Table Of Contents

What Is A Family Limited Partnership (FLP)?

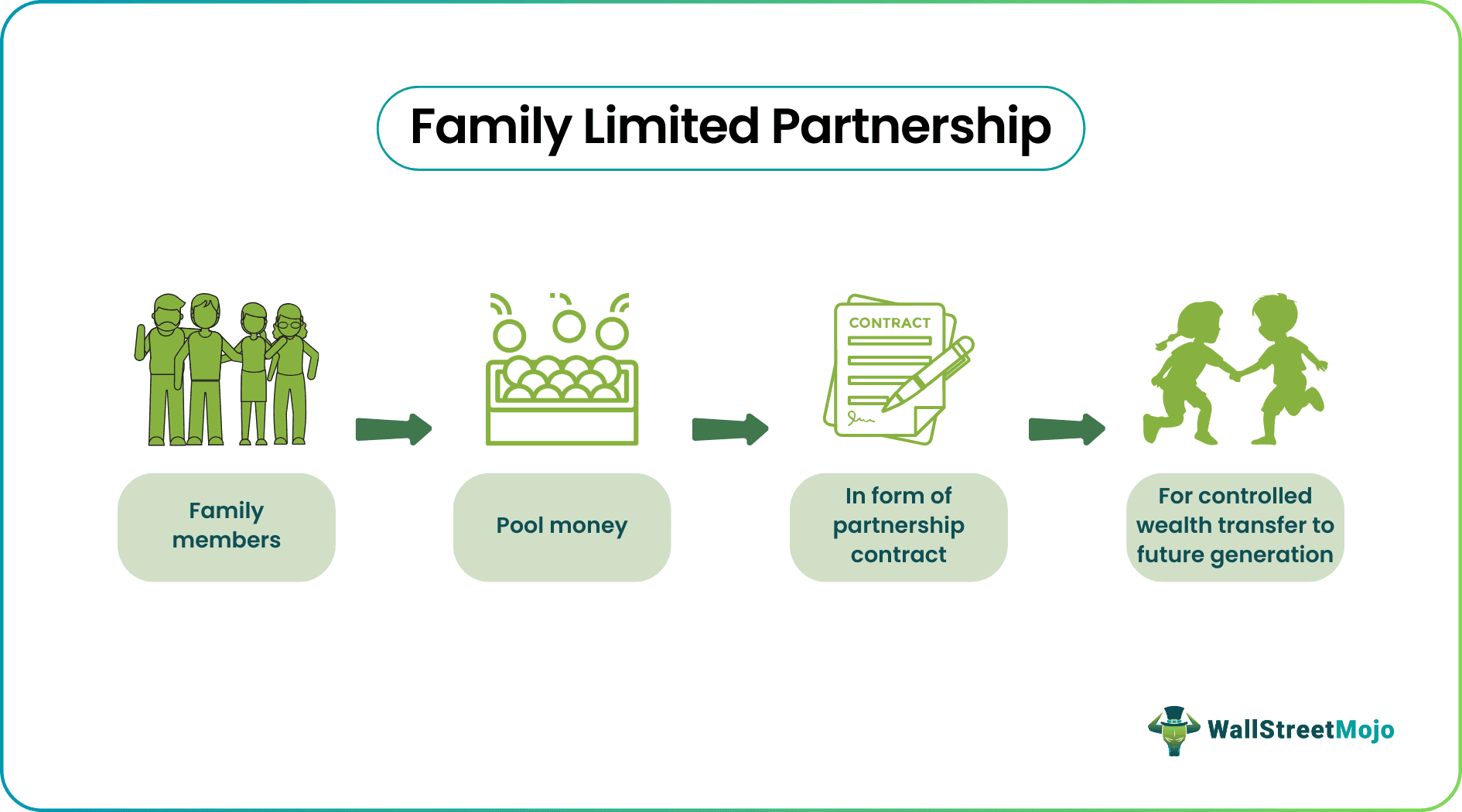

A Family limited partnership is a legal and financial structure in which family members pool their assets into a partnership. It consists of general partners who manage the partnership and limited partners who hold passive interests. FLPs are often used for estate planning, wealth transfer, asset protection, and tax minimization.

By gifting limited partnership interests to family members, the original owner can reduce the value of their taxable estate. Since limited partners have control over the partnership, the value of their partnership interests may discount for estate tax purposes, thus potentially reducing the overall estate tax liability.

