Table Of Contents

What Is a Financial Guarantee?

Financial Guarantee refers to the promise undertaken by a third party for any financial obligation of another company and, therefore, assumes the role of a guarantor for any unpaid financial obligations. In the process, this third party assures of repayment to lender if the actual borrower defaults.

Through a financial guarantee letter, lenders are relieved as they know that there is someone to recover the amount from if their borrower defaults. It is a legal contract which must be signed by all parties involved, which include the borrower, the lender, and the third-party or the guarantor.

Key Takeaways

- A financial guarantee is a promise made by a third party to assume the financial obligations of another company if they default on their payments.

- Banks or financial institutions often require financial guarantees before they will provide loans to companies to ensure the recovery of the loan if the borrower defaults.

- Financial guarantees differ from performance guarantees, which ensure payment or compensation in the event of inadequate or delayed performance by the party to the contract.

- Financial guarantees are an important mechanism for ensuring the continuity of projects and can be a win-win situation for both the borrower and the financial institution.

Financial Guarantee Explained

A financial guarantee stands as an excellent mechanism of ensuring the continuity of projects by acting as a source of assurance to the party of the underlying contract. It happens to be a win-win situation as the bank or the financial institution is assured of its payment, and at the same time, the borrower gets his required fund thanks to the guarantor that happened to intervene and help secure it.

A company may undertake any project or risky venture that may require borrowing from the bank. In this regard, the bank may demand that a certain entity give it a promise in terms of financial guarantee that should the borrowing entity default about its timely completion of the project or the said venture so that the loan amount can be sanctioned and the company may go ahead with the required project work.

Let us consider an example to understand how this financial guarantee market works:

- InNeed Co would require some amount of project financing for one of its upcoming projects. However, the bank seeks some surety that, should InNeed Co default on its performance or completion and not repay, it would need backing from another significant entity in terms of financial guarantee if there are any defaults InNeed Co.

- InNeed Co would now seek assistance from another friendly or parent company with significant net worth. The bank would be satisfied that the performing entity would meet its entire obligation and default to sufficient backing from the parent company.

- The parent company- VeryStrong Co would now stand as a financial guarantor if InNeed Co happens to default on any of its timely payments to the banks, and the bank is assured and has the right to claim the same from VeryStrong Co should the need arise given that there are defaults if any.

- There also happen to be times when more than one guarantor would provide the underlying guarantee. Under such circumstances, each guarantor would tend to be responsible for the pro-rata portion of the issue.

- Sometimes the parent company may also guarantee the bonds that its subsidiary company happens to issue, which also stands as an example.

Reasons

A financial guarantee contract is required to help all parties involved. It helps borrowers to have a helping hand or a repayment backup in case they are unable to pay back any loan amount. This contract gives the lenders relief as they know that there is no chance of getting ditched by borrower as the third-party guarantor will help recover the amount in case the borrower fails to repay the loan or defaults.

Some of the reasons that helps understand why one should use it are as follows:

- Should a corporate or a business owner engage in any risky project by resorting to borrowing, usually through forms of a loan from any financial institution or bank, the financial institution is concerned about the recovery from the concerned entity. It thereby demands surety in repayment through the mechanism of a financial guarantee from any other business/entity that would guarantee the payment that has to be recovered.

- Hence, at this stage, the entity would be required to take the assistance of a guarantor to act as a source of assurance so that there isn't any delay in securing the required finance for the project. Here, the savior happens to be a guarantor who would oblige for repayments if the borrower defaults if any. Hence to ensure there is no delay and timely finance available, it becomes imperative that one depends on the financial guarantee. Even from the bank's perspective or the financial institution, they need to ensure that the underlying borrowing does not turn into a non-performing asset and thus seek a guarantor in this regard.

Examples

Let us consider the following instances to understand the concept and see how the financial guarantee process works:

