Table Of Contents

Financial Accounting Definition

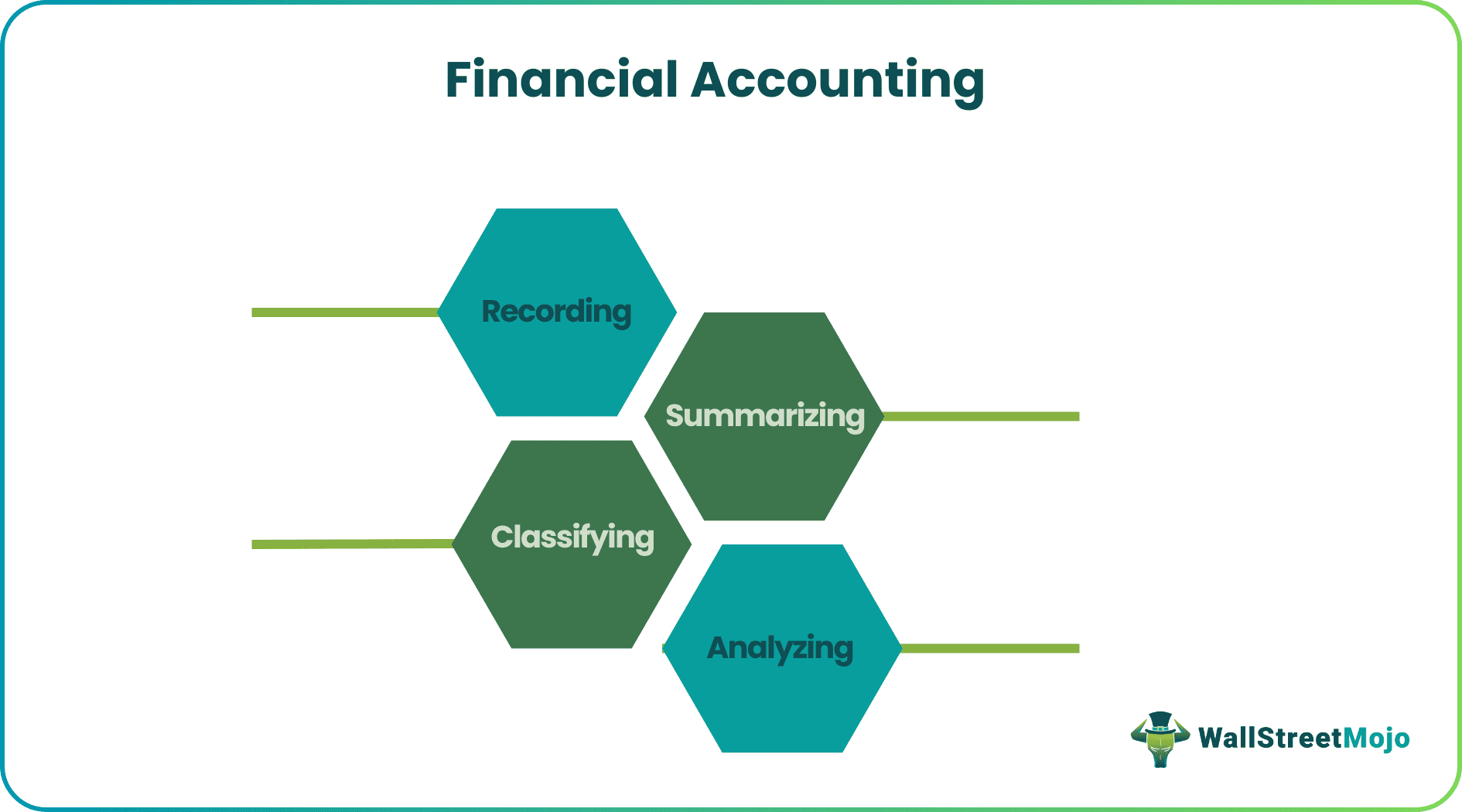

Financial accounting is the systematic procedure of recording, classifying, summarizing, analyzing, and reporting business transactions. The primary objective is to reveal the profits and losses of a business. Financial accounting provides a true and fair evaluation of a business. It, therefore, safeguards the interests of stakeholders.

Financial accounting includes the bookkeeping of financial transactions like purchases, sales, receivables, and payables. Accountants follow the Generally Accepted Accounting Principles (GAAP) for creating income statements, cash flow statements, balance sheets, and shareholder’s equity statements.

