Table Of Contents

What Is A Fill or Kill (FOK)?

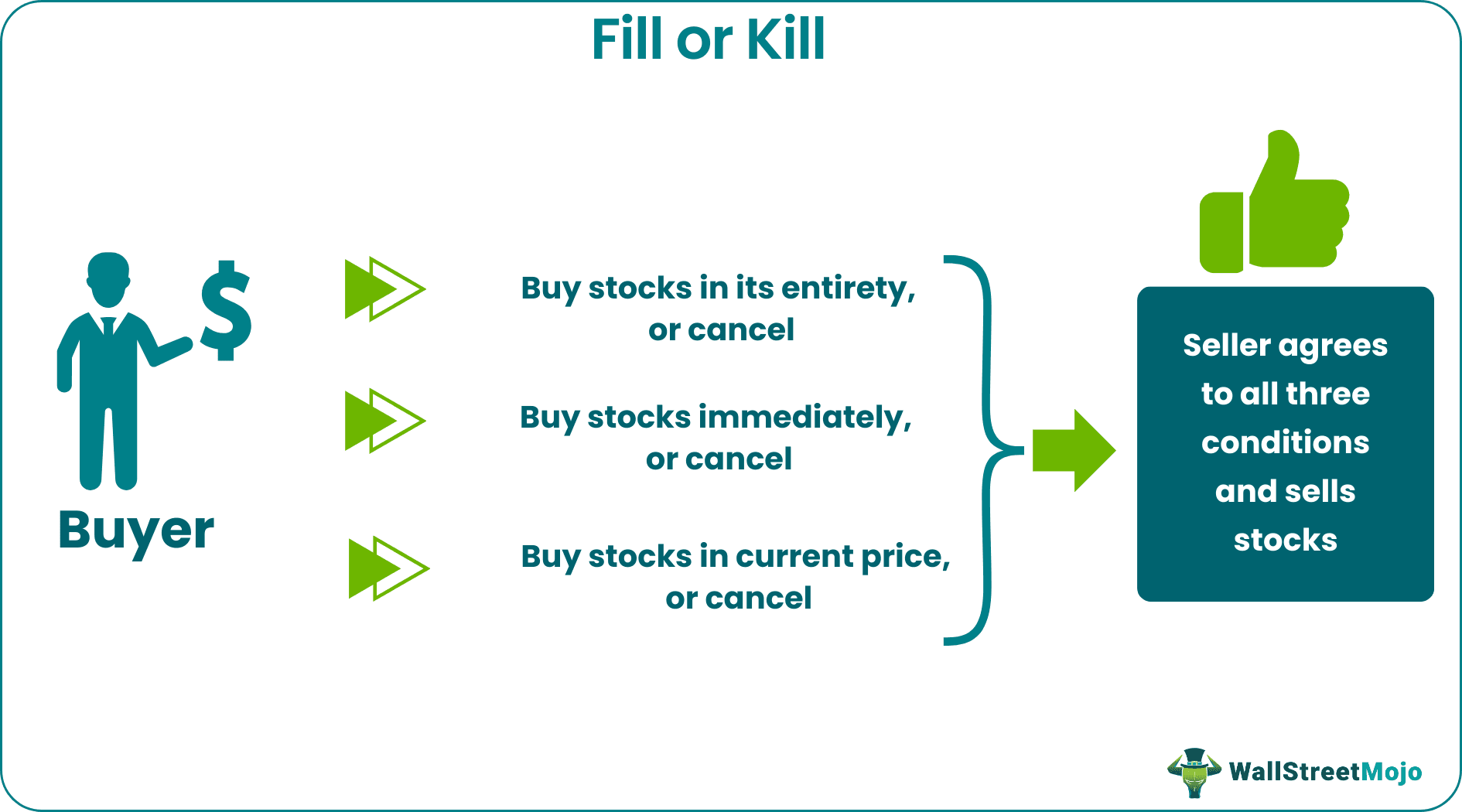

A fill or kill order is a type of conditional stock purchase order. FOK buyers look for an immediate purchase at a fixed price or better. The buyer demands that all conditions be fulfilled; if not, the order is canceled. It is an order type in trading that requires the entire order to be executed immediately or canceled.

FOK buyers don't settle for a middle ground. For example, they do not accept less than the demanded number of shares or delivery at a later date. On the other hand, sellers try to accommodate all the demands due to the sheer volume of purchases. Also, these purchases need to be executed immediately; prolonged periods of execution affect the market price of the stock.

Key Takeaways

- Fill or kill is a contingent order. The slots should be filled immediately and in full. Also, the purchase should only be executed at the stated price. The buyer cancels the order if the broker does not meet these conditions.

