The Importance Of Finance And Accounting Certifications in 2025

Table Of Contents

What Are Finance and Accounting Certifications?

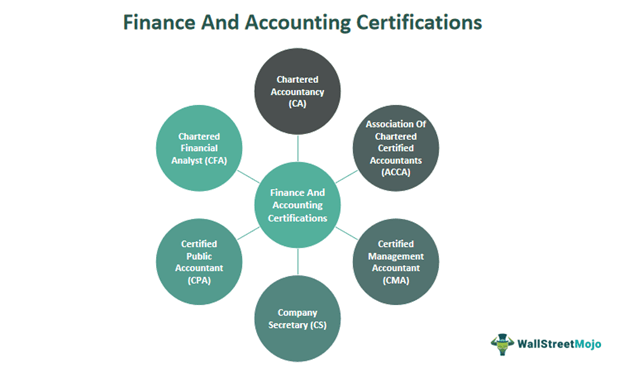

Finance and accounting certifications are proof of expertise in the money management industry. They are badges that showcase your proficiency in understanding and handling financial matters. There are a variety of certifications, each catering to different niches within the finance and accounting world.

For instance, there's the Certified Public Accountant (CPA) designation, which is like the gold standard for accountants in the United States. It proves that you've mastered accounting principles and passed a rigorous set of exams. Then there's the Chartered Financial Analyst (CFA) credential, ideal for those who are fascinated by investments and portfolio management. It's a grueling series of exams that tests your knowledge of financial markets and analysis.

Other certifications, like the Certified Management Accountant (CMA) or Certified Internal Auditor (CIA), target specific areas like management accounting and internal auditing, respectively. These certifications not only beef up your resume but also signal to employers and clients that you mean serious business when it comes to financial matters. Just as the best college admissions consulting firms help students secure spots at top universities, earning prestigious finance and accounting certifications from reputed organizations can significantly boost career prospects, setting professionals apart in a competitive job market.

Therefore, the best finance and accounting certifications from reputed organizations are boosters that help individuals achieve better career opportunities and credibility in the finance world. They validate your skills and knowledge, helping you stand out in a crowded field of professionals.

Key Takeaways

- Finance and accounting certifications, such as CPA, CFA, and ACCA, validate expertise and proficiency in specific areas of finance and accounting. They enhance career opportunities, credibility, and earning potential for professionals in the field.

- Certification programs typically involve meticulous training, examination, and ongoing professional development requirements.

- Certified individuals possess advanced problem-solving skills, in-depth knowledge of industry best practices, and global recognition.

- The choice of certification depends on individual career goals, interests, and industry requirements, with each certification offering unique advantages and career paths.

Understanding Finance and Accounting Certification

In the constantly evolving world of finance and accounting, a handful of top finance and accounting certifications play a pivotal role in establishing credibility and expertise. These designations, such as the Certified Public Accountant (CPA), Chartered Financial Analyst (CFA), Certified Management Accountant (CMA), and Certified Internal Auditor (CIA), are tangible proof of one's proficiency in specific areas of finance and accounting.

The CPA designation, for instance, is renowned for its extensive and complicated examination process, covering a broad spectrum of accounting principles and regulations. On the other hand, the CFA credential focuses more intensely on investment management and financial analysis, making it invaluable for professionals wanting to ease the complexities of the investment world.

These top finance and accounting certifications from the best online sources not only validate one's knowledge but also open doors to career advancement and increased earning potential. Employers often prioritize candidates with relevant certifications, viewing them as valuable assets capable of driving business success.

Hence, understanding finance and accounting certifications is critical to paving through the competitiveness of the financial industry. To understand the specifics of each of these certifications, let us discuss the most prominent certifications in this domain through the explanation below.

#1 - Chartered Accountancy (CA)

The chartered accountancy (CA) profession stands as a pinnacle of accounting expertise. CAs are financial experts who have undergone elaborate training and examination to attain their designation. They play a multitude of roles as trusted advisors to businesses, governments, and individuals alike.

A CA's responsibilities include a wide array of financial tasks, including auditing, taxation, financial reporting, and strategic financial management. Their expertise extends beyond number-crunching; they are adept at interpreting financial data, identifying risks, and providing strategic insights to drive business decisions.

To become a CA, individuals typically undergo extensive education, often combining academic studies with practical training through internships or apprenticeships. The culmination of this journey is passing a series of challenging exams and meeting stringent professional requirements.

To become a practicing CA, you have to pass three levels of examinations. These exams are CA foundations, CA intermediate, and CA finals. After completing the CA intermediate, candidates have to work as interns compulsorily before they are eligible to write the finals. This internship is often referred to as article ship.

#2 - Association Of Chartered Certified Accountants (ACCA)

The Association of Chartered Certified Accountants (ACCA) represents a prestigious international body for professional accountants, renowned for its global reach and high standards of expertise. ACCA members, known as Chartered Certified Accountants, possess an in-depth knowledge of accounting principles, financial management, and strategic business acumen.