Example 1

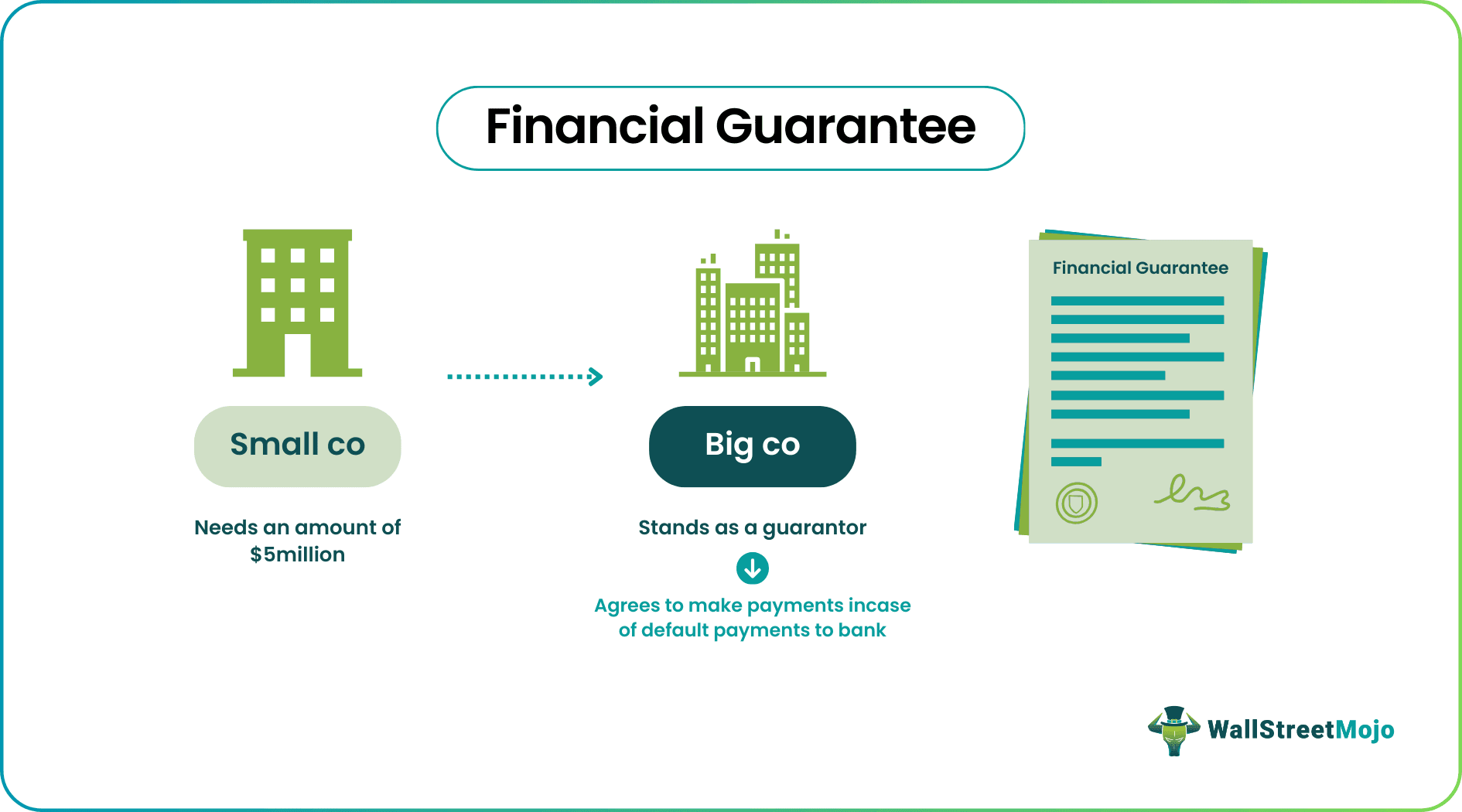

Small Co, a subsidiary of Big Co, wants to venture into building a magnificent residential society in New York and needs an amount of $5 million in this regard. It approaches the Super Lender Bank to finance towards this end. The bank agrees to do so but on the condition that the parent of the subsidiary being, Big Co, stands as a guarantor in this regard and agrees to make payments if the subsidiary Small Co happens to default on its timely repayments about payments of interest and principal components of the loan. Big Co, towards this end, thus stands to act as a financial guarantor for Small Co.

This act can be considered as a form of financial guarantee. In the future, should Small Co start defaulting on its obligations, Big Co would be called on in his role as guarantor to pay off the timely repayments as required by Small Co. Hence, Large Co becomes an important financial guarantor for its subsidiary, Small Co.

Another example could also be that of a shipping company that would seek to guarantee the value of a particular shipment from an assurance of that of a maritime insurance company that would act as a guarantor for the financial guarantee in this case.

Example 2

In August 2023, Multilateral Investment Guarantee Agency (MIGA), a World Bank Group investment agency, confirmed a financial guarantee for the MBP solar power plant located in South Africa, to ensure the latter takes appropriate initiatives for sustainable energy growth. MIGA provided a financial guarantee worth about $18.9 million to BTE Renewables, covering the equity investments of MBP.

MIGA took this initiative following South Africa’s contribution in making 85% of the population access electricity. However, despite such an advanced progress, the nation still suffers from power shortages and load shedding, which ultimately affects both residential and commercial activities.

Financial Guarantee vs Performance Guarantee

Financial guarantee and performance guarantee are two most widely used terms when it comes to guaranteeing an unaccomplished recovery, be it monetary or non-monetary. Listed below are some of the differences between the two. Let us have a quick look at them:

- A financial guarantee tends to make payment by the guarantor if the borrower fails to make the requisite repayments on the borrowed amount. The guarantor would be obliged to make the payments on behalf of the borrower.

- If any default takes place, it is then a financial guarantee comes in place.

- On the other hand, a performance guarantee ensures payment or any compensation in the event of inadequate or delayed performance by the party to the contract. It tends to state that if the party does not meet its standards in terms of performance expected, it is then that the guarantor will take on the required responsibility to pay off the guaranteed money. Suppose if one were to purchase certain equipment but it does not perform to the standard expected or fails to perform totally, then the guarantor has the responsibility to make good for the loss.