The distinction between the Financial Industry Regulatory Authority rules and SEC (Securities and Exchange Commission) are:

Financial Industry Regulatory Authority (FINRA)

Table Of Contents

Key Takeaways

- The Financial Industry Regulatory Authority is a private, self-regulatory (SRO), and not-for-profit organization in the United States of America. It is responsible for overseeing broker-dealer firms, investment advisors, and financial advisors.

- FINRA conducts the qualifying examination for aspiring securities professionals.

- FINRA also provides investors with resources such as BrokerCheck to safeguard their best interests against manipulative and illegal market activities.

- A common criticism of FINRA is that historical offenders often repeat their offenses, requiring stricter punishments.

Roles

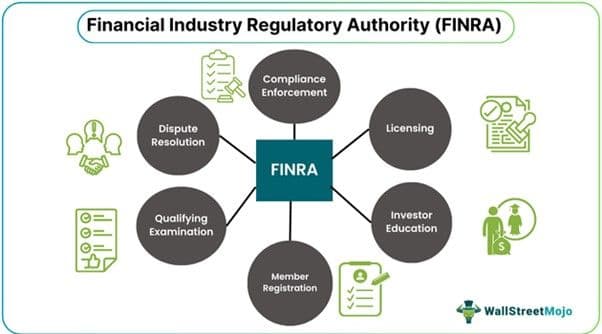

If anyone closely follows the Financial Industry Regulatory Authority news, they will find that FINRA has a multi-faceted role and they have supervision at different ends of the market. A few of the most prominent roles are:

- FINRA regulates trades in equities, securities futures and options, and corporate bonds.

- They have been bestowed the power to safeguard investors’ interests by Congress.

- FINRA supervises broker-dealer firms and brokers.

- They administer the qualification exams that securities professionals are expected to pass to sell or supervise the sale of securities.

- It also has an enforcement front. It can take disciplinary actions against registered firms or individuals who do not adhere to the norms.

- FINRA also maintains a database of brokers, financial advisors, and investment advisers from which investors can choose. The database is called the Central Registration Depository (CRD).

- The organization also has the power to ban or levy heavy fines on individuals or firms that violate the guidelines and rules outlined by them.

Compliance Requirements

To attain a Financial Industry Regulatory Authority license, a broker or a broker-dealer firm has to fulfill a few requirements. They might be complicated mediation processes or just general requirements. Some of the most critical compliance requirements are:

- Rule 2210: It addresses the contents of advertising materials and other such sales-related literature. FINRA requires firms and individuals to have a sensible bias before any recommendations are made.

- Rule 2265: It is the requirement concerning providing investment advice to clients. FINRA strictly directs firms and individuals to declare conflicts of interest, if any. Moreover, they are also required to have a system in place that has checks at different levels to avoid any instances of violation of FINRA rules.

- Rule 3310: FINRA directs firms to set up, maintain, and enforce supervision procedures in a written form. These procedures concerning their business activities must be well-circulated within the firm and communicated to all relevant parties.

- Rule 4512: All official communication with clients must be well documented. This rule requires firms and individual brokers and advisors to make such communication available to FINRA authorities upon request.

Benefits

A few benefits of FINRA are:

- The foremost benefit of firms and individual brokers and advisors following the Financial Industry Regulatory Authority rules is that the investor's best interest is considered in policymaking and its general execution.

- FINRA’s resources, such as CRD BrokerCheck, ensure that investors rely on qualified entities for investment and finance-related services.

- Violators of FINRA rules are often awarded hefty fines or even banned, depending on the magnitude of the violation. As a result, financial crimes are significantly lower.

- Their intentions of simplifying regulations and avoiding rule overlapping were made evident through the amalgamation of NYSE and NASD's regulatory operations into a singular organization.

- FINRA has the authority to curate new rules, enforce and administer qualifying examinations, and conduct mediation functions. Since it covers a wide array of aspects, it can ensure that all activities lead to the organization's primary objective.

Criticism

Despite the various benefits FINRA rules bring to all market players, they have been subject to some intense criticism as well. A few of the most common criticism include:

- Senators of various jurisdictions feel that the organization needs to do more to protect investors.

- Repeat offenders have often been the subject of the Financial Industry Regulatory Authority news. According to a study, advisors and entities with records of misconduct were more likely to repeat them.

- A general perception is that FINRA and other self-regulatory Organizations (SROs) do just enough to maintain public trust. As a result, there seems to be an innate conflict of interest.

- Repeat offenders and offenders with massive violations must be weeded out, and membership must be revoked. However, no such actions are taken. As a result, multiple market players have accused them of being hypocrites.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

FINRA vs. SEC

| Basis | FINRA | SEC |

|---|---|---|

| 1. Definition | A government-approved, self-regulatory, and non-profit organization that oversees brokers and broker-dealer firm activities. | A United States government agency that maintains the pinnacle in financial market governance. |

| 2. Incorporation | Formed in 2007. | Came into action with the Securities Exchange Act of 1934. |

| 3. Purpose | Its fundamental purposes include maintaining a fair and orderly market, regulating margin accounts, ensuring adherence to market norms, and upholding integrity. | Its foremost focus is to safeguard individual investors. It ensures that investors have faith in financial markets. |

| 4. Relationship with Government | The US government does not mandate it. It is a private SRO. However, FINRA has multiple registered broker-dealers (BDs) | It is an agency directly under the US government. |

| 5. Resources | It offers various insights and tools to investors to help them improve their financial future. | Yes, the SEC is one of the most reliable sources of insights and information concerning investments and financial goals. |

| 6. Function | Curates and enforces guidelines and rules. Moreover, it administers qualifying exams and issues licenses to BDs. | SEC is the ultimate creator and enforcer of rules in the securities market. In fact, it even oversees SROs such as FINRA. |