Key Takeaways

- Financial accounting includes bookkeeping, classification, and interpretation of business transactions. The profitability and financial position of a firm are ascertained.

- It represents revenue, expenses, assets, liabilities, and equity in respective financial statements, i.e., income statements, cash flow statements, and balance sheets.

- This information serves as the basis for many critical decisions. The data is used accordingly by managers, shareholders, creditors, lenders, and investors.

- Financial accounting is governed and regulated by the Generally Accepted Accounting Principles (GAAP) in the US.

Fundamentals Of Financial Accounting

Financial accounting is simply the bookkeeping and interpretation of transactions. It is carried out to gauge corporate performance and profitability. The regulatory bodies have stated some basic principles to standardize the process. In the US, companies follow the guidelines of GAAP.

All financial transactions revolve around five basic components, i.e., assets, liabilities, income, expenses, and equity. Also, every financial transaction has two equal aspects. For example, if cash is withdrawn from a bank in the company’s book under the double-entry system, both cash and bank would be affected. Under the double-entry system, we call these two aspects; debit and credit. Debit is either the increase in assets and expenses or the decrease in liabilities and income. Credit is either the increase in liabilities and income or the decrease in assets and expenses.

Video Explanations of Financial Accounting

Financial Accounting Objectives

The objectives companies aim to achieve by carrying out this process are as follows:

- Organizations comply with different statutory requirements and tax regulations via this process.

- It aims to enable key stakeholders of the business to get a clear idea of the financial position. Moreover, it helps in improving analytical decisions to maximize profits and sales.

- Organizations carry out the process to calculate the net income earned during a particular period.

- Another key objective of the process is to record all financial transactions in the company’s books of accounts. Organizations can utilize these transactions to optimize and analyze their financial performance.

Financial Accounting Principles

As financial accounting is solely prepared for disclosing a company's financial information, the statements and reports the company produces should be valid and credible. Companies follow specific rules charted under the “Generally Accepted Accounting Principles,” abbreviated as GAAP.

GAAP covers basic accounting principles, including going concern principle, full disclosure concept, accrual concept, matching, cost, consistency, economic entity, materiality, period, revenue recognition, and monetary unit. GAAP ensures accurate and reliable reports. However, GAAP doesn't always remain the same. Instead, it is constantly updated based on the complexities arising in accounting.

Types Of Financial Accounting

A company can record its transactions in two ways.

- Cash Accounting: The GAAP recommends this method. This kind of financial accounting considers cash transactions. Thus, each transaction has a debit and credit entry.

- Accrual Accounting: Most corporations prefer this method to record cash and non-cash business transactions. This method emphasizes the documentation of trades as and when they occur, irrespective of monetary exchange.

Financial Statements

Every investor should go through the following four financial statements of a company.

- Income Statement: The purpose of the income statement is to find the company's net income for the year. Accountants take all accounting transactions (including non-cash ones) and do a "revenue – expense" analysis to determine the year's profit.

- Balance Sheet: The Balance Sheet is based on the following equation –

- Assets = Liabilities + Shareholders' Equity.

- It states that a business entity possesses and owes.

- Shareholders' Equity Statement: It is a statement that includes shareholders' equity, retained earnings, reserves, and other stock-related items. It is an indicator of the changes in the ownership interest of the stakeholders.

- Cash Flow Statement: The cash flow statement combines three statements – cash flow from operating activities, cash flow from financing activities, and the cash flow from investing activities.

All non-cash expenses (or losses) are added back. Simultaneously, all non-cash incomes (or profits) are deducted. As a result, we derive net cash inflow for the year, total cash inflow – and total cash outflow.

Financial Accounting Users

The beneficiaries of financial accounting statements are as follows:

- Banks And Other Lenders: Lenders carry out a detailed comparison of a company’s obligations and assets to figure out whether they are in a position to pay off loans.

- Creditors And Vendors: Creditors and suppliers look at the financial accounts of a company to get an idea of an organization’s short-term liquidity.

- Employees: Employees observe the financial statements to get an idea of their companies’ financial stability and profitability.

- Regulatory Agencies: Regulatory agencies, including sales and income tax departments, require financial information gathered via financial accounting to impose and collect taxes. If a company does not carry out the accounting process, the tax paid to the agency might be incorrect, which in turn, can lead to penalties.

- Investors: These users carry out a comprehensive analysis of a company’s financial statements to understand its financial health. Based on their analysis, they decide whether investing in the company would be profitable.

