Common Finance And Accounting Mistakes You Can Avoid in 2025

Table Of Contents

What Are Finance And Accounting Mistakes?

Every individual on the face of the earth, barring a handful of exceptions, wants to be rich. While there are hundreds, if not thousands, of methods to reach financial freedom, there are actually only a few mistakes to avoid.

If anyone can make sure that they minimize making a few fundamental and few technical mistakes in their career span, financial freedom and amassing wealth would not be as challenging as we think it is.

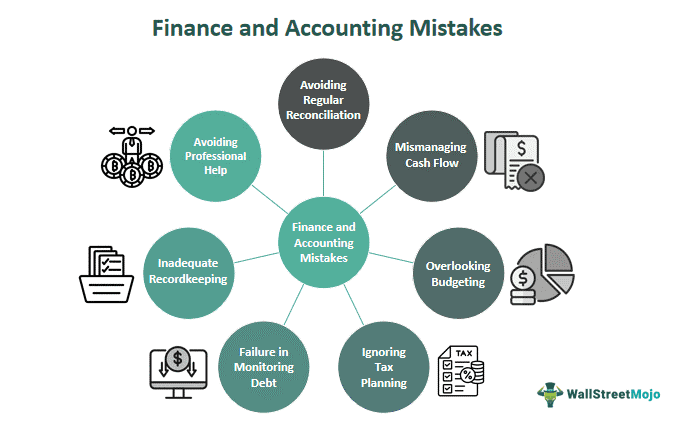

You are free to use this image on your website, templates, etc.. Please provide us with an attribution link.

First off, we've got the classic mix-up - not keeping personal and business finances separate. It's like throwing all your ingredients into one big pot and hoping for a gourmet meal. Without clear boundaries, you're in for a recipe for disaster. Another common slip-up is neglecting to budget. Try to clear a maze with no map. Without a budget, you're guessing where your money should go, and you'll likely end up lost and broke. And let's remember everyone's favorite: procrastination. Putting off financial tasks is a sure-shot way to invite chaos into your financial and personal life. Whether it's filing taxes or balancing the books, delaying the inevitable makes things worse in the long run. Lastly, we have the I-know-it-all mistake. Sure, you might be a natural with numbers, but that doesn't mean you should DIY everything. Sometimes, it's worth investing in professional help to avoid costly mistakes down the line. Please note it is completely fine to ask for help or assistance when you need it.

In this article, we will discuss a few of the most common and deadly finance and accounting mistakes to avoid in 2024 in detail.

Key Takeaways

- Accounts and finance are two main facets of any business or even for individuals. However, there are a few mistakes to avoid at all costs in this regard.

- Ignoring tax planning, not getting professional help, not managing cash flow, and inability to maintain a budget can be a few of the most common and significant mistakes.

- Seeking professional help and constantly updating yourself with respect to personal accounting and finance can go miles in terms of efficient tax planning and financial freedom.

- Avoiding these mistakes leads to increased investor confidence and better decision-making ability.

7 Most Common Finance And Accounting Mistakes

Some of the most common mistakes are usually right in front of our eyes, but we tend to miss them altogether. Sometimes, even the most experienced miss it. To ensure you are up-to-date about all possible mistakes in the world of finance and accounting, you can make use of the extensive information from the most reputed financial analyst course on the internet!

For now, let us understand the most common mistakes through the discussion below.

#1 - Neglecting Regular Reconciliation

Skipping regular reconciliation is risky business. Without reconciling your accounts regularly, you're essentially flying blind, unaware of any discrepancies or errors that could be lurking beneath the surface.

The solution is straightforward. It is to make reconciliation a non-negotiable part of your financial routine. Set aside time each month to compare your bank, credit card, and any other financial records to ensure they all match up. Use accounting software or get the help of a professional to streamline the process and catch any discrepancies early on. By staying on top of reconciliation, you'll not only maintain the accuracy of your financial records but also gain valuable insights into your spending habits and financial health.

#2 - Mismanaging Cash Flow

The death trap of mismanaging cash flow is something that MUST be discussed. Managing multiple bills is like a juggling act. It may seem like a beautiful act, but one wrong move could send everything crashing down. Misjudging cash flow can lead to missed payments, overdraft fees, and a whole lot of stress.

