Table Of Contents

What Is Fear And Greed Index?

Fear and Greed index, or FGI, is a financial market-timing strategy introduced by Cable News Network (CNN) Money to understand how investor emotions influence investment decisions. The index is one of the most critical components in determining whether the market is bullish or bearish.

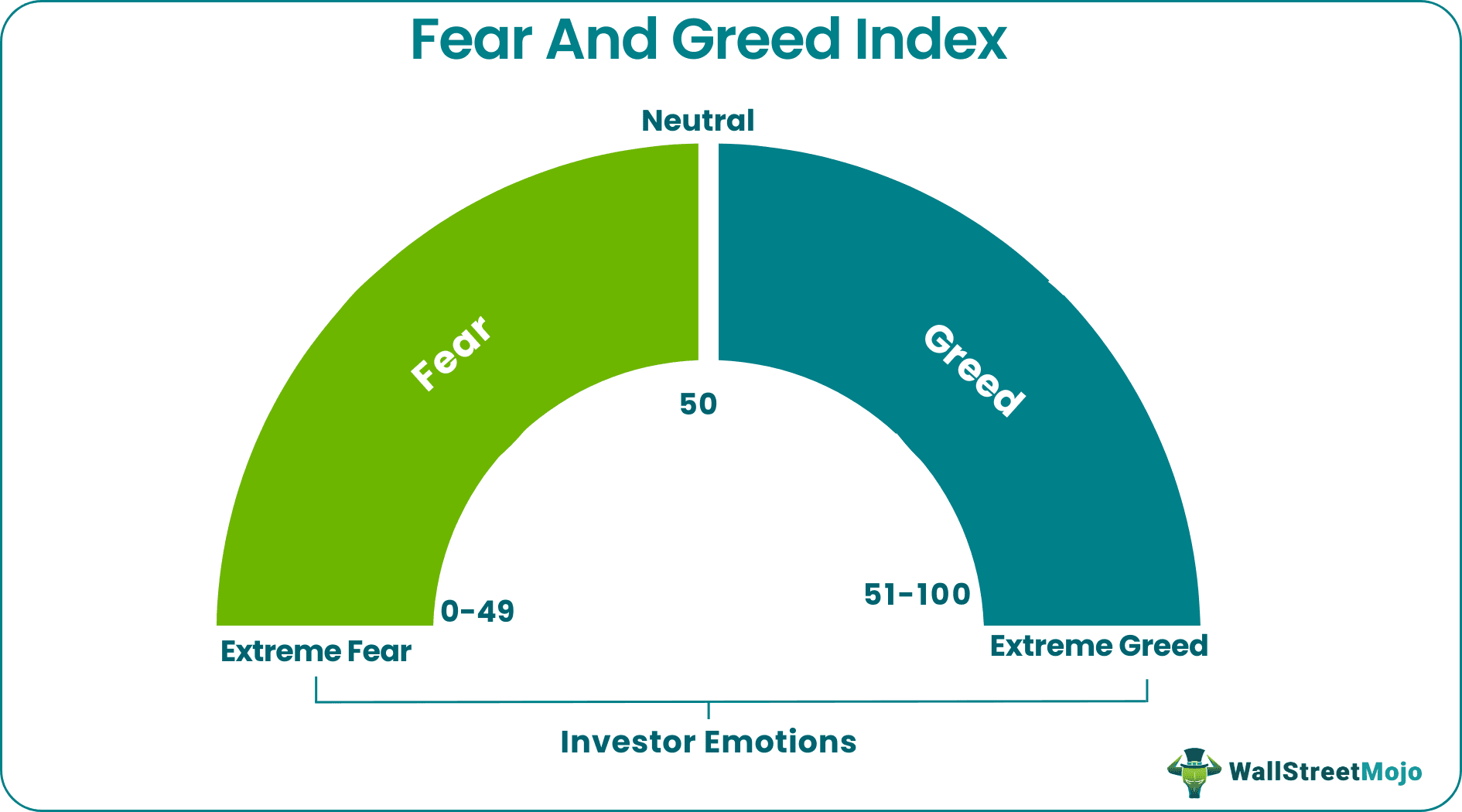

Fear and greed, the two primary emotions, have considerable effects on share prices, volatility, volume, and direction. The index calculates investor sentiment on a scale of 0 (extreme fear) to 100 (extreme greed) by tracking market price variations daily, weekly, monthly, and annually. Excessive fear tends to pull down stock values, whereas excessive greed has the reverse effect.

