Table Of Contents

What is the Federal Income Tax?

Federal Income Tax is the tax system in the United States, levied and governed by Internal Revenue Services (IRS), that helps determine the tax that is charged on the income earned by individuals, corporations, and various other legal entities. Income includes any kind of earnings i.e. salary, bonus, wages, capital gains, etc.

Explanation

Whenever an individual earns a certain income, say salary, a part of it has to be paid to the government in the form of income tax. The same rule applies to all other forms of income, like winning cash from the lottery, capital gains, bonuses, interest incomes, etc. Individuals pay income tax, which is usually taken directly from their paychecks, which in turn is paid by the employer to the government. The federal income tax system is a Progressive Tax System, which means higher income, higher tax rates, and vice-versa. All the income tax rules are discussed below in the article.

Purpose

The government raises money; we call revenue by collecting different types of taxes. Federal Income tax is an income of the government. It is perhaps one of the major sources of income for the government. This income is used by the government for the development of the economy, like providing improved medical facilities, improving infrastructure, improving other sectors like education, public transport, etc. Any form of income that is earned by any individual or any business entity comes under the purview of Federal Income tax.

Federal Income Tax Brackets and Rates

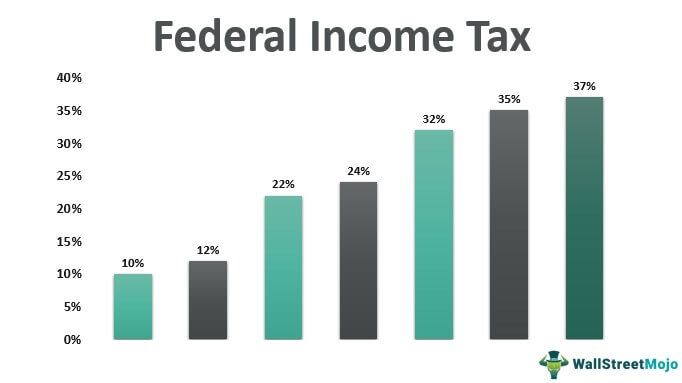

There are currently seven tax brackets under the US Federal tax system. These are:

There is an income threshold for each tax bracket.

Federal Income tax is levied on the basis of marginal tax rates i.e. if your total income falls under the tax bracket of 32%, that does not mean all of the income is taxable at the rate of 32%. Only the amount that falls into a 32% tax rate bracket is taxable at that rate.

Let’s first understand the Federal tax brackets for 2020 and 2021.

Federal Tax Brackets and Rates for 2019-20 (Tax due by July 2020)

Federal Tax Brackets and Rates for 2020-21 (Tax due by April 2021)

A person who is filing an income tax return and paying taxes must determine its filing status. There are following types of status under which one can file its return: Single, Married and filing Jointly, Married and filing separately, and Head of Household.

Single: The taxpayers who are unmarried or legally separated from their spouse and do not qualify for any other filing status come under this category.

Married and Filing Jointly: The taxpayers who are married before the end of the tax year comes under this category.

Married and Filing Separately: The taxpayer who is married but chooses to file return separately comes under this category.

Head of Household: The taxpayers who bear more than 50% of the household and living expenses of the qualifying person come under this category. A qualifying person is generally the child or parent of the head of the household.

Calculate Federal Income Tax

Let’s understand the tax brackets & the rates through an example:

Suppose Mr. A has a total income of $40,000 in the year 2019-2020. We will calculate the amount of tax payable under all four filing status:

Solution:

For Single

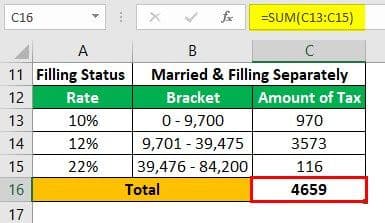

For Married and Filing Separately

For Married and Filing Jointly

For Head of Household

Federal Income Tax vs. State Income tax

- In the US, there are federal tax laws and state tax laws. Both the federal government and state government have their own tax rates and rules. Each state can have its separate tax rules.

- Federal Income tax is a Progressive income tax system, while State Income tax can either be progressive or flat tax system.

Advantages

- The federal income tax system is a progressive tax system, which means higher earnings, higher tax liability. This favors individuals with fewer earnings.

- A well established and working tax system keeps an eye on the earnings of the individual and corporations as they have to account for each and every penny they make.

- Income tax collected by the government is counted as its revenue. This revenue is used by the government for the growth and development of its economy.

Disadvantages

- Since the Federal Income Tax system is a progressive tax system, it demotivates an individual to work hard and earn more as a larger part of his earnings will be paid to the government as higher taxes.

- The whole income tax system is very complex to implement and maintain. There can be so many loopholes through which one can escape to pay taxes. A large army of tax accountants is required to work on this system.

- Paying taxes by the lower-income groups is considered a burden for them. Since they are already earning less income and again, a part of it is paid in the form of taxes.

Conclusion

An income tax is a tax charged by the government from the earnings of individuals and businesses. Tax paid by individuals is called income tax, and the tax paid by companies is called corporation tax. The tax system is a progressive system that means higher income, higher taxes, and lower-income, lower taxes. There can be different state tax laws and federal tax laws. An individual has to comply with both.