Top 10 Best Financial Freedom Books [2025]

Financial freedom refers to the idea of becoming financially independent and being able to spend on things an individual likes. The concept comes from retiring early and reaching a point in life where an individual has no obligations regarding money and is living a free and prosperous life doing work because they like to do not because they are bound to support a lifestyle. The secret to learn all about Financial Freedom is to study books that were authored by the brightest brains on the planet.

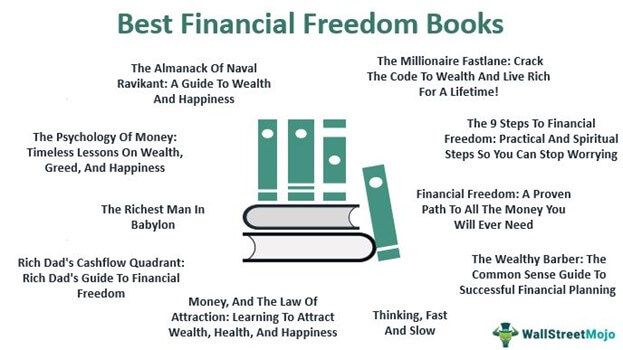

Below is the list of Top 10 books on Financial Freedom that you must read -

- The Almanack Of Naval Ravikant: A Guide To Wealth And Happiness ( Get this book )

- The Psychology Of Money: Timeless Lessons On Wealth, Greed, And Happiness ( Get this book )

- The Richest Man In Babylon ( Get this book )

- Rich Dad's Cashflow Quadrant: Rich Dad's Guide To Financial Freedom ( Get this book )

- The Millionaire Fastlane: Crack The Code To Wealth And Live Rich For A Lifetime! ( Get this book )

- The 9 Steps To Financial Freedom: Practical And Spiritual Steps So You Can Stop Worrying ( Get this book )

- Financial Freedom: A Proven Path To All The Money You Will Ever Need ( Get this book )

- The Wealthy Barber: The Common Sense Guide To Successful Financial Planning ( Get this book )

- Thinking, Fast And Slow ( Get this book )

- Money, And The Law Of Attraction: Learning To Attract Wealth, Health, And Happiness ( Get this book )

Let us go through these top financial freedom books to understand the idea and unravel the secret of financial independence.

#2 - The Psychology Of Money

By Morgan Housel

The book came in the year 2020. It shares a unique point of view towards the use of money and how people's weakness with their money lies with their relationship with it.

Book Review

The author illustrates that wealthy individuals make the most irrational financial decisions, and the goalpost keeps moving as we earn more. Therefore it is critical to know when to spend enough and be satisfied. The book also explains the car paradox where people, when seeing others in an expensive car, do not think them cool but imagine themselves in that car. The book is one of the best financial freedom books to read.

Key Takeaways

- The author uses the relationship and perspective of people towards money to explain why people are scared of investing and reinvesting.

- The book uses the example of businessman Warren Buffet as a true example of the power of compounding.

- The author states that a frugal budget, flexible thinking, a loose timeline can help people make good investments.

- The author encourages people not to confuse people for their visible wealth.

#3 - The Richest Man In Babylon

By George Samuel Clason

The book was originally published in 1926, but still, many people talk about it and take references from it to understand the importance of money.

Book Review

Along with seven rules for money, the book gives three lessons to start building wealth: living below your means, learning to be lucky by working hard, and never taking on debt. The author says that if anyone follows these three lessons, they are already ahead of many people. He adds that people should diminish their self-talk to justify their unnecessary purchases.

Key Takeaways

- The book gives seven rules of money.

- It delivers a strong idea for cash and is a must-read for beginners.

- The book suggests investing 10% of income in the right assets.

#4 - Rich Dad's Cashflow Quadrant

Rich Dad's Guide To Financial Freedom

By Robert T. Kiyosaki

The author, the founder of Rich Dad Co., focuses on private financial education. He is also the author of the classic “Rich Dad Poor Dad.”

Book Review

The book talks about how some people work less and earn more and motivates people to use this trick to do the same. The book is important because, for many people, it states how some people are making so much money while others and struggling financially. Robert Kiyosaki designed four quadrants: employee, business owner, self-employed, and investor. The book also discusses how people have been suffering from financial weakness for a long time and explains how they can overcome it.

Key Takeaways

- The book has a quadrant designed by the author to explain where and how people fall and what they should do.

- It explains the problem of poor mindset and the struggles of people to overcome it.

- The author condemns the poor mentality and says that there has to be a change in the mindset of people to become wealthy.

