Table Of Contents

What Are FAANG Stocks?

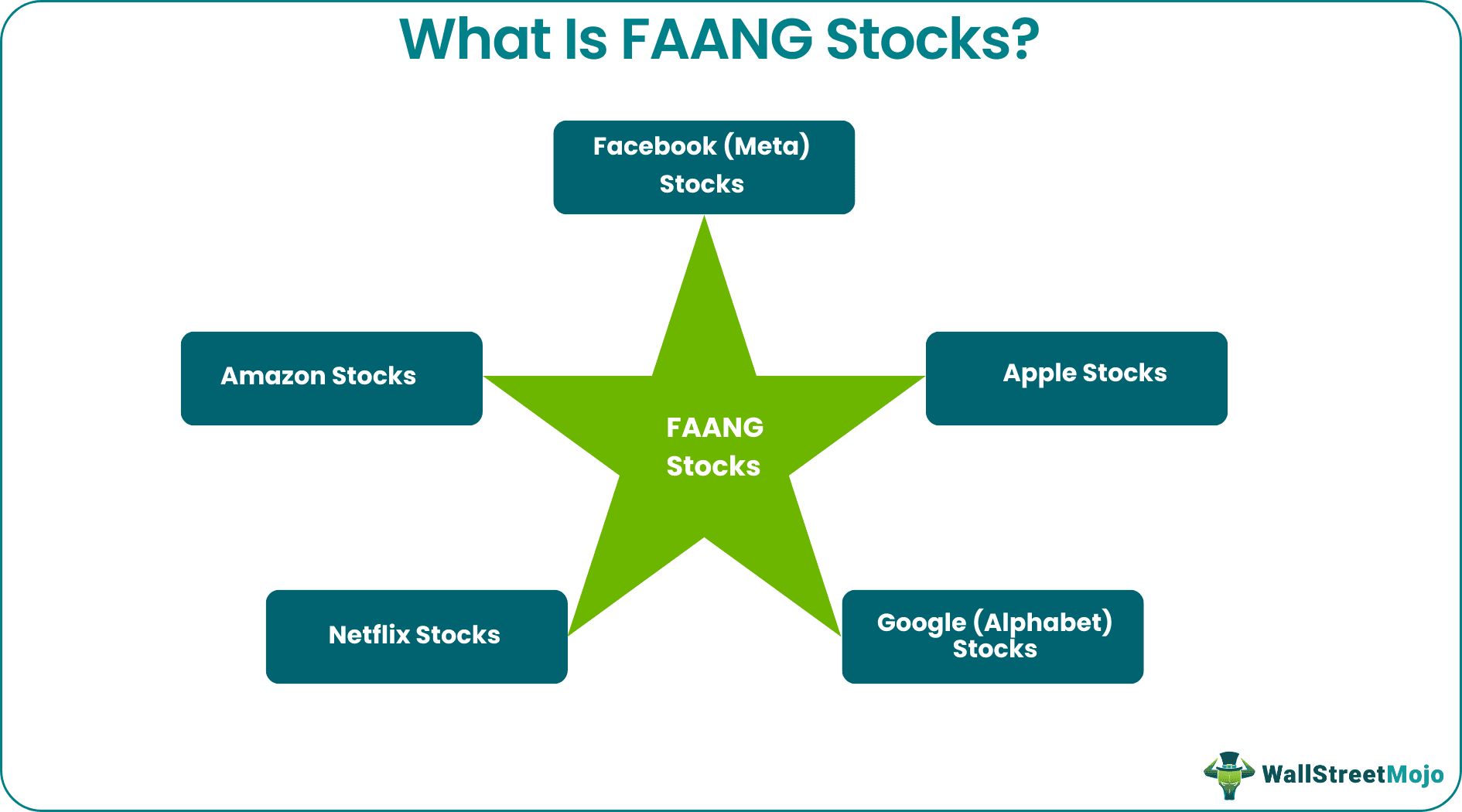

FAANG stocks refer to the stocks belonging to the big five American companies – Facebook (now Meta), Amazon, Apple, Netflix, and Google (now Alphabet). These tech giants make up a huge market in the stock industry, and hence, they get a unique acronym for investors looking to invest in the financial instruments of the best market players in the world.

Though the names of a few of these big five have changed, the FAANG stocks chart remains the center of attraction for investors. This is due to their trustworthy positions, the existence of their monopoly, and the excellent reputation that these companies hold in the market.