Key Takeaways

- The fear and greed index (FGI) is a timing strategy introduced by CNNMoney in financial markets, including stocks and cryptocurrencies, to understand how investor emotions affect investment decisions.

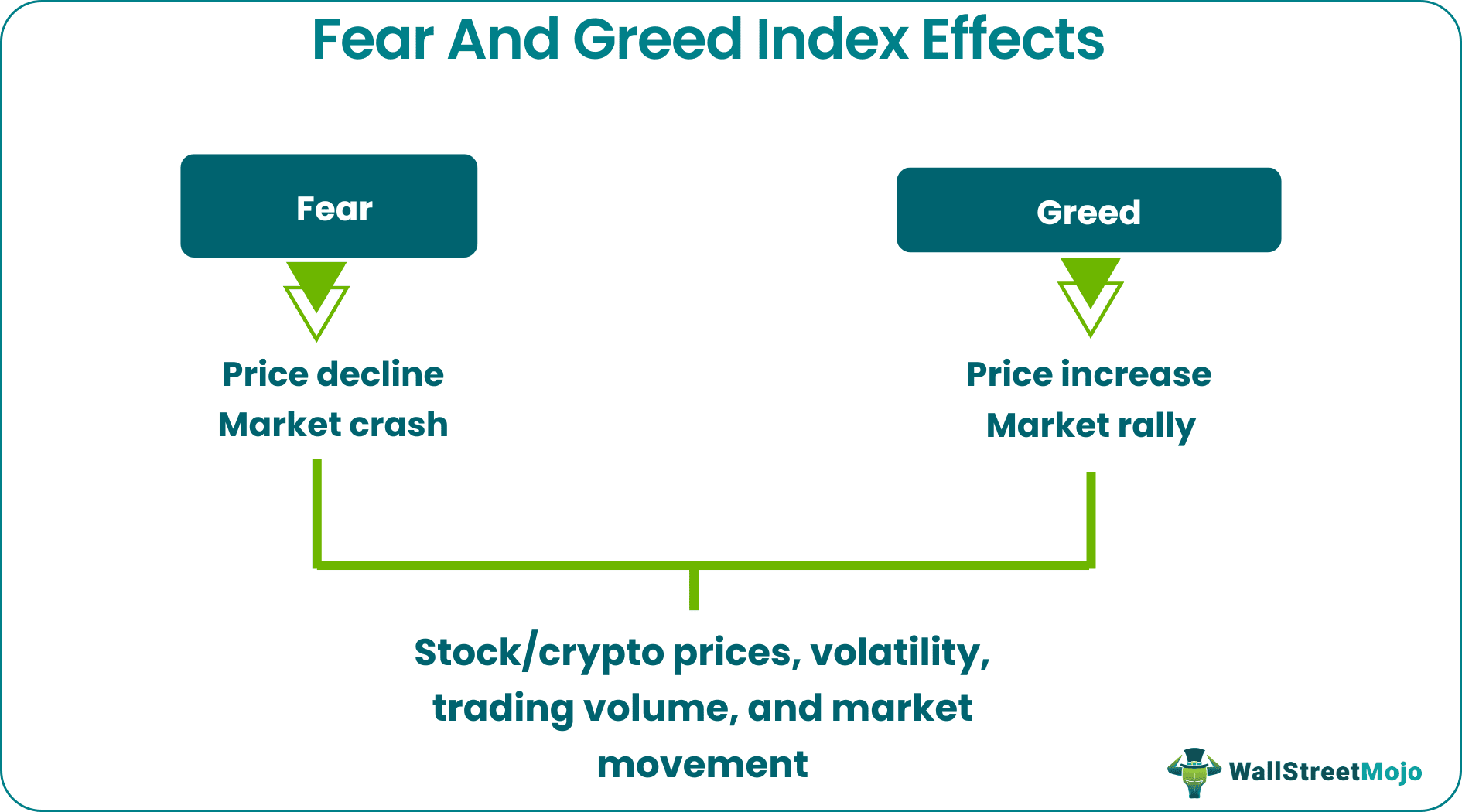

- The two human emotions, i.e., fear and greed, significantly affect stock prices, volatility, volume, and direction. While fear leads to price decreases, greed shows the opposite effect.

- It calculates investor sentiment on a scale of 0 (extreme fear) to 100 (extreme greed) and allows investors to make calculated investment decisions.

