Table Of Contents

What Is Financial Crime?

Financial crime is an illegal activity by organizations or individuals for monetary benefit. In the process, one party gains, and another party suffers a loss. Therefore, it is a significant threat to a country’s economy, society, and global financial system, affecting its growth and stability.

Financial crime is steadily rising in today’s technologically developed world, resulting in massive losses. Criminals are creating new deceptive tactics, and crime control authorities are devising ways to combat them. Such offenses may be related to cheques, credit cards, mortgages, property, terrorism financing, producing counterfeit goods or money, and even software and computer related.

Key Takeaways

- Financial crime is an unlawful activity performed by people or organizations for economic benefit.

- It might be related to banking, credit card, property, mortgage, producing counterfeit money or articles, financing terrorism, or cyber financial crime.

- It leads to massive losses to society, the country, and even the global economy, affecting security, balance, and development.

- Such crimes are continuously rising due to technological development and social changes, and crime control authorities are steadily devising plans to control and prevent them.

Financial Crime Explained

Financial crime is an unlawful practice that some entities or individuals conduct for monetary benefit. It affects not only society and nation but the entire global financial system.

It is a growing concern for the various national governments. It can occur in banking, financial markets, medical and healthcare, real estate, or technology and communication-related fields.

Such crimes conducted in one financial area cause a ripple effect in the entire economy, leading to unexpected setbacks. The job of a financial crime analyst is to remain vigilant to combat these situations by identifying signs of fraudulent and dishonest behavior or miscommunication of information which might indicate that some financial crime is about to or is taking place.

A financial crime lawyer is adept at handling legal proceedings in such situations. They do a lot of studies and master the art of providing legal assistance while investigating crimes related to money laundering, market manipulation, forgery or corruption, etc.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Types

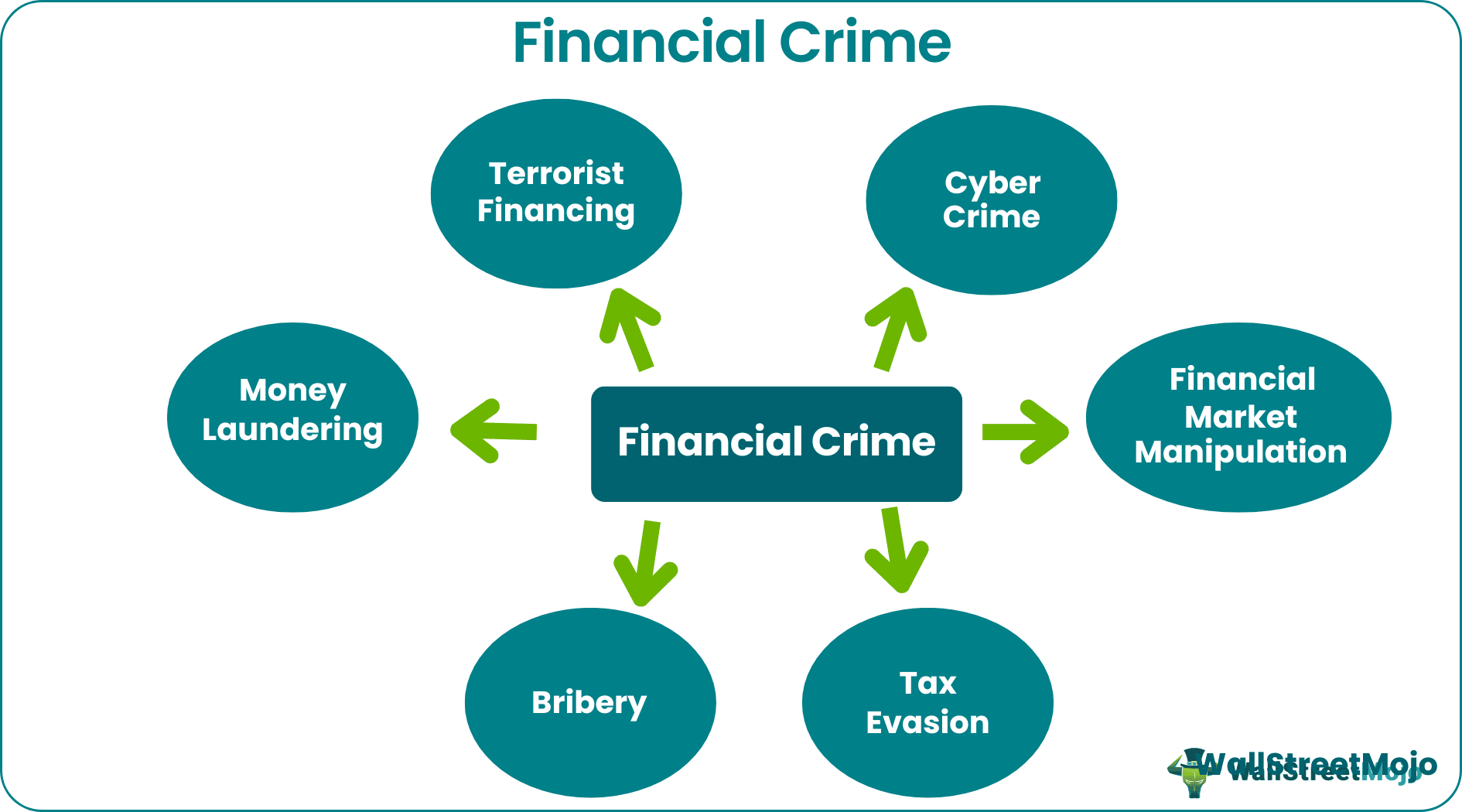

Financial crime can be of various types, as follows:

- Money laundering – Money laundering refers to illegally earning or transferring vast sums of money from a source to a destination for personal gain without informing the concerned parties.

- Bribery – Bribery offers vast sums of money or valuable items to a party on duty to achieve the desired result.

- Tax evasion – An individual or entity deliberately skips tax payments against the earned income to save more money.

- Financial market manipulation – The financial markets are often manipulated by spreading false rumors to influence prices, insider trading, or devising methods to deceive investors.

- Cyber crime - Cyber financial crime committed through email, the internet, or the use of specially designed software for a fraudulent purpose is on a steady rise in today’s world.

- Terrorist financing – In this type of fraud, some groups create funds or provisions to help carry out terrorism-related activities in a region.

Financial Crime Compliance

It is essential to comply with or adhere to rules and regulations to control and prevent financial crime. Financial regulators have various systems to help analyze and identify situations leading to such crimes.

The financial crime risk management (FCRM) process helps identify the suspicious situation that might make an entity a victim. Fraudsters target financial data and insider information which is easy due to continuous technological advancement and businesses going online. Thus, it is necessary to have a risk management process in place to avoid such cases.

The Financial Crimes Enforcement Network (FinCEN), which is a part of the treasury department of the US, has been playing an essential role in taking measures to enforce measures against finance-related crimes. It also gives importance to the fact that an entity should follow the compliance culture and take all rules seriously. They should ensure the following:

- The management is encouraging and supportive.

- There should be efforts to prevent money laundering, keeping every aspect of the business.

- There is transparency in the information-sharing process with the organization.

- There is an efficient allocation of resources.

- The entity should conduct periodic testing to ensure the risk management process is working correctly.

- There must be methods to train anti-money laundering staff to understand the process correctly.

However, it is necessary for organizations to change their practices related to surveillance, rules, and working procedures because the business scenario is continuously transforming. They should learn about any changes from the financial crime lawyer and investigators.

The risk management process should be properly functional, and the management should take ownership and responsibility for the same. But unfortunately, there is no fixed rule to fight against such a crime. So it is essential to keep upgrading the system.

Examples

Let us look at some examples to understand financial crime better.

Example #1

Max, an expert in building software for organizational use, is working with Star Trading, which is into financial advisory services. Max works in the Information Technology department that handles the company's technological systems and hardware and software functionalities.

Max is not satisfied with the compensation plan devised by Star Trading for its employees. He feels that his salary is less compared to his services. Thus, Max designed software that has successfully gained access to the software used in the accounts department. Through this, he can access the company's bank account details. Thus, Max can quickly and efficiently transfer funds to his account by forging the digital signature of the top authorities in the finance department.

He initially starts with a much smaller amount. Suddenly he moves some massive amount of money that comes to the notice of the finance department, which engaged a financial crime investigator to investigate the matter. After a thorough investigation, the company catches him and terminates his job.

The above example is a combination of money laundering and cybercrime that might affect any organization.

Example #2

According to Finbold, cryptocurrency has been giving rise to many financial scams that have affected investors leading to huge losses. Moreover, the fraudsters keep implementing new ideas to cheat them.

The scams that came to light were a “rug pull, " meaning software developers who had built applications for crypto blockchain platforms attracted people toward the new application but left the project unfinished, which led to a massive loss for people who put their funds into the project.

Such cases emerged relating to various crypto schemes and exchanges like the OneCoin scheme, the Thodex exchange scam, Uranium Finance, AnubisDAO, etc.

