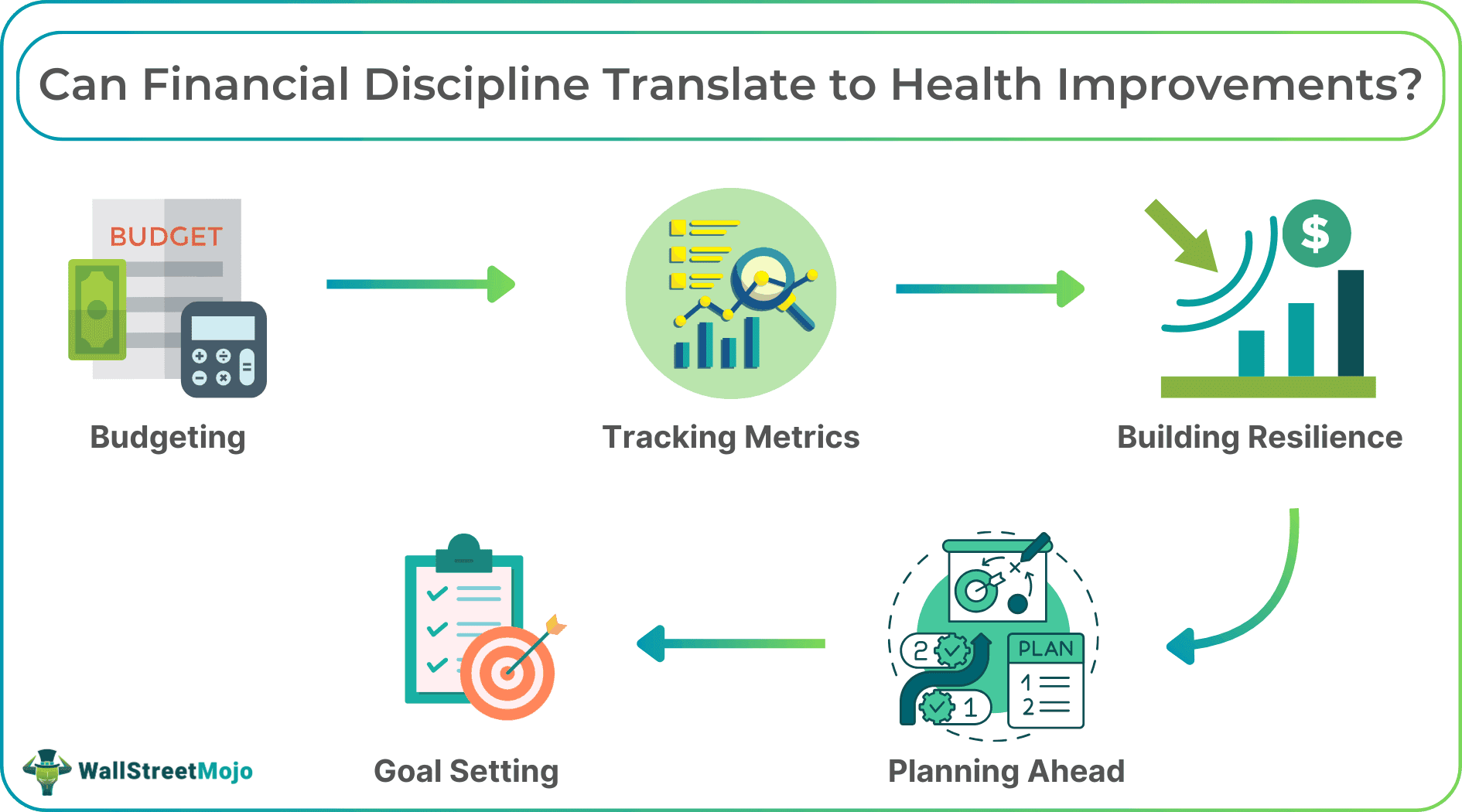

Can Financial Discipline Translate To Health Improvements?

Table Of Contents

Introduction

Finance and health are two cornerstones of every human life. If you are alive, you want to stay healthy; when you live in a society, you want to be financially stable. But have you ever thought about how the latter can help you achieve improvements with the former? We all have heard the proverb that "health is wealth." We are going to replace it with "better wealth is better health."

You are free to use this image on your website, templates, etc.. Please provide us with an attribution link.

Today, most people tend to focus more on accumulating wealth but ignore health but today, we establish a link between financial health and physical health and will learn how taking care of your money will help you take care of your health.