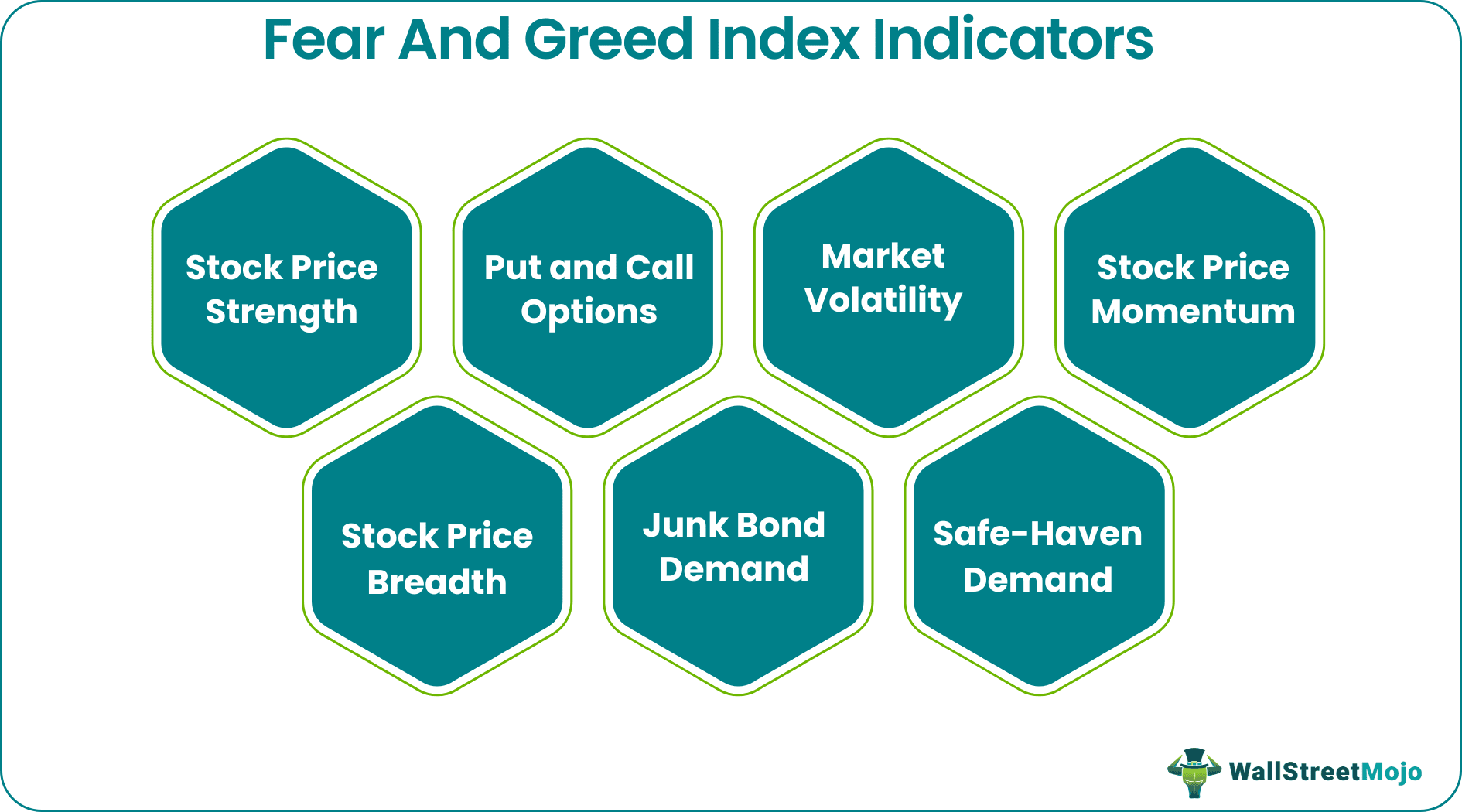

- Stock price momentum, stock price strength, stock price breadth, put and call ratio, market volatility, junk bond demand, and safe-haven demand are seven indicators that help calculate FGI.

How Does CNN Fear And Greed Index Work?

The CNN Fear and Greed Index lets speculators gauge the impact of investor sentiment on changes in equity markets and stock prices. Investor emotions drive financial market movements, including stocks and cryptocurrencies, and influence investment and trading decisions. While fear can result in stock market crashes, greed can lead to market rallies. Therefore, it is essential to track investor sentiments and develop a market-timing strategy before making investments.