One of the notable aspects of ACCA is its global recognition. It helps professionals to practice across borders and in diverse industries. This international perspective equips ACCA members with the versatility to thrive in today's interconnected business world.

To attain ACCA certification, individuals undergo an extensive program that combines academic study, practical experience, and a series of challenging examinations. This holistic approach ensures that ACCA members not only have commendable theoretical knowledge but also practical skills relevant to real-world financial scenarios.

ACCA professionals play crucial roles in various sectors, including auditing, taxation, financial analysis, and advisory services. They are valued for their ethical conduct, technical proficiency, and ability to provide strategic financial guidance to organizations of all sizes.

#3 - Certified Management Accountant (CMA)

Certified Management Accountants (CMAs) are esteemed professionals specializing in management accounting and financial management. Unlike traditional accountants who focus primarily on financial reporting and compliance, CMAs provide strategic insights that help with organizational performance and decision-making.

One of the distinguishing features of the CMA designation is its emphasis on management accounting. The emphasis involves analyzing financial data to support internal decision-making processes. CMAs are adept at cost analysis, budgeting, forecasting, and performance evaluation. These skills enable them to contribute directly to the strategic goals of their organizations.

To become a CMA, individuals must complete a rigorous certification process that includes passing a comprehensive exam and meeting stringent educational and experience requirements. This ensures that CMAs possess the necessary skills and knowledge to excel in their roles.

CMAs are valued for their ability to interpret financial information in a way that informs strategic planning and resource allocation. Their expertise is sought after in various industries, including manufacturing, healthcare, finance, and consulting.

#4 - Company Secretary (CS)

The role of a Company Secretary (CS) is multifaceted, including legal, governance, and administrative responsibilities within an organization. CS professionals are vital advisors to company boards, making sure legal and regulatory requirements are complied with while facilitating effective communication between stakeholders.

One of the primary functions of a Company Secretary is to make sure that the company adheres to corporate governance principles and statutory regulations. This includes managing board meetings, maintaining corporate records, and ensuring that decisions are made in accordance with relevant laws and policies.

Additionally, Company Secretaries play a crucial role in facilitating communication between the board of directors, senior management, shareholders, and regulatory authorities. They are the bridge between these stakeholders, disseminating information, managing conflicts of interest, and promoting transparency and accountability.

To become a Company Secretary, individuals typically undergo specialized training and obtain professional qualifications, such as those offered by recognized professional bodies like the Institute of Company Secretaries of India (ICSI) or the Chartered Governance Institute (formerly known as ICSA: The Governance Institute). This rigorous training equips Company Secretaries with the mastery and skills required to fulfill their duties effectively.

Therefore, CS professionals are irreplaceable in corporate governance, ensuring that organizations operate ethically, transparently, and in compliance with legal and regulatory frameworks. Their expertise is vital in maintaining trust and confidence among stakeholders and promoting the long-term success of the companies they serve.

#5 - Certified Public Accountant (CPA)

Certified Public Accountants (CPAs) are esteemed professionals in the field of accounting, recognized for their expertise in financial reporting, taxation, auditing, and consulting services. As licensed practitioners, CPAs play integral roles in making sure that the precision and correctness of financial information within organizations.

One of the primary responsibilities of CPAs is to conduct audits of financial statements to verify their precision and compliance with applicable accounting standards and regulations. These audits help to instill confidence among stakeholders, including investors, creditors, and government agencies, in the reliability of financial information.

CPAs also provide valuable advisory services to businesses and individuals, offering insights into tax planning, financial management, and strategic decision-making. Their expertise extends beyond number-crunching to include a detailed understanding of complex financial systems and regulations.

To become a CPA, individuals must meet specific educational requirements and pass a comprehensive examination overseen by the American Institute of Certified Public Accountants (AICPA) in the United States or other relevant regulatory bodies in different countries. This rigorous process ensures that CPAs possess the knowledge and skills necessary to uphold professional standards and serve the public interest.

#6 - Chartered Financial Analyst (CFA)

Chartered Financial Analysts (CFAs) are highly esteemed professionals in the field of investment management and financial analysis. Most known for their expertise in analyzing financial markets, evaluating investment opportunities, and managing investment portfolios, CFAs play pivotal roles in guiding investment decisions and maximizing returns for clients.

One of the primary responsibilities of CFAs is to conduct thorough research and analysis of financial assets, such as stocks, bonds, and derivatives, to assess their potential risks and returns. This involves applying advanced quantitative techniques and financial models to evaluate investment opportunities and develop sound investment strategies.

CFAs may also have a say in portfolio management, where they oversee the allocation of assets, monitor performance, and rebalance portfolios to achieve desired investment objectives. Their expertise in risk management and asset allocation helps clients make intelligent calls during volatile markets and achieve long-term financial goals.

To become a CFA, individuals must complete a meticulous program of study that includes passing three stages of exams overseen and curated by the CFA Institute and meeting relevant experience requirements. This comprehensive process ensures that CFAs possess the necessary knowledge, skills, and ethical standards to excel in the dynamic and competitive field of investment management.

