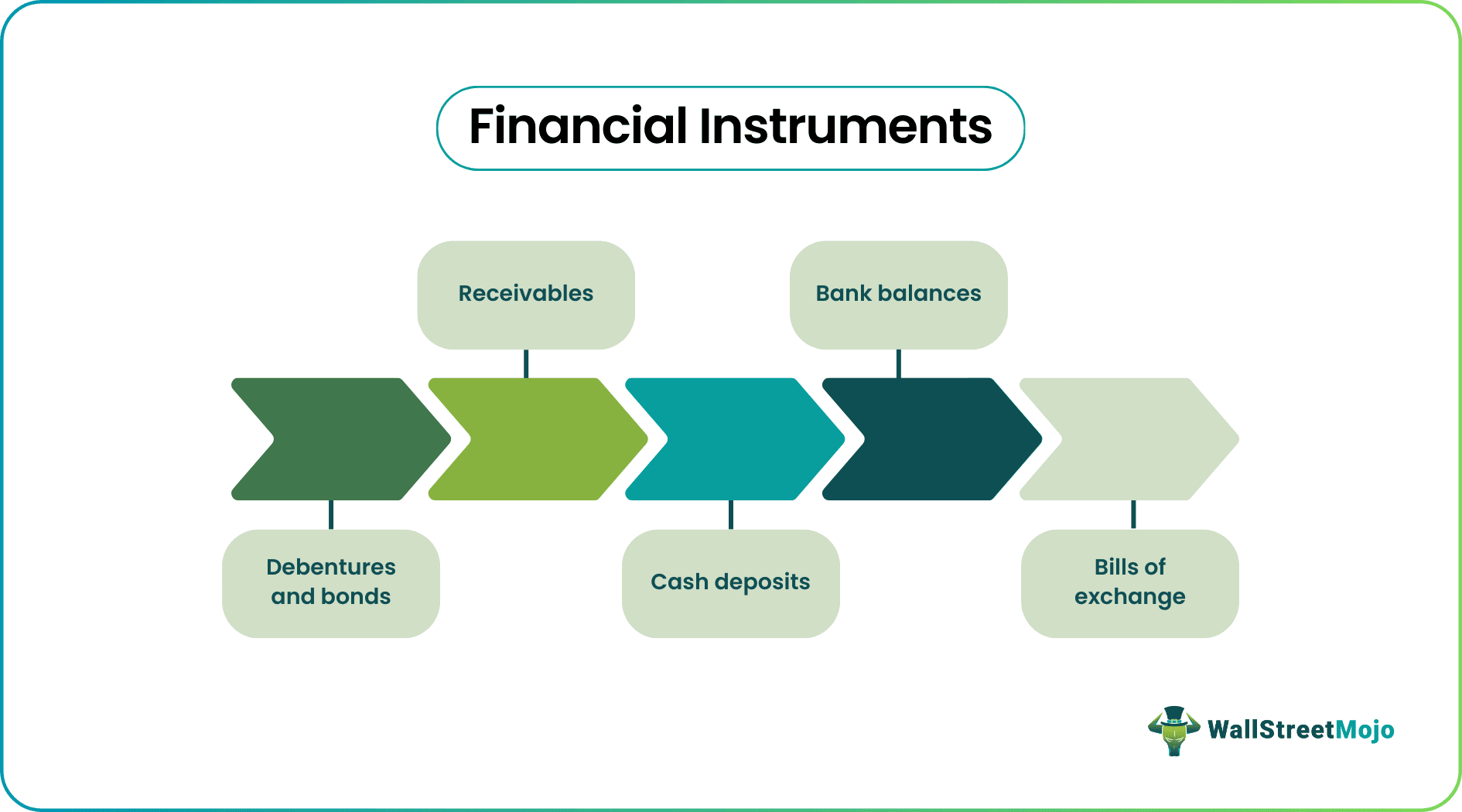

Financial instruments are certain contracts or any document that acts as financial assets such as debentures and bonds, receivables, cash deposits, bank balances, swaps, cap, futures, shares, bills of exchange, forwards, FRA or forward rate agreement, etc. to one organization and as a liability to another organization and these solely taken into use for trading purposes.

Informal and innovative financial instruments offer highly flexible services as per the needs of an individual. It can be initiated and completed within a few minutes of applying as it merely needs a simple cash receipt or an oral agreement.

Key Takeaways

- Financial instruments refer to contracts or documents representing financial assets, such as bonds, shares, and derivatives, which transfer obligations or risks between organizations.

- They can take various forms, such as debentures, bonds, cash equivalents, equity shares, swaps, etc.

- They provide companies with liquid assets, which can be used for quick payments or dealing with contingencies.

- Money market instruments, capital market instruments, and hybrid instruments are common categories of financial instruments.

