Table Of Contents

Fiduciary Relationship Meaning

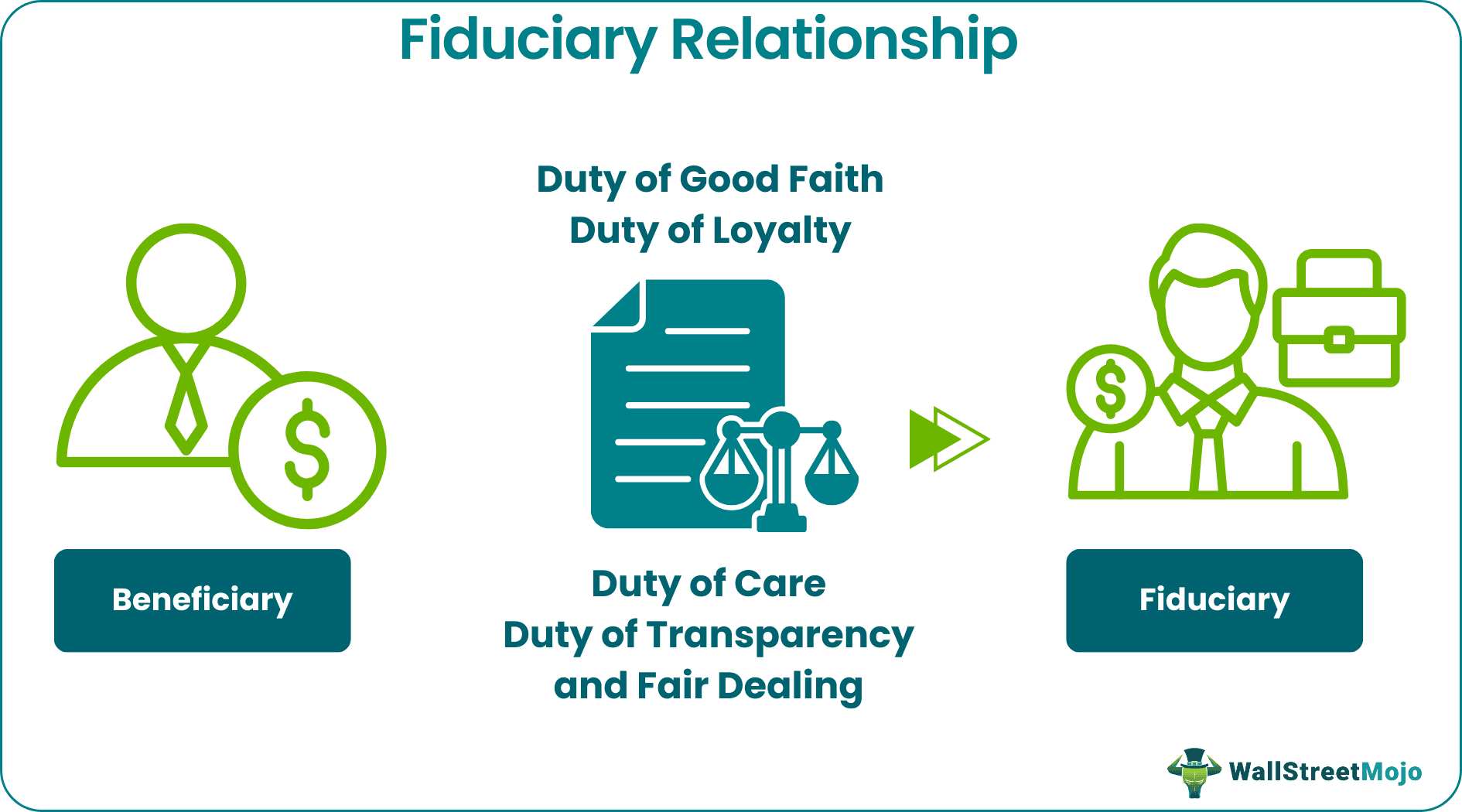

A fiduciary relationship is a relation between two parties wherein one party (fiduciary) has the duty to act in the best interest of the other party (beneficiary or principal). The purpose of studying fiduciary relationship is to identify the areas where it exists and gain an insight into the duties of a fiduciary.

The fiduciary has to act “in good faith,” implying that it must uphold the beneficiary’s trust, benefit, and goodwill under all circumstances. Moreover, the fiduciary must not place its interest over the interest of the beneficiary. Some fiduciary relationship examples include trustee-beneficiary, guardian-ward, attorney-client, company-director, administrator-retiree, etc.

Key Takeaways

- A fiduciary relationship consists of two parties, the fiduciary and the beneficiary. The former must act in the best interest of the latter.

- The responsibilities of a fiduciary include acting with care, working in good faith, and serving with loyalty, transparency, and fairness in all dealings.

- The major components of a fiduciary relationship are “trust” and “confidentiality.” Since the beneficiary trusts the fiduciary, the latter must keep the personal information of the former confidential.

- A breach of duty occurs when the fiduciary’s actions are against the interest of the beneficiary. If a breach of duty is proved in court, the beneficiary can recover the damages (if any) from the fiduciary.

Fiduciary Relationship Explained

A fiduciary relationship may or may not arise from a legal contract. However, the fiduciary has a legal obligation to provide its services on the premise of “trust.” Usually, a fiduciary is entrusted with the task of managing money or property on behalf of its client or beneficiary.

