Table Of Contents

What is Fair Value Accounting?

Fair value accounting is the process of maintaining items in Financial Statements in their current valuation that is the Fair value. Mark to market mechanism is applied at specified periods to change the value of items in financial statements and show them as their fair value in the market. When a particular item is shown in Fair value, regular unrealized profit/loss is shown in the Profit and Loss statement.

The fair value method is on the basis of the principle that an asset’s worth must be based on its true value. In other words, it is a value that does not fluctuate regularly. The buyer and seller frame the fair value of the particular asset. However, an analyst would assess the prices of similar transactions and decide the final price.

Fair Value Explained

Fair value accounting refers to the actual value of an asset in a free market where both the buyer and seller agree on the market price. The value of these assets such as stocks, securities or even products is based on the transactions and the volume circulated in the market for the said price.

The fair value accounting formula would apply only if the data points are from the current day and not from historical data. This is in contrast with market value which is constantly fluctuating. In fact, the calculation to derive a fair price also considers factors such as risk, future margins, and growth of the asset in question.

Slowly but surely, fair value calculation is being accepted by the accounting community and corporates alike. Therefore, understanding its intricacies might prove to be a significant source of knowledge.

Features

Let us understand the ebbs and flows of the fair value method by first understanding its features through the discussion below.

#1 - Market

The change in Fair value is dependent on the overall market; if a particular item is sold at a different price than its fair value, then the item's fair value doesn't change due to that transaction. Fair value is decided by the market, so as a whole, how much everyone is ready to pay for a particular item.

#2 - Holding Period

The fair value is determined when the item holder is in no rush to sell the security. However, during rush, the holder may be ready to sell the item at a discounted price. So Fair value accounting assumes that the fair value is being determined by persons prepared to keep the item for a long time.

#3 - Future Cash Flows

The asset's fair value will be determined based on the present value of all the future cash flows that the asset will generate. So this characteristic helps in the neutral pricing of assets.

#4 - Orderly Transaction

The transaction should occur in a public market where everyone can see the trade and participate. Transactions inside closed doors will not be called for Fair Value pricing. So in Fair Value Pricing, there shouldn't be any outside factor that affects the price.

#5 - Date Mentioned

Fair value is always calculated standing on a particular date. So every day, the fair value may change as the market conditions are not stagnant.

Examples

Fair value accounting formula can be applied in different situations depending on the data points available. Let us understand the concept better with the help of a few examples.

Example #1

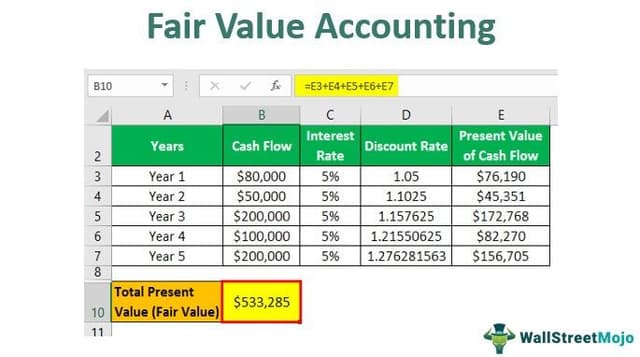

Mr. X is planning to buy a Road Roller. The income from the Road Roller year-wise is mentioned below –

- Year 1: $80,000

- Year 2: $50,000

- Year 3: $200,000

- Year 4: $100,000

- Year 5: $200,000

The Interest rate running in the market is 5%. The life of the Roller is five years. Calculate the fair value of the asset

Solution

The asset's Fair value should be its capacity to earn a return throughout its life after adjustment of the Interest rate.

Step #1 - Total Earning of the Road Roller

- = $80,000 + $50,000 + $200,000 + $100,000 + $200,000

- = $630,000

Step #2 - Calculate the Present Value of Future Cash-Flows

Bring all the payments that you will receive in the future to year 0. So discount them cash-flows with the interest rate prevailing in the market.

- Year 1 - Present Value of the Cash Flow $80,000 = 80,000 / 1.05 = 76,190

- Year 2 - Present Value of the Cash Flow $50,000 = 50,000 / (1.05)^ 2 = 45,351

- Year 3 - Present Value of the Cash Flow $200,000 = 200,000 / (1.05)^3 = 172,768

- Year 4 - Present Value of the Cash Flow $100,000 = 100,000 / (1.05)^ 4 = 82,270

- Year 5 - Present Value of the Cash Flow $200,000 = 200,000 / (1.05)^5 = 156,705

Calculation of Total Present Value

- = 76,910 + 45,351 + 172,768 + 82,270 + 156,705

- Total Present Value (Fair Value) = $533,285

So Mr. X should record $533,285 as of the asset's value on the asset side of the Balance Sheet.

Example #2

Mr. Y bought a derivative contract at $100,000 in November 2019. The contract is for three months. The accounting year starts in January. At the end of December, the contract value is $90,000. How will Mr. Y show this change if he follows Fair value accounting?

Solution

As Mr. Y is following Fair Value accounting, he must mark the market at the end of the financial year. At the end of the year, the contract's Fair Value is less than what is shown on the Balance Sheet. So Mr. Y will have to record an unrealized loss of $10,000 in Profit and Loss Statement and must reduce the value of the contract in the balance sheet by $10,000.

November 2019

In Balance sheet – Contract $100,000

January 2020

In Balance Sheet – Contract $90,000

In Profit and Loss Statement = Unrealised Loss $10,000

Advantages and Disadvantages

The application of a fair value accounting formula is bound to have difference in opinions, skepticism, and speculation. However, it is important to know both extremes of the discussion. Let us do so by discussing the advantages and disadvantages below.

Advantages

- Fair value accounting reflects the current prices of the items in the balance sheet. So the Balance sheet is very much updated and reveals the real picture of the entity.

- Regular market mark helps stakeholders get the actual profit/loss picture as unrealized gains/losses are marked under this system.

- As Fair value is used, management can't play with the pricing, and the auditor can easily check the prices.

Disadvantages

- The determination of fair value is painful at times. If too many buyers and sellers are not available, then the determination of Fair Value is tough.

- Management may play with the profit by showing an unrealized gain, which may not sustain during the actual sale of the asset.

- Fair Value brings volatility to the financial statements which many investors do not like. Investors prefer a stable balance sheet that they may trust.

Fair Value Accounting vs. Historical Cost Accounting

Both fair value and historical cost accounting have been closely linked and often misunderstood for one another. However, there are differences in their fundamentals, functionalities, and application. Let us understand how historical cost accounting is different from the fair value accounting method through the comparison below.

- Fair Value Accounting is the most unbiased form of accounting and is accepted by modern accounting standards. Historical Accounting is based on historical prices and was used by accounting standards earlier.

- Fair value accounting brings volatility in the Accounting Statements like Balance sheets and Profit and Loss because profit/loss is marked after every period. In contrast, Historical accounting keeps the Balance sheet and Profit/Loss stable as there is no mark to market and the value shown in statements remains fixed.

- Fair Value accounting makes the Balance Sheet more realistic as the prices shown in the balance sheet, whereas Historical Cost accounting is stale pricing. The value shown in Financial Statements under this accounting can't be trusted. Under historical accounting, the purchase value remains constant irrespective of its actual price in the market.