The index looks at several indicators to determine how fearful or greedy investors are at a given moment. It calculates results on a 0-100 scale, with 0-49 showing fear and 51-100 showing greed. The pointer on 50 means a neutral sentiment to the market behavior. If investors are greedy enough, stock prices will rise, and more people will buy stocks (sell indicator). On the other hand, if investors are fearful, share prices will fall even below the intrinsic value, and more people will sell their stocks (buy indicator).

Some self-imposed restrictions should be in place to ensure that fear and greed situations do not affect investment decisions:

- Develop and follow a trading strategy

- Set an amount for trading daily, weekly, monthly, or annually

- Fix the number of trades and stick to it to avoid being hit by greed

- Avoid trading on the same script out of greed

- Have a positive attitude toward losses

- Control anxiety to avoid investing in a more drastic deal

The tool offers an insight into whether the stock market is undervalued or overvalued. Since the fear of missing out (FOMO) signals a buying opportunity and vice-versa, this index saves investors from making emotional decisions.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Calculate Fear And Greed Index

CNNMoney measures seven distinct indicators on a scale of 0 to 100 and averages them equally to calculate FGI. These include:

#1 - Stock Price Momentum

This indicator looks at the performance of the Standard & Poor's 500 Index and then compares it to their 125-day moving average. If stocks perform above average, the market represents a bullish scenario, letting investors expect better results and making them greedy.

#2 - Stock Price Strength

This indicator looks through the New York Stock Exchange. It compares the number of stocks in the market hitting 52-week all-time highs with those reaching 52-week all-time lows. If the price strength is positive, i.e., more companies reaching higher highs, it suggests a bullish market, i.e., greedy investors and vice versa.

#3 - Stock Price Breadth

The third indicator measures volumes of stocks trading on the New York Stock Exchange. Whether the market is bullish or bearish, this indicator emphasizes the proportion of the stock market participating. Rising stocks trading higher than declining stocks indicate a greedy scenario and vice versa.

#4 - Put and Call Options

The next indicator on the list calculates the 5-day average of the put and call options. Put is the market situation where the stock value tends to move downward, while a call is a situation when the stock prices are likely to go upward. It determines whether the number of investors expecting low stock value is more or vice-versa. If the put/call ratio is lower, it signals greed and vice versa.

#5 - Junk Bond Demand

This indicator assesses the higher-risk strategies by measuring the spread between yields on junk bonds and investment-grade bonds. The lower the gap, the more would be the greed. Investment-grade bonds are relatively safer, and hence, most investors opt for them (signals fear). On the contrary, increased investments in junk bonds are signs of a stable economy (signals greed).

#6 - Market Volatility

This indicator measures the Volatility Index (VIX) from the Chicago Board Options Exchange on a 50-day moving average. VIX estimates market volatility in the next 30 days. The higher the value, the more volatile the market would be. It, thus, indicates a bearish market and creates fear among investors and vice versa.

#7 - Safe-Haven Demand

This indicator computes the difference in returns for stocks versus Treasury bonds based on the performances over the past 20 days. When stock prices move downward, investors rush towards purchasing bonds. This preference of bonds over stocks implies the weak stock market, signaling fear, and vice versa.

Examples

Let us consider the below-mentioned FGI examples to understand the concept better:

Example #1

Wilson studied the crypto fear and greed index recently to understand investor behavior. He observed that the market tends to be extremely greedy, with a score of 80 on the FGI scale. It could potentially lead to FOMO.

His financial advisor Lisa warned him not to invest in cryptos as digital currencies are prone to bear traps. Also, virtual coins often falsify the entire market scenario as fruitful for short positions. However, Wilson ignored Lisa’s advice and traded in cryptos only to incur a huge loss.

Example #2

Since the beginning of 2021, investors have been losing their investments in the U.S. stock market. The most significant of these was the loss of $ 11.5 trillion on February 19. Also, the top 20 wealthiest people in the world lost $293 billion in a month between mid-February and mid-March. It implies a fear-driven stock market due to an increase in sell-offs.

The CBOE Volatility Index and the CNNMoney FGI also showed a high degree of fear among investors in the stock market. While there are many reasons behind FOMO or the bearish market, the COVID-19 outbreak and rising oil prices led to the turbulent stock market.