A fiduciary relationship consists of the following elements:

- Trust: This is the most important component of a fiduciary relationship. Since the beneficiary trusts the fiduciary, the former passes the authority of making decisions to the latter. So, the fiduciary must use its powers and rights for the benefit of the beneficiary.

- Confidentiality: The fiduciary is responsible for keeping the beneficiary’s information confidential. At the same time, no information of the beneficiary must be used by the fiduciary to generate any personal profit or commission.

If the fiduciary fails to work in the best interest of the beneficiary, it is said to have committed a breach. In case of a breach, the beneficiary is entitled to recover damages (if any) from the fiduciary, provided that a breach of duty is proved in court.

Duties

The fiduciary has four main duties towards the beneficiary. These are listed as follows:

#1 - Duty of care

It requires the fiduciary to act with care like a prudent (or vigilant) person would in similar situations. This implies that the fiduciary must consider all the available information before making a decision on behalf of the beneficiary. Moreover, the fiduciary should accept the necessary inputs from its client and disclose all the viable alternatives to its actions.

#2 - Duty of loyalty

It requires the fiduciary to be loyal towards the beneficiary. This implies serving the latter’s interest and avoiding any personal gains that may accrue directly or indirectly. The fiduciary must prevent a conflict between personal interest and the beneficiary’s interest at all times.

#3 - Duty of good faith

It requires the fiduciary to act in good faith. This implies being honest and ethical in actions. In addition, every act of the fiduciary must aim to fulfill the objectives and desires of the beneficiary.

#4 - Duty of transparency and fair dealing

It requires the fiduciary to be ethical, fair, and transparent in its conduct. This implies that the fiduciary must share information related to the finances and assets with the beneficiary. It also includes disclosing the actions undertaken, wealth generated (by managing assets), issues resolved, etc.

To conclude, one can say that the fiduciary can accept personal benefits from a fiduciary relationship only with the consent of the beneficiary. If the fiduciary makes any hidden profits or indulges in any illegal dealings, fraud, misappropriation, etc., it will be held liable in a court of law.

Therefore, the fiduciary relationship safeguards the interest of the beneficiary and makes the fiduciary accountable for its actions.

Types

This section discusses some kinds of fiduciary relationships. These are listed as follows:

#1 - Trustee and beneficiary

In this relationship, the trustee acts as the fiduciary and handles the assets of the beneficiary. The trustee has the authority to manage the wealth of the beneficiary. The trustee should remain loyal and honest in its dealings.

#2 - Guardian and ward

In this relationship, a guardian, an adult, becomes the fiduciary of a minor. The court appoints a guardian if the minor is not cared for by the natural guardian. The fiduciary duty of the guardian is to facilitate the overall development of the minor. This includes looking after the latter’s education, health, food, and lodging needs. The guardian and ward relationship exists till the minor attains the age of majority.

#3 - Principal and agent

In this relationship, a principal or an agent can be an individual, government agency, partnership or corporation. The principal appoints an agent to act on its behalf as the fiduciary. The goal of the fiduciary is to manage the business stake of the principal and prevent any conflict of interest.

#4 - Attorney and client

In this relationship, the attorney acts as a fiduciary to the client. It is important that the attorney must represent the client fairly and honestly. The attorney and client relationship is one of the most stringent fiduciary relationships in the United States. If the attorney breaches his duty at any point of time or is not found to be compliant with the terms of the relationship, he/she is held liable by the court. In this way, the attorney is accountable for his/her actions.

#5 - Real estate agent and the buyer or seller

In this relationship, the real estate agent is the fiduciary and the buyer or seller of the property is the beneficiary. Such a relationship is referred to as the fiduciary relationship in real estate. The fiduciary needs to act in either of the following ways:

- If the fiduciary is working for the buyer, the former must not disclose the buying price in advance. This way, the fiduciary is responsible for protecting the buyer’s interest.

- If the fiduciary is working for the seller, the former must not disclose the least price accepted by the latter. This way, the fiduciary must protect the seller’s interest.

The fiduciary can disclose the personal information of the agent only if there is written permission for the same.

Examples

Let us consider some examples of fiduciary relationships.

Example #1

A patient X (beneficiary) goes to doctor Y (fiduciary) for the treatment of a chronic disease. Since this is the first time X has visited Y, the former began to discuss the critical points of Y’s advice with another patient. However, Y follows a policy of not disclosing the information of one patient to the other. The inferences are stated as follows:

- Doctor Y seems to have served in the best interest of patient X. This is because, being a fiduciary, Y had no right to disclose X’s information to any other patient.

- On the other hand, X was free to share his medications and treatment with the other patients. Hence, there has not been any breach of the fiduciary duty of the doctor. Instead, Y has rightly followed the code of conduct of his profession.

Example #2

Macellum Advisors, a hedge fund manager, holds 5% shares of Kohl’s Corporation, which runs a chain of department stores in the United States. In May 2022, Macellum Advisors claimed that some directors (fiduciaries) of Kohl’s failed to disclose certain material information to the shareholders (beneficiaries) before the annual meeting. The inferences are stated as follows:

- The board of directors was supposed to act as a fiduciary to the shareholders of the company. As a part of the fiduciary relationship, it was important for the directors to disclose all the necessary business information to the shareholders.

- An investigation will be carried out to find whether there has been a breach of fiduciary duty or not on the part of the directors. If a breach of duty is proved, the directors of Kohl’s will have to face the consequences.