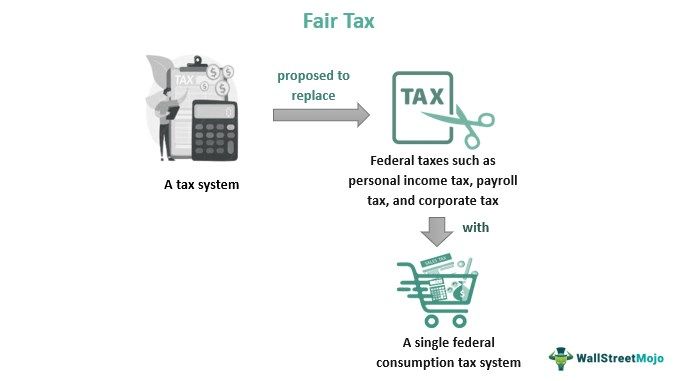

A fair tax plan refers to a tax system proposed in the United States to install a single sales tax replacing all other taxes. For example, it would replace federal taxes such as personal income, payroll, and corporate tax with a single national sales tax.

The proposal aims to simplify the tax system and reduce the tax burden on individuals. The rate for the sales tax has varied over time and has been the subject of debate, but the proposal generally calls for a tax rate of around 23% on retail goods and services. It would also help cover the sales tax on necessities for households below the poverty line.

The fair tax plan could potentially change the role of the IRS, but it is not explicitly stated that the IRS will be removed. The impact of fair tax on consumers would depend on various factors, such as the tax rate and tax exemptions. It is impossible to determine in advance whether consumers would save more on taxes under the fair tax plan.

History

The history of the fair tax proposal in the United States dates back to the late 20th century. The idea of removing unwanted deductions from corporate and personal income taxes had been discussed among political leaders in the 1980s.

In 1986, the U.S. Congress passed the tax reform act to simplify the tax system. However, this system had its disadvantages, and Georgia representative John Linder saw an opportunity to propose a new solution. In 1999, during the 106th United States Congress, Linder proposed a 133 pages fair tax reform, which aimed to replace various taxes, including payroll taxes, corporate taxes, gift taxes, and others, with a single national sales tax.

The term "fair tax" was popularized by the founders of "American for Fair Taxation" (AFFT) in the 1990s. The proposal gained national attention again during the 2008 U.S Presidential Elections, reminding the public of its potential impact on the tax system and the economy. Yet, despite the proposal's long history and continued advocacy, the system has yet to be fully implemented in the United States.