Uses

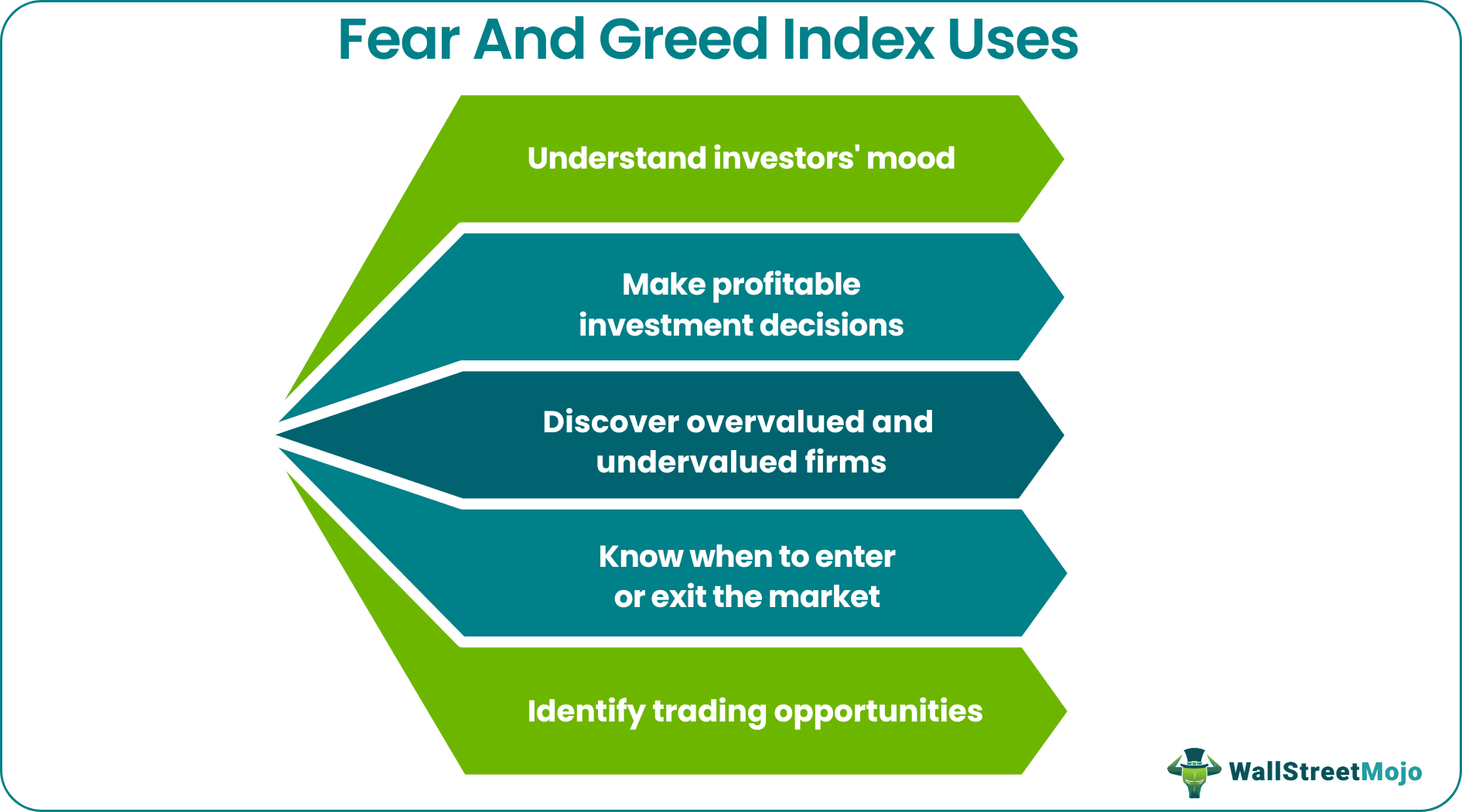

FGI can be useful for investors and traders in several ways, such as:

- Find out the mood of investors at any given time

- Make profitable investment decisions

- Know whether it is the right time to trade

- Identify the best time to enter or exit the market

- Discover firms that are undervalued or overvalued

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

FGI is a tool that gauges the impact of investor sentiment, i.e., fear and greed, on changes in financial markets, including stocks and cryptocurrencies. Thus, it enables investors to develop an effective market-timing strategy. It also measures share prices and stock market movements daily, weekly, monthly, and annually.

FGI calculates results on a 0-100 scale, with 0 showing extreme fear and 100 showing extreme greed. If investors are greedy, it attracts more buyers and acts as a sell indicator. On the other hand, if investors are under fear, it forces more people to sell their stocks and signals a buy indicator.

Seven indicators that help calculate FGI in crypto trading and stock investments are - stock price momentum, stock price strength, stock price breadth, put and call ratio, market volatility, junk bond demand, and safe-haven demand.