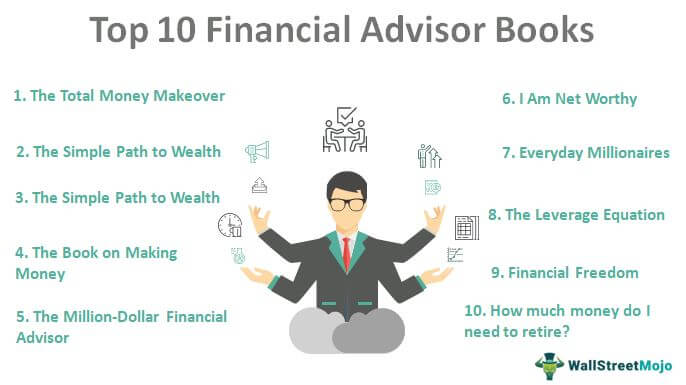

List of Top 10 Financial Advisor Books [2025]

Here we explain the top 10 books of financial advisors to read in 2023 that can be very helpful in capitalizing our earnings and building and securing our financial status.

- The Total Money Makeover ( Get this book )

- The Simple Path to Wealth ( Get this book )

- Financial Fitness Forever ( Get this book )

- The Book on Making Money ( Get this book )

- The Million-Dollar Financial Advisor ( Get this book )

- I Am Net Worthy ( Get this book )

- Everyday Millionaires ( Get this book )

- The Leverage Equation ( Get this book )

- Financial Freedom ( Get this book )

- How much money do I need to retire? ( Get this book )

Let us discuss each financial advisor book in detail, along with its key takeaways and reviews.

#1 - The Total Money Makeover

Author: Dave Ramsey

Book Review:

In an easily relatable manner, this financial advisor book interestingly highlights the systematic 7 steps for efficiently managing money and expenses. The author also does a perfect job of outlining the basics of changing harmful money habits.

Key Takeaways:

- The simple game plan for making over-the-money habits.

- Design a complete proof plan for paying all debts, i.e., installments for home, car loan, etc.

- Recognize the 10 most dangerous myths about money.

- Secure a significant fund for emergencies and retirement.

#2 - The Simple Path to Wealth

Author: JL Collins

Book Review:

A unique and approachable take on investing where the author gives his message visually and interestingly. This book is perfect for beginners and even seasoned investors against short-term investment strategies and speculation. Here are a few of the offerings by the author in this funny yet compelling book:

- Why does the stock market always go up, and why do most people still lose money investing in it?

- Why avoid debt, and what to do if you have it?

- What the 4% rule is, and how to use it safely?

#3 - Financial Fitness Forever

Author: Paul Merriman

Book Review:

This book provides a clear explanation of the investment strategies that the author offers to readers based on statistics and facts without any speculation. The following is a list of a few of the questions that the author tries to answer through his strategies in this book:

- Should I try to beat the market or accept the returns of the market?

- How should I diversify my investments?

- How should I manage risk?

- How should I insulate my investments from my emotions?

#4 - The Book on Making Money

Author: Steve Oliverez

Book Review:

The book provides an unconventional yet believable approach to building wealth, opposing traditional ideas like getting a good education, scoring high grades, and finding a steady job, ultimately leaving people with a heavy debt burden. Instead, the author encourages the readers to earn passive income, launch a start-up, and invest in the stock market.

Key Takeaways:

Here’s a quick view of a few of the learnings that the book imparts:

- Austere lifestyle and restricted spending prevent them from becoming wealthy

- Budgeting to get out of the debt burden.

#5 - The Million-Dollar Financial Advisor

Author: David J. Mullen, Jr.

Book Review:

Based on the interviews with 15 top advisors with several million dollars’ worth of business every year, the book distills their guiding principles to succeed. In the book, the author gives comprehensive strategies that wealth managers and financial advisors can use to build wealth.

Key Takeaways:

- Step-by-step lessons and principles for immediate application by veteran and new financial professionals.

- Developing a long-term approach.

- The best financial advisors are well-equipped to succeed regardless of the market condition.

#6 - I Am Net Worthy

Author: Chris Smith

Book Review:

This book tries to cover all the essential aspects of personal finance for today’s young adults, and while doing so, the author teams up with 9 different millennial co-authors in each chapter. The book provides a practical, step-by-step approach to tackling personal finances.

Key Takeaways:

- The basics of money, from saving to investing.

- How to create a proper budget not to overspend?

- Purchasing a car or home.

- Long term investing

#7 - Everyday Millionaires

Author: Chris Hogan

Book Review:

Based on the studies and research from interviews conducted with over 10,000 millionaires, this financial advisor book busts the myth that a person’s income or background has nothing to do with building wealth. Citing examples of ordinary people, the author tries to eradicate the common notion that being a millionaire requires exceptional talent or a lucky break.

Key Takeaways:

- Stories about the background of millionaires and their guiding philosophies.

- Millionaires live on less than they make.

- Millionaires avoid debt, invest, and are disciplined and responsible.

- One core principle it promotes is avoiding excessive risk in terms of investment.

#8 - The Leverage Equation

Author: Todd Tresidder

Book Review:

The author, a former hedge fund manager, highlights the principles, strategies, and tools needed to grow wealth in time to get the most out of it. In addition, the book shows how to use multiple types of leverage to reduce risk while accelerating results.

Key Takeaways:

- The hidden trap of regular paychecks and how to overcome it.

- The 9 principles of leverage that maximize your financial results.

- The right (and wrong) way to apply each of the six types of leverage.

#9 - Financial Freedom

Author: Grant Sabatier

Book Review:

Providing an approach to make more money in less time to utilize the time saved in enjoying life, the author highlights that while one’s ability to make money is limitless, one’s time is not. Therefore, there’s also a limit to how much you can save but not how much money you can make.

Key Takeaways:

- Save money without giving up what makes you happy.

- Create a simple, money-making portfolio that only needs minor adjustments.

- Think creatively to make money.

#10 - How much money do I need to retire?

Author: Todd R. Tresidder

Book Review:

This book presents straightforward and concise advice on retiring wealthy, focused on early retirement planning. The author disagrees with the traditional approach to building a retirement portfolio and advocates that incorrect estimation can make people underspend or overspend.

Key Takeaways:

A few of the major takeaways of the book are as follows:

- Three strategies to maximize spending today while protecting the future.

- How to calculate the amount of money you need to retire.

- The book has five critical assumptions that can destroy your financial security.

AMAZON ASSOCIATE DISCLOSURE

WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com