Key Takeaways

- Family limited partnerships are a powerful estate planning tool that gradually transfers wealth and assets from generation to generation while potentially reducing estate tax liabilities through valuation discounts.

- It consists of general partners who manage the partnership and limited partners who hold passive interests. This hierarchical structure allows for control retention by the general partners.

- It can apply valuation discounts to limited partner interests due to their restricted control and marketability, which can lower the taxable value of gifted or inherited assets.

How Does A Family Limited Partnership Work?

A family limited partnership operates as a legal and financial entity that involves family members pooling their assets under the framework of a partnership structure. Here's how it typically works:

- Formation: The process begins with the creation of a legal partnership agreement. This agreement outlines the conditions of the partnership, including the roles and responsibilities of general and limited partners, the allocation of profits and losses, and other operational aspects.

- General Partners: The FLP is usually managed by one or more general partners. These individuals control the partnership's day-to-day operations, management decisions, and strategic direction.

- Limited Partners: Other family members become limited partners by contributing assets to the partnership. Limited partners, as the name implies, have limited control over the partnership's operations and decisions.

- Asset Contribution: Family members contribute various assets to the FLP, including real estate, stocks, bonds, business interests, cash, and other valuable holdings.

- Ownership Interests: The partnership agreement defines the ownership structure. The ownership interests are divided into general partner interests and limited partner interests. General partners often hold a smaller percentage of ownership but retain control, while limited partners collectively hold the majority ownership.

- Valuation and Discounting: One of the critical benefits of FLPs is the ability to apply valuation discounts to limited partner interests. These discounts are based on the concept that limited partners have restricted rights and control within the partnership.

- Gifting: The FLP structure allows for gifting limited partnership interests to family members. By utilizing the annual gift tax exclusion and lifetime gift tax exemption, individuals can transfer wealth to their heirs without triggering immediate gift taxes.

- Income and Distributions: The partnership agreement outlines how income and distributions are allocated among partners.

How To Set Up?

Setting up a family limited partnership (FLP) involves several steps, including legal, financial, and administrative considerations. Here's a general overview of the process:

- Consult Professionals: Before proceeding, consult with qualified professionals, such as an attorney experienced in estate planning and partnership law, as well as an accountant or financial advisor familiar with tax implications.

- Define Goals: Clearly outline the goals you want to achieve with the FLP. This could include estate planning, asset protection, wealth transfer, or other objectives.

- Choose Partners: Determine who will be the general partners (usually the family members in control) and limited partners (those contributing assets).

- Draft Partnership Agreement: Work with your attorney to draft a comprehensive partnership agreement. This document should cover essential aspects such as ownership percentages, distribution of profits and losses, management authority, decision-making processes, admission of new partners, transfer of partnership interests, dissolution procedures, and more.

- Valuation of Assets: Each contributed asset needs to be accurately valued to allocate ownership interests and determine the initial value of limited partner interests.

- Contributions: Family members contribute assets (real estate, investments, etc.) to the partnership in exchange for partnership interests (units or shares).

- Ownership Structure: Define the ownership structure, including the percentage of ownership each partner holds.

- Valuation Discounts: Determine whether and how valuation discounts apply to the limited partner interests. These discounts account for these interests' little control and marketability.

- Draft Gift Documents: If gifting partnership interests to family members, create the necessary documents to formalize the transfer. This could include gift letters, assignment documents, and other legal forms.

- File Required Documents: Depending on your jurisdiction, you might need to file certain documents with local authorities or state agencies to establish the partnership.

- Funding the Partnership: Transfer the assets from the family members' ownership to the ownership of the FLP.

How To Dissolve?

Here's an overview of the steps to dissolve an FLP:

- Partner Consent: Depending on the partnership agreement, dissolution might require the consent of all partners or a specific majority of partners.

- Valuation of Assets: Conduct a thorough valuation of the partnership's assets to determine their current value. This will be essential for distributing assets to partners and addressing potential tax implications.

- Inform Stakeholders: Notify all partners, including general and limited partners, about the intention to dissolve the partnership.

- Liquidation of Assets: Sell or distribute the partnership's assets by the partnership agreement and applicable laws.

- Pay Off Debts: If the partnership has outstanding debts, settle them before distributing the remaining assets to the partners.

