What Financial Analysts Should Know About Nonforfeiture Clauses

Table of Contents

Introduction

Financial analysts are known to study, analyze, and evaluate financial products and investments. Moreover, they manage risks and advise their clients about the pros and cons of financial contracts. One such contract is an insurance policy. Individuals purchase such policies for an added layer of financial protection in the event of damage or loss concerning their health, life, or assets, for example, a house. In exchange for financial protection, one needs to make regular payments called premiums. The maximum compensation provided by a company in the event of any covered loss depends on the policy's limit.

As a financial analyst, one of the key things to be aware of is the nonforfeiture clauses in insurance policies, how they can impact the terms and conditions, and why they should matter to the policyholder.

This is a clause stating that the insured individual can receive full or partial benefits or a refund in case a policy lapses following a particular period because of missed premium payments. Moving ahead, let's discuss some of the key elements of the nonforfeiture clause and how to use it in the right way.

What To Look For In Nonforfeiture Clauses?

Here are some of the key elements that a financial analyst must check when dealing with a nonforfeiture clause before advising their clients -

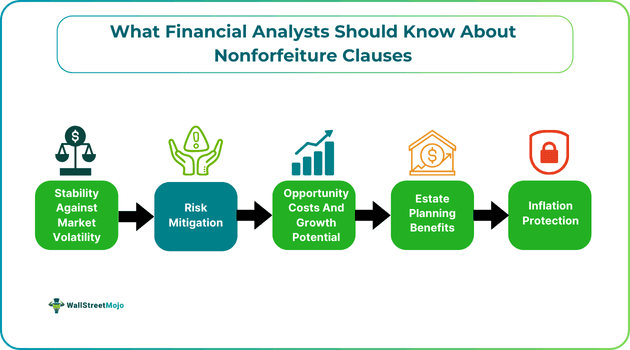

Stability Versus Market Volatility

The nonforfeiture clause in insurance works in favor of the policyholder. That said, a financial analyst needs to analyze the market volatility relative to market stability to evaluate the outcomes. Based on the analysis, they can advise your clients about the insurance. Buying an insurance policy is a long-term investment, and whether you believe it or not, market volatility is a crucial factor to consider when determining whether to buy a certain plan.

If the market is unstable or the insurance industry is in an economic slowdown, a forfeiture clause in an insurance policy can backfire. At the same time, if the market is in crisis and you do not have enough money to pay the premium but have been paying it for a sufficient period, the nonforfeiture clause can be helpful for you. Hence, be sure to check for such clauses and weigh the pros and cons thoroughly when purchasing a policy.

Risk Mitigation

The nonforfeiture clause protects your policy value and prohibits the insurance provider from getting it canceled just because you were unable to pay the premium on time. Hence, a financial analyst must highlight the significance of it when advising one to buy a certain insurance policy.

To understand risk mitigation concerning nonforfeiture clauses better, let us say an individual paid the premium regularly for three years. However, after that, for certain reasons, that person was unable to make the payment. In that case, the state law aligned with the nonforfeiture clause forbids the insurance companies from canceling the insurance policy and keeping the entire accumulated sum of money. As a result, individuals can get back a part of their money paid as premiums for the insurance policy through surrender value.

Note that without the underlying clause in an insurance policy, the insurer can do whatever it wants on the grounds of the policyholder failing to pay the policy’s premium.

Opportunity Costs and Growth Potential

As a competent financial analyst, it is your key responsibility to calculate and compare the opportunity costs of an insurance policy against its growth potential. Buying insurance of any type, whether for a property or health, is not an easy task. There are certain factors linked with it that directly and indirectly influence it over a period.

Nonforfeiture clauses in insurance are helpful, but as a financial analyst, you must evaluate if it aligns with the opportunity cost compared to other investments that the policyholder could have made during the same period and reaped better returns than the amount that would have been forfeited.

Estate Planning Benefits

Financial analysts guide their clients by providing valuable advice based on detailed analyses. They help their clients in estate planning, retirement planning, insurance, investment, and other financial aspects. Getting insurance for your real estate property is an essential part of your whole financial planning process, and your financial analyst and advisor know this. That is why they underline the importance of nonforfeiture clauses in insurance so that you can protect your estate if you miss out on your premium payment or, for any reason, are unable to pay it after continuously depositing the premium for years.

Inflation Protection

Think of it yourself: if you do not have the nonforfeiture clause in your policy and miss out on paying the premium, the insurer will keep the money, and you will get no refund. In such a scenario, all the money you paid for all those years at regular intervals gets wiped out. You can avoid such a scenario if you choose a policy with nonforfeiture benefits. The clause can protect the policyholder against inflation by allowing them to get back a part of their policy value.

With lifestyle expenses rising over time, this can help keep you financially stable.

Endnote

If you are a financial analyst reading this and have made it so far, be sure to understand the criticality of the nonforfeiture clauses in insurance and study all its key aspects in depth. It will enable you to truly comprehend what it means and how it can help individuals financially. Moreover, it can help you give advice to protect clients from getting manipulated by insurance companies.

On the other hand, if you are not a financial analyst but a regular individual planning to buy an insurance policy and reading this as a research article, speak with your advisor about the nonforfeiture clauses or conduct personal research and try to discuss it with your insurance agent. Always check all the insurance policy terms before signing the document. Our final advice will be to explore and do proper research whenever you are buying any insurance policy or any financial instrument.