Example #3

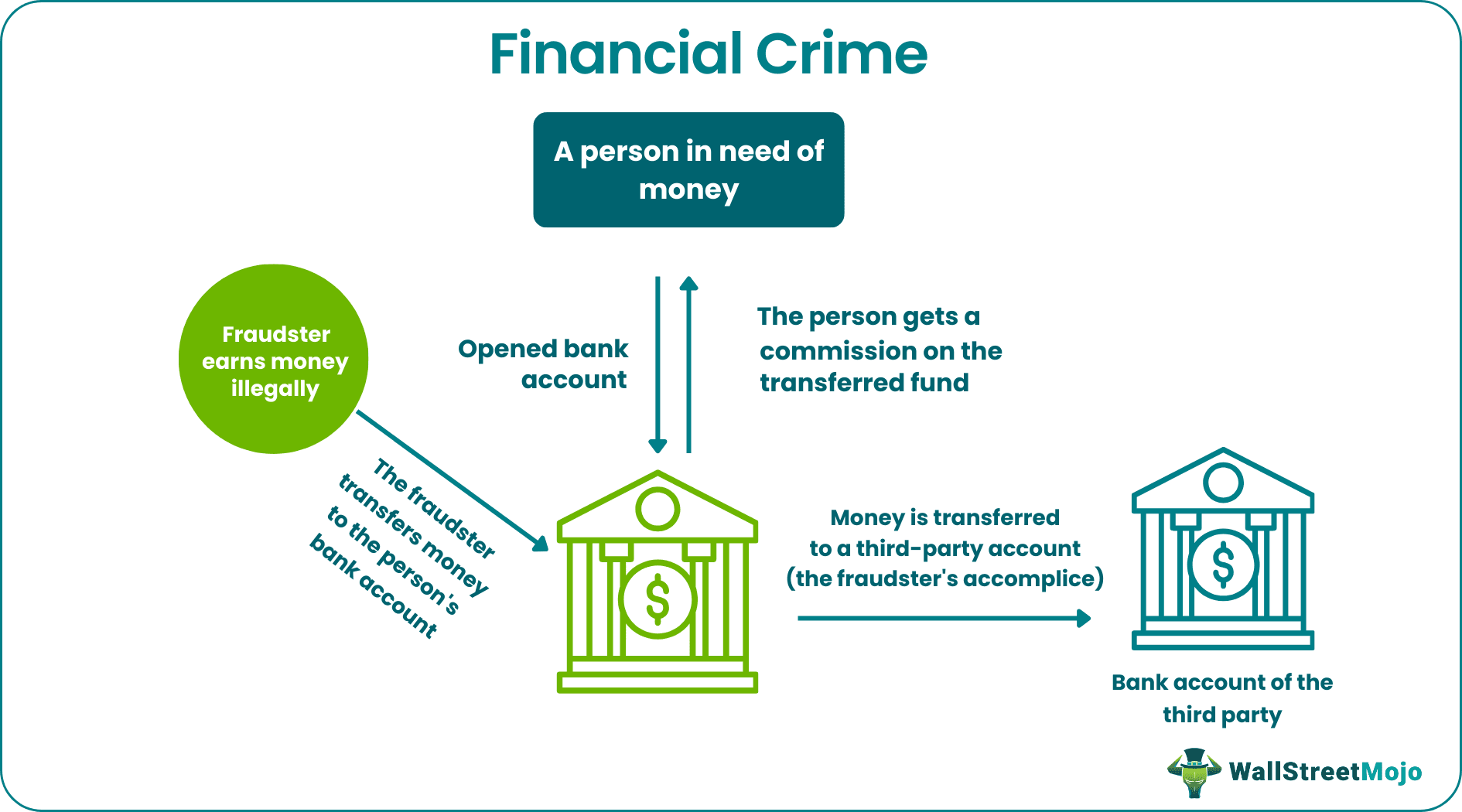

The COVID-19 pandemic left many young people jobless due to the entire economy suddenly coming to a standstill. As a result, the job market suffered a severe setback. Many fraudsters used this opportunity to target jobless young people as money mules.

In this arrangement, criminals use innocent people’s bank accounts to deposit money illegally acquired from some source. Then, they transfer the money elsewhere later, and the account holder gets a small fee. Thus, these jobless people act as money mules for fraudsters who are into money laundering.

Prevention

There are ways and means to prevent financial crime as follows:

- Confirming customer’s identity – Whenever any customer does a financial transaction with any entity, it is necessary to ask for proper identity-related documents through updated software.

- Document verification – It is also necessary to verify the documents taken from the customer.

- Establish due diligence regarding money transfers – There should be a rule regarding how much money to transfer at a time. The organization should block any transfer above that amount.

- Designing software to identify risk – The software designs should be such that they can identify any suspicious activity.

- Continuous risk monitoring – An entity should have a department for constant risk monitoring in different functional areas.

- Immediate action – It is crucial to take immediate action once there is fraud to keep the damage under control.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

1. Who investigates financial crimes?

In an organization, forensic accountants act as financial crime investigators in such cases. They analyze the financial statements and look for tax-related fraud in case of insider trading, money embezzlement, or any other type of scam to which an entity might be a victim.

2. What are sanctions financial crime?

They are some imposed sanctions that globally fight against financial fraud for any economy, a particular state, an entity, or an individual. For example, it might be in the form of restrictions on finance or trade with a country that has broken the law.

3. What does financial crime analyst do?

The job of such analysts is to prevent fraud related to finance. Therefore, they need knowledge and skill to identify cases like a fraud in insurance, identity theft, money embezzlement, banking or credit card fraud, bribing officials, or cybercrime.

4. What is financial crimes enforcement network?

This department in the United States Treasury guards the US financial system against illegal economic activity like money embezzlement, financing terrorism, manipulation of the US stock market, insider trading, or any other kind of financial fraud.