Financial Instruments Explained

Financial instruments are documents that act as financial assets to one organization and as a liability for another organization. These can either be in the form of debentures, bonds, cash, and cash equivalents, bank deposits, equity shares, preference shares, swaps, forwards and futures, call or notice money, letters of credit, caps and collars, financial guarantees, receivables and payables, loans and borrowings, etc. Each type of financial instrument has its advantages and disadvantages.

Financial instruments classification must be appropriately taken into use to derive the most benefits. These can be of huge significance for companies looking to minimize their costs and maximizing their revenue model. Thus, organizations must make sure that they are properly using them to reap greater benefits from it and eliminate the chances of them getting backfired.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Types

Let us understand financial instruments classification by understanding its types.

- Money Market Instruments: Money market instruments include call or notice money, caps and collars, letters of credit, forwards and futures, financial options, financial guarantees, swaps, treasury bills, certificates of deposits, term money, and commercial papers.

- Capital Market Instruments: It includes equity instruments, receivables, payables, cash deposits, debentures, bonds, loans, borrowings, preference shares, bank balances, etc.

- Hybrid Instruments: It includes warrants, dual currency bonds, convertible debt, equity-linked notes, convertible debentures, etc.

Examples

Let us understand the concept of innovative financial instruments with the help of a couple of examples.

Example #1

XYZ Limited is a banking company that issues financial instruments such as loans, bonds, home mortgages, stocks, and asset-backed securities to its customers. These may act as a financial asset for the banking, as mentioned earlier, company. Still, for customers, these are nothing but financial liabilities that must be duly paid on time by them. On the other hand, the amount deposited by the customers in the bank acts as a financial asset for the customers depositing the same, whereas a financial liability for a banking company.

Example #2

In March 2023 due to a global banking crisis, the stock markets across the world fell quite sharply for a couple of weeks. Amidst these turbulent times for economies, the interest rates on financial instruments were hiked and the markets did not receive it very well.

In a situation where the stock market grew by one step and fell by two steps on a regular basis, the statements from the Federal Reserve and Treasury secretary Janet Yellen’s statements about banks not being the safest place to place money, the sentiments only soared even further among investors and experts.

Importance

Let us understand the importance of financial instrument classifications through the discussion below.

- Derivatives like forwards and futures can bring huge benefits for small-sized companies, but if only these are taken properly into use. If these are inappropriately used, then these might cause an organization to suffer huge losses and bankruptcy.

- Organizations must be very careful while dealing with swaps since it carries a higher level of risk.

- Proper management of financial instruments can help firms cut down their material costs and maximize sales and profit figures.

- They are generally used by people who cannot afford or do not have access to credit facilities and systematic savings.

Advantages

Let us understand the advantages of innovative financial instruments through the discussion below.

- Liquid assets like cash in hand and cash equivalents are of great use for companies since these can be easily used for quick payments or for dealing with financial contingencies.

- Stakeholders often feel more secure in an organization that has employed more capital in its liquid assets.

- Financial instruments provide major support in funding tangible assets. It is possible through fund transfer from tangible assets that are running in surplus values to those lying in deficit.

- Financial instruments allocate the risk concerning the risk-bearing capacities of the counterparties participating in investing intangible assets.

- Companies that invest in real assets yield higher revenues since they get a diversified portfolio of hedged inflation. They can also hedge against uncertainties caused as a result of political reasons.

- These sources like equity act as a permanent source of funds for an organization. Equity shares also allow an organization to have an open chance of borrowing and enjoy retained earnings. With equity shares, payment of dividends to equity holders is purely optional.

Disadvantages

Despite acting as a prime source of financial aid for many, it has a few factors that act as a hurdle for its users. Let us understand the disadvantages through the points below.

- Liquid assets such as savings accounts balances and other bank deposits are limited for ROI or investment return. It is high because there are zero restrictions for the withdrawal of deposits in savings accounts and other bank balances.

- Liquid assets like cash deposits, money market accounts, etc., might disallow organizations from making a withdrawal for months or years, too, or whatever is specified in the agreement.

- If an organization wishes to withdraw the money before completing the tenure mentioned in the agreement, then the same might get penalized or receive lower returns.

- High transactional costs are also a matter of concern for organizations dealing with or wishing to deal with financial instruments.

- An organization must not over-rely on debts like principal and interest since these are supposed to be paid on a consequent basis.

- Financial instruments like bonds payout return much less than stocks. Companies can even default on bonds.

- Some financial instruments like equity capital are a Life-long burden for the company. Equity capital acts as a permanent burden in an organization. Equity capital cannot be refunded even if the organization has sufficient funds. However, as per the latest amendments, companies can buy back their shares for cancellation, but the same is subjected to certain terms and conditions.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.