- Alternatives for FOK include immediate or cancel orders, all or none orders, and good 'til canceled orders. These are all conditional orders with certain specifications prioritizing the timeframe or quantity.

- A FOK sales order will be triggered only when it is at a limited price or higher. At the same time, FOK buy orders start when it is at a limited price or lower.

Fill Or Kill (FOK) Order Explained

Fill or kill stock order is one of the many arrangements between a stock buyer and seller (or broker). Active traders opt for FOK orders when they want to purchase large amounts of a single stock.

A stock purchase order is referred to as a market order. It is an instruction to buy or sell a stock at the best price. These orders are usually executed immediately. It is an instruction from an investor sent to a broker or brokerage firm. It is a real-time transaction; there is no guarantee that the order will be executed at a specific price.

Investors or traders cannot place market orders outside market hours. Usually, investors place a market order when they think the price is right. But the price might vary slightly by the time the trade is executed.

Every stock quote has three elements—the highest bid, the lowest bid, and the last trade price. The last trade price may not necessarily be the stock's current price and might vary slightly. However, due to the dynamic and fast-moving nature of markets, metrics like the current bid and the offer price are more important than the last trade price (LTP).

For FOK orders, the buyer has three conditions—the number of stocks, the time of execution, and the purchase price.

The buyer demands that no less than the required amounts of stock be sold. The buyer also instructs that the stocks be sold immediately (within seconds if possible) and at the stock's current market price. These three parameters are so important to the buyer that in some exchanges, they fill as many stocks as available, buy the required amount, and cancel the rest.

This practice ensures that the market price doesn't get disrupted due to the enormity of stock purchases. Stock prices are subject to market conditions, and demand is one of the major forces. If the stock purchase order is too large, it can raise the demand and alter stock prices before the purchase is executed.

So, why would sellers agree if the buyers have so many conditions? Sellers agree to multiple conditions because they find the high volume (of purchase) attractive. High volume here refers to thousands of stocks or even hundreds of thousands. Even so, FOK transactions are not very common.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Example

Let us look at a fill or kill example to understand stock orders better.

Luke places a FOK order to buy 100,000 shares of XYZ at $20 per share. The broker agrees to sell 90,000 shares. The broker then requests Luke to wait for two days while he executes the large transaction. Luke kills the order—he demands immediate execution.

Eventually, the broker agrees to sell 100,000 stocks immediately, but at $22 per share. Luke cancels the order again. A FOK order is a limit order. A limit order refers to purchasing or selling the security at the mentioned price or better. A sell order will be triggered only when it is at a limited price or higher. At the same time, buy orders start when it is at a limited price or lower.

Luke will buy the shares only when the broker accepts the terms and sells at $20.

If the broker had sold the stock at less than $20 (say $19), Luke would still have bought the stocks owing to the large purchase. Thus, FOK buyers make significant profits from this purchase arrangement.

Fill or Kill vs Immediate Or Cancel vs All Or None

Let us look at fill or kill vs immediate or cancel vs all or none comparison to distinguish between them:

- Immediate or cancel (IOC) is a time-in-force order. IOC buyers demand that all or part of the stock be bought immediately. All or none (AON) is another conditional order specifying that the full stock is bought. If that's not possible, the order will be canceled. FOK orders are a simple combination of IOC and AON orders.

- In IOC, the timeframe is the priority and not the quantity. The order is canceled if the broker or seller cannot execute the transaction immediately. In AON, quantity matters more than time. FOK stresses immediate and full execution.

- One cannot say that time doesn't matter for AON. Time matters in all conditional contracts because as the time for execution rises, the large quantity of purchase pushes demand and alters prices—the buyer is at a disadvantage.

- Another conditional order type is the good 'til canceled order (GTC). For GTC orders, stocks remain good or active until the buyer either executes or cancels the trade.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The buyer places a FOK order to the broker or seller and specifies the number of shares they would like to buy in addition to the price. The broker checks the inventory; once they confirm the availability of the required number, the transaction is completed within seconds. Thus, the buyer's conditions pertain to time, quantity, and price. The buyer cancels or kills the order if the broker fails to meet even one of those conditions.

FOK buyers do not want the transaction to last beyond a few seconds. If it takes any longer, the stock price will rise before completing the purchase. As a result, the buyer would spend more for the same number of shares. To prevent this, buyers fill as many stocks as possible, pay for the required amount, and cancel the rest.

Active traders usually place FOK stock orders. These are the class of traders who aim to profit largely from short-term fluctuations. Secondly, FOK is a better choice for purchasing high quantities of stocks (in hundreds or thousands).