- Tax Considerations: Consult with a tax professional to understand the tax implications of dissolving the partnership.

- Distribution of Assets: Allocate and distribute the assets to the partners based on their ownership percentages outlined in the partnership agreement.

- File Legal Documents: Depending on your jurisdiction, you might need to file dissolution paperwork with the appropriate authorities or agencies to terminate the partnership formally.

- Resolve Outstanding Matters: Address any outstanding legal, financial, or administrative matters related to the FLP, such as finalizing accounting records, settling any remaining disputes, and closing bank accounts.

- Notify Third Parties: Inform relevant parties, such as banks, financial institutions, creditors, and legal professionals, about the dissolution of the FLP to prevent any further transactions or misunderstandings.

- Termination of Agreements: Cancel any contracts, agreements, or leases associated with the partnership's operations.

- Final Accounting: Prepare a final accounting report that details the partnership's financial transactions, distributions, and any remaining obligations.

- File Tax Returns: If necessary, file the final tax returns for the FLP and ensure the meeting of all tax obligations.

Examples

Let us understand it better.

Example #1

Suppose a Smith family owns many real estate properties across several states. They established a Family Limited Partnership (FLP) to better manage and transfer these properties to the next generation. Mr. Smith and his wife are the general partners, while their children and grandchildren are limited partners. The Smiths contribute the real estate properties to the FLP; over time, they gift limited partnership interests to their children.

This allows them to transfer ownership while gradually taking advantage of tax-based valuation discounts. The FLP provides a mechanism for ongoing management and distribution of rental income among family members. The Smiths aim to ensure a smooth transition of wealth and properties to their heirs while minimizing estate taxes.

Example #2

One well-known example is the "Walton Family Partnerships," involving the heirs of Walmart founder Sam Walton. The Walton family set up a series of FLPs to manage their substantial wealth, primarily in Walmart shares. These FLPs allowed the family to minimize estate taxes by applying valuation discounts to the limited partnership interests and achieve greater control over their assets.

However, it's important to note that the Internal Revenue Service (IRS) has challenged some FLPs, including those involving the Walton family because the discounts applied were excessive and did not accurately reflect the actual value of the assets. In some cases, the IRS has challenged FLPs through audits and legal proceedings to ensure that the valuation discounts are justified and not primarily used for tax avoidance.

Advantages & Disadvantages

Here's a comparison of the advantages and disadvantages of family limited partnerships (FLPs):

| Advantages | Disadvantages |

|---|---|

| Estate Tax Planning: FLPs can facilitate wealth transfer to heirs with potential estate tax savings through valuation discounts on limited partnership interests. | Complex Setup: Establishing and maintaining an FLP can be legally and administratively complex, requiring legal and financial expertise. |

| Asset Protection: FLPs can protect potential creditors due to limited partners' restricted control and ownership interests. | Lack of Control: Limited partners have minimal control over partnership operations, potentially leading to disagreements or conflicts. |

| Wealth Management: Centralized management can lead to efficient decision-making and potentially better investment opportunities. | Valuation Challenges: Valuation discounts applied to limited partner interests might be challenged by tax authorities if they're considered excessive. |

| Gifting and Tax Efficiency: FLPs allow gradual wealth transfer using the gift tax exclusions and lifetime exemptions. | Capital Constraints: Family members may need to meet certain financial requirements to become limited partners. |

Family Limited Partnership vs LLC vs Irrevocable Trust

A comparison of family limited partnerships, limited liability companies, and irrevocable trusts based on various factors:

| Factors | Family Limited Partnership (FLP) | Limited Liability Company (LLC) | Irrevocable Trust |

|---|---|---|---|

| Ownership Structure | General partners (control) and limited partners | Members (owners) with flexibility in management | Grantor (creator), trustee (manages), beneficiaries |

| Control | Controlled by general partners | Managed by members or managers | Managed by trustee |

| Liability Protection | Limited partners' liability is limited to their investment | Members' liability is limited to their investment | Beneficiaries not liable |

| Asset Protection | Can provide some protection against creditors | Offers limited asset protection | Can offer asset protection |

| Estate Planning | Can facilitate wealth transfer with valuation discounts | Can be used for planning and asset protection | Facilitates wealth transfer with tax efficiency |

| Tax Treatment | Pass-through taxation | Pass-through taxation | Tax treatment varies based on trust type |