Key Takeaways

- FAANG stocks refer to the stocks of the five most successful and popular companies – Facebook (now Meta), Amazon, Apple, Netflix, and Google (now Alphabet Inc.). They, except Meta, have a market capitalization of over one trillion dollars, which makes them all a FAANG member.

- The FAANG is now MAMAA, with two members changing their names and one being replaced.

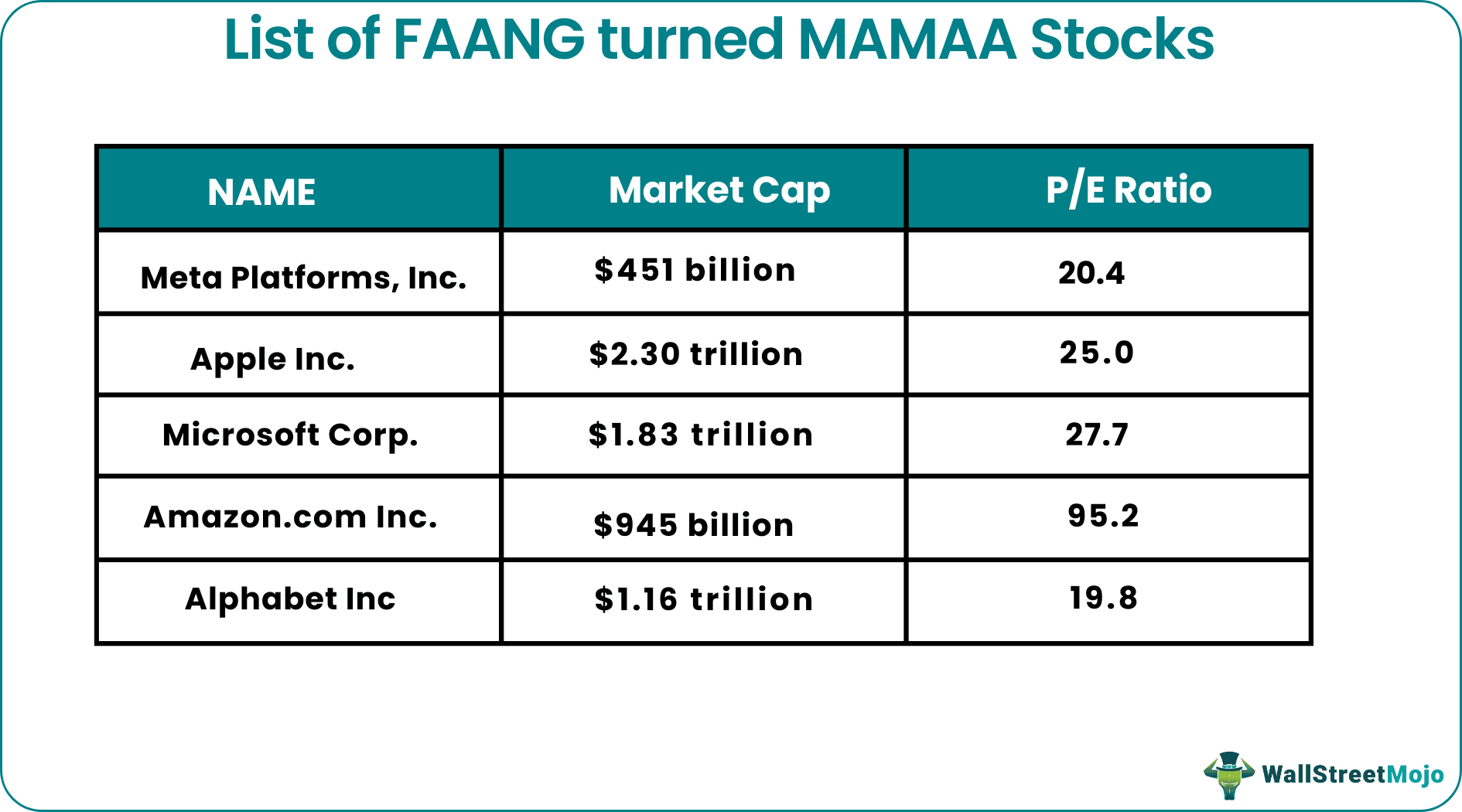

- MAMAA is an acronym for Meta, Amazon, Microsoft, Apple, and Alphabet.

