Table Of Contents

Factoring In Finance Meaning

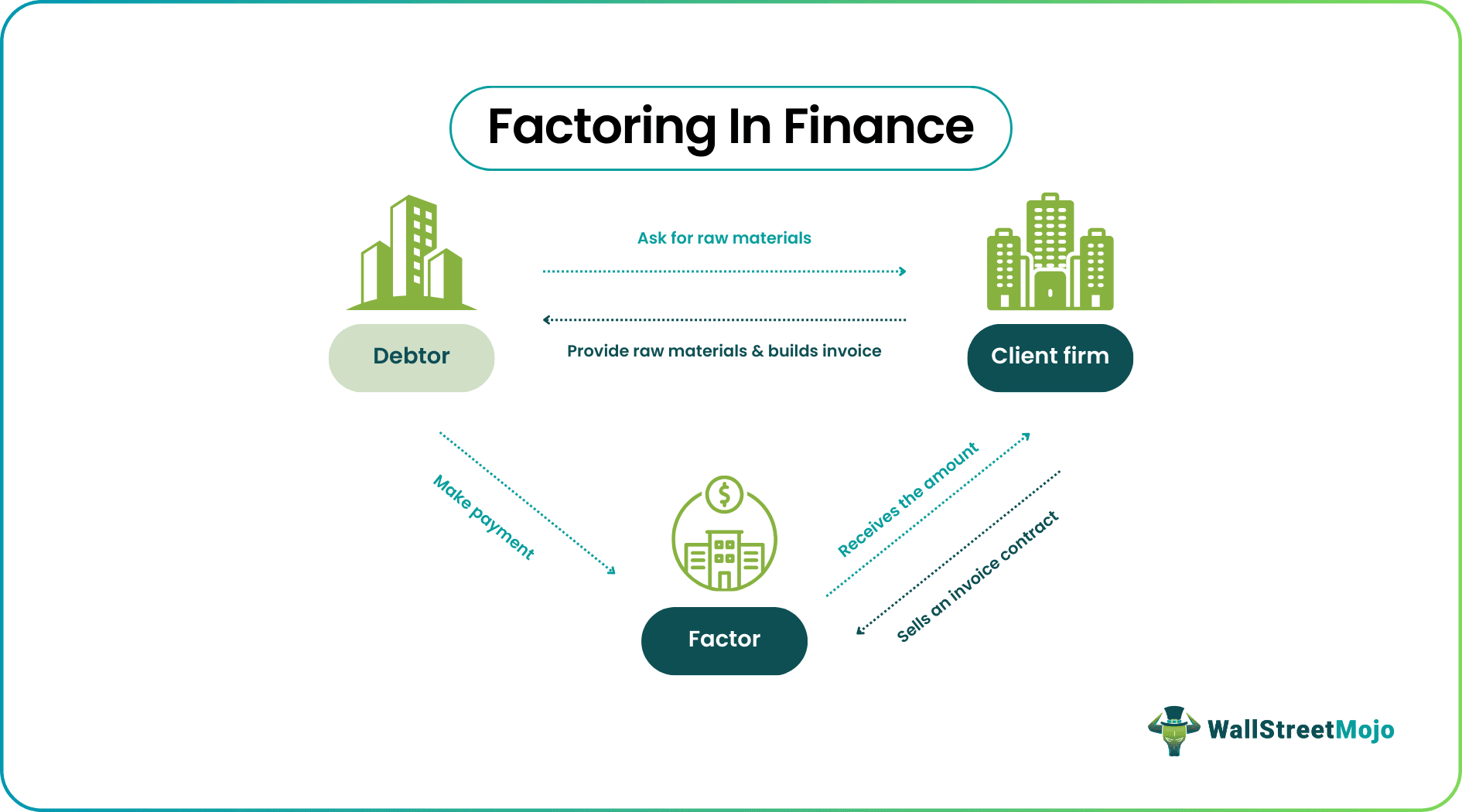

Factoring in finance is a source of immediate capital. It is acquired in exchange for accounts receivable. Hence, it is a financial arrangement between a financial institution (factor) and a small or medium-sized firm (client). A factor purchases trade debts or receivables from a client firm at a discounted price.

