Table Of Contents

Falling Knife Meaning

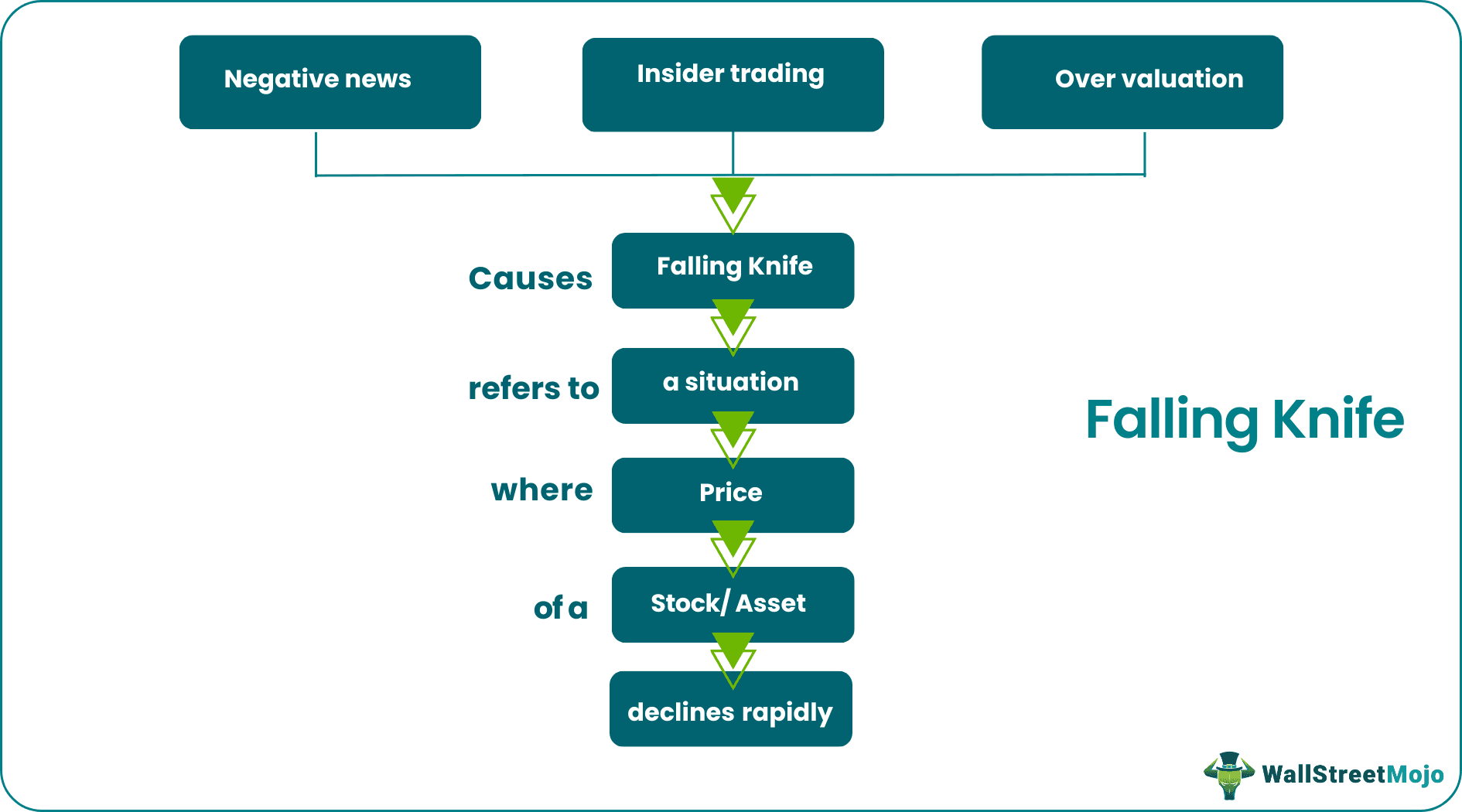

The term "falling knife" typically refers to a situation in the financial markets where the price of a particular asset, such as a stock or a commodity, experiences a rapid and sharp decline. The analogy of a falling knife suggests attempting to catch a falling knife. Its purpose is to give signals to traders in market.

In market terms, buying the asset in question as its price is plummeting is dangerous and likely to result in significant losses, just as trying to catch a falling knife by the blade will likely result in injury. It is important because it warns investors to avoid buying assets experiencing a sudden and steep decline in value and thus saves them from incurring losses.

Key Takeaways

- Falling knife in finance implies a sudden and quick fall in the price of a particular asset, such as stock, bond, or commodity. Catching it can be a risky and potentially costly strategy.

- To avoid losses in a falling knife situation, investors should wait for the price to stabilize, perform thorough research on the underlying asset, and consider diversifying their portfolios.

- Setting stop-loss orders and considering dollar-cost averaging can also help limit potential losses.

- It's important to stay informed about the news and seek professional advice if investors are uncertain about how to handle a falling knife situation.