- These giants are the best in their fields, create a monopoly, and rule the market. They may grow really powerful shortly, which makes investing in these stocks a wise but risky decision.

FAANG Stocks Explained

FAANG stocks was the term used by CNBC's Mad Money host Jim Cramer in 2013 to appreciate these five tech giants' roles in the market. Originally referred to as FANG with only Amazon as A, it became FAANG with the addition of Apple in 2017. These firms became the major elements of the New York Stock Exchange (NYSE), making up around 15% of the S&P 500 Index. Hence, CNBC grouped them and started calling them – the FAANG stocks.

With time, however, the players of the best FAANG stocks kept changing names, and the initials lost significance. With Google becoming Alphabet and Facebook being renamed Meta, FAANG lost its G and F in 2015 and 2021, respectively. While the major tech investors were searching for a new acronym for FAANG stocks, a considerable drop in the market capitalization of Netflix, accounting for $130 billion, affected the FAANG stocks price.

On the other hand, Microsoft showed a surge in the market cap of over $1 trillion, becoming a better tech player than Netflix. Hence, the former became a better contender for the FAANG stocks group, which made Cramer name these stocks per their new initials, considering the inclusions and exclusions. Hence, the FAANG became MAMAA, signifying stocks from Meta, Amazon, Microsoft, Apple, and Alphabet.

These stocks take up a massive chunk of the market cap in the exchanges, so movement in such stocks affects the whole index. Moreover, one can well understand the handful of stocks and check if they hold good market strength and are good enough to make or shake the indices. In addition, they affect their shareholders and the entire shareholder strength.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

List Of FAANG Stocks

Let us understand the FAANG stocks meaning and work through the FAANG-turned-MAMAA list below:

Data source - https://www.forbes.com/advisor/investing/faang-stocks-mamaa/

Thus, the above is the FAANG stocks list with their market capitalization.

Example

FAANG stocks have a huge influence in the stock market due to their extraordinary size. Due to continuous rise in the FAANG stocks price, the stock market witnessed a price bubble in 2018 with technology stocks consistently giving very high returns. But in the third quarter of the financial year, FAANG stocks performance went down and the market picture changed leading to a sharp drop in the valuations. Investors are always concerned about the heavy influence that these companies have, which leads to extreme volatility in the market.

FAANG Stocks Video Explanation

How To Invest?

Since they hold a significant share in total stock prices, investors must invest a good amount to purchase the FAANG ETFs or stocks. They are part of the best investments for investors since, over time, they have evolved very well and paid good returns. However, investing in this portfolio alone seems risky.

Investing in these stocks is always recommended, given the high influence, they have in the market. However, there are a few factors to consider regarding FAANG stocks performance before investors decide on investing in the assets:

Diversifying Portfolio

They must consider diversifying portfolios. If the investor deals with individual stocks, it becomes a primary reason for them to hedge the risks related to these stocks. For example, the best FAANG stocks can give quite good returns for a while, but the markets are volatile and risky. Thus, diversification helps investors maintain a balanced profile.

Tracking Market Performance

Investors must keep studying the FAANG stocks list to track its performance. They should not be under the notion that these stocks will always be paying well. A good investor is a well-informed research analyst, and they expect good returns only after tracking the movement of stocks and the market regularly.

Most major investment firms and mutual funds companies combine these stocks and other smaller ones, which helps investors diversify their portfolio. However, if the investment does not give expected returns in the future, investors tend to lose a huge amount in the name of those stocks.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Though MAMAA is the new normal, investors can still choose to invest in FAANG stocks, given their powerful presence and stable performance in the market. When people invest in these stocks, the returns are lucrative and expected to outperform the markets around them. However, the risk associated is equally high as there have been times when these stocks have been found performing insignificantly. Still, investing in these stocks could be given serious thought.

Recently, it has been observed that FAANG stocks have witnessed a drop in their prices. Starting from Apple, the largest tech giant observed a 20% fall with Alphabet and Meta stocks, plunging to 36% and 66%, respectively. These stocks have not been seen in a good position for quite some time now. The reasons behind the price drop are inflation and the increased cost of borrowing. Plus, FAANGs highly depend on advertising for revenues, and the advertising revenue has witnessed a significant fall, affecting their stocks' performance.

Recently, it can be said that these stocks are overvalued, given the falling prices of the stocks and the drop in the level of performance of the players as well. Investors' continuous dependency on these financial instruments leads to their overvaluation.