How Can Financial Discipline Offer Health Benefits?

#1 - Budgeting:

We always say and observe how one thing leads to another and a completely different scenario gets built. Well, it is true with budgeting and better health. Try this simple idea:

- Jot down every single expense you make in a month to understand how much your day-to-day lifestyle costs you.

- Try to see how much of that money goes into partying, takeout food, liquor and other habits such as going to clubs or fancy restaurants.

- Add all those numbers, and you will see how much you spend on these things, which technically are ruining your health.

We are not telling you to become a saint but to be smart enough to reduce unnecessary expenses. It is the first step toward inculcating financial discipline for health improvements. When you save money, you feel good; when you feel good, you don't feel the urge to go out and spend. In fact, you can use that money to buy a gym membership, subscribe to a dietician or buy an online health or weight loss program, such as WeightWatchers US, to invest in your health now. So, what started with smart finance ends with good health.

Indeed, budgeting is one of the many financial habits for good health that helps you understand how you can actually save and spend without having to compromise on your lifestyle. It also helps you realize how you can make your life better, starting from small health improvements.

#2 - Tracking Metrics:

Here, we shed light on both your financial metrics and your health metrics. Closely monitoring them is vital for instilling financial discipline for health improvements. Suppose you are someone who is working out; you already know these. Having said that, if you are someone who never crossed the threshold of a gym, you at least know the financial metrics. If you track your expenses, you should already focus on the health metrics such as the calories you take in, your current weight, the number of steps you take every day, and your sleep. Moreover, you should check for cholesterol and blood sugar levels.

Financial discipline is a personality trait that only a few people have. In fact, we can bet that there lies a separate crowd who doesn't know such a term exists. Regulating your finances and taking care of your body goes hand in hand. What will you do with your money if you don't have good health to enjoy something? Tracking metrics, reviewing them and working towards keeping them in control is something true for both finance and health. If you are disciplined in one, why don't you try the same thing with the other?

Remember, financial habits for better health will let you know where you are, where you are going, and what is progress.

#3 - Building Resilience:

Suppose an individual who is good in savings and invests regularly has created an emergency fund. It simply shows how resilient they can be to withstand any market crash, unforeseen expenses or financial crisis. Now think if the same person invests in healthcare, goes to the gym, takes a morning walk, works on their weight loss, eats well and builds a strong body. They can withstand any form of disease and health problems that eventually hit people after a certain age and can become permanent, such as obesity, heart issues, or diabetes.

Here again we see how financial discipline translates the same for your health improvements and how financial discipline affects well-being. When people tend to live healthily, they automatically transform themselves better in finance because they start a lifestyle that demands minimum elements and ultimately saves a lot of money. Building resilience is an important aspect; today, the world we live in tests our health on a daily basis. There is work-related stress, household issues, social commitments, work responsibilities and family problems. In such a mess, you actually need a healthy body and the right mindset, which comes by practicing financial and health discipline.

#4 - Planning Ahead:

In finance, with discipline, you start planning and building a long-term vision about your money, savings, and returns from assets. Similarly, with a healthy body, you can plan a better future with your family without having to worry about back pain, joint pain, constantly being sick or bedridden. You can only plan when you know that you are in a good state and will continue to maintain it. In fact, even small health improvements are technically part of your planning, whether it is a financial goal or a health-related ambition.

Financial discipline for health improvements works, but you plan first and then only start taking action. Plan your meals, schedule your sleep, take measures to improve your work-life balance, exercise daily and stick to your timetable. Remember, planning starts today.

#5 - Goal Setting:

Lastly, let’s talk about goal setting to instill financial discipline for health improvements. Just like you plan your finances to achieve financial goals, such as purchasing a TV, any home appliance, or a home itself, with health, you can do the same. You can set a goal to lose a specific number of kilos, quit smoking, become vegetarian, and so on. If you work out and have the knack for it, you can even set body-building goals such as getting abs, improving muscle mass, etc. All these are financial and health goals that align when you become better, showing improvements. Just like building savings and portfolio returns takes time, improving your health will also require time.

In the end, we can safely say that financial discipline does translate to health improvements, and budgeting, tracking metrics, building resilience, planning, and goal setting are vital in this regard. If you are financially disciplined, it's time to focus on financial health and improving your lifestyle. Try using some of the tricks mentioned above to become better and make significant health improvements over time.