Falling Knife Pattern Explained

The falling knife is a term that is often used in finance to describe a situation where the price of a particular asset is rapidly declining. This term is derived from the image of a knife falling uncontrollably, which can be dangerous to catch. In the same way, attempting to buy an asset that is falling in price can be very risky for investors, as the asset's value may continue to decline and result in significant losses.

Some investors might be tempted to buy a falling asset hoping to get a bargain, but this strategy can often lead to more losses. The best approach for investors is to wait until the price stabilizes and then consider purchasing the asset or avoid it altogether if the decline seems too significant or the underlying fundamentals do not support the asset's value.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Causes

There can be various causes of a falling knife in the stock market. Some of the common causes are:

- Negative news or events: Negative news, such as disappointing earnings reports, product recalls, or regulatory changes, can cause a sudden drop in a stock's price. These negative events can lead to declining investor confidence, causing investors to sell their shares and the stock price to fall rapidly.

- Market downturn: A market downturn or broader financial crisis can cause many stocks to experience a sharp decline in price, including those that were previously stable. These situations often lead to panic selling, which can exacerbate the decline.

- Overvaluation: When a stock becomes overvalued, its price can rise significantly higher than its true worth, leading to a correction where the price falls back to a more reasonable level. This correction can happen rapidly and result in a falling knife situation.

- Insider selling: If insiders, such as company executives or large shareholders, sell a significant number of shares, it can signal a lack of confidence in the company's prospects, leading to a decline in the stock's price.

- Technical factors: Technical factors, such as the stock price breaking through a key support level or the stock experiencing a significant increase in short selling, can also contribute to a falling knife situation.

How To Use?

The concept of a falling knife is a warning to investors to be cautious when investing in assets experiencing a rapid and significant decline in price. Here are some tips on how to use this concept in your investment strategy:

- Avoid impulsive buying: When a stock is rapidly declining, it's essential not to make any impulsive decisions to buy it in the hope of getting a bargain. Instead, wait for the price to stabilize and thoroughly analyze the company's financials, market position, and future prospects before making any investment decisions.

- Set stop-loss orders: Setting stop-loss orders can help limit your losses in a falling knife situation. A stop-loss order is an instruction to sell a stock automatically when it falls to a particular price level. This can help prevent further losses in case the price continues to decline.

- Diversify your portfolio: Diversifying your portfolio across different asset classes and industries can help minimize the impact of a falling knife situation on your overall investment portfolio. By spreading your investments across different assets, you can reduce your exposure to any single asset that experiences a sudden and significant decline in value.

- Keep an eye on the news: It's crucial to stay informed about any news or events that can impact your invested assets. By staying up to date with market trends, you can identify any falling knife situations early on and make informed investment decisions.

- Seek professional advice: If you're uncertain about how to handle a falling knife situation, seek professional advice from a financial advisor. A financial advisor can provide valuable insights and help you develop a long-term investment strategy that aligns with your goals and risk tolerance.

Examples

Let us have a look at the following examples to understand the concept better.

Examples #1

Let's say that XYZ company's stock price has been steadily increasing over the past year, from $50 per share to $100 per share. However, suddenly, the company announces a significant drop in earnings for the quarter, causing the stock price to plummet to $75 per share within a day.

Some investors may see this as an opportunity to buy the stock at a discounted price, but others may recognize the falling knife situation and avoid buying until the price stabilizes or the company's earnings outlook improves. Those who attempt to catch the falling knife and buy the stock immediately may lose money if the price continues to decline further. It's essential to note that every situation is different, and investors must perform their due diligence before making any investment decisions.

Example #2

Sarah is a seasoned investor who has been keeping an eye on a particular company's stock for a while. However, suddenly, the company announces that its primary product line is facing strong competition, causing the stock price to fall rapidly over a few days.

Some investors may see this as an opportunity to buy the stock at a discounted price, but Sarah recognizes this as a falling knife situation and decides to avoid buying the stock until the situation stabilizes. She reviews the company's financials and market position to determine whether the decline is a temporary setback or a sign of deeper problems. In this case, Sarah decides to wait for more information before making any investment decisions, as attempting to catch the falling knife may lead to significant losses if the stock price continues to decline.

Chart

In the example chart, we can see the price of indices which is 'Bank Nifty' in this case. It is represented by the red lines (candles) experiencing a sudden and significant decline, with the price falling continuously over a short period. This is a typical example of a falling knife situation in a chart.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Catching a falling knife in the stock market is generally not recommended, as it can be a risky strategy. Instead, investors should consider waiting for the price to stabilize before making any investment decisions.

The expression "falling knife" is derived from the image of a knife falling uncontrollably, which can be dangerous to catch. Similarly, buying rapidly declining asset prices can be risky for investors.

The expression "a falling knife has no handle" means that trying to catch an asset that is rapidly declining in price can be dangerous and lead to significant losses, just as attempting to catch a falling knife by the blade can result in injury.