Table of Contents

Introduction

There has been a lot of buzz around cryptocurrency, especially over the past decade. While investors have been allocating their funds to these digital assets, businesses are looking to integrate them into their day-to-day activities in recent times. While there are various key aspects related to cryptocurrency that seem to be promising for the future, the high volatility associated with the asset prices is quite concerning.

As this type of digital asset continues to grow in popularity, it is common for people to wonder what factors influence the prices in the market. If you are one of them, you are in the right place. In this article we will be providing you with detailed knowledge of the factors affecting crypto prices.

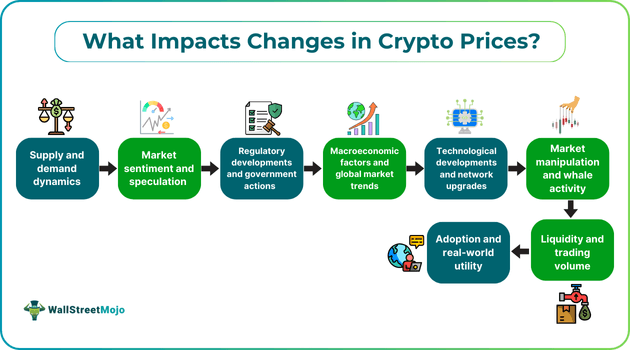

Factors impacting Crypto Prices

In the following section, we’ll discuss what factors contribute to high volatility concerning crypto prices.

#1 - Supply and Demand Dynamics

Supply and demand in crypto are two key aspects determining asset prices. If the supply of a cryptocurrency is high in the market while the demand is low, the price will likely be low. On the other hand, if the supply is low and demand is high, the price of the crypto will likely be high. Thus, simply put, the price is influenced by how many people want to buy the cryptocurrency and how many coins are available in the market.

#2 - Market Sentiment and Speculation

The feelings or sentiments of market participants can contribute to crypto price volatility. When investors are pessimistic, they speculate on prices to drop and thus sell their assets. As a result, crypto prices tend to fall.

On the flip side, when the market participants are optimistic after factoring in cryptocurrency market trends, or in other words, when they have a positive outlook, they expect the prices to rise. With this bullish sentiment, they buy crypto, speculating on the prices to surge.

Basically, when speculating, individuals engage in crypto price prediction by considering different factors related to the dynamic market environment. Based on their projection, they make buy-and-sell decisions.

Note that media attention can cause price volatility and fuel speculation. Typically, negative press results in panic selling, which, in turn, leads to a fall in crypto prices. On the other hand, positive views can cause crypto prices to skyrocket.

#3 - Regulatory Developments and Government Actions

Regulatory developments and government actions are two more noteworthy factors affecting crypto prices. Regulatory announcements or government actions, for example, higher taxation on capital gains can cause significant price fluctuations all of a sudden, resulting in uncertainty among traders and investors. This, in turn, can cause panic selling, resulting in a decline in crypto prices.

Having said that, positive regulatory changes can boost asset prices and minimize crypto price volatility.

#4 - Macroeconomic Factors and Global Market Trends

Unfavorable macroeconomic factors and global market trends can negatively impact crypt prices. On the other hand, favorable conditions can have a positive effect. Some of the macroeconomic factors affecting crypto prices include interest rates, geopolitical events, and inflation. These elements collectively impact the market sentiment and shape market dynamics.

For instance, lower inflation results in interest rate cuts. Moreover, it can lead to an increase in cryptocurrency liquidity. This, in turn, can raise crypto prices.

#5 - Technological Developments and Network Upgrades

Network improvements and technological development can have a significant impact on crypto prices. Developments or upgrades like enhancement in transaction speed, security improvements, and improvement in scalability solutions can improve a cryptocurrency’s appeal in the market. Moreover, innovations that can improve user experience or address any existing limitation result in improved demand among investors.

#6 - Market Manipulation and Whale Activity

Cryptocurrency market manipulation involves individuals or entities engaging in practices that inflate or deflate the prices of assets artificially. Some of the common types of market manipulation in the cryptocurrency space include pump and dump, wash trading, spoofing, and insider trading. Because of the price fluctuations resulting from such practices, investors can suffer substantial losses. Moreover, investors may lose trust in the cryptocurrency market because of these manipulations.

A crypto whale refers to an entity holding a large number of cryptocurrency coins or tokens. The quantity held by them is enough to influence prices and liquidity in the market. Hence, they can be problematic for other market participants. When they move a large number of tokens in a transaction, price volatility rises in the market.

Note that crypt whales can also try selling their holdings little by little over a period to avoid attention. Their sale can result in market distortions, with prices moving upward or downward unexpectedly.

#7 - Adoption and Real-World Utility

Mass adoption has a direct relationship with supply and demand in crypto, and it can drive asset prices upward. Indeed, if more and more people want the coins or tokens, their supply will decrease and fall below the market demand. As a result, the asset prices will rise. Also, if the real-world use cases of a cryptocurrency increase, its demand rises, and thus its price surges as well. Similarly, the demand for cryptocurrencies can drop if they fail to offer practical applications to people. As a result, their price decreases as supply increases.

#8 - Liquidity and Trading Volume

Liquidity and trading volume are two more elements among the various factors affecting crypto prices. A high trading volume suggests that the digital asset is attracting a lot of interest in the market, which positively impacts its perceived value. Precisely, it can indicate that investors are interested in buying or selling the asset, which may happen because of multiple reasons. Simply put, it indicates strong bearish or bullish market sentiment.

Also, a high trading volume indicates high liquidity, which plays a key role in decreased volatility and price stability in the market. Similarly, a low trading volume suggests low liquidity, which, in turn, means the asset price is volatile.

Conclusion

Now that you know what are the vital factors affecting crypto prices, you may consider allocating funds to this category of digital assets. It could be a great way to build a diversified portfolio and earn substantial returns. That said, make sure to consider certain aspects before parting with your savings. Some of these aspects are your risk appetite, financial goals, and the cryptocurrency market trends.