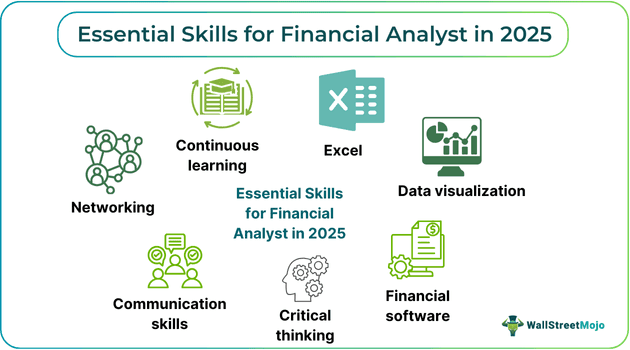

Essential Skills For The Financial Analyst In 2025

Table Of Contents

Introduction

Hiring a pro financial analyst is equally tough as hunting for a proper financial analyst’s job. For employers, it becomes difficult to judge a candidate based on some basic questions, as commonly asked questions are what every individual is pre-prepared with. As a result, recruiters in different companies remain particular while asking questions to ensure they can assess the essential skills required for the position in a better way.

You are free to use this image on your website, templates, etc.. Please provide us with an attribution link.

The competition is tough if you are looking for financial analyst jobs. Pretending you know something and proving the same would not be easy for you. Hence, you must acquire the essential skills for financial analysts 2025 if you plan to crack your dream job.

More knowledge of financial analysis and related aspects would only help you impress employers, who are not there to reject but select you based on how well you perform in the interview. To ensure this, some extra preparation is required, and that’s what this blog is about.

Let’s learn about the trending top skills for financial analysts in 2025 and how to bag the next big interview with these skills.

Top Financial Skills

A financial analyst acts as a liaison between the company and the stakeholders, delivering key insights about the business to the management and shareholders. Companies cannot just read the financial statements to the stakeholders. They must interpret them in a simple language for them to make relevant decisions per their assessment of the financial position of those companies.

As financial analysts, you need to provide them with a visually appealing narrative of the 12-month business so that stakeholders can understand the future impact of current decisions. Doing so becomes easier when you incorporate the required financial skills and the cognitive abilities you might already have.

The essential skills for financial analysts 2025 have been explained below to help you achieve your milestone!

#1 - Data Visualization

Often said, a picture depicts more than words. You own multiple data sets and accounting records, but you cannot mail them to stakeholders directly. No one will read them, and it would end up being junk mail. This is what makes most financial analysts today prefer using data visualizing techniques like graphs, charts, and pivot tables to communicate the details better. It helps categorize unstructured data into structured (diagram) form that drives better decision-making. Above all, the textual data presentation is significantly less impactful than the graphical representation of the same, which makes reading details easier, given the ups and downs being easily identifiable.

#2 - Excel

Undoubtedly, knowledge of Excel is among the top skills for financial analysts. Many employers and investment banking firms require candidates to know how to operate Excel at its full potential. It helps in faster calculations, which further assists in forecasting the financials for future years. Additionally, large data sets can be summarized easily through pivot tables. As a result, you tend to save a huge time, and your efforts also get reduced. However, learning basic functions won’t make a difference. Try to learn the different shortcuts, hidden functions, and tips that can save you time. Not to forget, even data visualization can be easily achieved using Excel.

#3 - Financial Software

When analyzing multiple interviews, a common question that recruiters asked almost every candidate was - “Are you aware of any financial analysis software?” If companies are asking for this skill, you need to prepare yourself in advance. While Excel holds a supreme position, there are other software as well that help in analysis. A few of them include NewSuite, Cube, Oracle Essbase, Anaplan, Argus, and DataRails. As financial modeling is the core aspect of financial analysis, software helps better understand, present, and interpret data. Nonetheless, using these tools, you can also perform multi-scenario modeling, budgeting, forecasting, risk management, and real-time reporting.

#4 - Critical Thinking

When computers and software reach their limits, the true value of financial analysts comes into play. Many job-specific resume templates for financial analysts highlight critical thinking as a key skill for success. However, this skill is often paired with problem-solving, observation, and decision-making. After projecting financial data on the screen, you must be able to connect the various elements and predict possible future outcomes. Financial analysts need excellent critical thinking abilities to determine whether an investment is worth pursuing. However, these judgments must also be logically sound and reasonable to ensure that decisions are both valid and actionable.

#5 - Communication Skills

Excellent ideas, but no tongue fluency can make your thoughts sound dull. Hence, communication skills are crucial in any job, including financial analyst. Since analysts must report their findings and analysis to stakeholders, you must have a good command of your language. Communication can be verbal (in-person talks, phone calls, video calls) and non-verbal (via emails and reports). Ensure that when speaking to investors or sharing important financial information, the tone should be professional, conversational, and convincing. At the same time, it should be easy to understand each level of stakeholders (C-suite executives, investors, employees, customers, and government).

#6 - Networking

Wondering how networking can help you become a financial analyst? Well, your social interaction does matter! A financial analyst profile emphasizes building meaningful relationships. The time you spend building new connections in this field and interacting with them helps you gain more knowledge about this role. Strong ties with already established people in this industry can help you more with the interview process, enabling you to crack it. For effective networking, tools like Wave Connect, a custom digital business card creator, can help you share your contact details instantly and make a professional impression during events or meetings. You can also leverage professional networking platforms, AI-powered matchmaking tools, and industry-specific online communities to connect with the right people beyond in-person events. Additionally, efforts to build your existing finance knowledge through eLearning platforms can help you excel further.

#7 - Continually Learning

No matter which field you are in, you always need to update your skills and upgrade yourself. Being a learner throughout your career would lead to continuous professional development, opening doors to advanced career options for you. Think of it as a lifetime investment that can bring explicit returns. You can take finance, investment banking courses, or FP&A courses as a part of your learning experience. It will help you stay updated on the market demands and motivate you to add more financial analysis skills 2025 for the next job hunt.

Conclusion

The finance industry has multiple candidates aspiring to become financial analysts yearly. Enthusiasts must have a robust preparation before thriving in an ever-increasing competitive and data-driven landscape. While technical skills, like Excel knowledge and hands-on experience with financial software, help manage complex data, soft skills like critical thinking, communication, networking, and continuous learning can help build professional relationships with stakeholders. By mastering these essential skills for financial analysts 2025, you can turn your dream of becoming a financial analyst into reality.

Head on and start your career as a financial analyst!