US Tax Jurisdiction Codes

The United States authorities assign tax jurisdiction codes to specific jurisdictions that identify to which jurisdiction a particular business belongs in the country. They are typically composed using small codes, basically digits, to represent state, county, district, or province. In the US, tax jurisdiction codes are usually created in the following manner:

- Three digits representing the state

- Two digits signifying a county

- Four digits showcasing a city

- Three digits representing a district

When all of the digits are placed together, they form a string of numbers: state + county + city + district. The exact format and digits can vary based on the tax authority and jurisdiction structure. If an individual does not know about their jurisdiction code, they can check it online by visiting the state’s official website.

In addition, the US has zip codes, and each zip code signifies at least one or multiple tax jurisdictions. Still, it is advised not to use them to determine jurisdiction or tax liability as they primarily run parallel to postal service and are mainly designed for mail services.

Choosing the Right Certification

When it comes to choosing the best finance and accounting certification, you can first consider getting your foundations right through a detailed basic accounting course that exposes you to the world of finance and accounting to be able to take a call from there on what to pursue.

- Career Goals: Determine your career aspirations and the specific areas of finance or accounting you are interested in, such as auditing, taxation, management accounting, or investment management.

- Industry Requirements: Research the certifications commonly required or preferred in your target industry or geographical region. Some certifications may hold more value in specific sectors or countries.

- Program Content: Evaluate the curriculum and exam structure of each certification program to ensure it aligns with your interests and career goals. Look for programs that cover relevant topics and provide practical skills applicable to your desired role.

- Reputation and Recognition: Consider the reputation and recognition of the certification body. Look for certifications that are well-respected in the industry and widely recognized by employers and professionals.

- Time and Cost: Assess the time and cost involved in obtaining each certification, including exam fees, study materials, and preparation time.

- Networking Opportunities: Consider the networking opportunities and professional communities associated with each certification. Look for programs that offer networking events, online forums, and resources to connect with peers, mentors, and potential clients in the field.

- Continuing Education: Determine if the certification requires ongoing continuing education or recertification to maintain your credentials. Consider the long-term commitment and benefits of staying current in your field.

How to Obtain Certifications?

Here's a step-by-step guide on how to obtain the best finance and accounting certifications. However, it is also essential to understand that this is a generic process. A few steps may vary depending on the certification, jurisdiction, and regulations.

- Research various certifications in finance and accounting, such as CPA, CFA, ACCA, or CMA, and determine which of these certifications resonate best with your career goals and interests.

- Fulfill the educational and experience requirements specified by the certification body. This may include obtaining a relevant degree, completing a certain number of years of work experience, or completing prerequisite courses.

- Enroll in exam preparation courses or self-study programs to prepare for the certification exams. Utilize study materials, practice exams, and review sessions to understand the exam content thoroughly.

- Register for the certification exams through the respective certification bodies. Choose exam dates and locations that accommodate your schedule, and ensure you meet all registration deadlines.

- Sit for the certification exams and strive to achieve passing scores. Make sure you are familiar with the exam format, ensure efficient time management, and answer questions accurately based on your knowledge and preparation.

- Complete any additional requirements, such as work experience or ethics training, as specified by the certification body.

- Once you meet all requirements and pass the exams, the respective certification body will disburse your certificate. Celebrate your achievement and leverage your certification to advance your career in finance and accounting.

Benefits

Here are the benefits of pursuing the best finance and accounting certifications:

#1 - Career Advancement Opportunities

- Finance and accounting certifications open doors to higher-level positions and increased responsibilities within organizations.

- Certified professionals are often preferred candidates for promotions and leadership roles due to their demonstrated expertise and commitment to continuous learning.

- Certifications give candidates a competitive edge above the rest in the job market, increasing opportunities for career advancement and higher salaries.

#2 - Problem-Solving Skills: A Crucible of Innovation

- Certifications equip professionals with advanced problem-solving skills honed through stringent training and examination.

- Certified individuals are experts at analyzing complex financial data, identifying trends, and proposing innovative solutions to business challenges.

- The problem-solving skills developed through certification programs enable professionals to adapt to dynamic market conditions and drive efficiency and innovation within their organizations.

#3 - Enhanced Skills and Knowledge

- Finance and accounting certifications signify a high level of expertise and proficiency in specialized areas of finance and accounting.

- Certified professionals possess in-depth knowledge of industry best practices, regulations, and emerging trends. The set of information and knowledge enhances their ability to make wise decisions and provide strategic guidance.

- Certification programs provide comprehensive training that goes beyond academic theory, equipping professionals with practical skills and real-world experience relevant to their roles.

#4 - Global Recognition and Credibility

- Finance and accounting certifications are recognized and respected worldwide, providing professionals with global career opportunities.

- Certified individuals enjoy enhanced credibility and trust among employers, clients, and colleagues, as certifications validate their skills and commitment to professional standards.

- The global recognition of certifications facilitates mobility and career progression across international borders, allowing professionals to pursue opportunities in diverse markets and industries.