The simple solution to this pertinent issue is to spend less than you earn. While it may seem like an oversimplification, it is a simple hack that goes a long way. Curate an in-detail cash flow forecast to foresee peaks and troughs in your finances. Set up an emergency fund to take care of any unexpected expenses and give yourself some breathing room.

#3 - Overlooking Budgeting

Let us throw some light on the all-too-common blunder of overlooking budgeting. You might end up somewhere without it, but it won't be where you intended. Without a budget, you are making it extremely easy to spend beyond your budget and lose sight of your financial goals.

Take the time to create a detailed budget that outlines your income, expenses, and savings goals. Track your spending regularly to ensure you're staying on target, and make adjustments as needed. Consider using budgeting apps or software to streamline the process and keep yourself accountable. By making budgeting a priority, you'll gain control over your finances and set yourself up for success in the long run.

#4 - Ignoring Tax Planning

While most people have strict budgets and terrific spending habits, they commit the classic blunder of ignoring tax planning. Failing to plan for taxes can lead to missed opportunities for deductions, credits, and savings, leaving you with a hefty bill and a case of buyer's remorse.

The solution is making tax planning a priority year-round. Stay up-to-date about changes to tax laws and regulations. Also, seek opinions or guidance from a qualified tax professional to optimize your tax strategy. Consider strategies like contributing to retirement accounts, maximizing deductions, and timing income and expenses to minimize your tax liability.

#5 - Failing to Monitor Debt

Taking up debt can ease expanding businesses and make settling personal bills way more manageable. However, ignoring your debt and continuing with reckless spending can lead to mounting interest, missed payments, and a sinking credit score.

It is wise to regularly monitor your balances, interest rates, and payment due dates. Create an extensive repayment plan that prioritizes high-interest debt and sets achievable goals. Consider consolidating or refinancing loans to lower interest rates and simplify payments. And most importantly, resist the temptation to take on more debt than you can handle.

#6 - Inadequate Record-Keeping

Without proper records, it is almost impossible to track your financial transactions or make intelligent decisions about your money. From missing out on potential tax deductions to struggling to reconcile accounts, inadequate record-keeping can lead to a host of headaches and missed opportunities.

Get organized and stay organized. Keep in-detail documentation and records of all your financial transactions, including receipts, invoices, and bank statements. Consider using accounting software or apps to streamline the process and ensure accuracy. Fix a time on a regular basis to review and update your records and back up vital documentation to safeguard against loss or damage.

#7 - Not Seeking Professional Help

Personal finances need to stay on top of economic policies, international trade scenarios, economic affairs, and personal investment objectives as well. You can do it on your own. While you might stumble your way through, you're bound to make wrong turns and encounter dead ends along the way. Whether it's tax planning, investment strategies, or debt management, trying to go it alone can leave you exposed to mistakes that prove to be costly and missed opportunities.

Be bold and bring the expertise of professionals on board. From financial advisors to tax specialists, there are experts out there who can help you deal with the intricacies of personal finance. Do your research, ask for recommendations, and find professionals you trust to guide you on your financial journey.

Impact of Accounting Mistakes on the Business

Let us understand the impact financial and accounting mistakes can have on a business' standpoint through the discussion below.

- Financial Mismanagement: Accounting errors can lead to mismanagement of funds, causing the company to overspend, miss opportunities for savings, or allocate resources inefficiently.

- Inaccurate Financial Reporting: Mistakes in financial statements can misrepresent the company's financial health, leading to incorrect assessments by investors, creditors, or potential partners. This can significantly reduce trust and credibility in the business.

- Legal and Compliance Issues: Accounting mistakes may result in non-compliance with tax regulations or other financial laws, leading to penalties, fines, or legal consequences that can harm the company's reputation and financial stability.

- Poor Decision Making: Inaccurate financial data can lead to poor decision-making by management, such as investing in unprofitable ventures or neglecting areas that require attention, ultimately impacting the company's growth and success.

- Loss of Investor Confidence: Investors rely on accurate financial information to gauge the organization's performance and potential for growth. Accounting mistakes can undermine investor confidence, leading to decreased investment or even withdrawal of support.

- Operational Disruptions: Resolving accounting errors can be time-consuming and may require diverting resources away from core business activities, causing operational disruptions and hindering productivity.

Addressing these issues requires years of experience in the field of business, accounting, or finance. Otherwise, a wiser and faster option is to enroll in one of the best financial analyst courses that allow you to explore all these problems and their ideal solutions.