- Company Management: The management team of a company uses the financial accounting statements to assess progress and identify the areas requiring improvement.

Financial Accounting Examples

Consider the example of Nestle Holdings Inc. and its 2020 financial statements. Notice how they prepare financial statements.

#1 - Income Statement

Given below is an extract of Nestle’s consolidated income statement for the year 2020:

As we can see, the company generated a net profit of $3290 million in 2020, which is more than three times the net profit of 2019.

#2 - Balance Sheet

The company assets, liabilities, and equity for the year 2020 were recorded as follows:

Therefore, based on the data, we can infer the following:

- There was a rise in the company's current and non-current assets in 2020, which led to total assets being valued at $54394 million.

- Similarly, the company’s current and non-current liabilities increased. As a result, total liabilities rose to $32783 million.

- In 2020. the total shareholder’s equity rose from $18594 million in 2019 to $21611 million.

#3 - Cash Flow Statement

Now let us have a look at Nestle’s CFS for 2020:

This financial statement signifies the following points:

- The cash flow generated from operations was comparatively less, amounting to only $1783 million in 2020. In comparison, $2287 million was generated in 2019.

- Whereas Nestle’s cash flow from investing increased to $2127 million. This was due to the disposal of businesses.

- Financing represented a negative cash flow which amounted to $3883 million in 2020. This was majorly a result of the loans given to the parent and affiliates.

- However, the company had a positive balance of $350 million in 2020. This includes both cash and cash equivalents at the end of 2020. The balance amount was higher than the previous year.

It is important to note that Nestle Holdings Inc. uses the calendar year for financial accounting.

If individuals aim to improve their understanding of financial accounting, they can consider opting for the Financial Planning & Analysis Course. The course has been designed to provide practical knowledge of key concepts related to financial accounting via examples.

Financial Accounting Advantages

Accounting is an indispensable part of any business since it reveals the actual financial position of the firm. Therefore, records are maintained for every year of operation. As a result, a comparison between different accounting periods can be made. Also, the firm can compare financial statements against the performance of other companies. Further, accounting is crucial for taxation, and these records become crucial legal documents if and when a dispute arises.

Besides, accounting discourages fraudulent practices and theft within the department. The transfer of every penny is visible. In other words, fraudulent transactions also leave a paper trail. Moreover, these are valuable documents for internal and external parties. Decisions ranging from cash flows and the status of resources to efficient utilization rely on this data. It is a crucial input for investors creditors, and lenders as it informs them of the business’ performance and potential risks.

Financial Accounting Limitations

Financial data is not perfect. It fails to record non-financial aspects like employee satisfaction and customer retention. Those factors also play a considerable role in impacting performance. Most historical data is less relevant for future planning. Even after taking all the measures, accounting may not unveil the actual business standing. This happens when a firm adopts the accrual basis of accounting or goes with the cost concept while the real asset cost varies.

The financial statements are prone to human errors. Personal bias is inevitable; each person has a different thought process. Opinions and judgments impact the analysis of statements. Financial accounting reveals overall business profits rather than disclosing the income and expense of each unit of goods or services. As a result, it is ineffective for cost management.

Financial Accounting vs. Tax Accounting

Individuals new to the world of finance often find financial and tax accounting confusing. The following table highlights the key differences between the two processes, thus helping them eliminate their confusion.

| Financial Accounting | Tax Accounting |

|---|---|

| This process involves recording, analyzing, reporting, and summarizing a business’s financial transactions, | It involves monitoring funds to figure out a company’s taxable income. |

| The main purpose is to record and report a business’s cash flow, financial transactions, and overall financial performance. | In this case, the main objective is to prepare, file, and manage taxes while meeting all regulations that are applicable. |

| In this case, the amount incurred depends on the extent of work and the business’s size. | The cost of hiring a tax accountant depends on the business structure’s complexity. |

| This form of accounting reflects a business’s current financial situation. Thus, it can help one assess a company’s financial health | It assists in preparing accurate tax returns. |

Financial Accounting vs. Auditing

If individuals are not sure how financial accounting and auditing differ, they can refer to the table below. It shows the main differences between the two processes.

| Financial Accounting | Auditing |

|---|---|

| It involves recording all financial transactions of an organization. | This process involves examining an organization’s financial records. Simply put, it involves verifying the accuracy of accountants’ work. |

| Financial accounting processes precede auditing. | This process begins once financial accounting for a certain duration is complete. |

| Typically, a business’s employees carry out this process. | This process is carried out by internal members and external entities or persons. |