#5 - The Millionaire Fastlane

Crack The Code To Wealth And Live Rich For A Lifetime!

By M. J. DeMarco

The book came in 2011, in which the author speaks about the decent way of creating wealth by following simple formulas and retiring early.

Book Review

The author is very keen on the idea of following the old and proper way of studying, getting a degree, doing a job, and starting saving and creating wealth in the very basic way most people do it. The book suggests that there is nothing wrong with working hard, but there are certain steps that people can take in between and ensure that its outcome will differ positively.

Key Takeaways

- The book tells the reader what is wrong with the old way of slowly earning and creating wealth.

- The author says wealth stands on three things, and none of them is money.

- It presents examples of many famous people to explain the income model concerning time.

- The author explains that it is important to become a producer than to remain a consumer.

#6 - The 9 Steps To Financial Freedom

Practical And Spiritual Steps So You Can Stop Worrying

By Suze Orman

The book was released in 1997 but is still relevant to financial planning, money management, and work and life balance.

Book Review

The book is about taking charge of personal finances to experience financial independence. The author asks people who have a sense of responsibility to help the less fortunate. Suze shares her personal experience as a Certified Financial Planner professional and other jobs she worked in. She also encourages people to face their fears and understand the meaning of true wealth. The book also sheds light on why people should respect their work and money.

Key Takeaways

- The author of this book offers nine steps to financial freedom.

- All the nine steps involve more about life than just money and finances.

- She explains that it is important, to be honest with yourself.

- The author states it is important to ensure long-term life insurance plans and other applicable benefits.

#7 - Financial Freedom

A Proven Path To All The Money You Will Ever Need

By Grant Sabatier

The author published this book in 2019 and offered guidance for people looking to become financially free and enjoy life to the fullest. For beginners, this ranks among the top financial freedom books.

Book Review

The author shares his personal experience of going from $2.26 to $1 million in just five years. He encourages readers to start investing as soon as possible because time is more valuable than money. Grant Sabatier guarantees that people can rewrite their retirement by following these simple steps. He also states that financial freedom comes from being true to your work and the objective of acquiring your amount.

Key Takeaways

- The author establishes seven steps to financial freedom.

- He asks people to think of a particular amount they feel is enough for them by the time they want to retire.

- The book explains how money is freedom.

- The author writes that impulse is an enemy of freedom.

#8 - The Wealthy Barber

The Common Sense Guide To Successful Financial Planning

By David Chilton

The book was originally published in 1989 and has greatly impacted people due to its subtle art of storytelling, where a reader can relate to the fictional character the author established in the book.

Book Review

The author introduces a fictional character Ray Miller, a barber, and through his life story and experiences, gave some slow and steady ways of making it big in the long run. There are many books where shortcuts are provided to make more money in life, but this book is different from other books about financial independence. The book is popular for its real-life references.

Key Takeaways

- The book talks about a different aspect of financial freedom.

- It is written in a format of novel that works in its favor and separates it from other financial freedom books.

- Financial freedom is an important subject, but many people find it boring to read, yet this book changes it.

#9 - Thinking, Fast And Slow

By Daniel Kahneman

The book was released in 2011 and has inspired people seeking mind upliftment, money management techniques, and financial literacy.

Book Review

The author says that the general behavior of the brain is lazy, and it prohibits people from using its full potential. In context to financial freedom books, this book says that when people make decisions about their money, they should keep aside their emotions. The author says that life is unpredictable, and people should possess a clear mindset about what they want. This book is one of the good psychology and financial freedom books to read.

Key Takeaways

- The book discusses two systems (conscious and automatic) that make the brain function and think.

- The author speaks about how most people fool themselves and cannot think straight.

- It suggests people study their faults. It is hard but must be done.

#10 - Money, And The Law Of Attraction

Learning To Attract Wealth, Health, And Happiness

By Esther Hicks, Jerry Hicks

The book was published in 2008 and has changed the life of many people. It specifically points out various issues people go through in their lives and can drive its stability.

Book Review

This book explains two prominent subjects - the use of the law of attraction in finances and the physical well-being of people around the society. The authors want people to take control of their finances and life decisions. They point out that many people duly suffer because of a lack of money, health, and power in their lives. With this book, they aim to induce the law of attraction in the lives of its readers.

Key Takeaways

- The book talks about people's life struggles and issues regarding money and living.

- Both authors want people to admire the law of attraction in finance and every aspect of their lives.

- The book stands among the top financial freedom books of all time.