Factoring involves three parties—a factor, a client, and a debtor. The factor is the financial institution that offers finance to a client (in exchange for receivables). The client is the firm that sells its receivables; the debtor is the party who owes the trade debt. The debtor, therefore, ends up paying the factor instead of the original business.

Key Takeaways

- The process of factoring in finance is an immediate source of money for the firms. Client firms transfer accounts receivables to a factoring company (factor) at a lower price than the unpaid invoice.

- The factor acquires debts and earns a margin when they encash the full value of the debt.

- But these short-term financings involve significant credit risks. Therefore, in recourse factoring, the credit risk is borne by the client—if the debtor defaults, the client firm repays the factor.

- Most clients opt for non-recourse factoring. Here, the entire risk is borne by the factor.

Factoring In Finance Explained

Factoring in finance is used to generate quick money. Firms transfer their right to collect accounts receivables to a third party—a factoring company. The factoring company extends money to small and medium-sized firms in exchange for accounts receivables.

The factoring company is also referred to as a factor. So, the factoring company buys unpaid invoices at a lower or discounted price from a firm (client). The client provides a margin or commission to the factor. The factor encashes accounts receivables (collected from the debtors) on the due date.

Such a trade debt would involve immense credit risk. If a debtor defaults on an outstanding payment, the liability to pay the invoice value falls on the client. However, if it is a non-recourse factoring, then the factoring company bears the credit risk.

Simply put, this arrangement resembles a loan—short-term financing raised against accounts receivables. Here, accounts receivables are shown as a current asset on the company's balance sheet.

Often, small or medium-scale firms make excessive credit sales and run short of operating cash. Due to this, they cannot meet their short-term financial obligations— electricity bills, rent, salary, etc. In such scenarios, factoring comes in handy. Struggling firms can clear cash flow deficits and pay off immediate expenses. To avail of such provisions, the client’s accounting books must reflect transparency and fairness.

Example of Factoring In Finance

Let us assume that ABC Corp. is a growing company. ABC sells goods to XYZ Ltd. worth $16000 on credit. The amount will be encashed within 45 days.

During this period, however, ABC Corp. runs out of working capital. Therefore, ABC approaches RS Funding Ltd. to avail factoring in finance. RS Funding agrees to buy accounts receivables at a 10% discount. Therefore, ABC opts for a recourse factoring.

Based on the given details, determine what will happen if XYZ Ltd. defaults on its payment.

Solution:

Given:

Unpaid Invoice = $16000

Discount Rate = 10% of $16000 = $1600

Now,

Money Financed = Unpaid Invoice – Discount Rate

Money Financed = $16000 - $1600 = $14400

Hence, RS Funding Ltd. lends $14400 to ABC Corp. On the due date, if XYZ Ltd. fails to pay the invoice amount to RS Funding Ltd., then ABC Corp. is liable to pay an outstanding sum of $16000 to the factor.

Benefits

Even after efficient cash flow management, business entities regularly face a cash crunch. Thus, factoring is crucial in fulfilling an urgent need for capital.

Given below are the various advantages of factoring in finance:

- Facilitates Short-Term Financial Needs: By utilizing this provision, businesses meet numerous operational expenses such as salary disbursement, bill settlement, payment to creditors, inventory purchase, etc.

- Provides Liquidity: It allows companies to convert their trade receivables into cash in an emergency.

- Non-recourse Factoring Protects Against Bad Debts: The non-recourse option transfers the credit risk and the receivables. This way, clients insulate themselves from bad debts.

- Boosts Working Capital: When companies run out of working capital, they can raise additional funds quickly.

- No Collateral Required: Since the factor extends funds in exchange for the receivables, the client firm is not required to submit any collateral.

- Easily Available: Compared to business loans, factoring is easier to avail. Business loans require thorough background checks and credit rating checks.

Drawbacks

Factoring also has certain drawbacks that cannot be overlooked.

- Primarily, it reduces the profit margin for client firms.

- Also, the factor's decision depends upon the debtors' credibility.

- Some customers may not prefer factoring addition; the factor directly deals with the debtor (customer), which may hinder the relationship between the client firm and the debtor (customer).

- Also, desperate firms end up incurring hidden costs. It further increases the financial burden of a struggling firm.